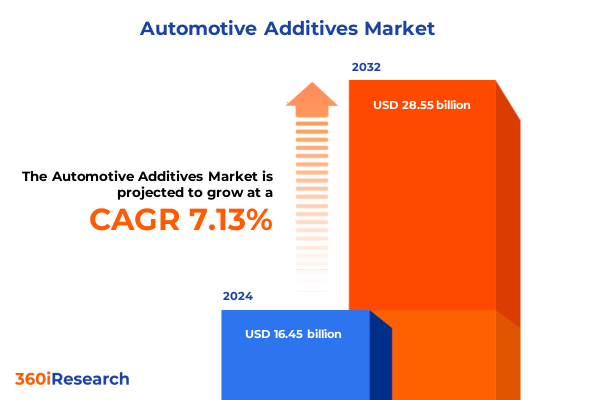

The Automotive Additives Market size was estimated at USD 17.60 billion in 2025 and expected to reach USD 18.84 billion in 2026, at a CAGR of 7.15% to reach USD 28.55 billion by 2032.

Pioneering the Future of Automotive Additives with Advanced Chemistry and Sustainability as Industry Drivers of Transformational Growth

Automotive additives represent the critical link between base fluids and exceptional vehicular performance, delivering enhancements in friction control, corrosion inhibition, and thermal stability across diverse powertrain and auxiliary systems. These specialized chemistries are engineered to meet stringent regulatory standards while addressing the ever-increasing demands for fuel economy, emission reductions, and extended service intervals. As original equipment manufacturers and aftermarket suppliers strive to differentiate on efficiency and durability, the role of additive innovation has become central to maintaining a competitive edge in a rapidly evolving mobility ecosystem.

In recent years, the additive landscape has witnessed a convergence of sustainability imperatives and advanced material science, propelling research into bio-derived inhibitors and polymer-based viscosity modifiers capable of delivering high performance with lower environmental impact. Moreover, digital integration in formulation optimization and supply-chain visibility has ushered in a new era of precision in additive deployment, ensuring consistent quality across global production sites. This executive summary lays the foundation for understanding how emerging technologies, regulatory frameworks, and shifting consumer preferences are collectively driving next-generation formulations that transcend traditional performance benchmarks.

Understanding the Profound Shifts Shaping Automotive Additives through Electrification Digitalization and Regulatory Evolution Impacting Product Innovation

The automotive additives sector is undergoing a seismic transformation driven by the transition to electrified drivetrains, which necessitates reimagined lubricant and coolant solutions tailored to battery thermal management and electric motor durability. Alongside electrification, digital platforms are revolutionizing product lifecycle management, enabling real-time monitoring of additive efficacy and predictive maintenance schedules that maximize uptime. At the same time, the industry is adapting to an increasingly complex regulatory environment, with new limits on phosphorus, sulfur, and heavy metals compelling formulators to innovate greener chemistries without compromising on performance.

This multifaceted evolution is further accentuated by the emergence of circular economy principles, prompting the development of recyclable additive packaging, bio-based raw materials, and closed-loop recovery processes for spent lubricants. As a result, collaboration between chemical suppliers, OEMs, and recycling specialists has intensified, giving rise to integrated value chains that enhance resource efficiency. Ultimately, these transformative shifts underscore a future where additive solutions not only improve mechanical reliability but also adhere to the highest standards of environmental stewardship.

Unpacking the Comprehensive Impact of 2025 United States Tariff Measures on Global Automotive Additives Supply Chains and Cost Structures

In 2025, the United States implemented a series of tariff adjustments under both Section 301 and Section 232 frameworks, placing additional duties on select petrochemical imports and specialty chemicals integral to additive formulations. These measures have redirected sourcing strategies, with many additive producers increasing domestic partnerships to mitigate the impact of import levies on raw alkyl phenol and phosphate ester feedstocks. Consequently, supply-chain realignment has accelerated investment in local production capacity to ensure uninterrupted access to critical intermediates while also insulating manufacturers from currency fluctuations.

The cumulative effect of these tariffs has manifested in a recalibration of cost structures throughout the aftermarket and OEM channels. Manufacturers are now balancing the imperative for high-performance chemistries against the need to preserve margin integrity, prompting a reassessment of pricing strategies and contract models. Looking ahead, companies adept at optimizing regional procurement networks and leveraging tariff exemptions for R&D activities will be best positioned to thrive in a landscape where trade policy and geopolitical dynamics continue to shape the economics of additive manufacturing.

