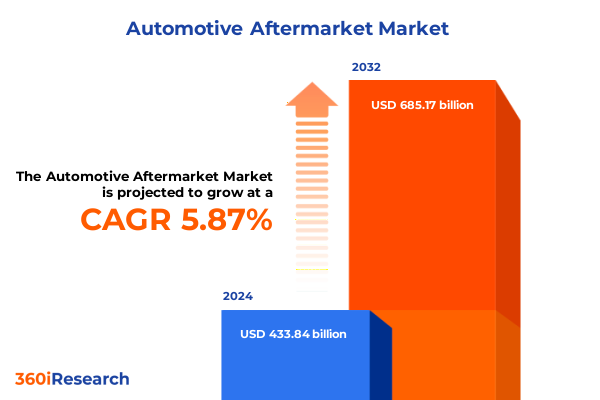

The Automotive Aftermarket Market size was estimated at USD 484.12 billion in 2025 and expected to reach USD 511.71 billion in 2026, at a CAGR of 5.91% to reach USD 724.09 billion by 2032.

Framing the modern aftermarket landscape with a concise orientation to consumer behavior, supply dynamics, and operational priorities for leadership alignment

The automotive aftermarket stands at a crossroads where consumer expectations, technological change, and distribution dynamics converge to reshape value creation across the industry. Recent shifts in vehicle design, ownership patterns, and maintenance modalities have altered where and how consumers access parts, accessories, and services. In response, suppliers, retailers, and service providers must reconsider product portfolios, inventory strategies, and customer engagement models to remain relevant and resilient.

Stakeholders face simultaneous pressures from rising component complexity, accelerated electrification, and evolving regulatory frameworks that influence supply chains and repairability. Meanwhile, end users expect seamless omnichannel experiences and trusted advice, whether they are performing do-it-yourself maintenance or engaging professional services. As a result, companies that prioritize agility, data-driven supply decisions, and clear value propositions will secure stronger customer loyalty.

This introduction sets the stage for a comprehensive assessment of transformative shifts, tariff impacts, segmentation-specific insights, regional dynamics, competitive movements, and actionable recommendations. The goal is to orient leaders toward practical choices that align operational capabilities with market realities, and to provide a framework for measuring short-term resilience alongside long-term strategic repositioning. By grounding strategy in a nuanced understanding of stakeholders and channels, organizations can convert disruption into differentiated opportunity.

How electrification, digital commerce, supply chain resilience, and sustainability imperatives are jointly redefining aftermarket business models and operational priorities

Over the past decade, the automotive aftermarket has experienced accelerating transformative shifts that are redefining competitive advantage and operational design. Electrification and advanced driver assistance systems have increased the technical complexity of replacement components and service tasks, prompting suppliers and service providers to invest in specialized diagnostics, training, and tooling. Concurrently, digital commerce has altered purchase journeys: consumers now combine online research with local service appointments, expecting transparent pricing, verified compatibility, and streamlined fulfillment.

Supply chain resilience has moved from a back-office concern to a strategic capability. Companies are diversifying supplier bases, shortening lead times through regional sourcing, and investing in inventory visibility tools to reduce stockouts and excess carrying costs. Meanwhile, aftermarket businesses are adopting software-enabled services to capture lifecycle revenue from connected vehicles, offering subscription models, remote diagnostics, and predictive maintenance recommendations. These new revenue streams require collaboration across manufacturers, parts suppliers, and service networks to deliver consistent customer experiences.

In addition, regulatory and sustainability imperatives are influencing product development and end-of-life processes. There is growing demand for recyclable materials, remanufactured components, and transparent supply chains that can demonstrate environmental and regulatory compliance. Taken together, these transformative shifts compel companies to prioritize digital integration, technical upskilling, and flexible distribution strategies to capitalize on new customer expectations and operational efficiencies.

Assessing the multifaceted operational and strategic implications of U.S. tariff adjustments on sourcing, inventory, and channel economics across the aftermarket

Tariff policy changes in the United States have introduced new considerations that ripple across sourcing choices, pricing structures, and supplier relationships. As duties alter the relative cost of imported components and accessories, procurement teams must reevaluate vendor portfolios and total landed cost calculations. In response, some suppliers accelerate nearshoring efforts and establish alternative logistics routes to reduce exposure to tariff volatility, while others renegotiate contracts to share risk more equitably across the supply chain.

