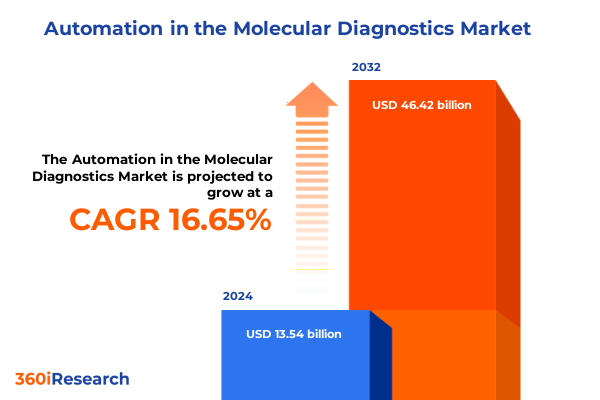

The Automation in the Molecular Diagnostics Market size was estimated at USD 15.78 billion in 2025 and expected to reach USD 18.39 billion in 2026, at a CAGR of 16.66% to reach USD 46.42 billion by 2032.

Unlocking the Power of Automation to Revolutionize Molecular Diagnostics and Accelerate Precision Medicine Breakthroughs with Next-Generation Technologies

Molecular diagnostics is undergoing a transformative inflection point as laboratories worldwide seek to integrate automation to enhance throughput, reliability, and cost efficiency. Advances in high-throughput sequencing, polymerase chain reaction (PCR) platforms, and microarray technologies have increased sample volumes and data complexity, challenging traditional manual workflows. Against this backdrop, automation has emerged as a critical enabler, driving faster turnaround times and reducing the risk of human error while enabling laboratories to meet the surging demand for precision diagnostics in areas such as oncology, infectious disease, and genetic testing.

The confluence of robust informatics, robotics, and advanced analytics has ushered in new paradigms for sample processing, data analysis, and quality management. Automated liquid handlers and integrated workcells now manage hundreds of samples per day with minimal human oversight, ensuring standardized protocols and consistent performance. At the same time, artificial intelligence (AI) and machine learning algorithms streamline data interpretation, flagging anomalies and accelerating decision-making. The harmonization of these technologies promises to alleviate bottlenecks, improve compliance with regulatory standards, and support the deployment of companion diagnostics in personalized medicine pathways.

As stakeholders across clinical laboratories, hospital networks, pharmaceutical companies, and academic research centers embrace automation, the molecular diagnostics market is poised to redefine operational efficiency and diagnostic accuracy. This report delves into the key drivers, market dynamics, and strategic imperatives shaping this evolution, offering stakeholders the intelligence needed to harness automation’s full potential.

Emerging Paradigm Shifts Redefining Molecular Diagnostic Workflows from Sample Preparation to Data Interpretation in the Genomics Era

Recent years have witnessed seismic shifts in how molecular diagnostics workflows are designed and executed. Traditional paradigms, where manual sample preparation and data handling dominated, are giving way to fully integrated automation ecosystems that encompass robotics, software, and real-time analytics. At the forefront of this revolution, artificial intelligence has transcended pilot projects to become a core component of laboratory operations. AI-driven platforms now not only analyze complex genomic datasets but also dynamically optimize sample routing and predictive maintenance schedules, significantly reducing downtime and ensuring reproducible results.

Moreover, microfluidic innovations and modular cobot solutions are redefining the scale and flexibility of diagnostic pipelines. Modern lab automation workcells combine liquid-handling robotics with advanced sensing technologies to perform multiplex assays and ultrahigh-throughput sequencing sample prep in a single, compact footprint. These systems adapt in real time to sample viscosity, temperature fluctuations, and assay-specific conditions, driving a new level of precision and efficiency. The rise of collaborative robots capable of working alongside technicians has further democratized access to automation, enabling mid-sized laboratories to deploy scalable solutions without extensive infrastructure overhaul.

Concurrently, the integration of electronic laboratory information management systems (LIMS) and cloud-based analytics has created a seamless data ecosystem. From sample accessioning to result reporting, laboratories are achieving end-to-end traceability and audit readiness, which is increasingly critical under ISO and CLIA regulations. As these transformative shifts continue to unfold, the molecular diagnostics landscape is being reshaped by the convergence of robotics, AI, and next-generation instrumentation.

