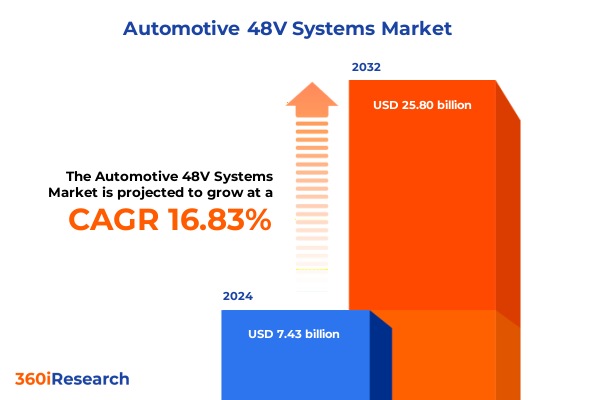

The Automotive 48V Systems Market size was estimated at USD 10.59 billion in 2025 and expected to reach USD 12.43 billion in 2026, at a CAGR of 17.78% to reach USD 33.32 billion by 2032.

Unveiling the Next Generation of Automotive Power Architectures with 48V Systems: A Strategic Overview of Emerging Trends and Drivers

The automotive industry is undergoing a profound transformation as 48-volt systems emerge as a pivotal technology in the pursuit of greater efficiency, reduced emissions, and enhanced driving experience. This report provides a foundational overview of key drivers shaping the adoption of 48-volt mild hybrid architectures, highlighting how advances in battery chemistry, power electronics, and control software are converging to unlock new levels of performance. By tracing the evolution from conventional 12-volt networks to robust 48-volt platforms, readers will gain clarity on the technological inflection points and regulatory milestones that have accelerated the shift.

Beyond technical evolution, this introduction delves into the strategic importance of 48-volt solutions for original equipment manufacturers and aftermarket stakeholders alike. It underscores how tightening fuel economy standards and consumer demand for responsive power delivery are reshaping engineering roadmaps. With this context established, the report sets the stage for an in-depth analysis of market dynamics, policy impacts, and competitive landscapes, positioning readers to navigate the rapidly developing 48-volt ecosystem with confidence.

How Electrification, Regulatory Mandates and Consumer Demand Are Converging to Accelerate the Adoption of 48V Automotive Systems Across Global Markets

Powertrain electrification has transitioned from a niche innovation to a mainstream imperative, driven by a confluence of regulatory mandates, consumer expectations, and technological breakthroughs. Globally, carbon dioxide reduction targets are tightening, compelling automakers to integrate mild hybrid architectures that offer meaningful emissions benefits without the complexity of full electrification. Concurrently, consumer appetite for vehicles that deliver both fuel efficiency and dynamic performance has escalated, elevating 48-volt systems as a preferred compromise that marries environmental responsibility with driving enjoyment.

Moreover, recent progress in semiconductor power density and thermal management has unlocked new design possibilities for DC/DC converters and electronic control units, enabling more compact, lighter, and cost-effective implementations. As a result, automakers are exploring multiple architecture tiers-from P0 belt-driven starter generators up through P3 transmission-mounted solutions-each tailored to distinct vehicle segments and performance requirements. These shifts are further reinforced by emerging partnerships between established suppliers and software innovators, fostering integrated solutions that streamline development timelines and accelerate market entry.

Assessing the Ramifications of 2025 United States Tariffs on Automotive 48V Supply Chains and Component Cost Structures for Strategic Planning

The introduction of tariffs in 2025 on key imported automotive components has reverberated across the 48-volt supply chain, prompting manufacturers to reassess sourcing strategies and cost structures. Components such as lithium-ion battery cells, DC/DC converters, and sophisticated electronic control units have become subject to increased duties, raising the total landed cost and compressing supplier margins. In response, several global Tier 1 suppliers have announced plans to expand local manufacturing footprints in the United States, incentivized by federal programs aimed at strengthening domestic production of critical electrification components.

This reconfiguration has led to a diversification of procurement channels, with original equipment manufacturers forging new alliances with North American battery assemblers and semiconductor fabricators. Although these developments promise greater supply chain resilience, they also introduce complexities in qualification processes and long-term vendor agreements. Ultimately, the tariff landscape of 2025 underscores the strategic imperative of supply base agility and localized collaboration to mitigate financial exposure and maintain program timelines in the evolving 48-volt arena.