Illuminating Market Dynamics through Integrated Segmentation Unveiling Tailored Opportunities across Product Function Vehicle Material and Distribution Channels

A granular examination of additive demand reveals that brake fluid, coolant, engine oil, fuel, grease, and transmission fluid segments each require tailored chemistries to meet distinct performance criteria, from high-temperature stability in transmission systems to low-viscosity flow in fuel lines. Delving deeper into functional requirements, anti-wear solutions split into phosphorus-free options and ZDDP formulations, while corrosion inhibitors range across amine-based and carboxylate-based technologies to protect metal surfaces under varied operating environments. Detergent-dispersants must balance calcium, magnesium, and separator detergent chemistries to maintain engine cleanliness, and friction modifiers leverage both inorganic and organic compounds to optimize energy efficiency. Meanwhile, viscosity index improvers rely on copolymer or polymer monomer structures to preserve viscosity across temperature extremes.

This diversity extends to end-use vehicle categories, where heavy commercial trucks demand extended-life additives, light commercial and off-road units require robust thermal protection, and passenger cars emphasize low-temperature fluidity and reduced emissions. Raw material sourcing influences performance and cost, with mineral, semi-synthetic, and fully synthetic bases each offering unique trade-offs in stability and biodegradability. Distribution channels bifurcate between original equipment manufacturers and aftermarket suppliers, the latter encompassing authorized dealerships, e-commerce platforms, and independent workshops. Finally, additive form factors from liquid concentrates and ready mixes to powders and solids define packaging, handling, and dosing strategies, underscoring the multifaceted nature of segmentation in unlocking targeted growth pockets.

This comprehensive research report categorizes the Automotive Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Function

- Raw Material

- Form

- Vehicle Type

- Sales Channel

Mapping Regional Variances in Automotive Additives Demand and Innovation across Americas EMEA and AsiaPacific to Guide Strategic Market Penetration

Regional analysis uncovers divergent drivers across the Americas, Europe Middle East and Africa, and Asia-Pacific, each presenting unique adoption patterns and regulatory landscapes for automotive additives. In the Americas, demand is propelled by widespread infrastructure investments and a growing emphasis on domestic production, with formulators prioritizing advanced synthetic lubricants and bio-derived corrosion inhibitors to meet increasingly stringent fuel-efficiency mandates. The aftermarket in North and South America is characterized by an expansive network of independent workshops leveraging e-commerce channels for rapid product delivery and technical support.

Within the Europe Middle East and Africa region, tight emissions regulations and aggressive decarbonization targets have catalyzed the introduction of ultra-low-sulfur diesel additives and next-generation friction modifiers that align with Euro 7 and beyond. Strategic hubs in Western Europe also serve as centers of excellence for additive innovation, fostering collaboration between academic research institutes and specialty chemical firms. Asia-Pacific exhibits the fastest growth trajectory, where emerging markets are investing heavily in automotive manufacturing and urban mobility. Here, a blend of mineral and semi-synthetic based formulations dominates, with scaling demand for high-performance engine oil additives driven by expanding passenger vehicle fleets and government incentives for cleaner transport technologies.

This comprehensive research report examines key regions that drive the evolution of the Automotive Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders Shaping the Future of Automotive Additives through Innovation Partnerships and Sustainability Initiatives for Market Leadership

The competitive landscape of automotive additives features a cadre of global and regional specialists, each leveraging proprietary chemistries and strategic alliances to gain market share. Leaders are distinguished by robust R&D pipelines, expansive blending capabilities, and dedicated sustainability programs that reduce carbon footprints across production cycles. Collaborations between oil majors and independent additive formulators have further enabled co-development of tailor-made packages, optimizing base oil and additive compatibility for specific OEM platforms.

Major industry participants have also embarked on targeted acquisitions and joint ventures to expand geographic reach and diversify product portfolios. These strategic moves are complemented by investments in advanced analytical laboratories, where molecular modeling and high-throughput screening accelerate discovery of novel dispersants and anti-wear agents. As competitive intensity rises, companies demonstrating agility in adjusting formulations to meet dynamic regulatory requirements and end-user preferences will solidify their leadership positions and drive the next wave of additive innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Afton Chemical Corporation

- Arkema S.A.

- BASF SE

- Chevron Corporation

- Clariant AG

- Croda International Plc

- Evonik Industries AG

- Infineum International Limited

- Innospec Inc.

