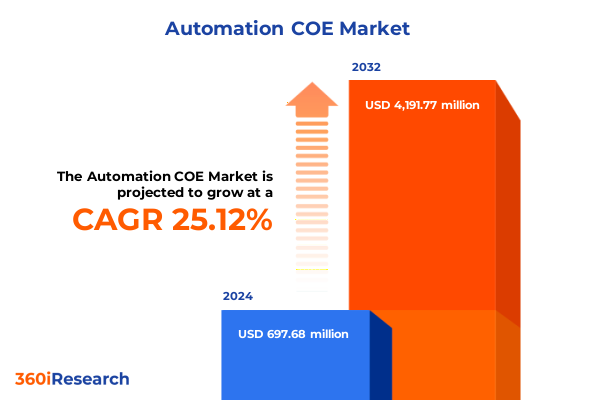

The Automation COE Market size was estimated at USD 871.69 million in 2025 and expected to reach USD 1,094.69 million in 2026, at a CAGR of 25.15% to reach USD 4,191.77 million by 2032.

Setting the Stage for Automation Excellence by Defining Objectives and Framing the Strategic Imperatives That Drive Organizational Transformation

In today’s rapidly evolving technological landscape, organizations are under mounting pressure to streamline processes and accelerate digital transformation, making the establishment of an Automation Center of Excellence (COE) a strategic imperative. An Automation COE functions as a centralized hub of expertise, governance, and best practices that not only ensures consistency across projects but also drives sustainable value by aligning automation initiatives with broader business objectives. By defining clear objectives, governance structures, and success metrics, enterprises can create a cohesive framework that bridges the gap between individual automation pilots and enterprise-wide adoption.

With clear guidelines and an emphasis on cross-functional collaboration, an Automation COE empowers stakeholders from IT, operations, and business units to work in concert, mitigating silos and reducing redundancies. This foundational structure is instrumental for organizations aiming to deliver rapid ROI, enhance operational resilience, and maintain compliance in an increasingly complex regulatory environment. Through iterative development and continuous feedback loops, the COE evolves in tandem with emerging technologies and shifting market demands, ensuring that automation strategies remain both relevant and impactful.

Examining the Emergence of Intelligent Automation Solutions and the Operational Paradigm Shifts Reshaping Business Processes Across Industries and Functions

Over the past few years, the automation landscape has undergone profound shifts as enterprises embrace intelligent solutions that extend far beyond traditional rule-based process automation. Emerging capabilities such as cognitive automation, robotic process automation (RPA) integrated with artificial intelligence, and hyperautomation have redefined the scope of what enterprises can achieve. Organizations are no longer simply automating repetitive tasks; they are orchestrating end-to-end workflows that combine data analytics, machine learning algorithms, and real-time decisioning to unlock new levels of agility and innovation.

In parallel, the convergence of automation with enterprise architecture has driven an evolution from point solutions to platform-based ecosystems. Technology vendors are increasingly offering integrated suites that blend RPA, AI, low-code development, and advanced analytics within a unified framework. As a result, enterprises can more readily scale automation across functions such as finance, supply chain, customer service, and human resources. Consequently, the role of governance has intensified, prompting the Automation COE to champion robust risk management, ethical AI practices, and transparent data governance. This holistic approach positions organizations to navigate complexity while capitalizing on the productivity gains and strategic insights enabled by next-generation automation platforms.

Assessing the Compound Effect of 2025 United States Tariff Measures on Automation Supply Chains Cost Structures and Strategic Vendor Partnerships

In 2025, the United States revised its tariff policy, imposing additional duties on certain imported components and subsystems frequently used in automation hardware and related technologies. These changes have created a ripple effect throughout global supply chains, compelling manufacturers to reassess sourcing strategies, component standardization, and vendor partnerships. Whereas many enterprises previously prioritized cost-effective offshore suppliers, the elevated duties have narrowed the margin of savings, generating renewed interest in nearshore or domestic alternatives.

