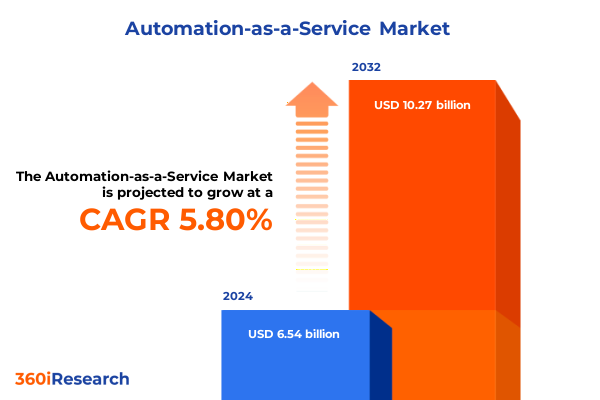

The Automation-as-a-Service Market size was estimated at USD 6.95 billion in 2025 and expected to reach USD 7.39 billion in 2026, at a CAGR of 5.72% to reach USD 10.27 billion by 2032.

Unveiling the Rise of Automation-as-a-Service to Drive Operational Excellence and Strategic Growth in Modern Enterprises

In an era defined by rapid digital transformation and relentless competitive pressure, Automation-as-a-Service emerges as a game-changing paradigm that redefines how organizations access, implement, and scale automation capabilities. By shifting away from traditional on-premises deployments toward cloud-delivered, consumption-based models, enterprises gain unprecedented agility to accelerate process efficiencies and refocus resources on core innovation. This model encapsulates software, support, and managed services into a unified offering, enabling subscribers to leverage best-in-class automation tools without incurring large capital expenditures or lengthy deployment cycles.

The convergence of cloud platforms, artificial intelligence, and low-code development environments has further fueled the ascendancy of Automation-as-a-Service. As enterprises grapple with increasingly complex workflows and labor constraints, they are turning to modular, subscription-based solutions to rapidly pilot and scale process automations. This transition empowers organizations to launch pilot programs with minimal risk, operationalize automation in weeks instead of months, and continuously iterate based on real-time usage insights.

Moreover, the service-based approach alleviates the burden of lifecycle management, patching, and version upgrades. With providers assuming responsibility for ongoing support, maintenance, and security, internal teams can dedicate their efforts to strategic initiatives that drive differentiation. Consequently, businesses across sectors are embracing Automation-as-a-Service not only as a cost-optimization lever but also as a catalyst for sustained innovation.

Examining the Transformative Shifts Redefining the Automation-as-a-Service Landscape from AI Integration to Cloud-Native Delivery Models

The Automation-as-a-Service landscape is undergoing a fundamental metamorphosis driven by several transformative shifts. First, the integration of advanced machine learning and natural language processing into orchestration platforms is enabling systems to interpret unstructured data and deliver sophisticated decision-making capabilities. This cognitive layer extends the reach of automation beyond repetitive tasks to complex workflows that require nuanced judgment.

Concurrently, cloud-native delivery models and containerized microservices architectures have become the backbone for rapid feature releases and seamless scalability. Providers are decoupling monolithic suites into modular components, empowering customers to assemble tailored automation stacks that align precisely with their operational requirements. This shift fosters a plug-and-play ecosystem of third-party connectors, accelerating time to value and reducing integration complexity.

Additionally, the emergence of “citizen developers” leveraging low-code and no-code interfaces is democratizing access to automation capabilities. Business analysts and domain experts can now design and deploy process automations without deep programming expertise, alleviating IT bottlenecks and enabling an order-of-magnitude increase in automation throughput. Together, these shifts underscore a maturation of the market, wherein innovation is no longer the sole domain of specialist teams but is increasingly distributed across the enterprise.

Analyzing the Cumulative Impact of United States Tariffs in 2025 on Automation Investments Supply Chains and Cost Structures for Businesses and Consumers

U.S. tariffs enacted in early 2025 have exerted significant pressure on corporate cost structures, with major manufacturers reporting substantial hits to their bottom lines due to levies on imported components. General Motors disclosed a second-quarter tariff cost of $1.1 billion and anticipates annual impacts of up to $5 billion as supply chains absorb duties on auto parts sourced abroad. Meanwhile, household budgets are feeling the squeeze, as economists at Yale’s Budget Lab project that average effective tariff rates-potentially reaching over 20 percent-could translate into a nearly $2 700 increase in annual living expenses per household.

Beyond direct cost increases, heightened policy uncertainty has stifled capital investments across the industrial automation sector. The National Bureau of Economic Research’s Economic Policy Uncertainty Index shows that sharp spikes in tariff-related ambiguity correlate with measurable declines in industrial output, with a 90-point rise in the index linked to a peak drop of 1.2 percent below baseline production levels. In response, manufacturers are deferring major automation rollouts and holding off on strategic facility upgrades, awaiting clarity on the duration and scope of trade measures.

