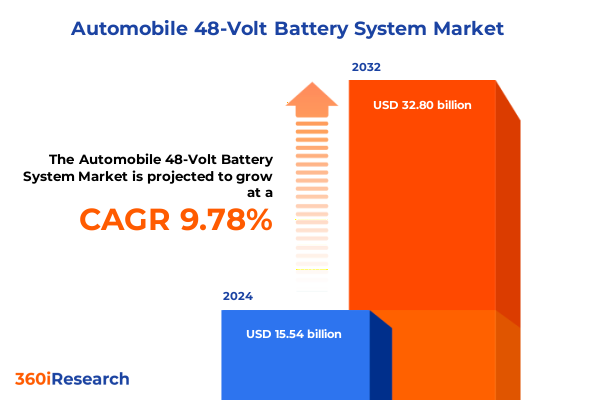

The Automobile 48-Volt Battery System Market size was estimated at USD 16.99 billion in 2025 and expected to reach USD 18.58 billion in 2026, at a CAGR of 9.84% to reach USD 32.80 billion by 2032.

Unveiling the Critical Role and Evolution of 48-Volt Battery Systems in Modern Automobiles Across Global Markets to Boost Efficiency and Sustainability

The automotive industry is undergoing a profound transformation driven by stringent emissions regulations and growing consumer demand for improved fuel efficiency. In this context, 48-volt battery systems have emerged as a pivotal technology that bridges the gap between traditional internal combustion engines and full electrification. Initially adopted to support stop-start functionality, these systems have evolved to enable advanced micro and mild hybrid architectures, delivering both performance enhancements and environmental benefits without the complexity or cost of high-voltage setups.

As energy recovery and load management become more critical, the importance of a robust 48-volt platform cannot be overstated. This power tier offers a cost-effective compromise, reducing fuel consumption by handling ancillary loads, smoothing torque delivery during acceleration, and supporting regenerative braking systems more efficiently than conventional 12-volt architectures. Furthermore, consumers experience tangible improvements in drivability, as the system delivers reduced engine noise and smoother restart cycles, enhancing overall driving comfort.

Transitioning from introduction to broader market context, this executive summary will explore the transformative shifts reshaping the landscape, analyze the impact of recent U.S. tariff developments, delve into nuanced segmentation and regional dynamics, profile leading industry participants, and offer strategic guidance for stakeholders. Each section is designed to equip decision-makers with actionable insights needed to capitalize on the expanding role of 48-volt battery systems in modern automotive design and sustainability initiatives.

Mapping Pivotal Technological and Regulatory Shifts That Are Redefining the 48-Volt Battery System Landscape in the Automotive Sector

In recent years, a confluence of regulatory mandates, technological breakthroughs, and changing consumer expectations has accelerated the adoption of 48-volt battery systems. Regulatory bodies in Europe and North America have tightened fleet-wide emissions targets, prompting OEMs to seek intermediate electrification solutions that deliver immediate gains in efficiency and emissions reduction. As a result, automakers have invested heavily in refining components such as compact lithium-ion modules, power electronics, and integrated belt-starter generator units.

Concurrently, advancements in battery chemistry and manufacturing processes have significantly improved energy density and cycle life, while reducing costs per kilowatt-hour. Lithium iron phosphate and nickel manganese cobalt formulations, for instance, now offer enhanced thermal stability and charging performance suitable for automotive applications. Meanwhile, module architecture innovations-spanning cylindrical, prismatic, and pouch formats-have enabled more flexible packaging configurations that integrate seamlessly into vehicle architecture without significant redesign.

Furthermore, digitalization and predictive analytics have become integral in optimizing system performance. AI-driven battery management systems now monitor state-of-charge and state-of-health with unprecedented precision, extending service life and ensuring safety under diverse operating conditions. Given these transformative shifts, industry participants are recalibrating their strategies to capture value in a landscape where hybridization plays an increasingly central role.

