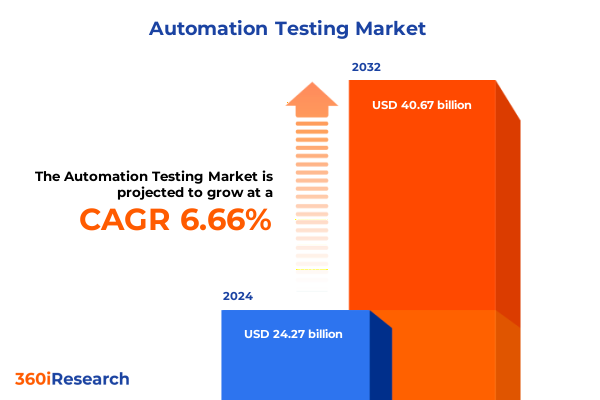

The Automation Testing Market size was estimated at USD 25.81 billion in 2025 and expected to reach USD 27.45 billion in 2026, at a CAGR of 6.71% to reach USD 40.67 billion by 2032.

Navigating the Complex Automation Testing Ecosystem by Unveiling Critical Drivers Shaping Quality Assurance Strategies Across Diverse Industry Verticals

The automation testing landscape has undergone rapid transformation as organizations strive to deliver high-quality software at unprecedented speed. Against the backdrop of digital acceleration, enterprises across sectors are deploying automated tools to streamline regression, load, and security testing processes, reducing time-to-market and enhancing application reliability. As technology ecosystems expand to include cloud-native, microservices, and DevOps pipelines, the demands on testing architectures grow correspondingly complex.

Amid these pressures, decision makers seek clarity on which testing approaches yield the highest return on investment and how emerging frameworks can integrate seamlessly into existing workflows. The convergence of open-source libraries and commercial solutions has created a diverse ecosystem, compelling teams to develop robust strategies for tool selection and test coverage optimization. This executive summary synthesizes current market dynamics, highlights disruptive trends, and provides forward-looking guidance to help stakeholders navigate the increasingly intricate domain of automation testing, ensuring sustained quality assurance excellence.

Exploring Groundbreaking Innovations in Test Automation That Are Redefining Workflow Efficiency and Driving Enterprise Agility in Today’s Dynamic Digital Era

The past year has seen a surge of transformative shifts in automation testing, as artificial intelligence and machine learning capabilities are now embedded within test design, execution, and analysis. Intelligent test generation tools automatically identify high-risk code paths and propose optimized test scenarios, thereby reducing manual effort while improving defect detection rates. Concurrently, low-code and no-code platforms have democratized test automation, enabling subject matter experts to author comprehensive test suites without deep scripting knowledge.

Transitioning to continuous testing models, organizations have adopted shift-left practices, integrating test cases directly into development pipelines. This migration has driven tighter collaboration between Dev and QA teams, fostering a culture of shared responsibility for software quality. Meanwhile, the rise of containerization technologies has introduced ephemeral test environments, allowing parallel test executions on dynamically provisioned instances. Together, these innovations are redefining how enterprises architect, scale, and manage their automation testing portfolios to meet stringent release schedules.

Assessing the Wide-Ranging Implications of 2025 United States Trade Tariffs on Automation Testing Operations Supply Chains and Cost Structures

In 2025, the United States implemented targeted tariffs affecting software services and technology imports, creating new cost considerations for organizations that rely on offshore development and third-party testing services. While the direct impact on native code and open-source tooling remains limited, the indirect effects on test infrastructure procurement, cloud service contracts, and third-party testing appliances have begun to alter sourcing strategies.

Testing teams that once sourced hardware-based load and performance testing rigs from international vendors now face increased lead times and premium pricing. To mitigate these challenges, several enterprises are shifting toward fully managed cloud testing platforms, reallocating budgets from capital expenditures to operational expenditures. This financial realignment encourages adoption of scalable, on-demand test environments while reducing exposure to tariff-induced price volatility. As a result, organizations are reevaluating vendor relationships, negotiating longer-term cloud commitments, and exploring co-development partnerships that offer greater cost predictability amid fluctuating trade policies.

