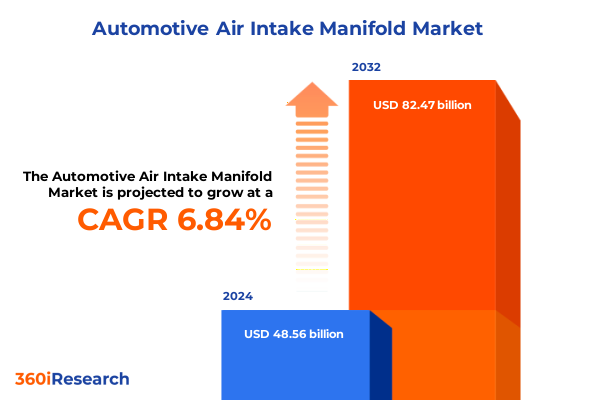

The Automotive Air Intake Manifold Market size was estimated at USD 51.96 billion in 2025 and expected to reach USD 55.18 billion in 2026, at a CAGR of 6.82% to reach USD 82.47 billion by 2032.

Unveiling the pivotal role of air intake manifolds in modern vehicles by enhancing engine breathing, power delivery, emissions control, and fuel efficiency

The air intake manifold plays a foundational role in modern automotive powertrains, regulating the flow of air into the engine to optimize combustion efficiency, power delivery, and emissions control. As internal combustion engines evolve to meet stringent environmental standards and customer expectations, the manifold’s design complexity has escalated. Today’s manifolds integrate advanced flow simulations, intricate runner geometries, and smart materials that resist heat and pressure, ensuring consistent performance across diverse driving conditions.

In this context, understanding the manifold’s functional and strategic importance becomes essential for automotive stakeholders. From original equipment manufacturers to aftermarket specialists, the manifold represents a critical nexus where mechanical engineering, material science, and regulatory compliance converge. Its design directly influences fuel consumption, torque curves, and throttle response, making it a focal point for performance tuning and emissions reduction initiatives.

Moreover, broader automotive trends-such as engine downsizing, turbocharging, and hybridization-have intensified demand for manifolds that balance lightweight construction with robust thermal management. Against a backdrop of global emissions regulations and consumer pressures for efficiency, the manifold has emerged as a key enabler of next-generation powertrains, warranting close attention from product planners and supply chain strategists alike.

Exploring breakthrough manufacturing innovations and integration of advanced materials driving a paradigm shift in air intake manifold performance and sustainability

In recent years, the automotive air intake manifold landscape has been reshaped by a series of transformative innovations that are redefining both production methods and end-use capabilities. Additive manufacturing, for instance, has enabled the creation of complex internal geometries that were previously unattainable through traditional casting or injection molding techniques. This shift is not merely academic; it translates into manifolds with optimized airflow characteristics, reduced pressure drop, and localized reinforcement where thermal or mechanical stresses concentrate.

Simultaneously, the integration of composite materials-often blending polymers with glass or carbon fibers-has challenged the long-standing dominance of aluminum. These composites offer a compelling mix of weight savings, corrosion resistance, and cost-effective scalability. At the same time, hybrid routes that combine plastic runners with metal flanges illustrate how manufacturers are fine-tuning material selections to meet both performance targets and cost imperatives.

On the technological front, manifold designs are increasingly embracing smart sensors and control valves. Variable intake manifolds featuring adjustable runner lengths tailor airflow to different engine speeds, boosting low-end torque while maintaining peak power at higher RPMs. This adaptive approach aligns with the broader industry pivot toward digitalization, where real-time data streams can inform predictive maintenance and continuous performance optimization.

Looking ahead, the convergence of electrification and combustion technologies promises further evolution. Innovative solutions such as electrically actuated intake valves and integrated intake-exhaust manifolds will unlock new efficiencies in mild-hybrid and dual-fuel powertrains, signaling a radical departure from legacy designs.

