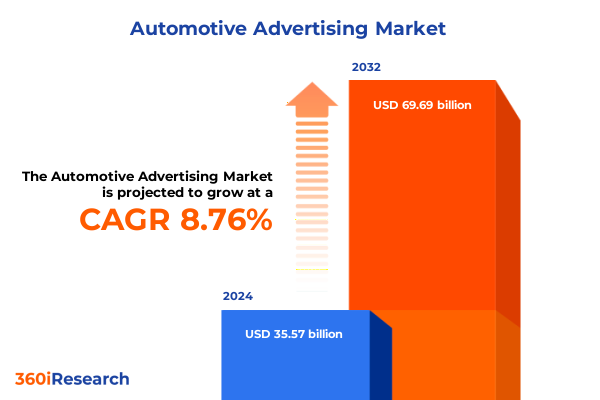

The Automotive Advertising Market size was estimated at USD 38.43 billion in 2025 and expected to reach USD 41.59 billion in 2026, at a CAGR of 8.87% to reach USD 69.69 billion by 2032.

Setting the Stage for a New Era of Automotive Advertising Powered by Location Intelligence and Integrated Digital Strategies

In today’s rapidly evolving automotive advertising industry, brands face an unprecedented intersection of technological innovation, shifting consumer behaviors, and regulatory pressures. The rise of in-car connectivity, the proliferation of location-based services, and heightened data privacy expectations have collectively transformed the way advertisers reach drivers and potential buyers. Against this backdrop, understanding the nuances of both digital and traditional channels has become a strategic imperative rather than a competitive advantage.

This executive summary offers a concise yet comprehensive overview of the critical forces reshaping automotive advertising in the United States and key international markets. It outlines the pivotal transformative shifts, examines the ripple effects of 2025 tariff policies on media strategies, and delves into granular segmentation insights that delineate audience preferences and media consumption patterns. Moreover, this summary highlights regional variations, competitive company strategies, and methodological rigor underpinning the underlying market research. Finally, it concludes with actionable recommendations designed to guide decision-makers through an era defined by programmatic innovation, data privacy compliance, and the integration of online and offline touchpoints.

Navigating the Transformative Shifts Reshaping Automotive Advertising Through Privacy Programmatic and Connected Mobility Innovations

In recent years, automotive advertising has undergone a radical metamorphosis, propelled by breakthroughs in programmatic technology and the urgent need to safeguard consumer data. Marketers now harness sophisticated algorithms that deliver real-time, location-based messages to drivers at critical purchase moments-whether they’re browsing dealerships, refueling, or test-driving a vehicle. Simultaneously, the sunset of third-party cookies and stringent privacy legislation such as CCPA and CPRA have spurred the deployment of privacy-centric identifiers and first-party data platforms. These platforms enable advertisers to maintain precision targeting while adhering to evolving regulatory mandates.

Furthermore, connected vehicles and telematics have opened new avenues for personalized engagement. By tapping into anonymized driving behavior, advertisers can tailor creative to specific mileage patterns, commuter routes, and regional preferences. This convergence of data science and mobility has elevated contextual advertising beyond simple location triggers, ushering in dynamic creative optimization based on real-time variables like traffic conditions and weather. Consequently, brands must now orchestrate seamless experiences across display, social, video, direct mail, and out-of-home formats to capture attention both inside and outside the vehicle.

Assessing the Cumulative Impact of 2025 United States Tariffs on Automotive Advertising Costs Supply Chains and Strategic Sourcing

The introduction of renewed tariffs in 2025 under Section 232 and related trade actions has reverberated across the automotive industry, imposing additional costs at the manufacturing level. While these duties primarily target steel and aluminum imports, the downstream effect has extended to advertising budgets as OEMs and dealers grapple with narrower margins. Advertising teams have responded by reallocating resources toward high-efficiency channels like programmatic display and social media, where real-time bidding and contextual relevance can offset rising media expenses.

Moreover, supply chain uncertainties stemming from tariff-induced sourcing shifts have prompted marketers to adopt more agile planning processes. Campaign timelines are now frequently adjusted to mirror production schedules, especially for commercial vehicle segments facing greater exposure to global raw material fluctuations. This adaptive approach has encouraged closer collaboration between procurement, finance, and marketing functions, ensuring that media investments align with projected inventory availability and regional demand. Ultimately, the cascading impact of 2025 tariffs underscores the need for resilient, data-driven advertising strategies that can withstand cost volatility and maintain brand momentum.

Unlocking Strategic Clarity Through Detailed Segmentation Frameworks Spanning Type Category Advertising Vehicles Applications and End Users

Effective automotive advertising now hinges on a multidimensional segmentation framework that captures the diversity of channels, contexts, and audience goals. When examining types of advertising, it is crucial to distinguish location-based offerings that trigger messaging tied to physical proximity, from location-independent approaches that rely on broader demographic and behavioral signals. Contextual relevance further divides the market into environments where ad creative aligns directly with content or situational triggers, versus non-contextual placements driven chiefly by audience targeting.

