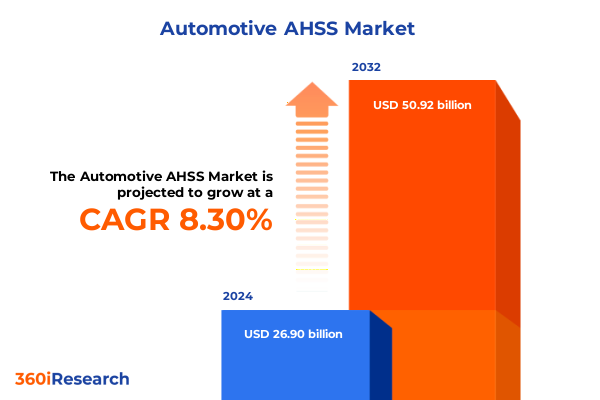

The Automotive AHSS Market size was estimated at USD 29.18 billion in 2025 and expected to reach USD 31.60 billion in 2026, at a CAGR of 8.27% to reach USD 50.92 billion by 2032.

Accelerating Material Innovation in the Automotive Industry through Advanced High-Strength Steel: Overview of Emerging Opportunities and Challenges

The automotive industry stands at a pivotal crossroads, driven by the relentless pursuit of vehicle lightweighting, enhanced safety performance and sustainability objectives. Across global manufacturing hubs and varied vehicle segments, automakers are turning to advanced high-strength steels (AHSS) as a cornerstone material to meet stringent regulatory mandates and consumer expectations. As regulatory bodies tighten targets for carbon emissions and fuel economy, the imperative to integrate materials that deliver strength-to-weight advantages is stronger than ever before.

Emerging propulsion trends, including the rapid expansion of electrified powertrains, are reshaping vehicle architectures, necessitating steel solutions that can balance crashworthiness with the requirements of battery packaging and thermal management. Concurrently, competitive dynamics among OEMs are driving a renewed focus on cost-effective material strategies that safeguard profitability without sacrificing performance. Within this landscape, the evolution of AHSS alloys, manufacturing processes and supply chain models is unlocking novel opportunities for differentiation.

This report’s introduction lays the groundwork by examining the market drivers that have elevated AHSS from a niche specialty product to a mainstream material choice. It sets the stage for an in-depth exploration of how breakthroughs in metallurgy, processing techniques and collaborative innovation between steelmakers and automotive OEMs are charting the next chapter in material advancement. This foundational overview invites stakeholders to engage with the transformative potential of AHSS as a catalyst for industry progress.

How Cutting-Edge Metallurgy, Regulatory Pressures and Digital Transformation Are Redefining Automotive Steel Applications

Over the last decade, a confluence of technological advances and shifting regulatory landscapes has instigated transformative shifts in the automotive materials ecosystem. Metallurgical breakthroughs have enabled the development of next-generation alloys that offer unprecedented combination of tensile strength and ductility without the traditional weight penalties. At the same time, innovations in thermo-mechanical processing have streamlined production methods, reducing costs while preserving performance characteristics critical to automotive applications.

Simultaneously, evolving safety standards have catalyzed adoption of novel steel grades tailored to deliver superior energy absorption in crash management systems. These performance requirements have spurred collaboration across the supply chain, with steel producers partnering with OEMs and tier-one suppliers to co-develop stamping processes, hot forming technologies and multi-material joining techniques. As electrification scales, the industry has responded by refining steel chemistries that facilitate integration of heavy battery modules without compromising structural integrity.

Moreover, digitalization and Industry 4.0 initiatives have permeated steel manufacturing, introducing real-time monitoring, predictive maintenance and quality control measures that enhance consistency and throughput. Together, these parallel advancements in material science, process engineering and supply chain integration have fundamentally reshaped the scope of what AHSS can deliver, heralding a new era of lightweight, safe and cost-efficient automotive design.