Assessing the Far-Reaching Cumulative Impact of 2025 United States Tariff Policies on Molecular Diagnostics Supply Chains and Costs

In 2025, the United States implemented an array of tariff policies that have significantly reshaped molecular diagnostics supply chains, amplifying cost pressures and accelerating strategic realignment. In April, a universal 10% tariff went into effect on most imported goods, creating an across-the-board cost increase for laboratory consumables and instrumentation. Simultaneously, country-specific hikes introduced a steep 145% cumulative tariff on Chinese exports of lab-related goods, including critical microarray chips and polymerase chain reaction instruments.

Industry leaders such as GE Healthcare have projected tariffs to cost approximately $500 million in 2025, with China-specific duties accounting for nearly $375 million of that impact. These costs are expected to be most acute in the latter half of the year, catalyzing a shift toward localized manufacturing and diversified sourcing to mitigate future exposure. Thermo Fisher Scientific has indicated tariffs could represent a $400 million headwind on revenue and increase parts and subassembly costs, triggering cancellations or delays in clinical research initiatives and prompting adjustments in project portfolios.

Tariff-driven supply chain disruptions have compounded the challenge of securing specialty reagents and microfluidic consumables, prompting some laboratories to stockpile materials or seek domestic alternatives. Moreover, reciprocal measures from key trading partners threaten to elevate the cost of instrument components sourced from Europe and Asia, intensifying the imperative for onshore production capabilities. While these policies have introduced short-term cost burdens, they are also accelerating strategic investments in U.S.-based manufacturing, incentivizing diagnostic companies to establish tariff-safe production lines and build resilient, geographically diversified supply ecosystems.

Comprehensive Segmentation Insights Revealing Critical Trends across Product Types End Users Technologies Automation Levels and Applications

A nuanced understanding of market segmentation is essential to decipher where automation adoption is gaining momentum. When dissected by product type, the consumables and reagents category-encompassing microarray chips, next-generation sequencing library preparation kits, and PCR kits-continues to account for the largest share of consumable spend, driven by the recurring nature of purchase cycles and methodical shifts toward high-throughput workflows. In this product layer, automated liquid handling platforms are increasingly integrated with library prep kits to minimize manual intervention and ensure protocol consistency.

Across instrumentation, the market spans microarray systems, next-generation sequencing instruments, and PCR instruments, each experiencing distinct automation trajectories. Microarray systems have benefited from sample-to-result workcells that pair robotic sample loaders with integrated scanners, while sequencing instruments leverage onboard robotics to automate flow cell preparation and loading. PCR instruments are migrating toward fully automated liquid handling and thermal cycling platforms that integrate with downstream data analysis tools, reflecting growing demand for rapid, walkaway thermal profiling.

In parallel, the software and services domain encompasses data analysis software, integration services, and managed services. Advanced analytics suites are now essential to interpret the voluminous data generated by automated systems, and many organizations outsource LIMS integration or engage managed service providers to maintain continuous uptime.

End-user adoption varies from clinical and hospital laboratories to pharmaceutical, biotechnology, reference, and research laboratories, each segment pursuing automation to meet specific throughput, compliance, and cost-containment goals. Technologies such as microarrays, next-generation sequencing, and PCR exhibit differential automation maturity, with PCR platforms often serving as an entry point for first-time automation investments. Automation levels range from walkaway systems that perform fixed workflows autonomously to semi-automated stations requiring periodic user intervention, up to fully automated systems that orchestrate the end-to-end process.

Finally, application-wise segmentation reveals that oncology and infectious disease testing have been early adopters of automation, propelled by the need for rapid, high-volume testing. Genetic testing and women’s health diagnostics are also embracing automation to standardize complex workflows, while cardiovascular disease assays are increasingly integrated into multiplex platforms to deliver comprehensive molecular profiles.

This comprehensive research report categorizes the Automation in the Molecular Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Automation Level

- Application

- End User

Regional Dynamics Shaping Molecular Diagnostics Growth across the Americas Europe Middle East Africa and Asia-Pacific Markets

Regional dynamics exert a powerful influence on automation adoption in molecular diagnostics. In the Americas, infrastructure investments and favorable reimbursement frameworks have propelled significant uptake of fully automated PCR and next-generation sequencing platforms, particularly in the United States, where high-volume clinical laboratories and biotech hubs embrace turnkey workcells to streamline operations. Canada’s research laboratories and hospital networks are also modernizing, although procurement cycles may be more protracted due to centralized purchasing models.