Analyzing the layered effects of 2025 United States tariffs on automotive air intake manifold supply chains, pricing dynamics, and competitive balance

The imposition of new tariffs by the United States in early 2025 has exerted significant pressure on global supply chains for automotive air intake manifolds. Originally designed to curb imports of specific alloy and composite components, these tariffs have reverberated throughout the manufacturing ecosystem, elevating per-unit costs and motivating the reassessment of long-standing sourcing strategies.

Companies with vertically integrated supply chains have been able to mitigate some of this impact by leveraging domestic foundries and plastic injection facilities. However, smaller suppliers and niche innovators-particularly those heavily reliant on imported aluminum or specialty composites-have encountered pronounced margin contraction. To preserve competitiveness, some businesses have initiated nearshoring efforts, relocating tooling and molding operations closer to key North American assembly plants.

Consequently, the tariff landscape has also spurred fresh negotiations between OEMs and tier-one suppliers, with longer-term contracts and volume commitments being used to secure cost predictability. Parallel to this, there is a growing interest in alternative feedstocks that either originate domestically or fall outside the tariff scope. Research partnerships exploring high-performance thermoplastics and reclaimed alloy blends are gaining traction, highlighting the industry’s drive to diversify material intake and reduce exposure to geopolitical fluctuations.

Despite these challenges, the overarching effect has been a realignment rather than a collapse of trade flows. Manufacturers poised to adapt quickly through strategic procurement, process optimization, and material innovation are emerging as beneficiaries of a more localized yet resilient supply chain framework.

Gaining nuanced understanding of market subdivisions driven by engine type variations, material choices, structural configurations, end-use demands, and vehicle classifications

A granular examination of the air intake manifold market reveals distinct dynamics across multiple segmentation dimensions. When viewed through the lens of engine types-such as CNG and LPG powerplants, traditional diesel setups, and gasoline-powered units-manifolds must contend with varying thermal loads, combustion characteristics, and pressure profiles. CNG/LPG applications, for instance, demand manifold materials with enhanced thermal stability and tight tolerances to prevent leakage under high-pressure gas feed conditions, whereas diesel systems emphasize durability to withstand soot-laden environments.

Turning to material considerations, aluminum remains a stalwart choice for its balance of weight, heat dissipation, and production versatility. Nonetheless, composite solutions are gaining favor in applications where weight reduction and corrosion resistance can translate into measurable gains in fuel economy. On the other hand, high-grade plastics-especially glass-reinforced polymers-are carving out a niche in lower-stress configurations, offering cost-effective alternatives for entry-level and aftermarket segments.

Structural distinctions further delineate market opportunities: dual-plane manifolds, with their separate runners for low-speed torque and high-RPM power, are highly sought after in performance and heavy-duty contexts, while single-plane designs are optimized for consistent high-speed flow in racing and specialized tuning environments. Each architecture entails unique casting or molding challenges, influencing production throughput and yield rates.

End-use segmentation sheds light on channel-specific trends. Original equipment manufacturers continue to drive high volumes of bespoke manifold designs aligned with vehicle launch cycles, but the aftermarket segment is experiencing robust demand for replacement units and performance upgrades, often favoring modular designs that simplify installation.

Lastly, vehicle type exerts a profound influence on manifold requirements. Heavy commercial vehicles prioritize robustness, high-temperature resistance, and ease of maintenance, whereas light commercial vehicles strike a balance between efficiency and cost. In the passenger car segment, emphasis falls on noise, vibration, and harshness standards, alongside the quest for smooth throttle response. Together, these segmentation insights illuminate the multifaceted nature of manifold design and the necessity for tailored strategies across each dimension.

This comprehensive research report categorizes the Automotive Air Intake Manifold market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Engine Type

- Material

- Structure

- End Use

- Vehicle Type

Revealing strategic regional trends and adoption patterns across the Americas, EMEA, and Asia-Pacific shaping the air intake manifold market landscape

Regional markets for air intake manifolds exhibit unique growth trajectories shaped by regulatory frameworks, industrial capacities, and consumer preferences. In the Americas, stringent fuel economy and emissions regulations in the United States and Canada have accelerated adoption of lightweight manifold materials and variable intake technologies. Meanwhile, Brazil’s burgeoning light commercial vehicle sector has created demand for cost-effective plastic manifolds that withstand tropical climates, underscoring the need for regionally calibrated design approaches.