Beyond direct cost effects, tariff dynamics influence strategic inventory positioning. Firms weigh the trade-offs between maintaining buffer stocks to hedge against import delays and implementing just-in-time strategies to minimize capital tied to inventory. This recalibration requires improved demand forecasting, contractual flexibility with logistics partners, and closer collaboration with distributors to smooth replenishment cycles. At the same time, manufacturers and aftermarket brands are reassessing product portfolios to identify high-margin, lower-tariff items that can support margin stabilization.

Furthermore, tariffs catalyze competitive responses that reshape market access and channel economics. Domestic producers may gain relative advantage in certain categories, prompting shifts in distributor relationships and marketing emphasis. Conversely, international suppliers may pursue alternative market entry strategies, including local assembly or licensing arrangements, to mitigate tariff-related constraints. As a result, leaders must adopt a more dynamic procurement and pricing playbook that anticipates policy shifts and preserves customer value propositions.

Precision segmentation reveals distinct product, user, and channel imperatives that demand tailored assortments, pricing, and inventory strategies for sustained relevance

Segmentation insights reveal differentiated demand drivers and operational requirements across product types, vehicle lifecycles, user behaviors, and distribution pathways. Based on Accessories, the market is studied across Exterior Accessories, Interior Accessories, and Performance Accessories; each category entails distinct aftermarket value propositions, with exterior upgrades focused on aesthetics and protection, interior accessories emphasizing comfort and personalization, and performance accessories targeting enthusiasts and performance-driven upgrades. Shifting to vehicle age, the market is studied across 0–3 Years, 13+ Years, 4–7 Years, and 8–12 Years; younger vehicles tend to demand technology-compatible accessories and warranty-conscious service options, while older vehicles exhibit higher demand for maintenance components and restorative products.

End user distinctions matter significantly, as the market is studied across DIY Consumers and Professional Services; DIY buyers prioritize clear fitment information, ease of installation, and price transparency, whereas professional services require reliable supply, bulk availability, and technical documentation. Distribution channel nuance further shapes commercial strategy, since the market is studied across Retailers and Wholesalers & Distributors, with Retailers further studied across OEMs and Repair Shops; retailers focus on consumer-facing presentation, brand trust, and omnichannel fulfillment, while wholesalers and distributors emphasize scale, lead times, and trade relationships. Repair shops and OEM-affiliated retail outlets carry different stocking logics and service integration requirements, and therefore companies must craft segmented product assortments, pricing models, and marketing propositions that align with each pathway.

Taken together, these segmentation lenses demonstrate that a one-size-fits-all approach undermines customer relevance. Instead, manufacturers and channel partners should adopt differentiated product specifications, tailored marketing narratives, and distinct inventory policies that reflect the technical, behavioral, and logistical realities of each segment. By doing so, organizations can improve conversion, reduce return rates, and strengthen long-term service relationships.

This comprehensive research report categorizes the Automotive Aftermarket market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Vehicle Age

- Service Type

- Customer Type

- Vehicle Type

- Distribution Channel

How regional market characteristics and regulatory diversity redefine inventory footprints, distribution partnerships, and product strategies across key global territories

Regional dynamics influence distribution models, supplier networks, and consumer preferences in meaningful ways. In the Americas, aftermarket activity is shaped by a mix of urban and rural service ecosystems, high consumer interest in personalization, and a strong presence of independent repair shops alongside franchise networks. This region places a premium on rapid fulfillment, parts availability for a diverse vehicle park, and clear compatibility information to support both DIY and professional end users. As a result, companies operating here benefit from a hybrid approach that combines e-commerce convenience with robust local stocking.

In Europe, Middle East & Africa, heterogeneous regulatory environments and a broad spectrum of vehicle types require flexible compliance processes and varied product offerings. Consumers in many markets emphasize sustainability and remanufactured solutions, while service networks range from highly consolidated chains to small independent operators. Therefore, regional strategies must accommodate complex homologation requirements and localized marketing that resonates with different market maturities. In Asia-Pacific, rapid adoption of digital channels, high urbanization rates, and an expansive independent service sector drive opportunities for digital-first distribution and aftermarket services integrated with fleet and ride-hailing operators. Regional hubs in this area often serve as supply bases for broader export strategies, and local partnerships can accelerate market access and operational scale.

