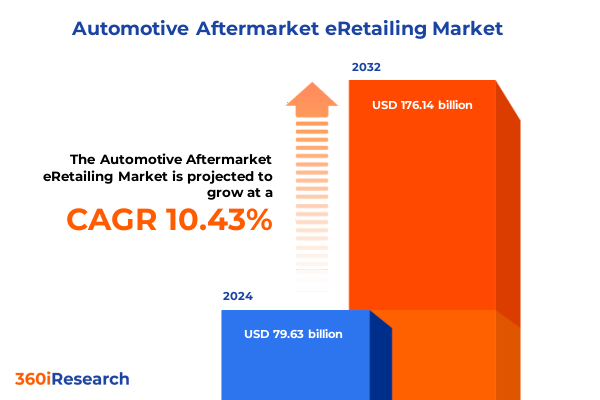

The Automotive Aftermarket eRetailing Market size was estimated at USD 88.12 billion in 2025 and expected to reach USD 97.50 billion in 2026, at a CAGR of 10.39% to reach USD 176.14 billion by 2032.

Exploring the Rapid Evolution of Automotive Aftermarket eRetail Platforms and Their Strategic Importance for Industry Stakeholders Nationwide

The automotive aftermarket eRetail sector has evolved from a niche channel into a central pillar of the spare parts ecosystem. Fueled by widespread internet access and consumer demand for convenience, digital storefronts have proliferated, offering everything from basic replacement brake pads to high-end alloy wheels. This digital migration has not only expanded the frontiers of accessibility but also catalyzed new models of engagement that prioritize real-time information, personalized recommendations and streamlined fulfillment processes.

In recent years, technological innovations such as AI-driven search algorithms and advanced logistics platforms have converged to deliver a seamless shopping journey. Consumers now access detailed product specifications, installation tutorials and community reviews at the click of a button. As traditional brick-and-mortar retailers integrate omnichannel models, the line between online and offline experiences continues to blur, fostering an environment where speed of delivery and consistency of service are as critical as product quality.

This report delves into the multifaceted dynamics shaping the modern automotive aftermarket eRetail landscape. It examines the interplay between evolving regulatory frameworks, shifting consumer behaviors and emerging technological enablers. Through targeted segmentation, regional analysis and an examination of key corporate strategies, we aim to provide stakeholders with the strategic clarity needed to navigate complexity and unlock growth.

This executive summary lays the groundwork for a deeper exploration of transformative shifts, tariff impacts, segmentation insights, regional patterns and targeted recommendations. It aims to equip decision-makers with strategic clarity for aligning eRetail initiatives with evolving market dynamics.

Analyzing Crucial Technological and Consumer Behavior Shifts Reshaping Automotive Aftermarket eCommerce Ecosystems in 2025 and Beyond Driving Growth and Differentiation

The landscape of automotive aftermarket eCommerce is undergoing a fundamental transformation driven by a confluence of technological breakthroughs and evolving consumer expectations. Artificial intelligence has emerged as a cornerstone of this shift, powering intuitive search and recommendation engines that guide buyers to the precise accessories, components or tires they require. Augmented reality tools now enable users to virtually preview exterior trim or wheel designs on their vehicles, thereby reducing purchase hesitancy and return rates. Concurrently, subscription models for maintenance parts and consumables are gaining traction, fostering recurring revenue streams and stronger brand loyalty.

Consumer behavior is also in flux, with mobile-first shopping experiences becoming the norm. Instant gratification has become a defining criterion; same-day and next-day delivery options are table stakes for leading platforms. Flexible returns policies and transparent tracking capabilities further bolster consumer confidence, prompting a shift away from traditional retail outlets.

From a technological standpoint, cloud-native architectures and microservices enable greater scalability and faster feature rollouts, while connected vehicle telematics feed real-time diagnostic data directly into eRetail platforms. This integration streamlines part identification and compatibility checks, reducing error rates and enhancing overall user satisfaction.

On the logistics front, partnerships with micro-fulfillment providers and last-mile specialists have become essential for managing peak volume periods and geographic coverage. Meanwhile, mergers and strategic alliances among digital platforms, parts distributors and OEMs underscore a broader trend toward consolidation, positioning vertically integrated ecosystems to compete on reliability, price and service differentiation.

