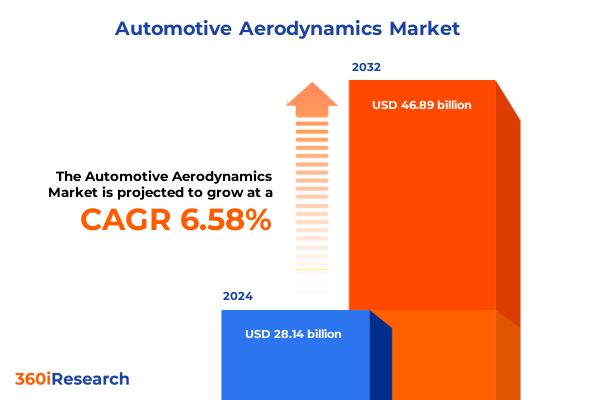

The Automotive Aerodynamics Market size was estimated at USD 29.96 billion in 2025 and expected to reach USD 31.89 billion in 2026, at a CAGR of 6.60% to reach USD 46.89 billion by 2032.

Unveiling the Pivotal Role of Advanced Aerodynamics in Driving Efficiency, Sustainability, and Competitive Advantage across Modern Automotive Landscapes

The world of automotive aerodynamics has evolved into a critical nexus that shapes vehicular performance, environmental compliance, and cost efficiencies. As manufacturers strive to meet aggressive emissions targets and maximize energy economy, aerodynamic refinement has emerged as a central pillar of competitiveness. Beyond the traditional focus on drag reduction, engineers now explore active control systems, adaptive surfaces, and integrated vehicle architectures to unlock performance gains that resonate across passenger cars and commercial fleets alike.

In recent years, regulatory agendas across major markets have imposed stringent carbon dioxide reduction mandates, driving automakers to innovate at an unprecedented pace. The push for electrification has further elevated aerodynamic excellence, as electric vehicles seek every percentage point of range extension. Advancements in computational fluid dynamics and virtual prototyping enable rapid iteration cycles, while lightweight materials and novel component geometries converge to redefine aerodynamic benchmarks. This introduction sets the stage for an exploration of transformative shifts, tariff-driven market dynamics, segmentation intelligence, regional trends, and actionable strategies that will equip stakeholders with a comprehensive understanding of the aerodynamic landscape.

Charting the Dynamic Evolution of Vehicle Aerodynamics through Electrification, Digitization, and Breakthrough Innovations Reshaping Industry Performance

The automotive landscape is undergoing transformative shifts propelled by three converging forces: the pursuit of sustainable mobility, the maturation of digital engineering tools, and the emergence of adaptive aerodynamic technologies. Electrification has rapidly transitioned from niche applications to mainstream adoption, altering vehicle packaging constraints and enabling previously impractical aerodynamic configurations. Battery electric vehicles now feature cabin-integrated airflow management systems, including active grille shutters that optimize thermal regulation without sacrificing drag coefficients.

Digital twins and real-time simulation platforms have democratized aerodynamic development, granting engineers the ability to predict airflow behavior across full-scale vehicle assemblies with unprecedented fidelity. These advanced simulation environments integrate large eddy simulation and Reynolds-averaged Navier Stokes models to deliver granular insights into turbulent flow phenomena. Coupled with modular wind tunnel testing protocols-encompassing closed loop and open loop facilities-this hybrid approach accelerates design validation while reducing reliance on costly physical prototypes.

Complementing this digital revolution is the proliferation of adaptive hardware. From adaptive spoilers that automatically adjust angle of attack based on vehicle speed to underbody panels that deploy supplementary flaps at highway cruising speeds, these systems exemplify the shift from static to dynamic aerodynamics. In parallel, passive devices such as diffusers and air curtains are being refined through benignly integrated geometries, harnessing airflow control with minimal energy penalty. Together, these developments illustrate a landscape in which aerodynamic design is both more agile and more deeply embedded in the core product development process.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Measures on Automotive Aerodynamics Supply Chains and Cost Structures

The introduction of broad-based U.S. tariffs in early 2025 targeting imported steel, aluminum, and specialized composites has generated a ripple effect across automotive aerodynamics supply chains and cost structures. While raw material surcharges have escalated component fabrication expenses, suppliers have responded by localizing production footprints and exploring alloy substitutes. This shift toward domestically sourced materials has mitigated some cost pressures but has also strained capacity in certain regions, leading to lead-time variability for core aerodynamic components.

