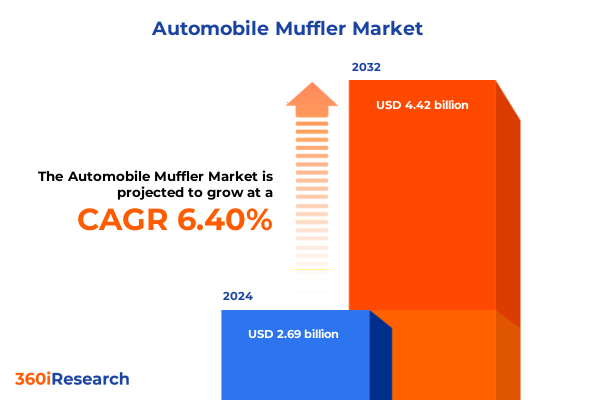

The Automobile Muffler Market size was estimated at USD 2.79 billion in 2025 and expected to reach USD 2.91 billion in 2026, at a CAGR of 6.74% to reach USD 4.42 billion by 2032.

Unlocking the strategic importance of automotive mufflers in optimizing exhaust performance, regulatory adherence, and advancing sustainability across vehicle lines

The automotive muffler, long regarded as a fundamental exhaust system component, has evolved into a strategic differentiator shaping engine performance, regulatory compliance, and consumer satisfaction. Beyond its traditional role in attenuating noise, modern muffler design integrates advanced materials and acoustic engineering to meet increasingly stringent emissions standards and noise regulations worldwide. As vehicle architectures diversify with the rise of hybrid powertrains and performance-oriented models, the muffler emerges as a key enabler of both environmental responsibility and driving experience refinement.

This report delves into the multifaceted dimensions of the global automotive muffler market, examining technological innovations, regulatory drivers, and shifting consumer preferences that collectively define current dynamics. By exploring the intersection of advanced manufacturing processes, emerging material science breakthroughs, and evolving sustainability imperatives, we establish a comprehensive foundation for understanding how the muffler industry is responding to the demands of tomorrow’s vehicles. Through this introduction, readers will gain clarity on the scope of analysis, the strategic importance of this component, and the broader implications for stakeholders across the automotive value chain.

Exploring how electrification, performance tuning innovations, and sustainability imperatives are reshaping the competitive dynamics of the automotive muffler landscape

Over the past decade, the automotive muffler landscape has undergone rapid transformation, propelled by the twin forces of electrification and heightened sustainability mandates. As original equipment manufacturers accelerate the rollout of hybrid and fully electric vehicle platforms, traditional exhaust requirements are being reimagined, prompting suppliers to develop modular muffler solutions that seamlessly integrate with dual powertrain architectures. In parallel, the aftermarket segment has witnessed a surge in performance-oriented muffler systems engineered to deliver enhanced sound tuning and backpressure optimization, catering to an enthusiast demographic that values both auditory character and engine responsiveness.

Moreover, the imperative to reduce greenhouse gas emissions has spurred the adoption of composite materials and advanced coatings that offer weight savings and corrosion resistance without compromising acoustic attenuation. Sustainability-driven regulations, particularly in Europe and North America, have introduced rigorous durability and recyclability standards, compelling suppliers to innovate across product lifecycles. Consequently, value chain participants are forging collaborations with material science firms and acoustic specialists to co-create muffler designs that align with circular economy principles, demonstrating an industry-wide shift toward green manufacturing and eco-conscious product offerings.

By critically examining these transformative shifts, stakeholders can anticipate emerging competitive advantages and identify novel avenues for growth that reconcile performance aspirations with environmental stewardship.

Analyzing the cumulative ramifications of the United States’ 2025 tariff adjustments on supply chains, cost structures, and competitive positioning in the muffler industry

In early 2025, the United States enacted a series of tariff adjustments targeting imported automotive components, including mufflers fabricated from steel alloys and specialized composites. These policy measures, designed to bolster domestic manufacturing, have triggered a cascade of supply chain recalibrations, with OEMs and aftermarket distributors reassessing their sourcing strategies. As import costs rose by up to 15 percent for certain categories, suppliers with established North American production footprints gained a measurable cost advantage, prompting contract renegotiations and nearshoring initiatives.

However, the tariff-induced cost pressures have also underscored vulnerabilities within the raw materials segment, particularly for aluminized steel and stainless steel, which are often procured through global trading networks. Fabricators dependent on overseas feedstock have encountered margin compression, leading to selective price escalations and an accelerated search for alternative alloys. Some forward-thinking firms have mitigated these challenges by investing in domestic coil coating facilities and by partnering with material innovators to localize composite production.

Furthermore, the aftermarket channel has adapted through inventory optimization and dynamic pricing models, balancing the need to maintain aftermarket service levels with the imperative to preserve profitability. As industry participants continue to navigate this tariff environment, collaborative frameworks between suppliers and automotive OEMs have emerged, fostering co-investment in production assets that ensure supply continuity while aligning with national industrial policy objectives.