Diving deeper into advertising formats, the landscape bifurcates between online and traditional methods. Online channels such as display, email, social media, and video advertising deliver dynamic, customizable experiences that can be optimized in real time, while traditional outlets including direct mail, out-of-home signage, printed flyers and brochures, newspapers and magazines, as well as radio and television spots, continue to provide broad reach and tangible engagement. Geofencing and digital display intersect with billboards and posters to create hybrid campaigns that weave together digital immediacy and physical presence.

Vehicle category segmentation underscores the strategic importance of refining messaging by commercial or passenger use, with the latter subdivided into hatchback, sedan, and SUV audiences that exhibit distinct lifestyle preferences. Applications for brand awareness, lead generation, product launches, and customer loyalty initiatives require tailored creative and media mix models. Finally, advertising investments are shaped by end user -whether automotive dealers seeking to drive showroom traffic or OEMs aiming to reinforce brand equity-each demanding unique attribution and performance metrics to measure success.

This comprehensive research report categorizes the Automotive Advertising market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Advertising Type

- Category

- Vehicle Type

- Advertising Form

- Application

- End-User

- Distribution

Illuminating Regional Dynamics Driving Automotive Advertising Strategies Across Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics exert a profound influence on automotive advertising strategies, necessitating nuanced approaches across the Americas, Europe Middle East and Africa, and the Asia Pacific. In the Americas, an accelerated shift toward digital advertising is underpinned by robust automotive e-commerce platforms and widespread adoption of connected vehicle technologies. Here, privacy regulations like the California Privacy Rights Act have mainstreamed first-party data collection practices, enabling localized campaigns that resonate with suburban SUV drivers as well as urban commercial fleet managers.

Conversely, in Europe Middle East and Africa, stringent data protection mandates such as GDPR and emerging ePrivacy laws are reshaping the role of programmatic advertising. Location intelligence is balanced with consent management frameworks, prompting marketers to innovate through contextual targeting and predictive analytics without infringing on privacy. Meanwhile, rising demand for electric and hybrid vehicles in key European markets is driving awareness campaigns that blend online video, targeted radio spots, and bespoke experiential activations.

Asia Pacific stands out for its rapid embrace of mobile-first strategies, where social commerce, in-app display, and short-form video have become primary touchpoints. In markets such as China and India, integrated digital ecosystems allow automotive brands to partner with ride-hailing and mapping services, leveraging real-time journey data to deliver hyper-contextual offers. Furthermore, outdoor advertising remains a pillar for mass-market appeal in densely populated urban centers, complementing digital efforts with large-format billboards and transit shelter displays.

This comprehensive research report examines key regions that drive the evolution of the Automotive Advertising market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping the Competitive Landscape of Leading Technology Platforms and Agencies Shaping the Future of Automotive Advertising Ecosystems

At the forefront of automotive advertising innovation are technology platforms and agencies that blend data science with creative storytelling. Industry giants offering programmatic media solutions have prioritized integrations with automotive telematics providers and vehicle OEM portals, enabling seamless audience segmentation based on driving behavior. Meanwhile, digital media networks continue to refine their automotive verticals, incorporating specialized ad formats-such as interactive test drive appointments and virtual showrooms-directly within social media and video platforms.

Specialized agencies and consultancies have capitalized on these capabilities by developing proprietary analytics suites that measure downstream sales impact and lifetime customer value. These firms often partner with mapping and geolocation innovators to deliver multi-touch attribution across online and offline channels. Traditional media buyers remain relevant by orchestrating integrated campaigns that synchronize national television and radio placements with geotargeted out-of-home and direct mail efforts, ensuring consistent brand messaging at every consumer touchpoint.

Moreover, several forward-looking advertisers have invested heavily in AI-driven creative engines that generate personalized video and display ads at scale. These tools dynamically adjust imagery, messaging, and call-to-action elements based on vehicle type, application goals, and user preferences. Collectively, these ecosystem players are reshaping the competitive landscape, driving both technological advancements and elevated performance standards across the automotive advertising domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Advertising market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adpearance, Inc

- Alioze

- Automotive Marketing Gurus

- BrandOnWheelz

- CMB Automotive Marketing Ltd.

- Dealer Teamwork LLC

- Digital Throttle, LLC

- enCOMPASS Advertising Agency

- FACT GmbH

- Force Marketing

- Foundation Direct, LLC

- Google LLC by Alphabet Inc.

- Green Line Digital

- Highervisibility, LLC

- Ignite Group

- Kammerer Druck & Medien GmbH & Co. KG

- LEWIS

- Meta Platforms, Inc.

- Microsoft Corporation

- PureCars Technologies, LLC

- SMARTSITES by MELEN LLC

- Social Media 55

- Stream Companies, LLC

- The Automotive Advertising Agency

- Visarc

- We Are Nameless Limited

- Zimmerman Advertising by Omnicom Group Inc.

