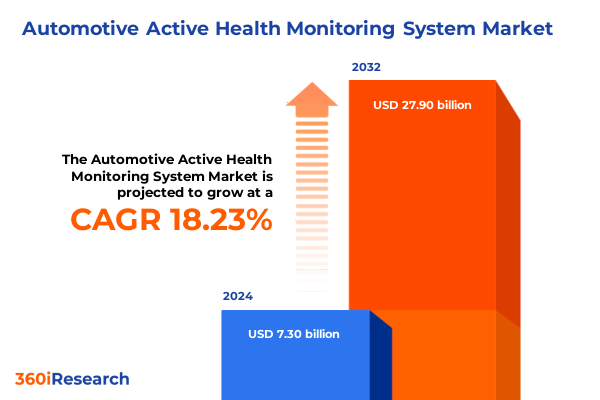

The Automotive Active Health Monitoring System Market size was estimated at USD 8.61 billion in 2025 and expected to reach USD 10.16 billion in 2026, at a CAGR of 18.27% to reach USD 27.90 billion by 2032.

Unlocking the potential of proactive vehicle maintenance through next-generation active health monitoring systems that enhance safety and operational efficiency

The automotive industry is undergoing a fundamental transformation driven by increasing demands for safety, efficiency, and connectivity, setting the stage for the widespread adoption of active health monitoring systems. These systems leverage embedded sensors, advanced telematics, and cloud-based analytics to continuously assess vehicle performance, detect anomalies in real time, and enable predictive maintenance protocols that minimize downtime and reduce operational risk. As manufacturers and fleet operators seek to differentiate their offerings, active health monitoring has emerged as a critical enabler of next-generation mobility solutions, ensuring vehicles remain reliable across diverse operating conditions.

In parallel with these operational imperatives, shifting customer expectations and regulatory pressures are compelling stakeholders to embrace proactive maintenance strategies. Rather than relying on periodic inspections or reactive repairs, automotive active health monitoring fosters a continuous feedback loop between the vehicle and centralized control platforms. This transition from a reactive to a proactive maintenance paradigm enhances asset utilization, extends component life cycles, and bolsters overall system resilience. As the concept gains traction across commercial vehicles, passenger cars, and emerging electric fleets, the integration of health monitoring capabilities is set to become a core differentiator in an increasingly competitive market landscape.

Navigating the rise of electrification, autonomous functionality, and digital connectivity as groundbreaking shifts redefining automotive active health monitoring paradigms

The landscape of automotive active health monitoring is being reshaped by three concurrent technological revolutions: electrification, autonomous functionality, and digital connectivity. Electrified powertrains introduce new parameters to monitor, including battery cell voltages, thermal profiles, and charge–discharge cycles, prompting suppliers to innovate sensor arrays and diagnostic algorithms tailored to electric vehicle (EV) requirements. These developments, in turn, dovetail with advanced driver assistance systems and autonomous driving functionalities, which rely on real-time insights to guarantee operational safety and to optimize decision-making under dynamic driving environments.

Moreover, the proliferation of high-throughput data networks, including 5G-enabled vehicle-to-cloud architectures, is enabling seamless transmission of diagnostic information to centralized analytics platforms. This convergence of sensor data, AI-driven anomaly detection, and remote software updates is morphing active health monitoring into a strategic service layer rather than a standalone component. Consequently, as software-defined vehicle concepts gain maturity, original equipment manufacturers and system integrators are exploring over-the-air calibration and real-time parameter tuning, thereby elevating active health monitoring from a maintenance tool to a continuous improvement enabler.

Assessing the cascading effects of 2025 United States tariffs on semiconductor sensors and automotive components reshaping supply chains and cost structures

The implementation of new tariffs by the United States in early 2025 has introduced a complex set of challenges and opportunities for automotive suppliers of sensors, microelectronic components, and diagnostic modules. With increased duty rates on key semiconductor inputs and specialized sensing elements, many manufacturers have faced margin pressures, prompting a thorough re-evaluation of global procurement strategies. Simultaneously, this realignment has incentivized onshore production initiatives, as suppliers seek to mitigate tariff impacts by localizing assembly operations and qualifying domestic component sources.