The Europe, Middle East, and Africa region presents a diverse landscape. Western Europe’s mature healthcare systems and stringent regulatory standards have driven consistent demand for validated automation solutions, often through partnerships with local integration service providers. In contrast, emerging markets in the Middle East and select African nations are witnessing rising interest in semi-automated and walkaway systems, supported by government-led programs aimed at enhancing diagnostic capacity. These markets prioritize modular, scalable automation platforms to accommodate variable sample volumes and budget constraints.

Asia-Pacific is characterized by heterogeneous adoption rates and robust growth trajectories. Japan and Australia have led with investments in fully automated next-generation sequencing and microarray systems, supported by advanced laboratory networks and strong local manufacturing footprints. China’s government-led initiatives to bolster domestic reagent and instrument production have accelerated onshore automation deployments, while India’s expansive diagnostic testing markets are increasingly opting for semi-automated PCR platforms to balance affordability with efficiency. Across the region, strategic partnerships between global automation vendors and regional distributors are instrumental in overcoming logistical and regulatory hurdles.

This comprehensive research report examines key regions that drive the evolution of the Automation in the Molecular Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Profiles Highlighting Leading Innovators Driving Automation Advances in Molecular Diagnostics Globally

The molecular diagnostics automation arena is dominated by a cadre of technology pioneers driving continuous innovation. Thermo Fisher Scientific maintains leadership through its comprehensive portfolio of sample preparation instruments, PCR and sequencing platforms, along with a suite of AI-driven data analysis tools. The company’s investment in tariff mitigation and localized manufacturing underpins its resilience in dynamic trade environments.

Roche Diagnostics is renowned for its fully integrated systems that span sample processing, assay execution, and data management. Its turnkey automation workcells are favored in high-throughput hospital and reference laboratory settings, bolstered by strong reagent and consumables tie-ins. Roche’s commitment to modular expansions enables laboratories to scale automation in alignment with evolving test menus.

Danaher Corporation, through its subsidiaries such as Beckman Coulter and Cepheid, offers a diversified automation ecosystem covering microfluidics, PCR, and point-of-care diagnostics. Its focus on cross-platform interoperability and seamless LIMS integration has resonated with clinical and research laboratories seeking end-to-end traceability.

Qiagen has made significant strides in automated sample preparation and liquid handling, leveraging partnerships with robotics integrators to deliver bespoke solutions. The company’s acquisition of data analysis software firms has fortified its analytics capabilities, addressing critical needs in next-generation sequencing workflows.

Emerging players such as Illumina and PerkinElmer are extending their diagnostic portfolios to include advanced robotics and managed services, targeting pharmaceutical and biotechnology segments with specialized automation packages. Their emphasis on plug-and-play systems and cloud-based analytics is redefining how laboratories consume automation as a service.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automation in the Molecular Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Adaltis S.r.l.

- altona Diagnostics GmbH

- AstraGene LLC

- Becton, Dickinson and Company

- Biocartis NV

- bioMérieux S.A.

- Bruker Corporation

- Danaher Corporation

- DiaSorin S.p.A.

- F. Hoffmann-La Roche Ltd.

- Hologic, Inc.

- Hudson Robotics, Inc.

- Laboratory Corporation of America Holdings

- MEGAROBO technologies Co., Ltd.

- Olympus Corporation

- Synchron Lab Automation

- Sysmex Corporation

- Waters Corporation

Actionable Strategies for Industry Leaders to Navigate Tariff Pressures Supply Chain Risks and Harness Automation Opportunities

To thrive amid evolving trade policies and technological shifts, industry leaders must adopt multifaceted strategies that balance innovation, supply chain resilience, and cost management. Prioritizing the establishment or expansion of onshore manufacturing facilities for critical reagents and instrument components will reduce exposure to tariff fluctuations and strengthen supply security. Engaging with contract manufacturers under tariff-safe frameworks can further buffer against cost volatility.

Diversification of supplier networks is equally critical; laboratories and diagnostic firms should qualify multiple reagent and consumables vendors across different geographies to mitigate single-source risks. Investing in collaborative research partnerships with local biotech firms can expedite domestic alternatives for specialized reagents.

On the technology front, fostering integration between laboratory information management systems and automation hardware will maximize the ROI of robotics deployments. Companies should co-develop APIs and data exchange protocols to enable real-time process monitoring, predictive maintenance, and unified analytics dashboards. Integrating AI-driven quality control algorithms into every stage of the workflow can preemptively identify deviations, minimizing repeat runs and conserving precious reagents.