Unveiling Market Segmentation Dynamics by Product Type Deployment Modes End User Preferences Distribution Channels and Technology Adoption Patterns

A nuanced understanding of market segmentation is critical for tailoring automation strategies to distinct buyer needs and technology requirements. When considering product type, organizations must evaluate offerings across hardware, services, and software, recognizing that consulting, implementation, and ongoing support services can dramatically influence project success through domain expertise and change-management capabilities. Equally important is deployment mode, where the choice between cloud and on-premises solutions entails trade-offs related to scalability, security, and regulatory compliance. Within the cloud segment, hybrid, private, and public cloud models provide varying degrees of flexibility and control, enabling enterprises to fine-tune their infrastructure to align with performance and data-privacy objectives.

End users also exhibit diverse automation adoption patterns based on their organizational complexity and regulatory imperatives. Government agencies often prioritize security and auditability, while large enterprises emphasize cross-border scale and integration with legacy systems. In contrast, small and medium enterprises frequently adopt agile, modular implementations to minimize upfront investment and accelerate time to value. Furthermore, distribution channels play an instrumental role in market penetration, with direct sales teams delivering bespoke solutions and indirect channels such as agents, distributors, and resellers extending reach through regional and industry-specific networks. Finally, technology choices-including AI, blockchain, and IoT-shape the sophistication of automation deployments, particularly when advanced machine learning and deep learning algorithms are leveraged to transform raw data into predictive intelligence and continuous process optimization.

This comprehensive research report categorizes the Automation COE market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Deployment Mode

- End User

- Technology

Analyzing Regional Variations in Automation Adoption Across the Americas Europe Middle East Africa and Asia Pacific to Illuminate Growth Opportunities

Geographic markets present distinct drivers and barriers to automation adoption, reflecting regional regulatory regimes, labor market dynamics, and digital infrastructure maturity. In the Americas, robust investment in technology innovation and a favorable policy environment foster rapid deployment of intelligent automation solutions, particularly across finance, healthcare, and manufacturing verticals. However, disparities in digital literacy and cybersecurity readiness in certain Latin American markets underscore the need for tailored enablement programs and strategic partnerships.

Across Europe, the Middle East, and Africa, regulatory frameworks such as the GDPR and emerging AI governance guidelines shape both technology selection and data processing strategies. Multinational corporations operating in these regions often navigate a complex mosaic of compliance requirements, driving demand for integrated platforms that ensure auditability and data sovereignty. At the same time, infrastructure gaps in parts of Africa and the Middle East are prompting investments in edge computing and hybrid architectures to bridge connectivity challenges. Meanwhile, the Asia-Pacific region is characterized by high adoption rates in nations with advanced digital ecosystems, such as Japan, South Korea, and Australia, alongside surging interest in emerging markets where cost-effective automation is seen as a catalyst for industrial modernization and labor augmentation initiatives.

This comprehensive research report examines key regions that drive the evolution of the Automation COE market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Automation Innovators and Strategic Market Players to Reveal Competitive Strengths Collaborative Ecosystems and Differentiation Strategies

Leading automation technology providers are differentiating themselves through unique combinations of product innovation, strategic alliances, and professional services. Several platform vendors have forged partnerships with leading cloud hyperscalers to offer preconfigured integration templates, accelerating time to deployment and reducing total cost of ownership. At the same time, specialized consultancies and system integrators are investing heavily in proprietary frameworks to bolster data-driven insights and change-management capabilities, ensuring that automation initiatives align with specific industry requirements.

In parallel, a growing cohort of fintech and insurtech startups is leveraging low-code automation platforms and AI-empowered analytics to challenge incumbents in niche verticals. These agile challengers are capturing market share by addressing use cases such as claims processing, regulatory reporting, and customer onboarding with speed and precision. Furthermore, several established hardware manufacturers are expanding their offerings to include edge computing devices equipped with embedded AI accelerators, enabling real-time process control and on-device decisioning. This convergence between software-driven automation and intelligent hardware is reshaping competitive dynamics, encouraging collaboration across ecosystems to deliver end-to-end solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automation COE market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Automation Anywhere Inc.

- Blue Prism Limited

- Capgemini SE

- Cognizant Technology Solutions Corporation

- Deloitte Touche Tohmatsu Limited

- Ernst & Young Global Limited

- Genpact Limited

- HCL Technologies Limited

- Infosys Limited

- KPMG International Limited

- Kryon Systems Ltd.

- Microsoft Corporation

- NICE Ltd.

- PricewaterhouseCoopers International Limited

- Tata Consultancy Services Limited

- ThoughtWorks, Inc.

- UiPath Inc.