Examining the Cumulative Economic and Strategic Impacts of Newly Enacted 2025 United States Tariffs on 48-Volt Battery System Supply Chains

The United States introduced a new tariff regime on critical battery components in early 2025, driven by national security concerns and a desire to bolster domestic manufacturing. These measures impose levies on imported cell materials, power semiconductors, and electromechanical subsystems, which has led to recalibrated supply chain strategies among OEMs and suppliers. Initially, manufacturers had to contend with higher input costs, forcing them to explore alternative sourcing options or negotiate price adjustments with domestic partners.

Subsequently, some firms accelerated investments in localized production facilities and strategic joint ventures to mitigate exposure to tariff-induced cost pressures. By realigning procurement toward U.S.-based cell fabrication and module assembly plants, companies aim to secure more predictable lead times and cost structures. This reshoring movement, however, requires careful management of capital expenditure and workforce development to ensure scalability and quality benchmarks are met.

In parallel, the tariff environment has incentivized innovation in material science, as battery developers seek to reduce reliance on subject-to-tariff raw materials. Emerging formulations that leverage domestically abundant resources are under evaluation, promising long-term resilience against policy fluctuations. As a result, the cumulative impact of the 2025 tariffs extends beyond cost implications; it is driving strategic reorientation across manufacturing, R&D, and collaboration models within the 48-volt battery ecosystem.

Uncovering Deep Insights Across Diverse Segmentation Dimensions from Application to Capacity Range for 48-Volt Battery Systems

To fully understand market dynamics, it is essential to analyze performance across multiple segmentation dimensions. Based on application, three primary use cases emerge: micro hybrid configurations capitalize on regenerative braking and minimal electrification to enhance fuel economy in urban driving, mild hybrids integrate belt-driven starter generators to support torque assist and reduce engine load during acceleration, and stop-start systems focus on reducing idle fuel consumption by seamlessly shutting off and restarting the engine at traffic stops.

Segmentation by vehicle type reveals a bifurcation between commercial vehicles, where durability and total cost of ownership considerations dominate, and passenger cars, which emphasize comfort, NVH reduction, and performance gains. Battery chemistry segmentation underscores the significance of lead acid for cost-sensitive applications, lithium-ion for high energy density and longevity, and nickel metal hydride where safety and thermal tolerance are paramount, with lithium iron phosphate and nickel manganese cobalt variants catering to specific performance and cost balance criteria.

When considering module type, cylindrical cells offer established manufacturing maturity and thermal management advantages, prismatic designs provide high volumetric efficiency, and pouch formats enable lightweight, flexible packaging solutions. Sales channel segmentation distinguishes aftermarket retrofits, where ease of installation and compatibility drive demand, from OEM adoption that prioritizes integration, warranty assurance, and system-level optimization. Finally, capacity range influences system architecture decisions, as sub-1 kWh setups excel in basic load management, 1 to 2 kWh modules support extended hybrid functionality, and greater-than-2 kWh configurations enable more aggressive torque assist and energy recovery, shaping product strategy across the value chain.

This comprehensive research report categorizes the Automobile 48-Volt Battery System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Battery Chemistry

- Module Type

- Capacity Range

- Application

- Sales Channel

Illuminating Key Regional Dynamics and Strategic Opportunities for 48-Volt Battery Systems Across Americas, Europe Middle East Africa and Asia Pacific Regions

Regional dynamics play a decisive role in shaping demand, innovation, and competitive positioning. In the Americas, strong policy support for electrification, tax incentives for hybrid vehicles, and established automotive manufacturing clusters underpin steady adoption of 48-volt systems. OEMs in this region benefit from robust infrastructure for component sourcing and aftersales service networks, while suppliers leverage proximity to end markets to accelerate product validation and scale.

In Europe, Middle East & Africa, stringent CO2 targets and city-level emissions restrictions have propelled automakers to prioritize mild hybrid architectures. Governments across the European Union offer purchase premiums for vehicles equipped with advanced electrification systems, driving rapid integration of 48-volt solutions in premium and mass-market segments alike. Meanwhile, emerging markets in the Middle East and Africa present opportunities for aftermarket conversions, where cost-effective fuel savings are highly valued amid fluctuating fuel prices.