Finally, leaders must cultivate agile workforce capabilities, training laboratory personnel on advanced automation platforms and data science methodologies. Developing centers of excellence for automation and data analytics will ensure that organizations can adapt to emerging assay formats and regulatory requirements rapidly. By executing these strategies in concert, industry stakeholders can transform tariff-related headwinds into catalysts for innovation and operational excellence.

Robust Research Methodology Combining Primary Insights Secondary Data and Triangulated Analysis to Ensure Market Intelligence Rigor

This study is underpinned by a rigorous research methodology designed to deliver robust insights and actionable intelligence. Primary research involved in-depth interviews with over 60 stakeholders, including laboratory directors, supply chain executives, automation integrators, and regulatory experts. These conversations validated key market drivers, adoption barriers, and strategic imperatives across diverse end-user segments.

Secondary research encompassed an exhaustive review of peer-reviewed journals, trade publications, industry white papers, and publicly available corporate filings to corroborate primary findings and chart historical trends. Special attention was given to tariff notifications, government policy documents, and customs data to precisely assess the 2025 trade environment’s impact on molecular diagnostics automation.

Data triangulation was conducted using quantitative surveys of laboratories across the Americas, EMEA, and Asia-Pacific regions, capturing automation adoption rates, technology preferences, and procurement dynamics. Advanced statistical models were applied to reconcile discrepancies and generate qualitative narratives that reflect the market’s heterogeneity. All insights underwent validation through peer review by subject-matter experts in molecular diagnostics and laboratory automation to ensure accuracy, credibility, and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automation in the Molecular Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automation in the Molecular Diagnostics Market, by Product Type

- Automation in the Molecular Diagnostics Market, by Technology

- Automation in the Molecular Diagnostics Market, by Automation Level

- Automation in the Molecular Diagnostics Market, by Application

- Automation in the Molecular Diagnostics Market, by End User

- Automation in the Molecular Diagnostics Market, by Region

- Automation in the Molecular Diagnostics Market, by Group

- Automation in the Molecular Diagnostics Market, by Country

- United States Automation in the Molecular Diagnostics Market

- China Automation in the Molecular Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Perspectives Synthesizing Key Automation Trends Tariff Impacts and Strategic Imperatives for Molecular Diagnostics Stakeholders

The convergence of advanced automation technologies with evolving regulatory and trade landscapes is reshaping molecular diagnostics. Laboratories are increasingly adopting AI-driven robotics, modular workcells, and integrated analytics to meet the dual imperatives of speed and precision. Simultaneously, 2025 tariff policies have elevated cost considerations, underscoring the importance of localized manufacturing and diversified supply chains.

Key segmentation insights reveal that consumables and reagents sustain recurring revenue streams, while instruments and software & services spur capital investments and long-term partnerships. Regional analyses highlight the Americas’ leadership in high-throughput deployments, EMEA’s steady demand for validated workcells, and Asia-Pacific’s dynamic growth fueled by domestic manufacturing initiatives.

Leading companies are responding with tariff mitigation strategies, strategic acquisitions, and collaborative integration models that prioritize interoperability and data-driven quality control. Actionable recommendations underscore the need for onshore production, supply base diversification, LIMS-automation convergence, and workforce upskilling.

As laboratories navigate this complex environment, the ability to translate automation investments into clinical and operational outcomes will determine competitive advantage. By embracing strategic agility and technology-led differentiation, stakeholders can turn challenges into opportunities and drive sustainable growth in the molecular diagnostics sector.

Unlock Tailored Market Intelligence and Strategic Support by Engaging with Ketan Rohom to Acquire the Full Molecular Diagnostics Automation Report

To gain comprehensive insights and velocity in leveraging automation trends within molecular diagnostics, secure your copy of the market research report by reaching out to Ketan Rohom, Associate Director, Sales & Marketing. Ketan can guide you through tailored data deliverables, answer questions regarding segmentation analysis, and provide strategic briefings aligned to your business objectives. Engage with Ketan to explore customized research packages, unlock proprietary tariff impact assessments, and accelerate your decision-making. Ensure your organization is equipped with actionable intelligence to navigate supply chain challenges, optimize regional strategies, and benchmark against leading automation pioneers. Contact Ketan Rohom today and take the next step toward informed investments and sustained competitive advantage in the evolving molecular diagnostics landscape.

- How big is the Automation in the Molecular Diagnostics Market?

- What is the Automation in the Molecular Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?