While the short-term effect of higher input costs has been an upward adjustment of vehicle configuration prices, the medium and long-term response has been characterized by supply chain diversification and strategic partnerships with U.S.-based component foundries. In parallel, the tariff-driven environment has spurred legislative discussions on strengthening domestic innovation ecosystems, with potential incentive programs aimed at advancing next-generation health monitoring sensor technologies. As the market continues to adapt, organizations that can effectively navigate this new tariff regime will emerge with more resilient supply chains and strengthened cost positions.

Illuminating tailored segmentation perspectives across vehicle type, system architectures, functional applications, sales channels, and end user landscapes

Dissecting the market through multiple segmentation lenses reveals nuanced insights into how active health monitoring systems address the diverse needs of vehicle operators and end users. When considering vehicle type, the market spans commercial vehicles-broken out into heavy and light segments-electric vehicles encompassing battery electric, hybrid electric, and plug-in hybrid variants, and passenger cars ranging from hatchbacks and sedans to SUVs, each demanding differentiated diagnostic and monitoring approaches tailored to their operating profiles. This diversity drives suppliers to offer modular solutions that can adapt to variations in weight, usage intensity, and powertrain complexity.

Looking at system architecture, wired implementations leveraging CAN bus or LIN bus networks continue to dominate legacy installations, while wireless modalities leveraging Bluetooth, NB-IoT, and RF connectivity are rapidly gaining traction for applications requiring minimal wiring or retrofit flexibility. The choice between wired and wireless often hinges on vehicle infrastructure constraints and the necessity for real-time versus periodic data reporting. Furthermore, from an application standpoint, the market is comprised of battery management solutions, subdivided into cell monitoring and thermal management; engine diagnostics covering coolant and oil monitoring functions; and tire pressure monitoring delivered through both direct and indirect TPMS technologies, each presenting distinct technical requirements.

The sales channel dynamic spans original equipment channels and aftermarket offerings sold online or through retail outlets, providing opportunities for system integrators to engage with both vehicle manufacturers and independent service providers. Finally, end user segmentation distinguishes between fleet operators, segmented into commercial and rental fleets, and individual consumers, underscoring how operational scale, maintenance budgets, and service expectations influence adoption patterns.

This comprehensive research report categorizes the Automotive Active Health Monitoring System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- System Type

- Sales Channel

- Application

- End User

Exploring nuanced regional dynamics across Americas, Europe Middle East and Africa, and Asia Pacific driving differential adoption of active health monitoring solutions

Regional dynamics demonstrate that the Americas region is experiencing robust uptake of active health monitoring driven by a combination of stringent safety regulations, advanced telematics infrastructure, and the dominance of commercial fleets seeking to reduce total cost of ownership. In this region, initiatives to retrofit aging truck and bus fleets with real-time monitoring capabilities have gained momentum, supported by incentives for reducing emissions and optimizing fuel consumption. At the same time, passenger car manufacturers are integrating monitoring modules as part of connected car subscriptions, further accelerating market penetration.

Conversely, Europe, the Middle East, and Africa present a complex environment characterized by heterogeneous regulatory frameworks and varying levels of infrastructure maturity. Western Europe leads adoption with rigorous vehicle inspection standards and a healthy appetite for premium safety features, while emerging markets in Eastern Europe and the Middle East are laying the groundwork through targeted infrastructure investments and pilot programs. Regulatory emphasis on vehicle electrification in key EMEA markets is also heightening the focus on battery health and thermal management systems.

