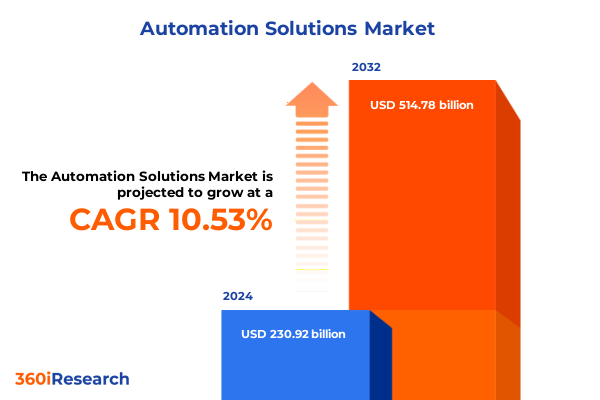

The Automation Solutions Market size was estimated at USD 255.80 billion in 2025 and expected to reach USD 278.77 billion in 2026, at a CAGR of 10.50% to reach USD 514.78 billion by 2032.

Setting the Stage for Unprecedented Automation Advancements and Strategic Market Opportunities in a Rapidly Evolving Industry Landscape

The global automation solutions landscape is entering an era defined by rapid technological advancements and strategic imperatives that demand visionary leadership. As industries from discrete manufacturing to process operations face intensifying cost pressures and talent constraints, decision-makers are turning to automation to drive resilience and unlock new capabilities. This executive summary sets the context by highlighting the convergence of digital technologies, evolving customer expectations, and macroeconomic factors that are reshaping investment priorities and solution roadmaps.

Within this dynamic environment, organizations must navigate complex choices around hardware, software, and service offerings while balancing near-term efficiency gains against long-term innovation objectives. Executives will gain a succinct overview of the key market drivers, transformative shifts, and regulatory considerations-such as the impact of United States tariffs in 2025-that collectively inform strategic planning. By examining segmentation insights across components, solution types, business functions, end user industries, and deployment modes, this introduction frames the broader narrative that unfolds in subsequent sections, guiding readers toward data-driven decision making and actionable takeaways.

Exploring the Fundamental Technological and Operational Shifts Redefining Automation Solutions Across Industries and Supply Chains Worldwide

The automation market is undergoing a fundamental metamorphosis driven by the integration of artificial intelligence, advanced robotics, and cloud-native architectures. Edge computing capabilities are enabling real-time decision support, while digital twin technologies facilitate virtual commissioning and predictive maintenance at an unprecedented scale. These developments have blurred traditional boundaries between factory floors and enterprise IT systems, empowering cross-functional collaboration and tighter alignment with corporate objectives.

Concurrently, ecosystem partnerships are accelerating, as robotics OEMs collaborate with software providers and system integrators to deliver turnkey solutions. The rise of autonomous mobile robots alongside collaborative robots underscores a shift toward flexible, modular deployments that cater to varying payloads, safety requirements, and workspace constraints. Meanwhile, services such as consulting, integration, and training are gaining prominence as organizations seek to bridge skill gaps and optimize return on investment. Overall, these transformative shifts highlight a move from siloed automation islands to interconnected, intelligent operations that drive continuous improvement and strategic differentiation.

Assessing the Cumulative Impact of Recent United States Tariff Adjustments on Automation Supply Chains Operations Product Strategies and Cost Structures in 2025

In 2025, expanded tariff measures imposed by the United States on selected foreign-origin machinery components and finished robotic systems have triggered a ripple effect across global supply chains. Manufacturers reliant on actuators, sensors, and controllers sourced from targeted regions are recalibrating procurement strategies to mitigate cost escalations. Many have accelerated near-shoring initiatives or qualified alternate suppliers, yet these adjustments introduce additional lead times and validation requirements that can slow time-to-production.

Beyond hardware, software licensing fees and integration services linked to affected equipment have experienced upward pressure, prompting buyers to negotiate bundled offerings or explore open-source control platforms. At the same time, services such as maintenance agreements and training engagements are being renegotiated to account for evolving total cost of ownership expectations. As these cumulative tariff impacts continue to evolve, forward-looking organizations are incorporating scenario planning to balance agility with cost discipline, ensuring resilience against further policy shifts and global trade uncertainties.