Asia-Pacific stands out for its diversified ecosystem. Japan and South Korea lead in advanced battery cell manufacture and materials innovation, while China’s accelerating hybrid vehicle registration rates have spurred local production of cost-optimized modules. Cross-border collaborations between automakers and tier-one suppliers are commonplace, aiming to share best practices and achieve economies of scale. These regional profiles underscore the strategic importance of tailoring approaches to local policy frameworks, infrastructure maturity, and consumer preferences.

This comprehensive research report examines key regions that drive the evolution of the Automobile 48-Volt Battery System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Shaping the Competitive 48-Volt Battery System Ecosystem Globally

A cohort of specialized battery developers, automotive OEMs, and component suppliers has emerged as the driving force in the 48-volt ecosystem. Leading cell manufacturers have introduced proprietary cathode formulations that balance energy density with safety and lifecycle robustness, while power electronics firms are delivering compact inverters and efficient DC/DC converters designed specifically for 48-volt architectures. Collaboration between these players and vehicle OEM R&D teams has accelerated integration cycles and reduced time-to-market for next-generation systems.

Simultaneously, module assemblers and thermal management specialists are innovating in cooling strategies, such as integrated liquid cooling plates and phase-change materials, to address the thermal challenges inherent to higher power demands. Strategic partnerships between material science companies and automotive suppliers are advancing breakthroughs in high-conductivity binders and reduced-weight enclosures. Moreover, aftermarket solution providers are carving out a niche by offering retrofit kits that enable fleet operators to upgrade existing vehicles with 48-volt capabilities, delivering a quick return on investment.

These competitive dynamics illustrate a landscape where synergy between chemistry innovation, electronics expertise, and system integration capabilities defines market leadership. As alliances evolve, stakeholders are increasingly focused on co-developing scalable platforms that can be adapted for multiple vehicle architectures and global regulations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automobile 48-Volt Battery System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BYD Company Limited

- Clarios LLC

- Continental AG

- Delphi Technologies PLC

- East Penn Manufacturing Co., Inc.

- EnerSys Inc.

- Exide Technologies

- Furukawa Electric Co., Ltd.

- GS Yuasa Corporation

- Hitachi Astemo, Ltd.

- Johnson Controls International plc

- LG Energy Solution, Ltd.

- Panasonic Corporation

- Robert Bosch GmbH

- Samsung SDI Co., Ltd.

- Toshiba Corporation

- Valeo SA

- VARTA AG

- Vicor Corporation

Delivering Strategic and Actionable Recommendations to Propel Industry Leaders Forward in the Evolving 48-Volt Battery System Landscape

Industry leaders must prioritize modular architectures that accommodate rapid updates in chemistry and power electronics, ensuring flexibility as regulations and performance benchmarks evolve. Investing in strategic collaborations with material providers and in-house R&D capabilities will allow firms to mitigate supply risks and capitalize on emerging low-cost cathode formulations. To maximize impact, decision-makers should integrate advanced battery management software that leverages predictive analytics for state-of-health monitoring, extending service intervals and enhancing system reliability.

Furthermore, localizing key manufacturing processes in tariff-impacted regions can protect margins and improve supply chain resilience. Establishing centers of excellence in areas such as thermal management and cell design will ensure quick pivoting in response to policy shifts or component shortages. Concurrently, OEMs are advised to engage fleet operators and aftermarket specialists in pilot programs, gathering real-world performance data that can guide product refinement and validate return-on-investment claims.

Finally, companies should cultivate cross-functional teams combining engineering, regulatory affairs, and market intelligence to create a seamless feedback loop. This integrated approach will enable timely adjustments to product roadmaps, ensuring that 48-volt offerings not only meet technical requirements but also align with changing consumer and legislative landscapes.