Moreover, the tariff landscape has influenced procurement strategies, with manufacturers restructuring global sourcing networks to evade punitive duties. Strategic partnerships with North American extrusion and stamping facilities have gained prominence, as has increased collaboration with localized wind tunnel and testing centers. Despite these adaptive measures, residual tariff impacts persist in the overall bill of materials, compelling companies to absorb or partially pass through costs to end users.

In parallel, higher material and logistics expenses have accelerated the adoption of advanced simulation techniques. By leveraging large eddy simulation and Reynolds-averaged Navier Stokes methodologies, engineers can identify design optimizations that reduce material usage without compromising aerodynamic performance. This emphasis on material efficiency underscores a strategic response to tariff pressures-driving greater reliance on digital validation workflows while reshaping supplier engagement and cost management approaches across the aerodynamic component ecosystem.

Revealing Critical Market Segmentation Patterns That Illuminate Demand Drivers from Vehicle Types to Propulsion Technologies and Testing Methodologies

An in-depth analysis of vehicle type segmentation reveals divergent aerodynamic priorities across Heavy Commercial Vehicles, Light Commercial Vehicles, and Passenger Cars. Heavy Commercial Vehicles emphasize drag reduction across large frontal areas to curb fuel consumption on long-haul routes, prompting the integration of robust underbody panels and passive diffusers. Light Commercial Vehicles, balancing payload versatility and efficiency, increasingly adopt active grille shutters to modulate airflow through the engine compartment. Passenger cars pursue sleek silhouettes and deploy adaptive spoilers that fine-tune stability and reduce lift at elevated speeds.

Examining propulsion type segmentation, Battery Electric Vehicles prioritize drag minimization to maximize driving range, leveraging both active aerodynamics and highly optimized underbody designs. Hybrid models frequently incorporate adaptive spoilers that align aerodynamic efficiency with thermal management demands, while traditional Internal Combustion Engine vehicles continue to benefit from aerodynamic add-ons that offset inherent cooling airflow targets.

Focusing on aerodynamic component segmentation, Active Aerodynamics such as active grille shutters and adaptive spoilers are penetrating across vehicle classes, driven by a blend of efficiency mandates and consumer demand for enhanced stability. Passive Aerodynamics, encompassing air curtains, diffusers, spoilers, and underbody panels, remain foundational, with design refinements increasingly informed by high-resolution CFD simulation.

End user segmentation illustrates divergent adoption patterns between the aftermarket and original equipment manufacturing channels. Aftermarket players introduce retrofit solutions focused on cost-effective drag reduction, while OEMs pursue integrated aerodynamic architectures earlier in the design process.

Finally, test method segmentation highlights a growing shift toward CFD simulation for rapid design iterations. Within simulation, large eddy simulation excels at capturing transient flow behaviors, while Reynolds-averaged Navier Stokes models provide steady-state performance benchmarks. Road testing remains critical for holistic validation under real-world conditions, and wind tunnel testing-both closed loop and open loop-continues to deliver high-precision aerodynamic coefficients for final calibration.

This comprehensive research report categorizes the Automotive Aerodynamics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Propulsion Type

- Aerodynamic Component

- Test Method

- End User

Illuminating Distinctive Regional Dynamics in the Americas, EMEA, and Asia-Pacific That Steer Adoption and Development of Aerodynamic Solutions

Regional dynamics in the Americas illustrate a strong regulatory impetus toward greenhouse gas reduction, with federal and state-level policies incentivizing aerodynamic enhancements as part of broader efficiency strategies. North American OEMs are investing heavily in active grille shutter systems that optimize thermal and drag performance, while aftermarket suppliers expand retrofit programs to serve commercial fleet operators in pursuit of cost savings on fuel expenditures.