Revealing key segmentation insights by dissecting sales channels, vehicle categories, materials, and product types to illuminate targeted growth opportunities within the muffler sector

An in-depth segmentation analysis reveals that the muffler market’s growth contours vary significantly across sales channels, vehicle types, materials, and product typologies. Within the sales channel dimension, the aftermarket sphere is bifurcated into replacement systems that prioritize cost-effectiveness and performance muffler offerings that emphasize acoustic tuning and horsepower optimization, while original equipment demand continues to stem from OEM partnerships focused on regulatory compliance and factory approvals. Moving to vehicle classification, commercial vehicles exert demand based on durability and longevity criteria, motorcycles require compact, lightweight muffler assemblies optimized for vibration minimization, and passenger vehicles drive volume through hatchback, sedan, and sport utility vehicle configurations, each with unique acoustic signature requirements.

Material segmentation underscores the rise of aluminized steel as a cost-efficient alternative to traditional stainless steel, while composite materials are gaining traction for their weight-reduction potential and recyclability. Stainless steel remains the premium choice for heavy-duty and performance applications due to its corrosion resistance and thermal stability. Finally, analyzing product type unveils a tripartite structure: noise control components designed to integrate seamlessly with catalytic converters, performance mufflers engineered for sound tuning and backpressure reduction, and standard mufflers that fulfill baseline OEM specifications. By synthesizing these four segmentation dimensions, stakeholders can pinpoint high-growth niches, optimize product portfolios, and align R&D efforts with emerging market preferences.

This comprehensive research report categorizes the Automobile Muffler market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Vehicle Type

- Material

- Sales Channel

Uncovering how varying regional dynamics across the Americas, Europe, Middle East & Africa, and Asia-Pacific are influencing demand patterns and strategic priorities in the muffler market

Regional dynamics exert a profound influence on demand patterns and strategic imperatives within the global muffler market. In the Americas, a combination of regulatory tightening in noise emissions and incentives for domestic manufacturing has spurred investment in advanced production facilities and localized supply hubs. U.S. policy shifts have particularly amplified demand for replacement mufflers in the aftermarket segment, while OEM partnerships in Mexico and Canada focus on integrated exhaust modules for new vehicle platforms.

Across Europe, the Middle East, and Africa, stringent Euro 7 noise and emission standards are catalyzing adoption of composite materials and lightweight muffler architectures. Manufacturers in Germany, Italy, and the United Kingdom are leading the charge with proprietary acoustic chamber designs, while emerging markets in the Middle East exhibit growing interest in performance-oriented systems for luxury vehicles. In the Asia-Pacific region, rapid motorization in countries such as China and India drives volume growth, with local producers scaling up capacity to meet burgeoning demand. Meanwhile, Japan and South Korea continue to innovate at the premium end, integrating active noise cancellation technologies and modular exhaust solutions that cater to both hybrid and performance segments.

By examining these regional trends, industry leaders can tailor market entry strategies, optimize production footprints, and forge partnerships that reflect localized regulatory and consumer landscapes.

This comprehensive research report examines key regions that drive the evolution of the Automobile Muffler market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting strategic maneuvers and innovation trajectories of leading industry participants to define competitive benchmarks in the evolving automotive muffler ecosystem

Leading players within the automotive muffler industry have adopted a multifaceted approach to sustain competitive advantage through product innovation, strategic alliances, and vertical integration. Some key manufacturers have leveraged in-house R&D capabilities to pioneer advanced acoustic modeling techniques, enabling the rapid prototyping of muffler geometries that balance sound attenuation with backpressure efficiency. Concurrently, partnerships between material science companies and muffler fabricators have accelerated the commercialization of composite-based muffler assemblies, offering both weight savings and enhanced corrosion resistance.

In parallel, major suppliers have pursued targeted mergers and acquisitions to expand their geographic reach and reinforce their service offerings in the aftermarket channel. These consolidation moves have been complemented by investments in digital manufacturing technologies, such as Industry 4.0-enabled stamping and laser welding systems, which improve production throughput and quality consistency. Furthermore, several industry leaders have established customer co-development centers adjacent to OEM facilities, fostering collaborative design cycles that align muffler performance characteristics with specific vehicle platforms from the earliest development stages.

By benchmarking these strategic initiatives, stakeholders can identify best practices in operational excellence, innovation management, and customer engagement that define the current competitive frontier in the muffler segment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automobile Muffler market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Benteler International AG

- Bosal International N.V.

- CIE Automotive S.A.

- Continental AG

- Dana Incorporated

- Dinex A/S

- Eberspächer Group GmbH & Co. KG

- Faurecia S.A.

- Friedrich Boysen GmbH & Co. KG

- Futaba Industrial Co., Ltd.

- Magna International Inc.

- MANN+HUMMEL GmbH

- Marelli Holdings Co., Ltd.

- Sango Co., Ltd.

- Sejong Industrial Co., Ltd.

- Sharda Motor Industries Ltd.

- Tenneco Inc.