Assessing the Strategic Effects of Recent United States Tariff Policies on Advanced High-Strength Steel Sourcing and Production Dynamics

In 2025, the cumulative impact of United States tariff measures on automotive AHSS has introduced both challenges and opportunities for domestic and international stakeholders. Import duties enacted earlier in the year have elevated costs for several key steel grades, prompting OEMs and tier suppliers to reassess sourcing strategies and inventory management practices. For North American manufacturers, the tariffs have translated into a recalibration of procurement models, driving a renewed emphasis on local production capacity and strategic partnerships with domestic steelmakers.

At the same time, tariff-induced cost pressures have intensified negotiations around long-term supply agreements and spurred investment in regional alloy production capabilities. Several integrated producers have responded by expanding rolling mills and enhancing processing lines to meet the heightened demand for AHSS grades formerly imported at competitive price points. While end-users have absorbed a portion of the incremental costs, many have leveraged value engineering initiatives to identify design adjustments and material substitutions that mitigate price escalation without eroding performance.

This convergence of policy, economics and material strategy underscores the importance of agile supply chain management. As tariffs continue to influence market dynamics, manufacturers that can adapt through localized production, flexible procurement and data-driven cost optimization are positioned to maintain resilience and competitive advantage.

Unveiling Critical Intersections in Product, Application, Vehicle, Form, Processing and End-Use Segmentation Shaping AHSS Demand and Innovation Trajectories

Insight into the advanced high-strength steel market emerges most clearly when examining how material selection, application requirements, vehicle segmentation, steel form preferences, processing approaches and end-use channels intersect to shape product demand and innovation. From a product perspective, the spectrum spans austenitic steel in its L1 and L2 variants through to more specialized ferritic, dual phase and martensitic alloys. Whereas L1 and L2 austenitic grades deliver exceptional formability, DP500, DP600 and DP800 dual phase steels balance strength enhancements with optimized stamping characteristics. In parallel, intercritical and laser-weldable ferritic steels cater to corrosion resistance and formability needs, while high-strength martensitic steels and their softer counterparts support cutting-edge crash management applications.

Application segmentation further nuances the market landscape, as material performance in body structures, bumpers and chassis components must align with specific functional demands. Within body structures, cross members, reinforcements and side members leverage high-ductility grades to accommodate complex stampings, while bumpers, crash boxes and bumper beams rely on the energy absorption capabilities of advanced martensitic and dual phase steels. Doors, hoods and roof panels impose additional variability in required thickness and tensile properties, driving OEMs to deploy distinct AHSS grades across these subcomponents to optimize weight and cost targets.

Vehicle type considerations reveal diverging AHSS adoption patterns as well. Commercial vehicles, especially heavy and light duty segments, often prioritize durability and load-bearing capacity, favoring higher-strength DP800 and martensitic solutions. Conversely, passenger cars in hatchback, sedan and SUV configurations increasingly integrate austenitic and DP500 grades for balanced performance and manufacturability. Regions characterized by intense safety regulations have accelerated uptake of laser-weldable ferritic steels, particularly for closure panels and roof reinforcements.

The form factor of steel-ranging from cold rolled to galvannealed, electrogalvanized and hot rolled variants-introduces further differentiation. Traditional cold rolled steels persist for their dimensional precision, whereas the adoption of trip steels reflects an industry shift toward steels that harness transformation-induced plasticity for enhanced strength and toughness. Galvannealed and electrogalvanized options are driven by exterior corrosion protection demands, with manufacturers calibrating coating thicknesses to balance aesthetic longevity and weight constraints.

Processing methodologies offer another axis of insight. Cold stamping remains ubiquitous for high-volume parts, hot stamping has surged in popularity for ultra-high tensile applications, and thermo-mechanical processing-encompassing quenching, partitioning and post-tempering sequences-enables novel microstructures that achieve next-generation strength-ductility synergies. Finally, end-use segmentation reveals the bifurcation between original equipment manufacturing and the aftermarket. OEM channels dominate volume and drive innovation partnerships, while refurbishment and replacement parts channels sustain demand for proven grades and cost-effective solutions, reinforcing the breadth of steel producer engagement across the value chain.