- Wipro Limited

- WorkFusion, Inc.

Crafting Strategic Action Plans for Industry Leaders to Accelerate Automation Initiatives Optimize Resource Allocation and Cultivate Sustainable Competitive Advantages

To realize the full potential of automation, industry leaders should first establish clear governance models that define roles, responsibilities, and success metrics, ensuring accountability and sustained executive sponsorship. Cultivating a center of excellence that bridges IT and business functions will accelerate uptake by embedding subject matter expertise within project teams and promoting a culture of continuous learning. In addition, organizations must prioritize investments in upskilling and reskilling programs, equipping employees with the data literacy and analytical capabilities necessary to partner effectively with automated systems.

Strategic vendor selection requires a balanced evaluation of platform flexibility, integration capabilities, and support offerings. Enterprises should engage in proof-of-concept initiatives that test technology resilience under realistic load conditions and validate ROI through clearly defined KPIs. Furthermore, adopting an agile project management methodology with incremental releases will reduce implementation risk and enable course corrections based on user feedback. Lastly, organizations should explore collaborative innovation models, including co-development partnerships and open-source communities, to accelerate solution enhancements and future-proof their automation investments.

Outlining Rigorous Research Methodologies Employed to Ensure Data Integrity Analytical Robustness and Comprehensive Insights Informing the Automation Center of Excellence Study

This research is grounded in a rigorous, multi-method approach designed to capture both quantitative market dynamics and qualitative insights from industry stakeholders. Primary data was collected through in-depth interviews with senior executives, process owners, and technology architects across a cross-section of industry verticals. These interviews provided real-world perspectives on implementation challenges, regulatory considerations, and innovation roadmaps. Complementing this, a comprehensive survey with stratified sampling was conducted to validate adoption trends and capture sentiment around emerging use cases.

Secondary research encompassed detailed analysis of proprietary vendor documentation, regulatory filings, and peer-reviewed publications to corroborate primary findings and ensure analytical robustness. Data triangulation techniques were applied to reconcile discrepancies and enhance the validity of market segmentation and regional assessments. Finally, our expert panel sessions, comprising former COE leaders and industry analysts, facilitated peer review and iterative refinement of key insights, ensuring that the final report delivers actionable guidance grounded in both strategic foresight and operational pragmatism.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automation COE market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automation COE Market, by Product Type

- Automation COE Market, by Deployment Mode

- Automation COE Market, by End User

- Automation COE Market, by Technology

- Automation COE Market, by Region

- Automation COE Market, by Group

- Automation COE Market, by Country

- United States Automation COE Market

- China Automation COE Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings and Articulating the Strategic Imperatives Essential for Achieving Scalable Automation Success and Sustained Operational Excellence

The insights presented reaffirm that a well-structured Automation Center of Excellence is no longer optional but essential for organizations seeking to navigate the complexities of digital transformation. By aligning governance frameworks, technological capabilities, and talent strategies, enterprises can overcome common challenges such as system fragmentation, skills shortages, and regulatory uncertainty. Moreover, the cumulative impact of recent tariff adjustments underscores the importance of agile supply chain management and strategic sourcing decisions to mitigate cost volatility.

Looking ahead, the convergence of AI-driven analytics, cloud-native architectures, and edge computing will continue to expand the scope and scale of automation possibilities. Organizations that cultivate a culture of experimentation, supported by robust governance and continuous learning, will be best positioned to capture value from these emerging technologies. Ultimately, the foundations laid by a mature Automation COE will serve as a springboard for next-generation initiatives, enabling enterprises to achieve sustained growth, operational resilience, and a clear competitive edge.

Partner with Our Associate Director of Sales and Marketing Ketan Rohom Today to Secure a Comprehensive Automation Market Research Report and Propel Your Strategic Decision Making

If your organization is poised to harness the transformative power of automation at scale, we encourage you to connect directly with Ketan Rohom, the Associate Director of Sales & Marketing, to explore how this comprehensive market research report can inform your strategic roadmap and accelerate your competitive advantage. His expertise in aligning technology solutions with business imperatives will ensure you receive tailored guidance on leveraging the insights contained within this report. Reach out today to initiate a collaborative partnership and secure the actionable intelligence needed to future-proof your automation initiatives and drive measurable returns.

- How big is the Automation COE Market?

- What is the Automation COE Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?