Decoding the Multifaceted Segmentation Dynamics of the Automotive 48V System Market to Illuminate Component Usage and Application Requirements

A nuanced understanding of market segmentation reveals how varying 48-volt components, architectures, application areas, and end-user channels interplay to define adoption trajectories. Component categories encompass battery solutions-spanning traditional lead-acid configurations to advanced lithium-ion chemistries-alongside DC/DC converters, electronic control units that integrate battery management systems and powertrain modules, and starter generators. Architecture tiers range from P0 configurations leveraging belt-driven starters to P3 designs employing transmission output shaft integration, each presenting unique cost-benefit trade-offs. Complementing these are architecture types that include crankshaft-mounted units and dual-clutch transmission-mounted systems, offering distinct packaging and performance characteristics.

Application insights further delineate the market into areas such as electric turbocharging, electronic power steering, regenerative braking, and stop-start systems, each driving specific power demands and cost sensitivities. Distribution pathways bifurcate between aftermarket suppliers and original equipment manufacturing channels, shaping product development, service strategies, and warranty frameworks. In parallel, vehicle segmentation highlights differing uptake rates between commercial vehicle fleets-where durability and fuel savings are paramount-and passenger vehicles that prioritize seamless user experience and cost efficiencies. Collectively, this segmentation matrix provides a comprehensive lens to gauge how technological, economic, and channel factors coalesce to influence 48-volt deployments.

This comprehensive research report categorizes the Automotive 48V Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Electrification Architecture

- System Configuration

- Application

- Sales Channel

- Vehicle Type

Exploring Regional Nuances in the Global Automotive 48V Systems Landscape to Uncover Growth Drivers and Adoption Patterns Across Key Territories

Regional analyses underscore that the Americas, Europe, the Middle East and Africa, and Asia-Pacific present distinct growth patterns driven by regulatory environments, industrial capabilities, and consumer preferences. In the Americas, federal and state-level incentives favor domestic manufacturing, spurring expansions in battery cell assembly and power electronics production, while fleet operators embrace stop-start and regenerative braking features to reduce total cost of ownership. Conversely, the Europe, Middle East and Africa region benefits from some of the world’s most stringent CO2 reduction mandates, catalyzing a rapid shift towards mild hybrid adoption, particularly in passenger cars that integrate 48-volt architectures to meet corporate average emissions targets.

Meanwhile, Asia-Pacific emerges as a dynamic hub, with leading automakers in China and Japan driving volume production of belt-driven starter generators and electronic turbocharging systems. Growing local supply chains, aligned with government policies aimed at reducing oil dependency and urban pollution, have accelerated deployment across both passenger and commercial segments. These divergent regional imperatives underscore the importance of tailoring technology roadmaps and partnership strategies to local market conditions while maintaining global platform synergies.

This comprehensive research report examines key regions that drive the evolution of the Automotive 48V Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Innovators and Strategic Partnerships Driving Advancement in 48V Systems with Insights into Competitive Positioning and Capabilities

Leading suppliers are advancing 48-volt system innovation through a combination of organic R&D, strategic partnerships, and targeted acquisitions. Bosch continues to leverage its deep expertise in power electronics and software integration to deliver next-generation DC/DC converters and battery management platforms optimized for high-volume applications. Continental has prioritized modular electronic control units, enabling scalable solutions across multiple architecture tiers and accelerating development cycles through standardized hardware designs coupled with flexible software stacks.

New entrants and tiered alliances are reshaping competitive dynamics, as component specialists collaborate with automotive OEMs to co-develop starter generator systems and integrated powertrain modules. Companies such as MAHLE and Valeo are investing in local production facilities to mitigate tariff impacts and shorten lead times, while also exploring joint ventures with battery cell manufacturers to secure long-term supply. These efforts underscore a broader industry trend towards vertical integration, where control over critical value chain elements increasingly determines market leadership in the 48-volt domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive 48V Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Robert Bosch GmbH

- VALEO SA

- Continental AG

- BorgWarner Inc.

- DENSO CORPORATION

- Aptiv PLC

- FORVIA SE

- Nexteer Automotive Corporation

- Magna International Inc

- Lear Corporation

- Dana Incorporated

- Texas Instruments Incorporated

- Mitsubishi Electric Corporation

- ZF Friedrichshafen AG

- Mahle GmbH

- Marelli Holdings Co., Ltd.

- Infineon Technologies AG

- Eaton Corporation PLC

- Toshiba Corporation

- HYUNDAI MOTOR GROUP

- Stellantis N.V.

- STMicroelectronics NV

- Allegro MicroSystems, Inc.

- Chilwee Group Co., Ltd.