Understanding the Far-Reaching Consequences of 2025 United States Tariff Adjustments on Global Automotive Aftermarket eRetail Supply Chains

In 2025, United States tariff policies have exerted a substantial influence on the sourcing and cost structures within automotive aftermarket eRetail. Recent adjustments to Section 232 steel and aluminum tariffs, coupled with targeted levies under Section 301 on select imported auto parts, have elevated landed costs for components such as alloy wheels and high-performance brake assemblies. Suppliers and online retailers have responded by reevaluating their supply chains, seeking alternative manufacturing hubs in North America, Latin America and select Asia-Pacific markets to mitigate tariff exposure.

The ripple effects of these measures have been felt across pricing strategies and inventory planning. E-commerce platforms are increasingly absorbing incremental duties to preserve competitive retail prices, while some have shifted to zone-based pricing models that reflect tariff differentials. At the same time, procurement teams are renegotiating contracts and exploring duty drawback programs to recoup tariff expenses on parts that re-enter international trade.

Supply chain resilience has gained fresh urgency as eRetailers balance the need for lean operations with the imperative of maintaining stock continuity. Companies have accelerated investments in domestic warehousing and on-demand manufacturing partnerships, reducing reliance on single-source suppliers exposed to geopolitical risk or punitive duties.

Looking ahead, the dynamic interplay between tariff policy and eRetail economics will continue to shape strategic decisions, influencing everything from platform pricing algorithms to cross-border logistics footprints. Industry leaders must remain vigilant in monitoring regulatory developments to adapt their sourcing models and sustain margin health.

Uncovering Nuanced Customer Experiences Through Deep-Dive Segmentation in Product Type Distribution Channel Vehicle Type Customer Type and Price Tier

A granular examination of the automotive aftermarket eRetail space reveals multiple dimensions of segmentation that inform strategic positioning and product portfolios. When dissecting the market by product type, offerings bifurcate into Accessories, Replacement Parts and Tires & Wheels. Accessories span both exterior trim and interior enhancements, while Replacement Parts range from critical brake systems and electrical modules to engine and suspension components. The Tires & Wheels category further divides into All-Season, Summer and Winter tire variants, as well as Alloy and Steel wheel options.

Distribution channel dynamics add another layer of complexity. Direct-to-Consumer channels encompass both manufacturer and retailer websites, whereas Online Parts Aggregators aggregate listings across multiple brands and sources. Third-Party Marketplaces complete the distribution spectrum, serving as neutral platforms that connect sellers and buyers within a shared digital ecosystem.

Vehicle type segmentation underlines the diversity of end-user requirements. Heavy Commercial Vehicles and Light Commercial Vehicles demand specialized components engineered for load-bearing and durability, while Passenger Cars-from hatchbacks to sedans and SUVs-drive volume with a focus on styling, performance and comfort features.

Customer typology also dictates marketing and fulfillment strategies. B2B buyers, including car rental companies, fleet operators and repair shops, seek volume discounts and just-in-time delivery, in contrast to B2C consumers who prioritize ease of navigation, product bundling and rapid returns. Finally, price tier segmentation distinguishes Economy, Mid-Range and Premium offerings, enabling eRetailers to tailor messaging and service levels in alignment with distinct buyer personas.

This comprehensive research report categorizes the Automotive Aftermarket eRetailing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Vehicle Type

- Price Tier

Mapping Regional Variations in Consumer Demand and Digital Infrastructure Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional disparities in digital infrastructure, regulatory frameworks and consumer readiness have given rise to distinctive eRetail growth trajectories across global markets. In the Americas, mature eCommerce ecosystems in the United States and Canada underpin high expectations for omnichannel fulfillment and expedited shipping. Infrastructure investments in warehousing and last-mile delivery have become strategic imperatives, while cross-border trade agreements with Mexico and select Central American nations continue to influence supply chain design.

Meanwhile, Europe Middle East and Africa markets exhibit a patchwork of regulatory standards and market maturity levels. Western European markets have embraced digital catalogs and predictive maintenance offerings, whereas emerging economies in the Middle East and Africa are in earlier stages of online penetration, relying on mobile-first interfaces and regional distribution hubs to bridge last-mile challenges.

