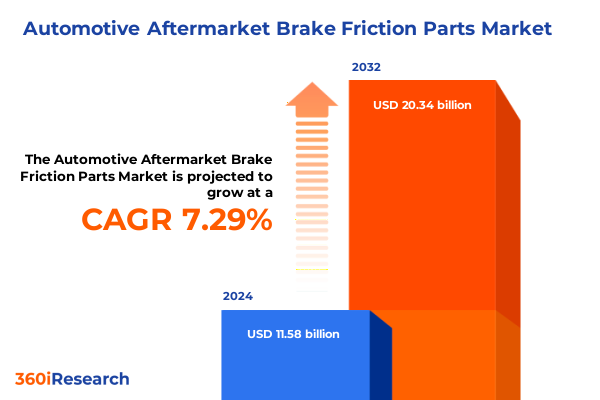

The Automotive Aftermarket Brake Friction Parts Market size was estimated at USD 12.42 billion in 2025 and expected to reach USD 13.32 billion in 2026, at a CAGR of 7.30% to reach USD 20.34 billion by 2032.

Setting the Stage for a Deep Dive into the Innovations and Market Dynamics Shaping Automotive Brake Friction Components

The automotive aftermarket for brake friction parts sits at the crossroads of safety imperatives and evolving mobility demands, underpinning the performance and reliability of vehicles worldwide. As global fleets expand and vehicle lifecycles extend, the need for replacement brake pads and shoes intensifies, highlighting the critical role of friction materials in ensuring consistent stopping power and minimizing environmental impact. In recent years, innovation has accelerated around advanced formulations that balance thermal stability, noise reduction, and compliance with tightening particulate matter regulations.

Moreover, aftermarket dynamics are being reshaped by shifts in consumer behavior and purchasing channels, as well as by broader macroeconomic and geopolitical factors. From the resurgence of e-commerce platforms facilitating easier access to replacement parts, to the implications of trade policies on cost structures, stakeholders must adapt rapidly to maintain efficiency and meet rising expectations. This executive summary distills the core developments, analytical frameworks, and strategic considerations essential for navigating the brake friction parts aftermarket, offering a concise yet comprehensive guide for manufacturers, distributors, and decision makers aiming to align with future industry trajectories.

Understanding the Pivotal Technological and Operational Shifts Transforming the Automotive Aftermarket Brake Friction Sector

Automotive brake friction materials are undergoing a transformative evolution driven by stringent environmental regulations and the rise of electrified powertrains. In recent years, regulatory bodies in Europe and China have imposed tighter limits on copper content and particulate emissions, accelerating the transition from traditional metallic blends to advanced ceramic and low-metallic compounds. According to a 2025 industry release, leading tier one suppliers are investing heavily in low-emission, copper-free, and ceramic-based friction materials to comply with Euro 7 and China 7 particulate regulations, reflecting a broader push toward sustainable manufacturing and end-of-life recyclability.

Simultaneously, the growing penetration of electric and hybrid vehicles has prompted the development of friction products tailored for regenerative braking systems. These bespoke materials must accommodate unique thermal profiles and lower friction demands to optimize energy recovery and minimize wear. Beyond material innovation, manufacturing processes are embracing digital quality controls and precision molding techniques that reduce scrap rates and enable complex pad geometries optimized for specific vehicle architectures. This confluence of regulatory pressure, sustainability imperatives, and technological advancement is redefining value chains, compelling both established manufacturers and agile start-ups to forge collaborative partnerships and accelerate research and development cycles.

Evaluating the Far-Reaching Consequences of the 2025 U.S. Tariff Measures on Automotive Aftermarket Brake Friction Parts Supply Chains

In March 2025, a presidential proclamation under Section 232 of the Trade Expansion Act invoked a 25 percent tariff on imported automobiles and certain automobile parts, with tariffs on passenger vehicles effective April 3 and parts duties set to begin May 3. The measure encompasses engines, transmissions, powertrain components, and electrical systems, imposing an ad valorem levy that compounds existing duties. This blanket tariff, intended to safeguard national security by protecting domestic manufacturing capacity, extends to all major trading partners, including those under USMCA, which face equivalent charges on non-compliant content.