Uncovering In-Depth Segmentation Insights into How Testing Types Deployment Modes Industry Verticals and Organization Sizes Converge to Drive Market Evolution

Segmentation analysis reveals that Compatibility Testing continues to ensure cross-platform consistency, while Functional Testing subtypes-ranging from Acceptance Testing to Integration, System, and Unit Testing-validate both high-level workflows and granular code modules. Performance Testing further branches into Endurance, Load, Spike, and Stress Testing, enabling organizations to simulate real-world usage patterns and uncover capacity constraints. Security Testing remains paramount, with Penetration Testing, risk-centric evaluations, and automated vulnerability scanning forming the backbone of modern test strategies.

Deployment Mode distinctions highlight that cloud-native automation frameworks provide on-demand scalability and global reach, hybrid architectures balance on-premises control with cloud elasticity, and traditional on-premises solutions are still preferred by institutions with strict data governance requirements. Examining End User Industry segmentation underscores that automotive players optimize testing across both OEM and aftermarket services, BFSI firms enforce stringent compliance and risk management standards, healthcare organizations test mission-critical hospital systems alongside medical device software and pharmaceutical data platforms, IT and telecom enterprises automate IT services workflows and telecom services reliability checks, and retail and consumer goods companies validate point-of-sale operations as well as e-commerce user journeys. Finally, Organizational Size analysis shows that large enterprises invest in enterprise-grade test orchestration suites, whereas small and medium enterprises favor lightweight, cost-effective tools that align with lean development teams.

This comprehensive research report categorizes the Automation Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Testing Type

- End User Industry

- Deployment Mode

- Organization Size

Illuminating Regional Adoption Trends Investments and Growth Patterns in Automation Testing across Americas Europe Middle East & Africa and Asia-Pacific Markets

Regional dynamics in automation testing adoption vary significantly. In the Americas, organizations in North America often lead with early adoption of AI-powered test generation and robust integration into CI/CD pipelines, while Latin American firms are increasingly outsourcing to managed service providers to accelerate digital transformation. Moving across to Europe, Middle East & Africa, Western European markets emphasize standardized compliance testing and localization validation, and they prioritize collaborative open-source projects, whereas Middle Eastern enterprises drive rapid modernization through strategic government-sponsored initiatives. African markets exhibit growing interest in cloud-based test platforms to support burgeoning fintech ventures.

In the Asia-Pacific region, multinational corporations leverage offshore development centers to blend cost efficiency with advanced testing methodologies. Key players in East Asia invest heavily in automation frameworks tailored for mobile and IoT applications, while South Asian organizations are expanding local talent through community-driven test automation training programs. Across Australia and Southeast Asia, hybrid testing models bridge on-premises security needs with agile cloud deployments. Together, these geographic trends underscore the importance of regional customization and partnership strategies for successful automation testing implementation.

This comprehensive research report examines key regions that drive the evolution of the Automation Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies Partnerships and Innovation Initiatives of Prominent Automation Testing Providers Driving Differentiation and Market Leadership

Major automation testing providers differentiate through targeted R&D investments, strategic alliances, and platform integrations. Some global vendors have forged partnerships with leading cloud providers to deliver seamless test environments that scale automatically with usage. Others focus on embedding advanced analytics within their suites, transforming raw test results into actionable dashboards that inform release readiness.

Start-ups and niche players carve out specialization in emerging domains such as blockchain validation and augmented reality testing, compelling incumbents to accelerate innovation roadmaps. Collaborative ventures between test tool developers and open-source communities continue to produce hybrid offerings that balance enterprise security with community-driven extensibility. Moreover, M&A activity has consolidated certain segments, as larger firms acquire complementary capabilities in AI-driven test generation or security vulnerability scanning, creating bundled solutions that address end-to-end quality assurance needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automation Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A1QA, Inc.

- Accenture plc

- Capgemini SE

- Cigniti Technologies Limited

- Cognizant Technology Solutions Corporation

- DeviQA LLC

- IBM Corporation

- ImpactQA Services Private Limited

- Infosys Limited

- QA Mentor, Inc.

