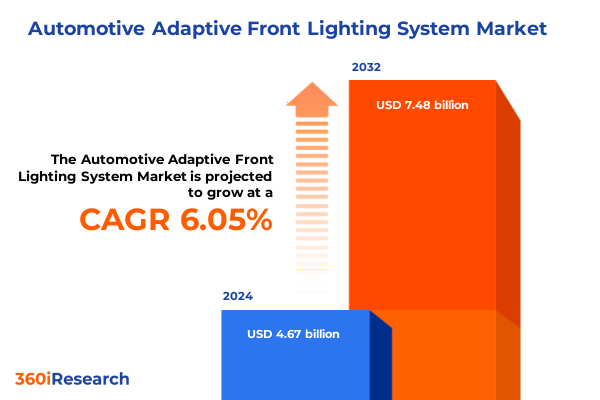

The Automotive Adaptive Front Lighting System Market size was estimated at USD 4.93 billion in 2025 and expected to reach USD 5.21 billion in 2026, at a CAGR of 6.12% to reach USD 7.48 billion by 2032.

Pioneering the Future of Vehicle Illumination with Intelligent Adaptive Front Lighting Technology to Elevate Road Safety and Driving Comfort Across Diverse Conditions

The automotive landscape is witnessing an unprecedented transformation as adaptive front lighting systems redefine how vehicles interact with their environment. These advanced illumination solutions extend beyond merely brightening the road; they dynamically adjust beam patterns, intensity, and direction to optimize visibility, enhance driver confidence, and significantly reduce collision risks. With regulatory bodies worldwide tightening safety requirements and consumers demanding premium driving experiences, adaptive front lighting has emerged as a critical differentiator for automakers striving to elevate vehicle safety and comfort.

Intent on delivering an executive-level synthesis of the adaptive front lighting ecosystem, this report distills the intricate interplay of technological innovation, regulatory shifts, and market dynamics shaping the industry’s trajectory. By examining the key drivers, challenges, and opportunities, we aim to inform decision-makers on how to harness the full potential of intelligent lighting solutions. As traditional static lighting systems give way to sensor-driven, connected architectures, stakeholders must adapt their strategies to remain competitive.

Through a structured exploration of emerging lighting technologies, evolving consumer preferences, and the impact of geopolitical factors such as tariffs, this executive summary sets the stage for deeper analysis. It serves as a foundational overview for readers to grasp the transformative power of adaptive front lighting and its role in fostering safer, smarter, and more efficient mobility.

Unveiling the Revolutionary Advances Reshaping Automotive Lighting through Adaptive Front Lighting Innovations and Emerging Digital and Sensor Technologies

Recent years have seen cascading technological advancements that have reshaped the contours of automotive lighting. The shift from traditional halogen lamps to high-intensity discharge units heralded a significant leap in illumination performance, only to be swiftly followed by the introduction of laser-based modules that offer unparalleled brightness and efficiency. Today, it is the rise of LED and camera-driven sensor arrays that is driving the next frontier, empowering dynamic bending, adaptive high beams, and real-time beam steering capabilities previously confined to concept vehicles.

Concurrently, the integration of advanced driver-assistance systems (ADAS) has accelerated the adoption of adaptive lighting functions, enabling vehicles to automatically detect ambient conditions, oncoming traffic, and pedestrian movement to optimize beam distribution. The convergence of connectivity and lighting has also brought about intelligent networking, where lighting modules communicate with navigation systems to anticipate curves and adjust illumination proactively.

Moreover, the transition to electrification has imposed stringent energy budgets, making the efficiency of LED and laser sources an indispensable asset. This confluence of safety imperatives, environmental considerations, and consumer expectations is reshaping manufacturers’ R&D priorities. As a result, investments are increasingly funneled into miniaturized sensors, software-defined lighting controls, and advanced materials, laying the groundwork for vehicles that can “see” and “respond” to their surroundings with human-like acuity.

Analyzing the Cumulative Economic and Technological Impact of United States Tariffs on Automotive Adaptive Front Lighting Systems in 2025

In 2025, the United States implemented a series of tariff modifications targeting imported automotive components, including modules and lenses integral to adaptive front lighting systems. These measures, introduced under broader trade policy revisions, have exerted multifaceted effects on supply chains, procurement strategies, and cost structures within the lighting sector.