The cumulative impact reverberates across the aftermarket for brake friction parts, as global suppliers grapple with increased landed costs and compressed margins. Industry groups representing automakers and aftermarket distributors have warned that these tariffs will disrupt fragile supply chains, trigger production stoppages, and ultimately pressure consumer pricing as inventories are drawn down. In response, many firms are exploring near-shoring strategies, vertical integration, and local content certification to mitigate exposure. While immediate price hikes at the consumer level have been delayed by inventory absorption, analysts project that sustained duties will necessitate adjustments in pricing models, supplier contracts, and long-term procurement strategies throughout the brake friction parts ecosystem.

Unlocking Market Nuances Through a Multi-Dimensional Segmentation Analysis of Automotive Aftermarket Brake Friction Parts

Diving into the nuances of the automotive brake friction market reveals a complex interplay between distribution pathways, product formats, vehicle segments, material compositions, and vehicle age profiles. The landscape bifurcates into offline and online channels, with brick-and-mortar outlets spanning non-store fleet account services and a spectrum of store-based settings ranging from auto part retailers to dealership networks and specialty shops. Concurrently, digital platforms-including broad marketplaces and pure-play e-commerce sites-are capturing an expanding share of aftermarket purchases as convenience and transparency become paramount.

From a product perspective, the segment divides into brake pads tailored for front and rear axles, and brake shoes configured as leading or trailing variants, each engineered to meet distinct performance and wear characteristics. Vehicle types span heavy and light commercial categories, passenger car sub-segments including hatchbacks, sedans, and SUVs, and two-wheeler assemblies, highlighting differential replacement cycles and performance demands. Material differentiation encompasses ceramic, low metallic, organic, and semi-metallic formulations, with the latter subdivided by metal content to balance heat dissipation and friction consistency. Additionally, replacement patterns are influenced by vehicle age brackets, distinguishing newer models under five years, mid-life vehicles between five and ten years, and legacy fleets exceeding a decade. This multi-dimensional segmentation framework underpins targeted strategies for product development, distribution optimization, and marketing alignment across the aftermarket spectrum.

This comprehensive research report categorizes the Automotive Aftermarket Brake Friction Parts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Vehicle Category

- Friction Material

- Brake Technology

- Brake Position

- Installation Method

- Sales Channel

Delineating Regional Dynamics Across Americas, Europe Middle East & Africa, and Asia-Pacific in the Brake Friction Parts Aftermarket

Regional dynamics in the brake friction parts aftermarket are shaped by distinct regulatory regimes, vehicle parc compositions, and distribution infrastructures, resulting in differentiated strategic imperatives across the globe. In the Americas, mature markets feature high vehicle ownership rates and well-established network coverage, fostering robust demand for premium friction materials even as cost pressures remain a focal concern. Aftermarket participants navigate complex state-level regulations in the United States, while emerging hubs in Brazil and Mexico present growth opportunities linked to fleet renewal cycles and expanding urban mobility.

Across Europe, the Middle East, and Africa, the aftermarket is characterized by the confluence of stringent EU emission and safety mandates alongside diverse market maturities. Western Europe leads in the adoption of low-dust, high-performance ceramic compounds, whereas Central and Eastern European markets maintain a balance between cost-effective organic materials and rising demand for advanced formulations. The Middle East and Africa regions exhibit wide variability in aftermarket penetration, with Gulf Cooperation Council states demonstrating rapid uptake of digital distribution channels and specialty retail formats.

In Asia-Pacific, market dynamics are driven by rising vehicle parc growth, particularly in India and Southeast Asia, and accelerated electrification policies in China, South Korea, and Japan. The region’s supply chain prominence supports local manufacturing clusters, yet tariff regimes and trade agreements continue to influence import dependence for specialized friction materials. As a result, aftermarket players are increasingly forging joint ventures and leveraging localized development to address both cost optimization and evolving regulatory requirements.