Across regions, the interplay between consumer expectations, regulatory norms, and logistics infrastructure requires adaptive commercial models. Consequently, firms should align regional product assortments, inventory footprints, and partnership models to local demand patterns while preserving global operational coherence for procurement and quality assurance.

This comprehensive research report examines key regions that drive the evolution of the Automotive Aftermarket market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive positioning in aftermarket value creation anchored in product reliability, service enablement, and partnerships that integrate parts supply with repair networks

Competitive dynamics in the aftermarket are driven by a mix of legacy manufacturers, specialized aftermarket brands, and distribution networks that have adapted to digital commerce and professional service demands. Companies that combine deep technical expertise with robust channel relationships and reliable logistics succeed in retaining trade customers and converting DIY consumers. Strategic differentiation emerges from investments in product quality, verified fitment data, and technical support resources that reduce install time and warranty friction.

In parallel, service providers that modernize customer touchpoints-through online appointment scheduling, integrated parts ordering, and transparent service estimates-enhance customer retention and increase average transaction value. Suppliers that support these service workflows with rapid replenishment and technical training add measurable value to repair networks. Additionally, firms that develop modular product platforms and adaptable accessory portfolios can respond faster to vehicle model cycles and aftermarket trends, while protecting engineering investments.

Partnerships remain a critical competitive lever. Collaborations between component suppliers, distributors, and service chains enable bundled offerings and integrated warranty programs that increase perceived value. At the same time, new entrants that focus on niche performance accessories or digital aftermarket services can capture loyal customer segments by delivering specialized expertise and community-driven brand experiences. Overall, market leaders balance operational excellence with selective innovation to maintain margins while expanding relevance across end-user segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Aftermarket market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- DENSO Corporation

- Continental AG

- Magna International, Inc.

- Aisin Seiki Co., Ltd.

- Bridgestone Corporation

- Valeo SA

- BorgWarner Inc.

- The Goodyear Tire & Rubber Company

- 3M Company

- ABS Friction Inc.

- Akebono Brake Industry Co., Ltd.

- ALCO Filters Ltd.

- Aptiv PLC

- Asimco Global Inc.

- ATR International AG

- BASF SE

- Compagnie Générale des Établissements Michelin SCA

- FORVIA Group

- General Motors Company

- Lear Corporation

- LKQ Corporation

- Mahle GmbH

- Marelli Holdings Co., Ltd.

- O'Reilly Automotive, Inc.

- PHINIA Inc.

- Schaeffler AG

- Sumitomo Electric Industries, Ltd.

- Tenneco Incorporated

- Yazaki Corporation

Action-oriented priorities for executives to accelerate omnichannel growth, secure supply chains, and operationalize segmented commercial strategies with partners

Industry leaders must act decisively to translate insight into durable advantage by prioritizing four core initiatives: digital enablement of the customer journey, resilient and diversified supply chains, targeted segmentation strategies, and collaborative partnerships across the value chain. First, investing in omnichannel platforms that deliver accurate fitment data, intuitive product discovery, and integrated service scheduling will convert research-driven interest into completed transactions and repeat business. These platforms should be instrumented for data capture to refine assortment decisions and personalize recommendations over time.

Second, procurement and operations teams should pursue supplier diversification, nearshoring where viable, and inventory orchestration technologies that balance service levels with capital efficiency. Closer coordination with logistics partners and distributors can reduce lead-time variability and improve fulfillment predictability. Third, adopt distinct product and go-to-market strategies informed by the accessory categories, vehicle age profiles, and end-user behaviors previously described to align service levels and marketing investments with customer value.

Finally, cultivate partnerships that extend beyond transactional supply: co-developed service bundles, training programs for technicians, and co-marketing with repair networks can accelerate adoption and reduce return incidence. Leaders should also pilot sustainability initiatives-remanufacturing, recyclable packaging, and transparent sourcing-to appeal to regulatory expectations and environmentally conscious consumers. By sequencing these priorities pragmatically and measuring impact through operational KPIs, organizations can deliver immediate resilience and long-term market positioning.

