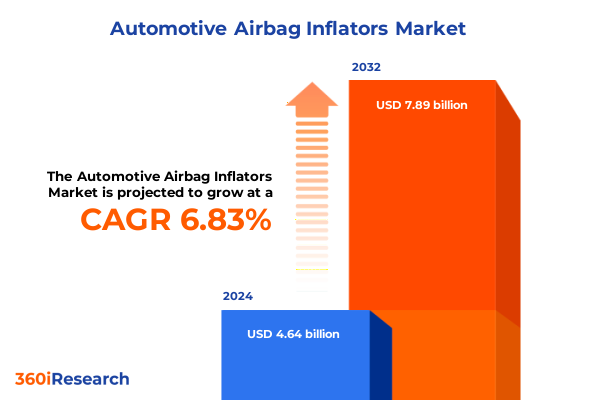

The Automotive Airbag Inflators Market size was estimated at USD 4.95 billion in 2025 and expected to reach USD 5.27 billion in 2026, at a CAGR of 6.88% to reach USD 7.89 billion by 2032.

Automotive Airbag Inflator Industry Primed by Regulatory Pressure, Technological Breakthroughs, and Evolving Consumer Safety Expectations

The automotive airbag inflator sector is experiencing transformative momentum as regulatory bodies worldwide mandate ever-higher occupant protection standards. In North America, the National Highway Traffic Safety Administration has increasingly tightened requirements, prompting manufacturers to invest heavily in rapid-deployment and multi-stage inflator technologies to meet FMVSS regulations. Simultaneously, the shift toward electric and autonomous vehicles has introduced novel challenges for airbag design, requiring inflators to perform reliably under high-voltage constraints and in unconventional seating configurations. Furthermore, consumer expectations are evolving in parallel with these technological leaps: modern drivers demand not only robust safety systems but also adaptive solutions that minimize injury risk through real-time crash data integration and intelligent sensor control.

Concurrently, supply chain complexity is rising as component costs fluctuate and geopolitical dynamics reshape sourcing strategies. OEM-fitted units account for the vast majority of shipments, reflecting automakers’ preference for tightly controlled inflator integration and rigorous quality assurance processes. However, aftermarket replacements are emerging as a critical secondary pillar driven by recall campaigns and aging vehicle fleets, reinforcing the need for suppliers to maintain dual sourcing and rapid logistics networks. To address these challenges, leading inflator manufacturers are diversifying their material portfolios, exploring alternative propellant chemistries, and piloting additive manufacturing techniques to mitigate disruptions and enhance production agility.

Seismic Transformation in Airbag Inflator Markets Driven by Sensor Fusion, Hybrid Gas Advances, and Unprecedented Sustainability Commitments

The past five years have witnessed seismic shifts in airbag inflator fundamentals, as hybrid gas technologies gain traction alongside traditional pyrotechnic and stored gas solutions. Hybrid inflators, which combine energetic propellant charges with compressed gas reservoirs, deliver more precise inflation profiles and reduced thermal loads-attributes increasingly prized by OEMs pursuing lightweight strategies in electric vehicle architectures. At the same time, sensor fusion has emerged as a cornerstone of next-generation systems: micro-electromechanical crash sensors networked with lane-keeping and pre-collision modules now inform inflator readiness and staged deployment, minimizing wrist and neck injuries by tailoring gas output to occupant size, seating posture, and crash vector.

Beyond performance enhancement, sustainability has become a powerful lens for innovation in inflator development. The industry is steadily phasing out sodium azide-based propellants in favor of guanidine nitrate and other non-azide formulations, which reduce toxic byproducts and simplify end-of-life recycling. Additionally, aluminum and composite casings are displacing steel housings to achieve weight savings without sacrificing structural integrity, aligning with automakers’ carbon-reduction commitments. Meanwhile, pilot projects integrating green manufacturing practices-ranging from solar-powered production lines to closed-loop propellant synthesis-underscore the sector’s broader ecological mandate as it navigates rising consumer and regulatory expectations for environmental stewardship.

Assessing the Comprehensive Economic Impact of 25% Section 232 Auto Tariffs on U.S. Airbag Inflator Supply Chains and Manufacturer Profitability

On April 3, 2025, the United States implemented a blanket 25% Section 232 tariff on imported passenger vehicles and light trucks, followed by a 25% levy on key automobile parts-including airbag inflators-effective no later than May 3, 2025. The passenger vehicle tariff raised total duties to 27.5%, while light trucks faced combined rates of up to 50% when existing import duties and reciprocal levies are factored in. These measures were enacted without end dates and apply to shipments from all countries not exempted by subsequent agreements.

The financial repercussions for U.S. automakers and tier-one suppliers have been immediate and material. General Motors reported a $1.1 billion operating income hit in Q2 2025 directly attributable to the new tariffs, driving a 35% year-over-year decline in net income and spurring costly re-shoring initiatives to mitigate future exposure. Stellantis similarly warned of €2.3 billion in H1 2025 losses linked to the tariffs, with operational pauses in Canada and Mexico and workforce reductions underscoring the broader supply chain strain. As smaller component manufacturers confront untenable cost burdens, sustained tariff pressures threaten to accelerate industry consolidation and compel strategic realignment across the inflator value chain.