Automakers and suppliers reliant on overseas manufacturing hubs have faced increased landed costs, prompting a reassessment of sourcing strategies. Some have sought to diversify their supplier base, negotiating long-term agreements with non-tariffed jurisdictions or forging joint ventures with domestic producers to mitigate exposure. Meanwhile, component manufacturers have begun to localize production of critical optical elements and sensor enclosures, leveraging reshored capabilities to maintain competitive pricing.

Despite the immediate inflationary pressures, the tariff landscape has also galvanized innovation. Firms are investing in advanced manufacturing techniques-such as precision injection molding and additive metal fabrication-to reduce dependency on imported tooling and high-cost assemblies. At the same time, the reshaping of cost models has underscored the strategic value of end-to-end supply chain resilience. As the industry adapts, companies that proactively address tariff-induced volatility are better positioned to sustain margins and preserve the pace of technological progress.

In-Depth Segment Analysis Reveals How Technology Types Vehicle Classes and User Applications Are Shaping the Adaptive Front Lighting Market Dynamics

A nuanced appreciation of adaptive front lighting dynamics emerges when examining the technology spectrum, where traditional halogen solutions, including fog lamps and tail lights, coexist with high-intensity discharge systems featuring projector headlights and xenon lights. Laser-based lighting offers advanced functions like adaptive high beam control and dynamic bending, while LED modules deliver efficient daytime running lights alongside high-performance headlamps. This technology-based segmentation underscores how innovation pathways differ according to performance requirements and regulatory mandates.

By vehicle type, commercial platforms such as heavy trucks and light commercial vehicles represent distinct application cases compared with passenger sedans and SUVs. The robustness and durability criteria for commercial vehicles drive demand for ruggedized control units and lighting components, whereas passenger car applications prioritize aesthetic integration and premium user experiences.

Delving deeper into component composition, adaptive front lighting architectures rely on electronic control units-including both general-purpose ECUs and specialized lighting control units-paired with advanced lighting technologies such as dynamic corners and adaptive headlight modules, and complemented by sensor arrays ranging from camera-based units to LIDAR. These elements collaboratively enable real-time environmental detection and light field modulation.

Mode-based segmentation reveals that automatic shift functions handle transitions between day and night or detect and adjust for fog conditions, while manual override settings empower users to control beam angles via switch-based adjustments or custom configurations. End-user preferences further distinguish economy segments-where budget-friendly SUVs and compact cars emphasize cost efficiency-from luxury vehicles like high-end sports cars and premium sedans that demand state-of-the-art illumination experiences.

Sales channel dynamics also play a critical role, with aftermarket platforms, both online and traditional retail, offering retrofit opportunities, and original equipment manufacturers delivering factory-fitted solutions through direct sales agreements or tender-based supply contracts. Together, these interwoven segmentation dimensions illuminate the multifaceted nature of the adaptive front lighting market and the tailored strategies required for each segment.

This comprehensive research report categorizes the Automotive Adaptive Front Lighting System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- System Type

- Vehicle Type

- Sales Channel

- End User

Comparative Regional Assessment Highlights Distinct Growth Patterns and Adoption Drivers for Adaptive Front Lighting Systems across Major Global Markets

The Americas region exhibits a robust appetite for adaptive front lighting, driven by stringent safety regulations and consumer affinity for premium technology in North America, alongside emerging demand in South America where infrastructure investments are on the rise. Local manufacturers and international suppliers navigate a complex landscape of regulatory compliance, tariff considerations, and evolving consumer expectations for advanced visibility solutions.

Across Europe, the Middle East, and Africa, diverse regulatory frameworks and road conditions necessitate scalable lighting solutions. Western Europe’s rigorous safety standards and incentives for energy-efficient vehicle systems favor the adoption of LED and laser-based modules, while the Middle East’s high ambient temperatures demand thermal management innovations. Meanwhile, Africa’s varied road infrastructures present opportunities for rugged, sensor-based adaptive lighting systems capable of overcoming challenging driving environments.