This comprehensive research report examines key regions that drive the evolution of the Automotive Aftermarket Brake Friction Parts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting the Competitive Landscape by Examining Strategies of Leading Brake Friction Parts Suppliers and Innovators

Leading participants in the brake friction parts arena are pursuing a mix of innovation, scale, and market penetration strategies to solidify their competitive positions. Global brake system specialists are intensifying investment in research and development to create low-dust and noise-reduction solutions, leveraging proprietary material blends and manufacturing processes to differentiate product portfolios. Mid-tier suppliers are capitalizing on regional partnerships and contract manufacturing agreements to expand reach in emerging markets, while also enhancing logistical efficiencies through distribution alliances.

In parallel, several independent aftermarket brands are broadening service offerings by integrating technical support, training programs, and digital ordering platforms to improve customer retention. Collaboration between OEM-aligned friction divisions and aftermarket-focused entities is growing, facilitating rapid technology transfer and scale economies. Meanwhile, agile entrants and startups are exploring niche segments-such as high-performance EV brake solutions and connected monitoring systems-to challenge incumbents with specialized value propositions. Through this competitive interplay, the landscape is marked by both consolidation among traditional players and the emergence of innovative challengers pushing the boundaries of material science, digitization, and customer engagement models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Aftermarket Brake Friction Parts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADVICS Co., Ltd.

- AISIN Corporation

- Akebono Brake Industry Co., Ltd.

- Astemo, Ltd.

- Bendix Commercial Vehicle Systems LLC

- Brembo N.V.

- Continental AG

- Delphi Technologies PLC

- Dongying Xinyi Automobile Fitting Co., Ltd.

- Federal-Mogul Motorparts LLC

- Fras-le S.A.

- Hella GmbH & Co. KGaA

- HL Mando Corporation

- Japan Brake Industrial Co., Ltd.

- MAT Holdings, Inc.

- Meritor, Inc.

- Nan Hoang Traffic Instrument Co., Ltd.

- Nisshinbo Brake Inc.

- Nisshinbo Holdings Inc.

- Robert Bosch GmbH

- Sangsin Brake Co., Ltd.

- Tenneco, Inc.

- TMD Friction Holdings GmbH

- Valeo S.A.

- ZF Friedrichshafen AG

Strategic Imperatives and Tactical Recommendations for Industry Leaders to Navigate the Evolving Brake Friction Parts Aftermarket

To capitalize on evolving market conditions, industry leaders should prioritize strategic investments in advanced friction materials that address both environmental regulations and electric vehicle braking requirements. Accelerating the integration of sensors and data analytics into friction components will enhance predictive maintenance capabilities and strengthen value-added service models. Furthermore, diversifying supply chain footprints through a blend of near-shoring and trusted global partnerships can mitigate tariff exposure and improve responsiveness to demand fluctuations.

Additionally, cultivating direct digital engagement channels will be crucial for capturing the growing share of e-commerce transactions, while reinforcing brand trust through transparent quality assurance and certification programs. Companies should also consider cross-segment collaborations and licensing agreements to accelerate the diffusion of proprietary technologies into aftermarket channels. Finally, scenario planning and contingency frameworks will enable rapid adaptation to shifts in trade policy, regulatory enforcement, or raw material availability, ensuring continuity of supply and competitive resilience in the brake friction parts aftermarket.

Outlining the Comprehensive Research Framework and Data Collection Methods Underpinning the Automotive Brake Friction Parts Market Study

This study employs a structured research framework combining primary insights and secondary data analysis to ensure robust and comprehensive market coverage. Primary research consisted of in-depth interviews with executives and technical specialists across the value chain, including material scientists, manufacturing engineers, distribution managers, and aftermarket service providers. These qualitative inputs informed the validation of key trends, competitive dynamics, and adoption drivers that underpin the brake friction parts landscape.