This comprehensive research report categorizes the Automotive AHSS market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- Vehicle Type

- Form

- Processing Type

Examining Regional Drivers of High-Strength Steel Adoption and Innovation Across Americas, EMEA and Asia-Pacific Automotive Markets

Regional dynamics continue to play a pivotal role in defining the trajectory of advanced high-strength steels. In the Americas, the interplay of regulatory incentives for fuel efficiency and domestic content policies has reinforced commitments to local production of high-performance steel grades. North American OEMs have deepened alliances with integrated steel producers to secure just-in-time supply of complex dual phase and martensitic steels, while aftermarket channels have leveraged refurbishment services to extend component lifecycles and reduce replacement costs.

Across Europe, Middle East and Africa, stringent safety and emission requirements have driven rapid AHSS integration, with regional producers differentiating through sustainable manufacturing investments. Steelmakers have adopted renewable energy sources for electric arc furnaces and instituted circular economy practices to lower carbon footprints, thereby aligning with EU carbon border adjustment mechanisms and regional decarbonization roadmaps. In parallel, the Middle East emerging automotive hubs have capitalized on high-strength steel imports to support nascent OEM activities, with a focus on premium passenger vehicles.

Meanwhile, Asia-Pacific remains the largest consumer and innovator in the AHSS domain, propelled by robust automotive manufacturing bases in China, Japan and South Korea. Local producers have led in alloy development, refining thermo-mechanical treatments that yield market-leading DP and martensitic steels. The region’s rapid electrification rollout has also spurred collaboration between battery manufacturers and steel suppliers to co-engineer structural components that accommodate packaging complexities without compromising crashworthiness. As ASEAN economies pursue domestic OEM growth, strategic steel investments are forging pathways for regional self-sufficiency and technological leadership.

This comprehensive research report examines key regions that drive the evolution of the Automotive AHSS market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring How Leading Steel Producers Are Leveraging Alliances, R&D and Flexible Production to Dominate Automotive AHSS Value Chains

A diverse competitive landscape underpins the advanced high-strength steel market, with leading producers advancing distinct strategies to capture OEM partnerships and aftermarket channels. Global integrated steelmakers have intensified focus on alloy portfolio expansion, tailoring grade properties to meet region-specific requirements and application needs. Collaborations with automotive OEMs have yielded co-development agreements aimed at optimizing stamping processes for complex part geometries and reducing total cost of ownership through efficiency gains.

Meanwhile, specialty steel producers differentiate through nimble R&D frameworks that accelerate deployment of cutting-edge chemistries and processing techniques. These firms often emphasize localized support models, embedding technical experts within OEM and tier-one supplier facilities to facilitate rapid material trials and iterative design improvements. The convergence of digital simulation tools and advanced mechanical testing has elevated producers’ ability to validate performance under real-world conditions, bolstering confidence in novel steel solutions.

At the same time, mid-tier players are carving niches by offering flexible capacity commitments, dual-sourcing options and aftermarket focuses that ensure component availability and long-term supply continuity. Through strategic joint ventures and technology licensing agreements, these companies are expanding geographic footprints and enhancing product offerings without the capital intensity of full-scale plant expansions. This collaborative ecosystem fosters a dynamic environment where material innovation and application engineering proceed in tandem, shaping the future of automotive design and manufacturing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive AHSS market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ArcelorMittal S.A.

- Benteler International AG

- China Baowu Steel Group Corporation Limited

- Dongkuk Steel Mill Co Ltd

- Gestamp S.A.

- HBIS Group Co Ltd

- Hyundai Steel Company

- JFE Steel Corporation

- JSW Steel Limited

- Kobe Steel Ltd.

- Magna International Inc.

- Nippon Steel Corporation

- Nucor Corporation

- POSCO Holdings Inc.

- SSAB AB

- Steel Dynamics Inc.

- Tata Steel Limited

- thyssenkrupp AG

- United States Steel Corporation

- voestalpine AG

Driving Competitive Advantage through Early-Stage Collaboration, Regional Partnerships and Digital Integration in AHSS Development and Deployment

Industry leaders looking to thrive in this evolving landscape should prioritize integrated material strategies that align product design objectives with steel supplier capabilities. By engaging early in the design phase, automakers can co-define alloy specifications and processing sequences that optimize both performance and manufacturability. This proactive collaboration mitigates downstream quality issues and unlocks opportunities for cost-effective lightweighting.