- QASource, Inc.

- Qualitest Ltd.

- QualityLogic, Inc.

- ScienceSoft, Inc.

- Testlio, Inc.

Formulating Actionable Strategies for Industry Leaders to Harness Automation Testing Innovations Elevate Quality Assurance and Achieve Operational Excellence

Industry leaders should prioritize integration of AI-powered test creation tools within existing DevOps workflows, ensuring that intelligent algorithms augment rather than replace skilled QA professionals. By embedding machine learning models that predict high-risk code regions, teams can focus manual efforts on edge cases and complex scenarios. Simultaneously, organizations must strengthen governance around test data management to comply with evolving privacy and security regulations.

Investments in cross-functional training programs will further democratize test automation, equipping developers with low-code scripting capabilities while empowering testers with insights into software architecture. Embracing a platform-agnostic approach to deployment, combining cloud agility with on-premises control, will protect against geopolitical and tariff-related uncertainties. Finally, forming strategic alliances with key vendors and service providers can unlock co-innovation opportunities, accelerating adoption of emerging capabilities in containerized testing, mobile test labs, and continuous performance monitoring.

Detailing Robust Research Methodology Combining Qualitative and Quantitative Analysis to Ensure Comprehensive and Reliable Automation Testing Market Insights

This research synthesizes qualitative insights from expert interviews with senior QA architects, DevOps leads, and technology vendors, ensuring a diverse array of practitioner perspectives. Secondary sources include technical whitepapers, open-source community contributions, and regulations documentation, which have been critically evaluated to validate accuracy and relevance.

Quantitative analysis draws on primary survey data collected from global enterprises spanning multiple industries, complemented by anonymized usage metrics from major automation platforms. Data triangulation techniques were applied to reconcile discrepancies, while statistical methods such as cross-tabulation and regression analysis were employed to identify correlations between deployment modes, organization size, and adoption barriers. The methodology prioritizes transparency, with documented assumptions, detailed variable definitions, and reproducible analytic workflows.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automation Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automation Testing Market, by Testing Type

- Automation Testing Market, by End User Industry

- Automation Testing Market, by Deployment Mode

- Automation Testing Market, by Organization Size

- Automation Testing Market, by Region

- Automation Testing Market, by Group

- Automation Testing Market, by Country

- United States Automation Testing Market

- China Automation Testing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Drawing Conclusive Perspectives on Automation Testing Developments Outcomes and Strategic Implications to Guide Decision-Making and Foster Future Innovations

Drawing on comprehensive segmentation studies, regional analyses, and competitive intelligence, this report concludes that automation testing is at a pivotal juncture. The convergence of AI, cloud-native execution, and standardized frameworks is unlocking unprecedented efficiency gains, yet it also imposes new skill requirements and governance considerations. Tariff-related supply chain shifts reinforce the strategic importance of cloud deployment flexibility and local partnerships.

Enterprises that adopt a holistic approach-integrating intelligent test generation, cross-functional training, and agile infrastructure-will be best positioned for sustained quality improvements and accelerated release cycles. As test automation evolves from a functional requirement to a strategic enabler of digital transformation, organizations that align their testing roadmaps with broader business objectives will gain competitive advantage.

Driving Action with Ketan Rohom’s Expert Guidance to Secure Your Comprehensive Automation Testing Market Research Report Purchase for Strategic Advantage

To capitalize on evolving automation testing imperatives and maintain a competitive edge, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive market research report can inform your strategic roadmap. His expert guidance will help you align your quality assurance initiatives with industry best practices, mitigate challenges posed by tariff fluctuations, and accelerate adoption of cutting-edge test automation frameworks. By partnering with Ketan Rohom, you gain direct access to tailored insights, prioritized recommendations, and an actionable implementation plan designed to elevate your organization’s testing capabilities. Engage with his team today to secure your copy of the full research report and unlock data-driven strategies that will drive operational efficiency and sustain long-term growth in the dynamic automation testing arena.

- How big is the Automation Testing Market?

- What is the Automation Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?