Delivering Critical Market Segmentation Insights Across Components Solutions Business Functions End User Industries and Deployment Modes

A nuanced understanding of market segmentation is critical to tailoring strategies for growth and investment. By component, the landscape encompasses hardware disciplines such as actuators, controllers, end effectors, and sensors; services including consulting and training alongside integration and maintenance; and software domains covering human-machine interfaces, manufacturing execution systems, PLC programming, and SCADA solutions. Transitioning to solution type reveals the prominence of automated guided vehicles, autonomous mobile robot variants-from unit load to heavy-duty payload and towing systems-collaborative robot safety modes like power-and-force limiting and speed-&-separation monitoring, as well as industrial robotics families such as articulated, Cartesian, delta, and SCARA robots.

When examining business function applications, it becomes evident that finance and accounting require precision automation in bookkeeping, reporting, budgeting, and forecasting, while human resources benefit from payroll automation and talent acquisition workflows. Manufacturing processes span discrete and process manufacturing optimized through robot-assisted production, and research and development cycles are streamlined via product design, development, testing, and validation platforms. Sales and marketing functions leverage customer relationship management, lead management, and marketing automation, whereas supply chain management is revolutionized through automated logistics, procurement, and warehousing distribution. Finally, deployment mode considerations range from cloud-native or on-premise systems to hybrid edge-enabled solutions and orchestration frameworks, underscoring diverse IT infrastructure strategies.

This comprehensive research report categorizes the Automation Solutions market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Solution Type

- Application

- End User Industry

- Deployment Mode

Uncovering Distinct Regional Dynamics and Opportunities Across the Americas Europe Middle East Africa and Asia Pacific for Targeted Market Entry

Geographic dynamics play a pivotal role in shaping automation adoption and investment patterns. Across the Americas, North American leaders are driving advanced robotics deployments in automotive assembly and electronics manufacturing, with Latin American markets showing growing interest in food and beverage automation to address labor scarcity and quality compliance. Europe, the Middle East, and Africa present a mosaic of maturity levels: established Western European manufacturers pioneer collaborative robotics, while key Middle Eastern and African nations prioritize oil and gas automation to enhance safety and throughput.

Asia-Pacific remains at the forefront of scale deployments, particularly within the electronics, semiconductor, and pharmaceutical industries, leveraging low-cost manufacturing bases alongside government incentive programs for digital transformation. Cross-border trade agreements and regional supply chain corridors further influence regional vendor footprints and partnership models. Strategic entrants must therefore align their go-to-market strategies with local regulatory regimes, talent availability, and infrastructure readiness to unlock targeted growth opportunities in each distinct region.

This comprehensive research report examines key regions that drive the evolution of the Automation Solutions market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Critical Competitive Movements Strategic Partnerships and Technological Innovations Shaping Leading Automation Solution Providers Worldwide

In the competitive arena, leading automation providers are distinguishing themselves through strategic acquisitions, technology alliances, and turnkey solution introductions. Major hardware OEMs have strengthened their portfolios by integrating AI-driven vision systems and advanced sensor suites, while independent software vendors are expanding into hardware integration services to offer end-to-end packages. Collaborative partnerships between cloud providers and systems integrators are yielding subscription-based offerings that lower entry barriers for small and mid-sized enterprises.

Simultaneously, several pure-play robotics companies are scaling globally through distribution partnerships and localized support networks, ensuring rapid deployment and service responsiveness. In parallel, niche startups specializing in specialized solution types-such as heavy-duty autonomous mobile robots and precision delta robots-are attracting significant venture capital funding and strategic investment from established industrial conglomerates. These combined moves underscore a trend toward consolidation and collaborative ecosystems, where technological innovation is accelerated through shared expertise and complementary capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automation Solutions market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- B&R Industrial Automation GmbH

- Beckhoff Automation GmbH & Co. KG

- Cognex Corporation

- Emerson Electric Co.

- Endress+Hauser Group Services AG

- Fanuc Corporation

- Festo SE & Co. KG

- Hexagon AB

- Honeywell International Inc.