Asia-Pacific exhibits perhaps the most dynamic growth potential, with a surge in digital adoption driven by urbanization and rising disposable incomes. In established markets like Japan and Australia, advanced telematic integrations and subscription spare parts models are gaining traction. Southeast Asian economies are experiencing rapid mobile commerce uptake, supported by government initiatives to enhance broadband access and e-payment infrastructures.

This comprehensive research report examines key regions that drive the evolution of the Automotive Aftermarket eRetailing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Moves of Leading Platforms Suppliers and Distributors Shaping Competitive Dynamics in Automotive Aftermarket eRetail

Leading platforms and distributors in the automotive aftermarket eRetail space are deploying differentiated strategies to capture market share and foster brand allegiance. Amazon has leveraged its global logistics network and Prime subscription benefits to offer same-day delivery on select automotive components, while integrating Alexa voice search to expedite reordering. eBay Motors, on the other hand, focuses on a marketplace model that aggregates both OEM and aftermarket listings, pairing advanced bidding features with buyer protection programs to bolster trust.

Specialist retailers such as AutoZone and Advance Auto Parts have invested heavily in hybrid store-to-door models, enabling customers to order online and pick up in local branches within minutes. These chains leverage proprietary loyalty platforms and predictive inventory algorithms to optimize stock levels and personalize offers.

At the pure-play end of the spectrum, digital disruptors like RockAuto and CarParts.com differentiate through extensive aftermarket catalogs and user-generated review systems that drive community engagement. Some new entrants are experimenting with blockchain-enabled provenance tracking, ensuring authenticity for high-value components and providing transparent histories of part origin and ownership.

Original equipment manufacturers are also enhancing their direct-to-consumer channels, offering certified parts via branded eCommerce portals that emphasize warranty assurance and installation support. Strategic partnerships between OEMs and eRetail platforms underscore a growing trend toward co-branded initiatives that blend product credibility with digital distribution expertise.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Aftermarket eRetailing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 1A Auto, Inc.

- Advance Auto Parts, Inc.

- Amazon.com, Inc.

- AutoAnything, Inc.

- autoDOC GmbH

- AutoZone, Inc.

- BuyAutoParts.com, Inc.

- eBay Inc.

- Euro Car Parts Limited

- Genuine Parts Company

- JEGS High Performance, Inc.

- LKQ Corporation

- Mister-Auto SAS

- O'Reilly Automotive, Inc.

- PartsGeek

- RockAuto LLC

- Summit Racing Equipment, Inc.

- The Pep Boys

- Tire Rack, Inc.

Delivering Actionable Strategic Guidance to Elevate Omnichannel Integration Supply Chain Resilience and Digital Engagement for Automotive Aftermarket Leaders

To excel in today’s competitive eRetail environment, industry leaders must prioritize a multifaceted approach that blends digital innovation with operational excellence. First and foremost, platforms should invest in end-to-end omnichannel integration, ensuring a consistent customer journey from mobile browsing to post-purchase support. By synchronizing inventory data across warehouses, storefronts and third-party partners, retailers can minimize stockouts and expedite order fulfillment.

Equally essential is the deployment of advanced analytics and AI-driven personalization engines. By harnessing consumer browsing patterns and telematic signals, eRetailers can deliver hyper-relevant product recommendations and predictive maintenance alerts. This not only enhances average order value but also strengthens long-term engagement.

Supply chain resilience demands dedicated attention as well. Leaders should establish diversified sourcing strategies, combining domestic and nearshore manufacturing with strategic inventory buffers to mitigate tariff shocks and geopolitical disruptions. Partnerships with agile logistics providers can unlock flexible warehousing solutions and dynamic route optimization to reduce transit times.

Finally, segmentation-driven marketing and pricing strategies will distinguish top performers. Tailored promotions for B2B buyers, value-added bundles for economy-tier customers and premium service tiers for high-end segments can drive customer lifetime value. Coupled with continuous UX testing and feedback loops, these initiatives will empower decision-makers to refine offerings and stay ahead of evolving market needs.