Across Europe, the Middle East, and Africa, manifold innovation is closely linked to a mosaic of emissions standards-from Euro 6d-temp in Western Europe to rapidly evolving Gulf Cooperation Council regulations. European OEMs are pioneering manifold-integrated heat management systems to meet these requirements, while North African markets are gradually embracing aftermarket upgrades to extend the service lives of aging vehicle fleets. Application of durable aluminum alloys in harsh Middle Eastern operating environments further highlights the region’s technical rigor.

In the Asia-Pacific arena, manifold production has flourished in China, India, and Southeast Asia, where extensive manufacturing clusters and lower labor costs have attracted tier-one suppliers. This region combines high-growth demand for passenger vehicles with a rapidly expanding commercial fleet segment, driving manifold volumes across both OEM and aftermarket channels. Additionally, emerging markets such as Thailand and Vietnam are adopting domestic content regulations, prompting suppliers to establish local extrusion and molding facilities to secure business from national OEMs.

By recognizing these region-specific drivers-from regulatory stringency to production economics-stakeholders can tailor investments in material sourcing, manufacturing footprint, and product development to align with diverse market requirements.

This comprehensive research report examines key regions that drive the evolution of the Automotive Air Intake Manifold market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting leading industry players driving innovation, collaboration, and competitive differentiation in the air intake manifold sector through strategic initiatives

The air intake manifold sector is populated by a mix of global conglomerates and specialized innovators, each vying for competitive advantage through technological differentiation and strategic partnerships. Several leading players have invested heavily in advanced material science, forging alliances with polymer developers to introduce high-temperature composites into mainstream applications. Others have focused on vertical integration, acquiring foundries or molding facilities to control quality and mitigate supply chain risks.

Strategic collaborations between OEMs and manifold specialists have also gained prominence. Co-development agreements for variable intake systems and integrated thermal management modules reflect a shift toward holistic powertrain optimization rather than isolated component improvements. In parallel, a number of suppliers have expanded their aftermarket footprints by launching branded performance lines and establishing direct distribution channels to tuning houses and independent garages.

Moreover, mergers and acquisitions have accelerated consolidation in the supplier landscape. Smaller technology-driven startups with niche expertise in additive manufacturing or sensor-embedded manifolds have attracted investment from traditional tier-one conglomerates, signaling the value placed on next-generation design capabilities. This trend underscores the importance of agility and innovation as success factors in a market where regulatory pressures and customer expectations continue to intensify.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Air Intake Manifold market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co. Ltd.

- Boge Rubber & Plastics Group

- Carcoustics International GmbH

- Denso Corporation

- Eberspacher Group

- Futaba Industrial Co. Ltd.

- Hitachi Automotive Systems Ltd.

- Inzi Controls Co. Ltd.

- Keihin Corporation

- Kojima Industries Corporation

- Magna International Inc.

- Magneti Marelli S.p.A.

- Mahle GmbH

- Mann+Hummel GmbH

- Mikuni Corporation

- Montaplast GmbH

- Novares Group

- Polyplastic Group

- Rochling Group

- Sogefi SpA

- Spectra Premium Industries Inc.

- Srivari Fibers and Composites

- Yorozu Corporation

Offering targeted strategic imperatives for industry leaders to optimize design, streamline supply chains, and capitalize on emerging market opportunities

To thrive amid evolving regulations, material shifts, and supply chain complexities, industry leaders should prioritize a set of strategic imperatives. First, invest strategically in R&D partnerships that accelerate the adoption of lightweight composites and advanced polymers. By co-innovating with material specialists, companies can achieve performance benchmarks while mitigating cost and sustainability challenges.

Second, optimize manufacturing footprints through a combination of nearshoring and digital process integration. Establishing regional micro-factories equipped with additive manufacturing capabilities can shorten lead times, reduce inventory overhead, and enhance response to market fluctuations. Concurrently, deploying digital twins for process simulation will enable continuous improvement in yield and quality.