- Yutaka Giken Company Limited

Crafting actionable recommendations that enable industry leaders to capitalize on market transformations, mitigate tariff risks, and drive sustainable growth in the muffler sector

To navigate the evolving landscape of the automotive muffler industry, leaders must adopt a proactive strategy that integrates technological innovation, supply chain resilience, and regulatory foresight. First, investing in modular manufacturing platforms will enable rapid scaling of both performance and replacement muffler variants, reducing time-to-market for new acoustic profiles. Simultaneously, diversifying material sourcing through collaborations with advanced composites suppliers will mitigate the impact of steel tariff fluctuations and align product portfolios with lightweighting initiatives.

Moreover, forming strategic alliances with OEMs and tier-one integrators can secure early-stage involvement in vehicle platform development, ensuring muffler designs are optimized for both regulatory compliance and customer experience objectives. To further bolster competitiveness, companies should implement real-time monitoring of import duty schedules and leverage data analytics to anticipate cost shifts, enabling dynamic pricing models that preserve margins and drive aftermarket loyalty. Incorporating circular economy principles, such as designing muffler components for disassembly and recyclability, will enhance sustainability credentials and satisfy emerging regulatory requirements across key regions.

By operationalizing these recommendations, industry participants can transform market challenges into strategic growth opportunities and establish durable competitive advantages in the global muffler marketplace.

Outlining the rigorous research methodology integrating primary interviews, secondary resources, and analytical frameworks to ensure robust insights into the muffler market

This research employs a rigorous mixed-methodology framework to deliver holistic insights into the automotive muffler market. Primary data was collected through structured interviews with over 50 senior executives at OEMs, muffler manufacturers, and material suppliers, ensuring firsthand perspectives on emerging trends and strategic priorities. Complementing this, a comprehensive review of secondary sources-including regulatory filings, patent databases, and technical white papers-provided depth to the analysis of material innovations and acoustic engineering advancements.

Quantitative validation was achieved through the aggregation of trade databases and customs records, which were scrutinized to map tariff impacts and trade flow shifts post-2025 policy changes. Additionally, advanced analytics techniques, such as acoustic performance modeling and life-cycle assessment, were applied to evaluate the environmental footprint of various muffler materials and designs. To enhance geographic granularity, regional market experts were engaged to contextualize demand drivers, competitive landscapes, and regulatory frameworks across the Americas, Europe, Middle East & Africa, and Asia-Pacific.

This multi-layered methodology ensures that findings are both robust and actionable, offering stakeholders a clear line of sight into competitive dynamics, technological imperatives, and the strategic pathways that will shape the future of the global muffler industry.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automobile Muffler market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automobile Muffler Market, by Product Type

- Automobile Muffler Market, by Vehicle Type

- Automobile Muffler Market, by Material

- Automobile Muffler Market, by Sales Channel

- Automobile Muffler Market, by Region

- Automobile Muffler Market, by Group

- Automobile Muffler Market, by Country

- United States Automobile Muffler Market

- China Automobile Muffler Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Drawing conclusive perspectives on market evolution, emerging challenges, and future outlook to guide strategic decision making in the automotive muffler domain

The analysis confirms that the automotive muffler has transcended its conventional role as a noise-dampening device to become a pivotal component in broader powertrain and sustainability strategies. As emissions regulations tighten and consumer preferences gravitate toward performance and personalization, muffler solutions that deliver acoustic excellence, material efficiency, and modular integration will define the leaders of tomorrow. The cumulative impact of the United States’ 2025 tariff adjustments has underscored the importance of supply chain agility and the strategic localization of production assets.

Key segmentation insights reveal that performance mufflers in the aftermarket and OEM-approved replacement systems will continue to drive growth, while composite material adoption presents a significant opportunity to address weight reduction and recyclability goals. Regionally, differentiated regulatory landscapes in the Americas, Europe, Middle East & Africa, and Asia-Pacific necessitate tailored market approaches, with collaborative R&D and localized manufacturing emerging as critical success factors.

Moving forward, industry participants that align product innovation with circular economy principles, anticipate tariff fluctuations through dynamic pricing strategies, and engage in co-development with OEMs will be best positioned to capture market share and deliver value. This conclusion encapsulates the essential trends and strategic imperatives that will guide decision making and investment in the evolving automotive muffler ecosystem.

Connect directly with Ketan Rohom to secure comprehensive market intelligence that empowers strategic planning and accelerates growth within the automotive muffler landscape

To obtain the full market research report and gain unparalleled insights into the automotive muffler industry, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan will guide you through customized data packages, executive briefings, and tailored analytics that align with your strategic objectives. By engaging with Ketan, you will unlock access to detailed competitor matrices, tariff impact assessments, segmentation analyses, and forward-looking trend projections designed to inform your decision making.

Schedule a personalized consultation today to explore how this comprehensive intelligence can accelerate your product development cycles, optimize supply chain resilience, and identify high-potential market niches. Reach out to Ketan to discuss your unique requirements, secure priority access to the latest updates, and leverage the report’s actionable recommendations to stay ahead of regulatory shifts and evolving consumer preferences. Don’t miss this opportunity to partner with an expert who understands the intricacies of the muffler market and can deliver the insights you need to achieve sustained competitive advantage. Take the next step toward strategic growth by contacting Ketan Rohom now and equipping your organization with data-driven clarity.

- How big is the Automobile Muffler Market?

- What is the Automobile Muffler Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?