- Exedy Clutch Europe Limited

- Molex, LLC

- Schaeffler Technologies AG & Co. KG

- SEG Automotive Germany GmbH

- Semiconductor Components Industries, L.L.C.

- Vicor Corporation

Crafting Actionable Strategies for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Risks in the Evolving 48V Automotive Ecosystem

Industry leaders seeking to capitalize on 48-volt opportunities should prioritize the localization of critical component production, forging partnerships with domestic cell assemblers and semiconductor foundries to mitigate tariff exposure. Concurrently, accelerating cross-functional collaboration between powertrain engineering teams and software developers will be essential to optimize system-level performance and shorten validation cycles. By adopting a platform-based approach to electronic control unit design, manufacturers can achieve economies of scale while preserving the flexibility to differentiate across vehicle segments.

Moreover, engaging in early-stage co-innovation with fleet operators and targeted aftermarket providers can uncover use-case insights that inform product roadmaps for applications like regenerative braking and electronic power steering. Finally, establishing digital twin frameworks to simulate thermal management, energy recovery, and system integration scenarios will enable data-driven design decisions, reducing time to market and enhancing reliability credentials in increasingly competitive landscapes.

Outlining a Robust Mixed-Method Research Methodology Underpinning the Analysis of Automotive 48V Systems with Emphasis on Data Integrity and Expert Validation

The findings presented in this report are underpinned by a robust mixed-method research framework that harnesses both qualitative expert insights and quantitative industry data. Primary research involved in-depth interviews with senior engineering executives, supply chain leaders, and regulatory experts to capture firsthand perspectives on technology adoption and strategic priorities. These conversations were complemented by a series of technical workshops and site visits to component manufacturing facilities, ensuring direct observation of production processes and innovation pipelines.

Secondary research encompassed the systematic review of regulatory filings, patent databases, and company disclosures, alongside a comparative analysis of powertrain architectures across leading vehicle platforms. The triangulation of data sources provided a high degree of confidence in trend identification and segmentation logic, while continuous validation sessions with advisory board members helped refine analytical frameworks. Together, these methodologies deliver a comprehensive and credible portrayal of the automotive 48-volt systems landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive 48V Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive 48V Systems Market, by Component

- Automotive 48V Systems Market, by Electrification Architecture

- Automotive 48V Systems Market, by System Configuration

- Automotive 48V Systems Market, by Application

- Automotive 48V Systems Market, by Sales Channel

- Automotive 48V Systems Market, by Vehicle Type

- Automotive 48V Systems Market, by Region

- Automotive 48V Systems Market, by Group

- Automotive 48V Systems Market, by Country

- United States Automotive 48V Systems Market

- China Automotive 48V Systems Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Strategic Takeaways to Reinforce the Transformational Potential of 48V Systems in the Contemporary Automotive Sector

In conclusion, 48-volt systems represent a strategic inflection point for the automotive industry, offering a balanced pathway to achieve emissions reduction targets while preserving the driving dynamics valued by consumers. The convergence of advanced battery technologies, scalable power electronics, and sophisticated control software has created a versatile platform that spans multiple architecture tiers and application domains. However, navigating supply chain complexities-exacerbated by recent tariff measures-demands agile sourcing strategies and local production investments to safeguard program viability.

By dissecting segmentation insights, regional dynamics, and competitive positioning, this report equips stakeholders with the intelligence needed to formulate strategic roadmaps. As regulations tighten and consumer expectations evolve, businesses that embrace collaborative innovation, platform modularity, and data-driven design processes will be best positioned to lead the next wave of 48-volt adoption and redefine the future of efficient, electrified mobility.

Empower Your Strategic Decisions with Specialized Automotive 48V System Research – Engage Ketan Rohom to Access Comprehensive Market Insights and Analysis

Elevate your strategic planning and gain a competitive edge by securing the full automotive 48V systems report through Ketan Rohom’s expert guidance. This comprehensive resource provides detailed analyses, deep-dive segmentation insights, regional performance profiles, and forward-looking recommendations tailored for decision-makers and innovation teams alike. By partnering directly with Ketan Rohom, Associate Director of Sales & Marketing, you can customize your research package to align with your organization’s priorities, whether it’s optimizing supply chains, benchmarking product portfolios, or exploring collaborative opportunities. Acting now ensures timely access to the most current data and thought leadership, empowering your team to accelerate product development and market entry. Contact Ketan today to unlock the full potential of 48V systems and transform insight into action.

- How big is the Automotive 48V Systems Market?

- What is the Automotive 48V Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?