Asia-Pacific continues to be a hotbed of growth driven by rapid urbanization, expanding ride-hailing services, and aggressive EV rollout policies. Market leaders in northeast Asia have invested heavily in integrated sensor platforms, while Southeast Asian nations are exploring lower-cost wireless monitoring options to service a burgeoning two-wheeler and light commercial vehicle sector. Across all regions, the interplay between local regulations, infrastructure readiness, and fleet characteristics shapes the trajectory of active health monitoring adoption.

This comprehensive research report examines key regions that drive the evolution of the Automotive Active Health Monitoring System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining strategic maneuvers of leading solution providers forging partnerships, innovating offerings, and scaling operations across a competitive ecosystem

Leading technology providers and system integrators have adopted diverse strategies to solidify their positions within the automotive active health monitoring ecosystem. Some incumbents have pivoted toward strategic alliances with semiconductor foundries and cloud analytics firms to deliver end-to-end monitoring solutions that combine hardware sensors, edge computing modules, and AI-driven platforms. Others have pursued targeted mergers and acquisitions to bolster their intellectual property portfolios, particularly in areas such as thermal imaging, cell balancing software, and wireless diagnostic gateways.

Simultaneously, software-led entrants are differentiating their offerings by emphasizing machine learning algorithms capable of predictive failure analysis and anomaly detection. These players often complement their software stacks with open API frameworks, enabling seamless integration with vehicle electronic control units and third-party fleet management systems. Partnerships between global tier-one suppliers and regional technology firms have also emerged, designed to accelerate certification processes and localize support services, thereby increasing market agility.

In addition, several firms are investing in scalable manufacturing footprints, leveraging flexible production lines to accommodate sensor variants for electric, commercial, and passenger vehicles. This approach allows them to rapidly respond to surges in demand, particularly in light of evolving regulatory compliance requirements around safety and emissions, positioning these companies for sustained growth in a competitive environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Active Health Monitoring System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acellent Technologies, Inc.

- Analog Devices, Inc.

- Aptiv PLC

- Continental AG

- Denso Corporation

- FORVIA Faurecia

- Gentex Corporation

- Harman International

- Hoana Medical, Inc.

- Hyundai Mobis

- Infineon Technologies AG

- KritiKal Solutions Pvt. Ltd.

- NXP Semiconductors N.V.

- Omron Corporation

- Panasonic Corporation

- Parker Hannifin Corp

- Plessey Semiconductors

- Qualcomm Technologies Inc.

- Robert Bosch GmbH

- Sensata Technologies Holding plc

- Valeo SA

- ZF Friedrichshafen AG

Presenting actionable strategic recommendations for automotive stakeholders to capitalize on evolving technologies and optimize health monitoring deployment strategies

To effectively capitalize on the burgeoning automotive active health monitoring market, industry leaders should prioritize the seamless integration of hardware sensors with advanced analytics platforms, ensuring that data collected at the vehicle edge can be rapidly contextualized into actionable insights. This requires fostering close collaboration between sensor developers, telematics providers, and data scientists to co-create interoperable solutions that can adapt to different vehicle architectures and OEM standards.

In parallel, stakeholders should explore opportunities to establish regional centers of excellence that support local certification, customization, and aftersales services. By creating these localized hubs, organizations can reduce time-to-market, optimize supply chains to navigate tariff regimes, and deliver faster service turnarounds in critical regions. As electrification accelerates, dedicating research and development resources to battery cell monitoring algorithms and thermal management software can yield competitive differentiation, particularly in markets where EV adoption is incentivized through regulatory frameworks.

Finally, adopting a customer-centric go-to-market approach that engages both fleet operators and individual consumers through subscription-based models can unlock recurring revenue streams. Combining predictive maintenance offerings with performance guarantees and service level agreements will not only deepen customer relationships but also generate valuable usage data that can inform iterative product enhancements and drive long-term loyalty.