Simultaneously, tariffs have triggered supply chain disruptions that reverberate through warehousing and logistics operations. Organizations are stockpiling critical components to hedge against future duty increases, elevating inventory carrying costs and driving up demand for flexible storage solutions. To mitigate these pressures, many firms are accelerating investments in domestic automation technologies-embracing AI-driven robotics and reshoring initiatives-to reduce exposure to geopolitical volatility and secure long-term supply-chain resilience.

Deriving Key Segmentation Insights from Component and Solution Type to Enterprise Size Industry Vertical and Application Perspectives

The Automation-as-a-Service market is dissected through multiple lenses to uncover nuanced growth drivers and investment priorities. From a component standpoint, the offering is bifurcated between cloud-enabled software suites that orchestrate end-to-end process flows, and a comprehensive array of services spanning consulting, hands-on implementation, and ongoing support and maintenance. These services ensure that customers not only deploy automations effectively but also maintain peak performance throughout the solution lifecycle.

When viewed by solution type, three primary categories emerge: digital process automation platforms that streamline case management, workflow orchestration, and business process management; intelligent automation systems that leverage machine learning, natural language processing, and process mining to adapt processes in real time; and robotic process automation technologies, featuring attended, hybrid, and unattended bots that tackle rule-based tasks across user interfaces.

Organizational profiles further stratify into large enterprises with global footprints and robust IT budgets, agile mid-market firms balancing cost controls with growth objectives, and small businesses seeking rapid ROI from turnkey automation tools. Vertically, financial institutions, healthcare and life sciences companies, IT and telecom providers, manufacturers, and retail and e-commerce players each demand specialized capabilities aligned to regulatory, compliance, and customer-experience imperatives. Finally, application areas span customer service workflows, finance and accounting back-office processes, HR and payroll operations, IT-and DevOps-related automations, and supply chain and logistics enhancements-underscoring the expansive scope of opportunities across industry functions.

This comprehensive research report categorizes the Automation-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Solution Type

- Enterprise Size

- Industry Vertical

- Application

Unlocking Growth Opportunities through Key Regional Insights Spanning the Americas EMEA and Asia-Pacific Automation Markets

Regional dynamics in Automation-as-a-Service adoption reveal distinct market maturities and opportunity vectors across the Americas, Europe Middle East and Africa, and Asia-Pacific. In the Americas, North American enterprises lead global uptake, propelled by digital-first strategies and favorable cloud infrastructures. U.S. organizations, in particular, are leveraging subscription-based models to scale automations across remote and hybrid work environments, while Latin American firms are quickly adopting process-as-a-service to modernize legacy operations and improve fiscal resilience.

In Europe, Middle East and Africa, regulatory complexity and data sovereignty requirements shape implementation roadmaps. Companies across Western Europe emphasize compliance-ready automation solutions bolstered by stringent security certifications, whereas Gulf–region markets are accelerating infrastructure investments to diversify away from resource dependency. Meanwhile, emerging markets in Eastern Europe and Africa are increasingly turning to managed-service providers to fast-track automation pilots without incurring heavy upfront costs.

Asia-Pacific represents the most heterogeneous landscape, with advanced economies such as Japan and Australia integrating cognitive automations to address labor shortages, and high-growth markets like China and India driving large-scale adoption through government-sponsored Industry 4.0 initiatives. In each case, local providers and global vendors collaborate to tailor service delivery models that align with distinct regulatory, linguistic, and cultural requirements.

This comprehensive research report examines key regions that drive the evolution of the Automation-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Competitive Dynamics and Strategies of Leading Companies Shaping the Automation-as-a-Service Ecosystem Globally

A vibrant competitive ecosystem underpins the Automation-as-a-Service market, featuring established technology vendors, specialist pure-plays, and global consulting firms. Leading pure-play RPA providers have expanded their portfolios to include AI-driven process discovery and cloud-native orchestration, while platform incumbents have deepened strategic partnerships to offer integrated suites that span automation, analytics, and low-code development.

Global consulting and systems integrators have also cemented their positions by embedding managed automation services into digital transformation roadmaps, carving out high-margin opportunities in advisory and change-management engagements. These firms leverage their domain expertise and industry ecosystems to accelerate large-scale rollout programs, blending off-the-shelf technology frameworks with tailored accelerators and governance models.

Emerging entrants are differentiating through niche capabilities such as hyper-automated workflow composition, human-in-the-loop orchestration, and vertical-specific solutions tailored for compliance-intensive industries. Meanwhile, hyperscale cloud providers continue to bolster native automation toolkits, integrating them seamlessly with identity management, data lakes, and microservices. This confluence of capabilities is driving a shift from point solutions to comprehensive, platform-led offerings that address the full spectrum of enterprise automation requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automation-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Alibaba Group Holding Limited

- AntWorks Ltd.

- Appian Corporation

- Automation Anywhere, Inc.

- Automation Hero, Inc.

- AutomationEdge Technologies Private Limited

- Blue Prism Group plc

- C² Technologies, Inc.

- DataRobot, Inc.

- DataToBiz

- Emerson Electric Co.

- Honeywell International Inc.