In Europe, Middle East, and Africa, stringent phase-out targets for internal combustion engines by 2035 have galvanized research into both active and passive aerodynamic solutions. European manufacturers pioneer integrated underbody systems with multifunctional energy absorption features, and wind tunnel facilities across Germany and the United Kingdom are expanding to support advanced vehicle testing scenarios. Meanwhile, Middle Eastern markets, driven by performance-centric luxury segments, showcase adaptive spoiler technologies that blend aesthetic appeal with aerodynamic function. African markets, albeit nascent, are primed for growth through retrofit packages aimed at fuel efficiency improvements in logistics and public transport fleets.

The Asia-Pacific region continues to outpace global production volumes, with China deploying large-scale CFD simulation centers to accelerate aerodynamic development for electric buses and light commercial vehicles. Japan and South Korea, home to advanced component suppliers, emphasize active aerodynamics that synchronize with vehicle stability control systems. Southeast Asian markets, characterized by mixed fleet compositions, are adopting passive diffuser and air curtain upgrades in urban mobility applications to navigate dense traffic conditions. Collectively, these regional variations underscore the importance of tailoring aerodynamic strategies to local regulatory, climatic, and operational contexts.

This comprehensive research report examines key regions that drive the evolution of the Automotive Aerodynamics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Pivotal Competitive Strategies and Innovative Initiatives Undertaken by Leading Suppliers in the Automotive Aerodynamics Ecosystem

Leading suppliers in the automotive aerodynamics space have distinguished themselves through early investments in digital engineering platforms and strategic collaborations with vehicle manufacturers. Some core component providers have enhanced their CFD capabilities by partnering with specialized simulation software developers, enabling more precise airflow modeling and rapid iteration cycles. These alliances have catalyzed the development of proprietary adaptive spoiler mechanisms and active grille shutter modules designed for seamless integration with vehicle electronic control units.

In addition, several tier-one aerodynamic specialists have pursued vertical integration by acquiring wind tunnel facilities and establishing expansive testing networks across key geographies. This approach has streamlined validation processes and reduced turnaround times for new design releases. Others have focused on modular product architectures that allow OEMs to customize aerodynamic kits for diverse vehicle platforms without extensive retooling.

Innovation labs sponsored by these companies explore next-generation materials, including biodegradable composites and functionally graded alloys, aimed at achieving favorable strength-to-weight ratios. Concurrently, data-driven insights from connected vehicle tests feed back into R&D pipelines, informing iterative refinements to both active and passive aerodynamic components. Collectively, these strategic moves position leading players to capture emerging opportunities in electrification, regulatory compliance, and aftermarket retrofit markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Aerodynamics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Corporation

- BorgWarner Inc.

- Brose Fahrzeugteile SE & Co. KG

- Continental AG

- DENSO Corporation

- Faurecia SE

- Gentex Corporation

- Hella KGaA Hueck & Co.

- Magna International Inc.

- Valeo SA

- ZF Friedrichshafen AG

Proposing Strategic Imperatives and Tactical Next Steps for Industry Leaders to Capitalize on Aerodynamics Advances and Strengthen Market Positioning

Industry leaders should prioritize the integration of modular active aerodynamic systems early in the vehicle development cycle, enabling seamless software and hardware co-optimization to meet evolving efficiency mandates. Strategic alliances with simulation technology providers can expedite digital prototyping efforts, reducing time to market and lowering physical testing expenditures. In parallel, strengthening supply chain resilience through localized material sourcing will mitigate the impact of future trade policy shifts and raw material volatility.

Moreover, executives should consider targeted investments in lightweight composite materials that deliver aerodynamic performance without incurring excessive cost premiums. These innovations can unlock new design freedom for passive components such as diffusers and underbody panels, generating cumulative efficiency gains.

To fuel aftermarket growth, establishing performance-verified retrofit solutions will appeal to fleet operators seeking immediate return on investment. These offerings should be supported by comprehensive field data demonstrating fuel savings under diverse operating conditions. Finally, fostering cross-functional champions within organizations-bridging design, procurement, and sales channels-will ensure that aerodynamic enhancements align with broader corporate sustainability and profitability objectives.