Secondary research leveraged a diverse array of authoritative sources, encompassing regulatory publications, trade association reports, and company disclosures. Tariff measures and policy implications were corroborated through official government documents, including the White House proclamation under Section 232 and subsequent Federal Register notices. Market segmentation logic was developed based on industry standards for sales channels, product typologies, vehicle classifications, material compositions, and vehicle age profiles, ensuring alignment with practitioner and academic frameworks.

Quantitative insights were synthesized through triangulation methods, reconciling data from multiple channels to achieve consistency and minimize bias. The final analysis underwent rigorous peer review and quality checks to validate accuracy, relevance, and actionable utility for stakeholders seeking to navigate the evolving automotive brake friction parts aftermarket.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Aftermarket Brake Friction Parts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Aftermarket Brake Friction Parts Market, by Product Type

- Automotive Aftermarket Brake Friction Parts Market, by Vehicle Category

- Automotive Aftermarket Brake Friction Parts Market, by Friction Material

- Automotive Aftermarket Brake Friction Parts Market, by Brake Technology

- Automotive Aftermarket Brake Friction Parts Market, by Brake Position

- Automotive Aftermarket Brake Friction Parts Market, by Installation Method

- Automotive Aftermarket Brake Friction Parts Market, by Sales Channel

- Automotive Aftermarket Brake Friction Parts Market, by Region

- Automotive Aftermarket Brake Friction Parts Market, by Group

- Automotive Aftermarket Brake Friction Parts Market, by Country

- United States Automotive Aftermarket Brake Friction Parts Market

- China Automotive Aftermarket Brake Friction Parts Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 4452 ]

Synthesis of Key Findings and Final Reflections on Navigating the Future of the Automotive Brake Friction Parts Aftermarket

The examination of the automotive brake friction parts aftermarket reveals a sector in the midst of profound transformation, shaped by environmental mandates, electrification trends, and shifting trade policies. Innovative material formulations and digital enhancements are redefining product value while regulatory imperatives continue to drive the migration toward cleaner, high-performance friction solutions. Concurrently, the imposition of broad U.S. tariffs in 2025 has underscored the importance of supply chain agility and strategic sourcing decisions.

Segmentation analysis highlights the need for tailored approaches across sales channels, product types, vehicle classifications, material categories, and vehicle age cohorts, while regional insights emphasize divergent regulatory landscapes and market maturities. Competitive dynamics feature a diverse mix of global incumbents, regional specialists, and niche innovators, each vying for differentiation through technology, scale, and customer engagement. By adopting the recommended strategic imperatives-focusing on advanced materials, digital integration, supply chain diversification, and proactive scenario planning-industry participants can navigate uncertainties and capture emerging opportunities as the brake friction parts aftermarket continues to evolve.

Connect with Our Associate Director, Sales & Marketing, to Access Detailed Insights and Secure Your Automotive Brake Friction Parts Market Report

Engaging directly with our Associate Director of Sales & Marketing, Ketan Rohom, presents a unique opportunity to secure a comprehensive understanding of the automotive aftermarket brake friction parts landscape through our in-depth market research report. With his expertise in market dynamics and client advisory, you can gain tailored insights that align with your strategic objectives and operational priorities.

By reaching out, you will unlock access to exclusive data, expert analysis, and actionable intelligence designed to inform your decision making and investment planning. Ketan Rohom will guide you through the report’s key findings, methodological rigor, and sector-specific implications, ensuring that you derive maximum value from the research. Whether you are evaluating supply chain adjustments, product innovation pathways, or competitive strategies, his personalized consultation will equip you with the clarity and confidence needed to drive growth.

To arrange a briefing and obtain details on pricing, delivery timelines, and customization options for the market research report, please contact Ketan Rohom. This engagement will empower your team to navigate uncertainties, capitalize on emerging opportunities, and maintain a competitive edge in the rapidly evolving brake friction parts aftermarket.

- How big is the Automotive Aftermarket Brake Friction Parts Market?

- What is the Automotive Aftermarket Brake Friction Parts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?