- International Business Machines Corporation

- Microsoft Corporation

- Mitsubishi Electric Corporation

- Oracle Corporation

- Pegasystems, Inc.

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens Industry, Inc.

- UiPath, Inc.

- WorkFusion, Inc.

- Yokogawa Electric Corporation

Actionable Recommendations for Industry Leaders to Accelerate Adoption Optimize Infrastructure and Harness Automation-as-a-Service for Competitive Advantage

Industry leaders looking to harness the full potential of Automation-as-a-Service should adopt a strategic roadmap that balances rapid value realization with long-term scalability. It begins with identifying high-impact use cases through rigorous process mining and stakeholder alignment, ensuring that automation initiatives deliver measurable efficiency gains and quality improvements. Organizations should then prioritize the adoption of open-architecture platforms that support API-first frameworks and seamless integration with existing IT ecosystems.

To optimize total cost of ownership, enterprises must embrace consumption-based pricing models, tying fees to actual usage metrics and avoiding inflated fixed-fee contracts. Concurrently, investment in robust security governance and change-management procedures will mitigate operational risks and accelerate user adoption. Upskilling existing talent through cross-functional training programs and establishing dedicated automation centers of excellence fosters internal capabilities and reduces dependence on external resources.

Finally, innovation roadmaps should encompass continuous optimization cycles and cross-functional governance, enabling organizations to adjust priorities as regulatory, economic, and technological landscapes evolve. By embedding automation into core business strategies and fostering a culture of experimentation, companies can convert rapid pilots into enterprise-wide transformations that sustain competitive advantage.

Understanding the Rigorous Research Methodology Employed to Deliver Reliable Market Insights and Ensure Comprehensive Analysis of Automation-as-a-Service

This report is underpinned by a rigorous, multi-stage research methodology designed to ensure the reliability and comprehensiveness of our findings. The process began with an extensive review of secondary sources, including company filings, press releases, whitepapers, and industry journals, to map the competitive landscape and identify emerging market signals. To validate these insights, we conducted in-depth primary interviews with seasoned automation executives, process excellence leaders, and technical architects representing end-user organizations and solution providers.

Our research framework employs a bottom-up sizing approach that triangulates revenue data, deployment statistics, and contract values across leading vendors and geographies. This is complemented by a top-down analysis using organizational financial disclosures and macroeconomic indicators, enabling us to cross-verify market dynamics and growth vectors. Segmentation logic was rigorously applied to component tiers, solution types, enterprise scales, industry verticals, and application domains, ensuring that each dimension accurately reflects real-world deployments.

Quantitative findings were further stress-tested through econometric modeling and scenario analysis, accounting for policy shifts such as tariff changes and regulatory reforms. Finally, we subject our conclusions to peer review by independent industry experts, ensuring that our market insights are robust, actionable, and grounded in current industry realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automation-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automation-as-a-Service Market, by Component

- Automation-as-a-Service Market, by Solution Type

- Automation-as-a-Service Market, by Enterprise Size

- Automation-as-a-Service Market, by Industry Vertical

- Automation-as-a-Service Market, by Application

- Automation-as-a-Service Market, by Region

- Automation-as-a-Service Market, by Group

- Automation-as-a-Service Market, by Country

- United States Automation-as-a-Service Market

- China Automation-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Perspectives on the Strategic Imperatives and Future Trajectories Shaping the Automation-as-a-Service Market Landscape

The Automation-as-a-Service market stands at an inflection point, poised to drive the next wave of enterprise efficiency and innovation. As organizations continue to grapple with cost pressures, complex compliance landscapes, and the imperative to scale digital transformation efforts, the ability to deploy agile, subscription-based automation solutions will be a decisive competitive differentiator.

Key market forces such as AI-augmented workflows, citizen developer empowerment, and cloud-native architectures underscore an irreversible shift from traditional CapEx-intensive models to flexible, outcome-oriented consumption frameworks. At the same time, external factors like evolving trade policies and regional regulation will impose new considerations for deployment strategies, risk management, and supply-chain resilience.

Ultimately, businesses that proactively integrate Automation-as-a-Service into their strategic imperatives-supported by structured governance, cross-functional collaboration, and continuous optimization-will be best positioned to unlock sustainable growth. By treating automation not as a standalone project but as an ongoing capability, enterprises can achieve operational excellence, drive superior customer experiences, and chart a course for enduring digital leadership.

Connect with Ketan Rohom for Exclusive Access to the Comprehensive Automation-as-a-Service Market Research Report and Tailored Strategic Insights

Whether you are seeking a deeper exploration of strategic use cases, competitive benchmarking, or customized growth scenarios, Ketan Rohom is ready to guide you through the process and ensure you have everything needed to make informed investment decisions

Reach out to Ketan Rohom (Associate Director, Sales & Marketing) to secure your copy, access exclusive analyst briefings, and explore tailored consulting add-ons that will fast-track your organization’s automation roadmap

- How big is the Automation-as-a-Service Market?

- What is the Automation-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?