Detailing the Robust Research Methodology and Analytical Framework Employed to Illuminate 48-Volt Battery System Market Dynamics and Trends

This analysis draws upon a comprehensive research methodology that integrates primary interviews with automotive OEM R&D executives, battery developers, and aftermarket specialists, along with secondary data from regulatory filings, patent databases, and industry consortium reports. The primary research phase involved structured discussions to uncover technical challenges, regulatory interpretations, and investment priorities across key regions and stakeholder groups.

Secondary research entailed rigorous review of publicly available policy documents, corporate sustainability disclosures, and materials science publications to map evolving tariff frameworks, chemistry advancements, and module innovations. Data triangulation techniques were employed to validate findings, cross-referencing multiple sources to mitigate bias and ensure consistency. Quantitative assessments of technology readiness levels and supply chain configurations were complemented by qualitative insights into strategic partnerships, market entry barriers, and distribution channel dynamics.

To synthesize these insights, a multi-layered analytical framework was utilized, encompassing segmentation analysis, regional profiling, competitive benchmarking, and scenario planning. This structured approach enabled the identification of critical inflection points and the development of forward-looking recommendations tailored to diverse stakeholder needs, from OEM program directors to tier-one suppliers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automobile 48-Volt Battery System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automobile 48-Volt Battery System Market, by Vehicle Type

- Automobile 48-Volt Battery System Market, by Battery Chemistry

- Automobile 48-Volt Battery System Market, by Module Type

- Automobile 48-Volt Battery System Market, by Capacity Range

- Automobile 48-Volt Battery System Market, by Application

- Automobile 48-Volt Battery System Market, by Sales Channel

- Automobile 48-Volt Battery System Market, by Region

- Automobile 48-Volt Battery System Market, by Group

- Automobile 48-Volt Battery System Market, by Country

- United States Automobile 48-Volt Battery System Market

- China Automobile 48-Volt Battery System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Critical Insights and Strategic Imperatives for Stakeholders Navigating the Future of 48-Volt Battery Systems in Automotive Applications

The emergence of 48-volt battery systems represents a pivotal milestone in automotive electrification, offering a versatile platform that balances cost, performance, and ease of integration. From the incremental gains of stop-start technology to the torque-assist capabilities of mild hybrid architectures, these systems are fostering a new era of sustainable mobility. Regulatory pressures, technological advances, and shifting consumer preferences have collectively shaped an ecosystem where innovation is both imperative and collaborative.

As U.S. tariffs recalibrate supply chain strategies and regional policies drive localized production, stakeholders must remain agile, leveraging deep segmentation insights and robust methodologies to guide investment decisions. The strategic interplay of chemistry optimization, modular design, and digital battery management will determine market leadership, while targeted partnerships and manufacturing localization will safeguard resilience against external shocks.

Ultimately, success in the 48-volt domain hinges on the ability to translate technical prowess into compelling value propositions for vehicle manufacturers, fleet operators, and end consumers. By synthesizing critical insights and embracing a proactive approach to strategy, industry participants can navigate uncertainties and unlock the full potential of this transformative technology.

Engage with Ketan Rohom to Unlock Comprehensive 48-Volt Battery System Market Analysis and Secure Your In-Depth Research Report Today

Ready to elevate your strategic planning and gain unparalleled market clarity on 48-volt automotive battery systems by partnering with Ketan Rohom, Associate Director of Sales & Marketing at our firm. Schedule a personalized consultation to delve into comprehensive market intelligence that addresses the nuanced challenges and emerging opportunities across applications, vehicle types, battery chemistries, module configurations, and regional dynamics. Let this in-depth research report serve as your roadmap for innovation, risk mitigation, and revenue acceleration in a rapidly evolving automotive electrification landscape. Reach out today to secure access to proprietary data, expertly curated insights, and tailored recommendations that empower decision-makers to stay ahead of the competition and confidently navigate 48-volt battery system market transformations.

- How big is the Automobile 48-Volt Battery System Market?

- What is the Automobile 48-Volt Battery System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?