Methodological approach combining primary interviews, channel mapping, and scenario analysis to translate industry practices into executable operational recommendations

The research underpinning these insights combines qualitative interviews, channel partner analysis, and a systematic review of industry practices to produce a balanced and actionable perspective. Primary inputs included in-depth conversations with procurement leaders, distributor executives, repair shop owners, and product managers to surface practical challenges and adaptive strategies. These conversations were complemented by a detailed mapping of distribution networks and product assortments to identify common bottlenecks in replenishment, technical support, and customer conversion.

Analytical methods employed scenario analysis to stress-test procurement and inventory options under different policy and logistics conditions, and process reviews to assess the operational readiness of service providers to integrate new product types and digital tools. Triangulation across interviews and network mapping ensured that observations reflected both strategic intent and operational realities. Where relevant, case examples illustrate successful adaptations, clarifying how companies shifted sourcing strategies, reconfigured inventories, or developed service partnerships to protect margins and improve customer outcomes.

Transparency and reproducibility were maintained through documented interview protocols, standardized assessment templates for channel evaluation, and a clear explanation of assumptions used in scenario exercises. The methodology emphasizes practical applicability, enabling executives to adapt recommended actions to their organizational constraints and market contexts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Aftermarket market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Aftermarket Market, by Product Type

- Automotive Aftermarket Market, by Vehicle Age

- Automotive Aftermarket Market, by Service Type

- Automotive Aftermarket Market, by Customer Type

- Automotive Aftermarket Market, by Vehicle Type

- Automotive Aftermarket Market, by Distribution Channel

- Automotive Aftermarket Market, by Region

- Automotive Aftermarket Market, by Group

- Automotive Aftermarket Market, by Country

- United States Automotive Aftermarket Market

- China Automotive Aftermarket Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesis of strategic imperatives emphasizing immediate operational fixes and capability investments to convert disruption into sustainable aftermarket advantage

In conclusion, the automotive aftermarket is undergoing a period of substantive change driven by technological complexity, shifting consumer behavior, policy influences, and evolving distribution economics. Companies that respond with clarity-by differentiating product assortments, strengthening supply chain resilience, and embedding digital capabilities into the customer experience-will preserve margins and capture emerging opportunities. Simultaneously, targeted partnerships and regionally attuned strategies will unlock efficiencies and accelerate market access.

As leaders consider next steps, it is essential to balance immediate operational fixes with medium-term investments in capability building. Tactical moves such as improving fitment accuracy and streamlining replenishment can deliver quick performance improvements, while investments in diagnostic support, training, and sustainability initiatives build long-term differentiation. Importantly, decisions should be informed by the segmentation lenses and regional dynamics discussed earlier to ensure initiatives deliver value where it matters most.

Ultimately, the path forward requires disciplined execution, close monitoring of policy and technology developments, and a willingness to iterate commercial models. Firms that combine these elements-practical short-term actions with strategic capability development-will turn market disruption into sustainable competitive advantage.

Clear next steps to translate comprehensive aftermarket intelligence into purchase, personalized briefings, and implementation support with senior sales leadership

Ketan Rohom, Associate Director, Sales & Marketing, invites senior leaders, procurement teams, and strategic planners to secure the full market research report to inform immediate decisions and long-range planning. The report synthesizes primary interviews, supplier mapping, and distribution channel analysis to deliver pragmatic pathways for procurement resilience, cost optimization, and revenue diversification. Prospective buyers will receive support in translating insights into action: tailored briefings, executive summaries for board review, and optional deep-dive workshops to align cross-functional teams around prioritized initiatives.

To move from insight to implementation, request the report and arrange a consultative session with Ketan Rohom (Associate Director, Sales & Marketing). During the session, you will clarify which sections of the research align with your strategic priorities, identify relevant case studies, and map a phased execution plan for sourcing, inventory strategies, or aftermarket service enhancements. This approach helps operational teams adopt recommended actions with measurable milestones and accountability.

Engagement options include an enterprise license for executive distribution, a focused practitioner package with implementation templates, and bespoke advisory support for integration into existing transformation programs. Reach out to arrange a personalized briefing to evaluate how the content can accelerate competitive differentiation, protect margins, and strengthen customer retention across retail and professional channels. Secure the research to transform market signals into prioritized actions and sustained advantage.

- How big is the Automotive Aftermarket Market?

- What is the Automotive Aftermarket Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?