- Kangtai Lubricant Additives Co., Ltd.

- Lucas Oil Products, Inc.

- MidContinental Chemical Company, Inc.

- The Lubrizol Corporation

Formulating Actionable Strategies for Industry Leaders to Navigate Emerging Regulatory Technology and Sustainability Challenges in Automotive Additives

Industry leaders should prioritize development of green chemistries that align with emerging environmental mandates while preserving or enhancing performance metrics. Establishing cross-functional teams that integrate formulation scientists with regulatory and sustainability experts fosters a holistic approach to product development. Simultaneously, diversifying supply chains by forging alliances with regional raw material suppliers can mitigate tariff-related cost pressures and reduce lead times for critical components.

Furthermore, investment in digital formulation platforms and predictive analytics will empower organizations to fine-tune additive packages for specific powertrain architectures, from internal combustion engines to hybrid and electric systems. Companies should also explore modular blending facilities near key automotive clusters to expedite response to changing demand patterns. By adopting these strategic imperatives, additive manufacturers and end-users can navigate a landscape defined by regulatory complexity, shifting mobility paradigms, and an unwavering focus on resource efficiency.

Detailing Rigorous Research Methodologies Employed to Ensure Data Integrity Analytical Rigor and Comprehensive Coverage of Automotive Additives Market Insights

This research employed a rigorous multi-tiered methodology to ensure the validity and reliability of findings. Primary interviews were conducted with formulators, OEM technical specialists, aftermarket distributors, and regulatory authorities to capture firsthand insights into product performance criteria and market dynamics. Concurrently, secondary research aggregated data from industry white papers, patent filings, scientific journals, and trade association publications to contextualize emerging trends and benchmark technological advancements.

To enhance analytical rigor, data triangulation techniques were applied, cross-verifying quantitative inputs from financial reports with qualitative feedback from expert panels. Geographic coverage spanned leading automotive hubs and high-growth markets, ensuring that regional variations were accurately reflected. Additionally, sensitivity analyses evaluated the resilience of supply chains under different tariff and raw material price scenarios. The culmination of these efforts is a comprehensive compendium of additive market intelligence that empowers stakeholders to make informed, strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Additives Market, by Product Type

- Automotive Additives Market, by Function

- Automotive Additives Market, by Raw Material

- Automotive Additives Market, by Form

- Automotive Additives Market, by Vehicle Type

- Automotive Additives Market, by Sales Channel

- Automotive Additives Market, by Region

- Automotive Additives Market, by Group

- Automotive Additives Market, by Country

- United States Automotive Additives Market

- China Automotive Additives Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesizing Key Findings and Strategic Vision to Conclude the Transformative Narrative of Automotive Additives in Today’s Dynamic Mobility Ecosystem

The synthesis of market drivers, supply-chain dynamics, and regulatory pressures paints a compelling narrative of an industry in the midst of transformative change. Additive chemistries are evolving to support a spectrum of propulsion technologies, from advanced internal combustion engines to the thermal management requirements of electric vehicles. Concurrently, global trade policies and sustainability mandates are redefining cost structures and innovation priorities, compelling producers to rethink sourcing strategies and R&D investment approaches.

As segmentation analyses reveal nuanced opportunities across product types, functional categories, vehicle classes, raw materials, sales channels, and form factors, industry participants are better equipped to tailor solutions that address specific performance gaps. Regional insights further guide market entry and expansion strategies, illuminating pockets of growth driven by localized regulatory regimes and infrastructure developments. Together, these insights converge into a strategic vision that underscores the enduring importance of automotive additives as enablers of efficiency, reliability, and environmental compliance within the dynamic mobility ecosystem.

Engage with Ketan Rohom to Secure Expert Insights and Acquire the Definitive Automotive Additives Market Intelligence Report Without Delay

Engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure unparalleled expertise and gain immediate access to the comprehensive market intelligence report on automotive additives. By partnering with a seasoned specialist who understands the nuanced demands of additives for braking, lubrication, cooling, and fuel optimization, you can ensure your strategic decisions are underpinned by robust data and forward-looking insights.

Reach out to Ketan Rohom to explore tailored subscription options, discuss bespoke research deliverables, and unlock exclusive pricing arrangements designed to accelerate your market entry or product development roadmap. Don’t miss the opportunity to lead with confidence in an era where advanced chemistries and regulatory dynamics are reshaping competitive advantage in the additives landscape.

- How big is the Automotive Additives Market?

- What is the Automotive Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?