In the Asia-Pacific, rapid automotive production growth and increasing focus on smart vehicle features propel significant uptake of adaptive front lighting technologies. Regulatory encouragement for vehicle safety features in major markets-coupled with expanding electric vehicle portfolios-fosters demand for energy-efficient LED and laser systems. Moreover, local suppliers are collaborating with global technology providers to tailor solutions that address region-specific lighting requirements, from monsoon-affected Southeast Asia to high-altitude regions in China and India.

By understanding these regional nuances, OEMs and suppliers can calibrate their product roadmaps, partner networks, and supply chain footprints to effectively capitalize on the diverse drivers shaping each market’s trajectory.

This comprehensive research report examines key regions that drive the evolution of the Automotive Adaptive Front Lighting System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Solution Providers Demonstrates the Strategic Moves and Innovation Portfolios Driving Competitive Edge in Adaptive Front Lighting Industry

Leading stakeholders in the adaptive front lighting landscape have forged ahead with differentiated strategies to claim market leadership. Established automotive tier-one suppliers are channeling resources into strategic R&D partnerships, focusing on miniaturized laser modules and integrated sensor-lighting architectures. Concurrently, innovative start-ups are securing intellectual property through patents on beam-forming algorithms and next-generation projector designs, posing competitive challenges to legacy players.

Some companies are reinforcing their market positions through acquisitions, targeting niche sensor manufacturers and optics specialists to broaden their technology portfolios and expedite time-to-market for new solutions. Others are emphasizing collaboration with vehicle OEMs to co-develop customized lighting systems that align with specific vehicle platforms, thereby deepening integration into the vehicle electronics ecosystem.

At the same time, software providers are advancing algorithms for adaptive beam shaping and predictive lighting control, leveraging artificial intelligence and machine learning to anticipate driving scenarios. These software-centric firms are forging alliances with hardware manufacturers to ensure seamless interoperability and continuous over-the-air updates.

Together, these strategic moves reflect a dynamic competitive landscape where technological differentiation, supply chain agility, and co-development partnerships define the race to deliver the most advanced and reliable adaptive front lighting systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Adaptive Front Lighting System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BMW AG

- Continental AG

- De Amertek Corporation

- General Motors Company

- HELLA GmbH & Co. KGaA

- Hyundai Mobis Co. Ltd.

- Ichikoh Industries, Ltd.

- Koito Manufacturing Co., Ltd.

- Koninklijke Philips N.V.

- Lear Corporation

- LITE-ON Technology Corporation.

- Lumax Industries Ltd.

- Mazda Motor Corporation

- Nissan Motor Co., Ltd.

- OSRAM GmbH

- Renesas Electronics Corporation

- Robert Bosch GmbH

- Semiconductor Components Industries, L.L.C.

- Texas Instruments Incorporated

- Valeo S.A.

- Varroc Lighting Systems

- ZKW Group GmbH

Strategic Recommendations for Automotive Leaders to Leverage Adaptive Front Lighting Technologies and Navigate Regulatory and Competitive Challenges Effectively

Automotive manufacturers and lighting suppliers should prioritize the integration of advanced sensor arrays with real-time environmental analytics to unlock the full potential of adaptive front lighting. Investing in modular platform architectures will enable rapid deployment of new functionalities, such as dynamic bending and predictive beam control, across multiple vehicle lines. Establishing collaborative innovation hubs with component specialists, software developers, and OEM engineering teams can accelerate product development cycles and reduce integration risks.

To address supply chain vulnerabilities and tariff-related cost pressures, firms should diversify their sourcing networks, including forging partnerships with regional manufacturing facilities and exploring additive manufacturing for critical optical components. Implementing end-to-end digital supply chain visibility tools will further strengthen resilience by providing actionable insights into lead times, quality metrics, and potential disruptions.

On the product strategy front, conducting user experience studies across diverse driving conditions will inform the calibration of manual override and auto shift modes, ensuring solutions resonate with both economy-segment drivers and luxury vehicle enthusiasts. Simultaneously, shaping dialogue with regulatory bodies and industry consortia can help influence standards development, paving the way for next-generation lighting capabilities to transition from pilot projects to mass-market adoption.

Finally, embedding agile project management methodologies and continuous feedback loops within innovation processes will allow teams to iterate rapidly, adapt to emerging technologies, and sustain competitive differentiation in a market defined by relentless technological evolution.