Additionally, expanding local production and forging strategic alliances with regional steelmakers can buffer organizations against policy fluctuations and supply chain disruptions. Establishing joint R&D centers proximal to key manufacturing hubs accelerates development cycles for next-generation AHSS grades and fosters knowledge transfer between material scientists and application engineers.

Embracing digital technologies across the supply chain-from predictive analytics in raw material sourcing to digital twin simulations of forming processes-will enhance decision-making and promote agile responsiveness to emerging trends. Finally, cultivating a balanced supplier ecosystem that includes both global integrated producers and specialty steel companies ensures access to a diverse portfolio of material solutions, enabling tailored responses to unique application requirements and regional market dynamics.

Detailing the Comprehensive Multi-Layered Methodological Framework Integrating Primary Interviews, Secondary Analysis and Strategic Validation

This research initiative employed a rigorous, multi-faceted methodology to capture the nuances of the advanced high-strength steel market. Primary research involved structured interviews with C-level automotive executives, material engineers and procurement specialists across OEMs, tier-one suppliers and leading steel producers. These dialogues yielded firsthand insights into material performance priorities, sourcing strategies and innovation roadmaps.

Secondary research encompassed the systematic review of industry publications, regulatory filings and technical whitepapers that charted advancements in alloy development, manufacturing processes and policy developments. Triangulation of qualitative inputs from primary engagements with quantitative data extracted from production reports and trade databases enabled a coherent synthesis of market dynamics.

Analytical frameworks such as SWOT analysis and Porter’s Five Forces were applied to assess competitive intensity and strategic positioning. Detailed profiling of key stakeholders provided clarity on technological competencies, capacity expansions and partnership models. The iterative validation process ensured the integrity of findings and delivered a robust foundation for actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive AHSS market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive AHSS Market, by Product Type

- Automotive AHSS Market, by Application

- Automotive AHSS Market, by Vehicle Type

- Automotive AHSS Market, by Form

- Automotive AHSS Market, by Processing Type

- Automotive AHSS Market, by Region

- Automotive AHSS Market, by Group

- Automotive AHSS Market, by Country

- United States Automotive AHSS Market

- China Automotive AHSS Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Synthesizing Key Takeaways on How AHSS Innovations and Strategic Alliances Will Shape the Future of Automotive Design and Manufacturing

As the automotive sector advances toward more stringent performance and sustainability benchmarks, advanced high-strength steels will play an increasingly central role in enabling transformative vehicle architectures. The confluence of material innovation, regulatory drivers and strategic collaborations is setting the stage for AHSS to deliver superior strength-to-weight ratios, enhanced safety performance and improved cost efficiency. The insights presented throughout this executive summary underscore the imperative for manufacturers, suppliers and industry stakeholders to adopt holistic strategies that integrate design, processing and supply chain considerations.

In the face of evolving policies, trade dynamics and electrification trends, organizations that leverage collaborative frameworks, digital capabilities and regional partnerships will be best positioned to capture the full potential of advanced steel technologies. By aligning technical expertise with market intelligence, the industry can navigate complexity and drive the next wave of automotive evolution.

Empower Your Strategic Decisions by Securing the Definitive Automotive AHSS Market Study Through Direct Consultation with Our Senior Sales Executive

To secure a comprehensive understanding of the advanced high-strength steel landscape and capitalize on emerging opportunities, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise spans strategic planning, technical insights and tailored solutions to align your organization with the evolving demands of lightweighting, safety and sustainability through a detailed market research report designed to empower decision-makers with practical guidance and actionable intelligence. Connect today to obtain your copy of the full market study and gain the advantage of in-depth data analysis, competitive assessment and forward-looking perspectives tailored to drive growth and innovation in the automotive sector.

- How big is the Automotive AHSS Market?

- What is the Automotive AHSS Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?