Detailing Rigorous Multi-Modal Research Methodology Combining Primary Interviews, Advanced Simulations, and Comprehensive Validation Techniques

This research integrates a multi-modal methodology that combines primary and secondary data collection with advanced computational techniques. Primary insights were gathered through interviews with leading aerodynamic engineers, procurement executives, and R&D directors across prominent OEMs and tier-one suppliers. These structured conversations provided contextual understanding of strategic priorities, technology adoption trends, and supply chain challenges.

Secondary sources encompassed peer-reviewed journals on fluid dynamics, regulatory filings, and publicly available technical presentations from international automotive symposiums. This body of literature informed the comparative analysis of active and passive aerodynamic components, as well as the assessment of test methodologies including closed loop and open loop wind tunnel configurations.

In parallel, computational fluid dynamics simulations were conducted using both large eddy simulation and Reynolds-averaged Navier Stokes frameworks to validate aerodynamic performance assumptions. These simulations were calibrated against industry-standard wind tunnel tests and real-world road trials, ensuring that virtual models mirrored practical outcomes. The convergence of primary interviews, literature review, and hybrid simulation-testing protocols underpins the rigor and reliability of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Aerodynamics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Aerodynamics Market, by Vehicle Type

- Automotive Aerodynamics Market, by Propulsion Type

- Automotive Aerodynamics Market, by Aerodynamic Component

- Automotive Aerodynamics Market, by Test Method

- Automotive Aerodynamics Market, by End User

- Automotive Aerodynamics Market, by Region

- Automotive Aerodynamics Market, by Group

- Automotive Aerodynamics Market, by Country

- United States Automotive Aerodynamics Market

- China Automotive Aerodynamics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Chapters of Insight to Articulate the Strategic Imperatives and Forward-Looking Outlook for Automotive Aerodynamics

Throughout this executive summary, we have traced the trajectory of automotive aerodynamics from foundational drag-reduction strategies to sophisticated adaptive and passive systems harmonized with electrified powertrains. The cumulative impact of U.S. tariff measures underscores the need for agile supply chain strategies and intensified digital validation workflows. Meanwhile, segmentation insights reveal how vehicle types, propulsion systems, aerodynamic component categories, end user channels, and test methods coalesce to shape demand patterns.

Regionally, the Americas, EMEA, and Asia-Pacific exhibit distinct regulatory motivators, technological capabilities, and operational imperatives that demand tailored aerodynamic solutions. Leading companies are differentiating through strategic investments in simulation, testing infrastructure, and modular product designs. Finally, actionable recommendations offer a roadmap for stakeholders to prioritize supply chain resilience, leverage material innovations, and expand aftermarket retrofit programs.

As aerodynamic refinement becomes ever more integral to efficiency mandates and consumer expectations, this report provides a comprehensive foundation for informed decision-making. Stakeholders equipped with these insights are well-positioned to navigate policy shifts, technological disruptions, and competitive pressures, ultimately securing a sustainable performance advantage in the global automotive market.

Empowering Decision-Makers with Exclusive Access to In-Depth Aerodynamics Intelligence Through a Personalized Engagement with an Expert

Engaging directly with Ketan Rohom, the Associate Director of Sales & Marketing, provides you with a tailored pathway to secure unparalleled insights into automotive aerodynamics. By initiating a collaborative dialogue, you gain VIP access to the complete research findings, including detailed breakdowns of tariff effects, segmentation dynamics, regional growth accelerators, and cutting-edge company strategies. Connect with Ketan to arrange a personalized briefing call where you can explore custom data extracts, discuss strategic implications for your organization, and identify specific areas for investment or innovation. This hands-on engagement ensures that you receive recommendations calibrated to your unique business objectives, arming you with the intelligence needed to outpace competitors and drive long-term success.

- How big is the Automotive Aerodynamics Market?

- What is the Automotive Aerodynamics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?