Third, diversify sourcing strategies to reduce reliance on tariff-impacted materials. Proactively exploring alternative feedstocks and forging long-term agreements with domestic suppliers can stabilize input costs and shield operations from geopolitical shocks.

Fourth, deepen collaboration with OEMs to co-develop manifolds that integrate sensing and actuation capabilities. Embedding temperature and pressure sensors within the manifold body allows for real-time feedback loops that optimize engine calibration and facilitate predictive maintenance, creating added value for vehicle manufacturers.

Finally, embrace aftermarket service models that leverage smart replacements and performance upgrades. By offering modular manifold kits with integrated diagnostics, suppliers can foster recurring revenue streams and strengthen brand loyalty among automotive enthusiasts and service networks.

Detailing the comprehensive research framework, data collection techniques, and analytical approaches underpinning robust market insights for air intake manifolds

This study employs a rigorous multi-pronged research methodology to ensure the highest standards of accuracy and relevance. Primary research included in-depth interviews with procurement heads, powertrain engineers, and aftermarket specialists across key geographic regions. These discussions provided qualitative insights into emerging design preferences, material prioritization, and regulatory impacts.

Secondary research encompassed the systematic review of technical journals, patent filings, and government policy documents to map historical trends and regulatory timelines. Data triangulation techniques were used to validate findings, cross-referencing interview outputs with public financial disclosures and industry white papers.

Quantitative analysis involved aggregating production and trade data from customs databases, supplemented by proprietary shipment records provided by leading tier-one suppliers. Advanced statistical models were applied to discern patterns in material selection, regional demand shifts, and tariff impacts, ensuring robust segmentation insights.

Finally, all findings were subjected to a peer review process, engaging external industry experts to critique methodological assumptions and validate interpretive conclusions. This comprehensive approach underpins the report’s credibility and equips stakeholders with actionable intelligence grounded in both empirical data and domain expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Air Intake Manifold market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Air Intake Manifold Market, by Engine Type

- Automotive Air Intake Manifold Market, by Material

- Automotive Air Intake Manifold Market, by Structure

- Automotive Air Intake Manifold Market, by End Use

- Automotive Air Intake Manifold Market, by Vehicle Type

- Automotive Air Intake Manifold Market, by Region

- Automotive Air Intake Manifold Market, by Group

- Automotive Air Intake Manifold Market, by Country

- United States Automotive Air Intake Manifold Market

- China Automotive Air Intake Manifold Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Summarizing the critical findings and strategic outlook that underscore the evolving trajectory of the automotive air intake manifold ecosystem

This report synthesizes the latest innovations, regulatory shifts, and competitive strategies shaping the air intake manifold landscape. By weaving together segmentation insights-from engine type and material to structure, end use, and vehicle classification-it illuminates the nuanced demands driving design and manufacturing priorities.

The analysis of 2025 tariff dynamics highlights the resilience and adaptability of supply chains, while regional deep dives underscore the importance of local regulatory and economic conditions in guiding investment decisions. Meanwhile, profiles of key industry players reveal how collaboration, consolidation, and technological differentiation are redefining competitive moats.

Ultimately, stakeholders who embrace agile supply chain models, invest in material and process innovation, and forge strategic partnerships will be best positioned to capitalize on emerging opportunities. As powertrain architectures continue to evolve, the manifold will remain a critical leverage point for achieving performance, efficiency, and compliance objectives.

Connect with Associate Director Ketan Rohom to unlock actionable insights and secure your authoritative air intake manifold market intelligence today

To explore how these insights can directly inform your strategic planning and drive tangible growth, reach out to Associate Director Ketan Rohom. He can guide you through the report’s detailed findings, tailor a briefing to your organization’s priorities, and ensure you obtain the precise market intelligence necessary to stay ahead in a rapidly evolving landscape. Engage today to secure your comprehensive air intake manifold market report and transform insights into action.

- How big is the Automotive Air Intake Manifold Market?

- What is the Automotive Air Intake Manifold Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?