Detailing a rigorous research framework integrating primary insights, secondary data synthesis, and robust analytical methodologies to ensure comprehensive market understanding

Our research framework was constructed to deliver a holistic view of the automotive active health monitoring ecosystem through a combination of methodological rigor and multi-source data integration. The analysis began with a comprehensive secondary research phase, reviewing technical white papers, industry regulatory guidelines, and patent filings to map out the technological building blocks and emerging innovation trajectories. This desk research established the foundational understanding of sensor types, communication protocols, and analytics platforms.

Complementing this, a robust primary research initiative was undertaken, involving in-depth interviews with senior executives at OEMs, tier-one suppliers, fleet operators, and technology vendors. These conversations yielded critical insights into strategic priorities, adoption barriers, and future investment plans, enabling us to validate and refine the segmentation structure. Data triangulation was achieved by cross-referencing qualitative findings with quantitative inputs from industry associations, trade publications, and government bodies overseeing vehicle safety and emissions regulation.

Finally, proprietary analytical models were applied to synthesize the data across vehicle types, system architectures, applications, sales channels, and end users, ensuring a nuanced understanding of market dynamics. The combination of qualitative and quantitative techniques delivers confidence in the conclusions and strategic recommendations presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Active Health Monitoring System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Active Health Monitoring System Market, by Vehicle Type

- Automotive Active Health Monitoring System Market, by System Type

- Automotive Active Health Monitoring System Market, by Sales Channel

- Automotive Active Health Monitoring System Market, by Application

- Automotive Active Health Monitoring System Market, by End User

- Automotive Active Health Monitoring System Market, by Region

- Automotive Active Health Monitoring System Market, by Group

- Automotive Active Health Monitoring System Market, by Country

- United States Automotive Active Health Monitoring System Market

- China Automotive Active Health Monitoring System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing critical findings and future trajectories to conclude on the transformative potential of active health monitoring within modern vehicle ecosystems

In conclusion, the automotive active health monitoring landscape is poised for accelerated growth as electrification, autonomous vehicle technologies, and digital connectivity converge to reshape vehicle maintenance paradigms. The shift from reactive servicing to proactive, data-driven health management is redefining how fleet operators and passenger vehicle owners perceive reliability and total cost of ownership. Regional variations in regulatory frameworks, infrastructure maturity, and fleet composition underscore the importance of a localized approach to solution design and market entry.

Key industry players are actively forging partnerships across hardware, software, and cloud domains to build integrated platforms capable of real-time diagnostics and predictive analytics. Tariff-driven supply chain adjustments are catalyzing domestic innovation and onshore manufacturing investments, enhancing the resilience of sensor and semiconductor ecosystems. Looking ahead, the alignment of strategic research, focused product development, and customer-centric service models will determine which organizations capture the most value in this evolving landscape. As stakeholders continue to navigate technology disruptions and policy shifts, those who embrace a proactive monitoring ethos will be best positioned to drive the next wave of automotive excellence.

Connect with Ketan Rohom to engage directly and unlock full executive insights empowering strategic decision making through comprehensive research acquisition

We invite industry experts and decision makers to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to unlock the full depth of our comprehensive analysis on the automotive active health monitoring market. By partnering with Ketan, you will gain tailored guidance on how the insights within this report can be applied to your organization’s strategic road map. His expertise spans engaging demonstrations, customized data breakdowns, and one-on-one consultations to ensure that your unique business challenges are addressed with precision. Reach out to Ketan for a personalized overview of the research findings, learn how you can prioritize investments, and determine the optimal path for integrating active health monitoring solutions across your fleet or product lineup. This direct line of communication guarantees you will be equipped with actionable intelligence needed to seizing new growth opportunities and mitigating supply chain complexities. In today’s rapidly evolving automotive environment, having a dedicated advisor to interpret the report’s implications and translate them into tangible strategies is invaluable. Connect with Ketan Rohom to transform research into results and drive your organization toward proactive vehicle health excellence.

- How big is the Automotive Active Health Monitoring System Market?

- What is the Automotive Active Health Monitoring System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?