- Keyence Corporation

- KUKA AG

- Mitsubishi Electric Corporation

- Omron Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- SICK AG

- Siemens AG

- Yaskawa Electric Corporation

- Yokogawa Electric Corporation

Presenting Actionable Strategic Recommendations for Industry Leaders to Enhance Operational Efficiency and Accelerate Automation Adoption Across Verticals

Industry leaders should prioritize the adoption of hybrid deployment models that seamlessly blend cloud scalability with on-premise reliability. By embracing edge orchestration frameworks, organizations can achieve low-latency control while maintaining centralized analytics for continuous improvement. It is also advisable to cultivate supplier diversity to reduce dependency risks associated with tariff volatility and geopolitical disruption, ensuring that alternate sources for key components and services are validated and contractually secured.

A shift toward outcome-based service agreements can further align vendor incentives with performance metrics such as uptime, yield improvements, and cost savings. Investing in workforce upskilling through targeted consulting and training programs will enable smoother technology integration and foster a culture of innovation. Finally, leveraging advanced segmentation insights to tailor solutions-whether by end user industry requirements or specific business function pain points-will enhance differentiation and maximize return on investment.

Detailing a Rigorous Research Methodology Combining Primary Insights Secondary Data and Robust Analytical Techniques to Ensure Comprehensive Findings

This research report is grounded in a rigorous methodology that integrates primary data collection, secondary source analysis, and expert validation. Primary inputs encompass structured interviews with industry stakeholders, including automation practitioners, supply chain executives, and technology developers, ensuring direct insight from end users and solution providers. Secondary research includes analysis of publicly available white papers, technical journals, policy notices, and corporate disclosures to contextualize market evolution and regulatory drivers.

Quantitative data underwent normalization to reconcile differing reporting conventions, while qualitative feedback was coded to identify emerging themes and strategic priorities. Interactive workshops and advisory sessions with subject matter experts provided further guidance on scenario planning, risk assessment, and opportunity mapping. This multi-pronged approach guarantees the accuracy, relevance, and depth of insights presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automation Solutions market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automation Solutions Market, by Component

- Automation Solutions Market, by Solution Type

- Automation Solutions Market, by Application

- Automation Solutions Market, by End User Industry

- Automation Solutions Market, by Deployment Mode

- Automation Solutions Market, by Region

- Automation Solutions Market, by Group

- Automation Solutions Market, by Country

- United States Automation Solutions Market

- China Automation Solutions Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Synthesizing Key Insights and Strategic Perspectives to Provide a Clear Vision on the Future Trajectory of Automation Markets and Technologies

By synthesizing technological trajectories, tariff influences, segmentation nuances, regional dynamics, and competitive strategies, this summary offers a holistic perspective on the automation solutions market. Key takeaways reveal that agility, interoperability, and strategic partnerships will be the cornerstones of success as organizations navigate evolving customer demands and regulatory landscapes. The convergence of hardware innovation, service-oriented models, and software intelligence is creating unprecedented opportunities for efficiency gains and transformative value creation.

Looking ahead, companies that embrace integrated ecosystems-leveraging cloud-edge architectures, resilient supply chains, and outcome-based engagements-will be best positioned to thrive. The path forward demands a balanced approach, marrying short-term cost management with long-term innovation investments. In doing so, stakeholders can confidently chart a course toward sustainable growth and competitive advantage in the dynamic world of automation solutions.

Driving Strategic Decisions with Market Intelligence Contact Ketan Rohom Associate Director Sales and Marketing to Access Exclusive Automation Market Report

Are you ready to leverage deep market intelligence that transforms strategic planning and fuelling your competitive edge? Contact Ketan Rohom, Associate Director, Sales and Marketing, to gain privileged access to the most comprehensive automation solutions research insights. With a specialized focus on the latest component innovations, evolving solution types, critical business function applications, and regional dynamics, this report offers the clarity and depth required to make confident investment decisions and operational enhancements. Engage today to unlock actionable data, tailored recommendations, and expert analysis that will propel your organization toward sustained growth in a rapidly evolving automation landscape.

- How big is the Automation Solutions Market?

- What is the Automation Solutions Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?