Driving Growth and Resilience Through Actionable Strategic Recommendations for Automotive Advertising Leaders Embracing Data Privacy and Innovation

To thrive in this complex environment, industry leaders must adopt a proactive stance that balances innovation with compliance. Marketers should prioritize investment in privacy-first data infrastructures that centralize first-party information from dealership visits, service records, and connected vehicle telemetry. By doing so, they can sustain precise targeting in a cookieless world and deliver personalized engagements without regulatory risk.

Simultaneously, brands must expand programmatic capabilities beyond desktop and mobile to encompass in-car infotainment systems and over-the-top media applications. Leveraging dynamic creative optimization will enable real-time adaptation of messaging-such as highlighting fuel efficiency for long-distance commuters or promoting electric vehicle incentives during low-emission zone entry. This adaptive creative approach will elevate relevance and foster stronger emotional connections with diverse consumer segments.

Furthermore, allocating a portion of budgets to hybrid campaigns that integrate traditional out-of-home and direct mail with digital micro-moments will unlock synergies across touchpoints. Deploying geotargeted outdoor messaging alongside synchronized mobile and email follow-ups can reinforce brand recall and drive showroom traffic. Finally, cultivating strategic alliances between automotive dealers and original equipment manufacturers will facilitate unified cross-channel campaigns, align performance metrics, and accelerate sales cycles.

Detailing the Rigorous Research Methodology Integrating Primary Expert Interviews Secondary Analysis and Data Triangulation Techniques

This market research report is grounded in a robust methodology combining primary and secondary data sources to ensure comprehensive and reliable insights. The primary phase involved in-depth interviews with senior marketing executives across OEMs, dealership groups, and leading agencies, capturing firsthand perspectives on emerging challenges and best practices. Concurrently, a quantitative survey of over 150 professionals validated qualitative findings, providing statistical rigor to segmentation and channel effectiveness analyses.

The secondary phase entailed an extensive review of publicly available industry publications, regulatory filings, and corporate disclosures to map recent tariff actions, privacy regulations, and technological advancements. Proprietary data sets from advertising platforms and telematics providers were triangulated to assess implementation rates of location-based tactics and connected vehicle campaigns. All findings underwent cross-validation through expert panel workshops, ensuring that thematic conclusions reflect both market realities and strategic foresight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Advertising market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Advertising Market, by Type

- Automotive Advertising Market, by Advertising Type

- Automotive Advertising Market, by Category

- Automotive Advertising Market, by Vehicle Type

- Automotive Advertising Market, by Advertising Form

- Automotive Advertising Market, by Application

- Automotive Advertising Market, by End-User

- Automotive Advertising Market, by Distribution

- Automotive Advertising Market, by Region

- Automotive Advertising Market, by Group

- Automotive Advertising Market, by Country

- United States Automotive Advertising Market

- China Automotive Advertising Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2544 ]

Concluding Strategic Reflections on the Evolution and Imperatives of Automotive Advertising in an Era of Digital Transformation and Regulatory Change

As automotive advertising enters a pivotal juncture, the convergence of data privacy imperatives, programmatic sophistication, and connected mobility is redefining what it means to engage drivers and prospects. Advertisers must navigate a delicate balance between personalization and compliance, leveraging first-party data and contextual insights to maintain relevance across an increasingly fragmented media landscape. The cascading effects of 2025 tariff policies further underscore the need for agile budget management and cross-functional collaboration.

Looking ahead, success will hinge on the ability to harmonize online and offline channels, crafting seamless consumer journeys that begin with digital discovery and culminate in showroom action or post-purchase loyalty. Brands that embrace dynamic creative, invest in privacy-centric infrastructures, and align dealer and OEM objectives will secure lasting competitive advantage. In sum, the future of automotive advertising belongs to those who can translate rich data signals into compelling narratives while adapting swiftly to regulatory and economic headwinds.

Take the Next Step in Elevating Your Automotive Advertising Strategy by Engaging Ketan Rohom for the Comprehensive Market Research Report

To gain an unparalleled competitive advantage in automotive advertising, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expertise in translating deep market intelligence into actionable strategies ensures you’ll harness the full potential of data-driven, location-based, and contextual advertising insights. By scheduling a brief consultation, you’ll explore how targeted campaigns can drive higher engagement, optimize media spend, and foster stronger relationships with dealers and OEMs alike. The comprehensive market research report offers granular analysis of segmentation dynamics, regional trends, and regulatory impacts, enabling you to tailor campaigns for passenger SUVs, commercial fleets, and omnichannel initiatives. Engage with Ketan Rohom today to unlock customized recommendations, leverage real-time programmatic innovations, and navigate evolving privacy regulations with confidence. Take the next step toward elevating your automotive advertising strategy and secure your copy of the report for an in-depth blueprint that will drive growth and resilience in 2025 and beyond.

- How big is the Automotive Advertising Market?

- What is the Automotive Advertising Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?