Comprehensive Research Methodology Combining Diverse Data Sources Expert Interviews and Rigorous Analytical Frameworks to Ensure Insightful Market Understanding

The insights presented in this report derive from a meticulous research framework that combines primary interviews with industry executives, supply chain specialists, and automotive engineers, alongside secondary analysis of peer-reviewed journals, patent filings, and regulatory publications. Primary engagements included in-depth discussions with technology leads at sensor manufacturers, lighting system integrators, and semiconductor firms to uncover real-world challenges and innovation roadmaps.

Complementing the primary data, a comprehensive review of industry whitepapers, technical conference proceedings, and governmental safety regulations provided contextual grounding. Patent landscaping techniques were employed to map emerging intellectual property trends, while scenario planning exercises helped assess potential market shifts under varying tariff and regulatory conditions.

Quantitative modeling was deliberately excluded to maintain focus on qualitative insights, though key thematic trends were validated through cross-comparison of multiple data sources. The triangulation of evidence ensures that conclusions reflect the consensus among thought leaders while highlighting areas of strategic divergence. Quality assurance processes included peer reviews by independent automotive consultants and iterative validation workshops with expert panels, guaranteeing the reliability and relevance of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Adaptive Front Lighting System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Adaptive Front Lighting System Market, by Component

- Automotive Adaptive Front Lighting System Market, by Technology

- Automotive Adaptive Front Lighting System Market, by System Type

- Automotive Adaptive Front Lighting System Market, by Vehicle Type

- Automotive Adaptive Front Lighting System Market, by Sales Channel

- Automotive Adaptive Front Lighting System Market, by End User

- Automotive Adaptive Front Lighting System Market, by Region

- Automotive Adaptive Front Lighting System Market, by Group

- Automotive Adaptive Front Lighting System Market, by Country

- United States Automotive Adaptive Front Lighting System Market

- China Automotive Adaptive Front Lighting System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Concluding Insights Emphasize the Critical Role of Adaptive Front Lighting in Future Mobility Ecosystems and the Path Forward for Industry Stakeholders

Adaptive front lighting systems represent a paradigm shift in how vehicles perceive and respond to their environments, offering a convergence of safety, efficiency, and user-centric design. As illumination technologies continue to evolve-from halogen and HID to laser and advanced LED arrays-the integration of sensors and intelligent control units has become indispensable for delivering next-level visibility and adaptive functionality.

The interplay of regulatory pressures, shifting trade policies, and regional market drivers underscores the importance of strategic agility. Companies that proactively adapt their supply chains, foster collaborative innovation, and align product roadmaps with diverse segmentation needs are poised to thrive. Moreover, the race toward electrification and autonomous capabilities further cements the role of adaptive lighting as a foundational element in future mobility ecosystems.

In closing, the journey toward fully autonomous driving and connected vehicle platforms will place even greater emphasis on intelligent lighting as a critical enabler. Industry stakeholders must therefore remain vigilant to emerging technologies, collaborate across the value chain, and continually refine their approaches to meet the evolving demands of safety, sustainability, and user experience.

Act Now to Gain a Competitive Advantage with Exclusive Adaptive Front Lighting System Insights—Contact Ketan Rohom to Access the Full Market Research Report Today

Seize this opportunity to equip your organization with unparalleled insights into the rapidly evolving domain of adaptive front lighting through a comprehensive market research report tailored to executives and decision-makers. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure your copy and unlock actionable intelligence that empowers your strategic roadmap. Gain clarity on the latest technological breakthroughs, regulatory implications, and competitive strategies that will define the future of vehicle illumination. Engage with our experts to customize the research scope, ensuring you address the unique challenges and opportunities within your market. Don’t let uncertainty hinder your progress-invest in authoritative analysis today and drive innovation within your organization’s product development, marketing, and investment strategies. Partner with us to transform the way you approach adaptive front lighting systems and maintain a decisive edge against emerging competitors. Act now to translate deep market understanding into tangible business outcomes, from optimized technology portfolios to robust risk mitigation plans. Begin a conversation with Ketan Rohom and embark on a journey toward sustained growth and leadership in the automotive lighting landscape.

- How big is the Automotive Adaptive Front Lighting System Market?

- What is the Automotive Adaptive Front Lighting System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?