Detailing a Robust Mixed-Method Research Framework Incorporating Primary Interviews Secondary Data and Quantitative Analyses for Rigorous Insight Generation

This research was conducted using a rigorous mixed-method approach to ensure both depth and breadth of insight. Primary research included structured interviews with senior executives from OEMs, leading eRetail platforms and parts distributors, supplemented by online surveys targeting B2B buyers and consumer segments. These engagements provided firsthand perspectives on purchasing behaviors, pricing sensitivities and service expectations.

Secondary research encompassed a comprehensive review of trade publications, regulatory filings, logistics reports and white papers. Publicly available datasets from government agencies and industry associations were leveraged to cross-verify tariff schedules, import-export statistics and digital penetration metrics. Proprietary news aggregators and market intelligence tools were also consulted to track ongoing mergers, partnership announcements and technology rollouts.

Quantitative data points were triangulated across multiple sources to validate reliability and identify outlier trends. The segmentation framework was tested through cluster analysis techniques and validated via focus groups to ensure that the resulting categories accurately reflect real-world buyer personas. Regional findings were benchmarked against macroeconomic indicators and internet infrastructure rankings to contextualize digital readiness and growth potential.

By combining these methodologies, the report delivers a holistic view of the automotive aftermarket eRetail ecosystem, offering actionable insights grounded in empirical evidence and expert opinion.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Aftermarket eRetailing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Aftermarket eRetailing Market, by Product Type

- Automotive Aftermarket eRetailing Market, by Distribution Channel

- Automotive Aftermarket eRetailing Market, by Vehicle Type

- Automotive Aftermarket eRetailing Market, by Price Tier

- Automotive Aftermarket eRetailing Market, by Region

- Automotive Aftermarket eRetailing Market, by Group

- Automotive Aftermarket eRetailing Market, by Country

- United States Automotive Aftermarket eRetailing Market

- China Automotive Aftermarket eRetailing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Critical Findings and Emerging Trends to Illuminate the Future Pathways of Automotive Aftermarket eRetail Excellence Across Stakeholder Segments

The automotive aftermarket eRetail sector stands at the nexus of digital transformation, regulatory flux and evolving consumer demand. Technological advancements in AI-powered search, AR-enabled previews and connected vehicle interfaces are elevating the customer experience, while mobile commerce and omnichannel models continue to redefine convenience benchmarks. At the same time, tariff adjustments in 2025 have underscored the importance of adaptive supply chain strategies and diversified sourcing plans.

Segmenting the market across product types-from accessories and replacement components to specialized tire and wheel offerings-illuminates distinct pathways for targeted growth. Distribution channels ranging from manufacturer websites to third-party marketplaces each present unique value propositions, while vehicle type and customer typology demand customized service levels and pricing architectures. Regionally, mature markets in the Americas contrast with emerging digital ecosystems in EMEA and surging mobile adoption in Asia-Pacific, highlighting the need for granular, localized strategies.

Key players are differentiating through advanced logistics partnerships, proprietary loyalty ecosystems and blockchain-enabled authenticity solutions. At the same time, emerging entrants and established OEMs are blurring traditional boundaries, forging co-branded alliances that leverage complementary strengths in product integrity and digital distribution.

As the sector continues to mature, the ability to harness segmentation insights, navigate tariff headwinds and deploy cutting-edge technologies will determine which organizations achieve sustainable leadership. Stakeholders equipped with a clear understanding of these dynamics will be best positioned to capture value and deliver superior experiences across the aftermarket journey.

Partner with Ketan Rohom to Unlock Comprehensive Market Intelligence and Drive Revenue Growth through Informed Automotive Aftermarket eRetail Strategies

If your organization is ready to transform its eRetail strategy and capitalize on the insights presented in this comprehensive market research report, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Leveraging extensive expertise in automotive aftermarket analysis and a deep understanding of digital commerce trends, Ketan can guide you through a tailored purchasing process that ensures your team gains immediate access to actionable intelligence. Reach out to explore bespoke licensing options, volume discounts for enterprise deployments, and customized data packages designed to support your strategic goals. Take the next step toward achieving a competitive edge in the automotive aftermarket eRetail sector by partnering with Ketan Rohom and securing the in-depth report that will drive informed decision-making and sustainable growth.

- How big is the Automotive Aftermarket eRetailing Market?

- What is the Automotive Aftermarket eRetailing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?