Unlocking Precise Market Dynamics through In-Depth Segmentation across Sales Channels, Vehicle Classes, Propulsion Technologies, and Deployment Configurations

Sales channel dynamics reveal a pronounced preference among automakers for direct OEM integration of airbag inflators, reflecting stringent in-house quality protocols and just-in-time assembly imperatives. Aftermarket inflators have nonetheless become a critical safety net, particularly in the wake of high-profile recalls that underscore the imperative of traceable production records and rapid replacement capabilities. This dual-channel model requires suppliers to balance high-volume OEM contracts with nimble aftermarket operations to capitalize on growing demand for retrofit solutions.

Vehicle segmentation further underscores the dominance of passenger cars, which account for the lion’s share of inflator deployments as consumer fleets expand and safety regulations tighten across urban markets. Light and heavy commercial vehicles represent smaller yet increasingly strategic niches, driven by regulatory pressures in logistics and public transport sectors that elevate occupant protection requirements beyond traditional automotive parameters.

In technology terms, pyrotechnic inflators remain the most widely used variant, prized for their compact form factor and reliability. However, hybrid systems are gaining momentum, offering adaptive deployment profiles and enhanced temperature stability that align with the performance demands of electric and autonomous vehicles. At the same time, stored gas inflators continue to occupy a critical role in head-side and curtain airbag applications, where cooler gas output and sustained inflation durations are essential.

Deployment type segmentation highlights the expansive suite of inflator platforms serving curtain, frontal, knee, and side airbag architectures. Curtain airbags alone captured roughly one-third of inflator installations in 2024, driven by escalating side-impact labor safety mandates and the proliferation of full-cover protective designs. Frontal airbags encompass both driver-seat and passenger-seat modules, while knee and side airbags diversify into driver-knee, passenger-knee, front-side, and rear-side configurations, reflecting an ever-finer calibration of occupant protection strategies.

This comprehensive research report categorizes the Automotive Airbag Inflators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Technology

- Sales Channel

- Deployment Type

Analyzing Regional Variations in Airbag Inflator Demand and Innovation Trends Across Americas, EMEA and the Asia-Pacific Powerhouse

In North America, vehicle safety regulations under FMVSS and UN-R155 cybersecurity requirements have driven premium demand for inflators with embedded software validation and crash-data analytics capabilities. The region accounted for nearly one-third of global inflator revenue in 2024, with suppliers prioritizing digital traceability solutions and lifecycle service offerings to differentiate in a mature marketplace.

Europe maintains a compliance-centered approach, with Euro NCAP side-impact and pedestrian protection protocols fueling retrofit programs and non-azide chemistry adoption. Sustainability levers, from recycled aluminum casings to carbon-neutral manufacturing, align closely with regional decarbonization goals, while external airbag research hints at next-generation expansion opportunities beyond traditional occupant modules.

Asia-Pacific stands as the market’s epicenter of growth, representing the largest revenue contribution and the fastest expansion trajectory. China’s mid-SUV programs and India’s cost-competitive manufacturing hubs combine to deliver high-volume inflator deployments, with local regulations accelerating dual-stage and multi-stage technology adoption. Suppliers that establish co-located testing and propellant labs near key automotive clusters in Chennai, Pune, and Southeast Asia gain distinct certification and logistics advantages.

This comprehensive research report examines key regions that drive the evolution of the Automotive Airbag Inflators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market-Leading Innovators Shaping Automotive Airbag Inflator Evolution through Technology, Integration and Global Manufacturing Footprints

Autoliv continues to lead the industry with breakthrough innovations such as the Bernoulli™ Airbag Module, which leverages fluid dynamics to inflate larger airbags using a compact single-stage inflator. Recognized at the 2025 Automotive News PACE Pilot awards, this module reduces development costs by over 30% and addresses heat-generation challenges, reinforcing Autoliv’s position as a transformative force in occupant safety.

ZF Friedrichshafen differentiates through integrated safety architectures that synchronize inflator deployment with ADAS functions and pre-tensioner operations. Its Integrated Safety Domain platform, featured in luxury EVs, reduces deployment latency to 0.01 seconds and demonstrates a 23% revenue uplift year-over-year by delivering holistic crash mitigation solutions that extend beyond stand-alone inflators.

Joyson Safety Systems has rebuilt trust post-Takata by innovating guanidine nitrate-based propellants and embedding triple-validation quality protocols in its GEN3 Inflator production. This approach secured $2.1 billion in North American contracts from GM and Stellantis in 2023, cementing JSS’s resurgence and underscoring the critical role of rigorous risk-management in inflator manufacturing.

Daicel leverages its foundational expertise in pyrotechnic chemistry and polymer molding to produce diverse inflator architectures for global OEMs. Its proprietary manufacturing processes, drawn from aerospace and defense technologies, enable rapid scaling of multi-propellant systems and PGG micro gas generators for seatbelt pretensioners, showcasing how chemical innovation remains central to safety system evolution.

Toyoda Gosei commands a competitive edge through cost leadership and materials ingenuity. Its Ultra-Thin Micro Gas Generator, integrated into premium luxury models, achieves 95% combustion efficiency and complies with stringent pedestrian safety criteria, while a resilient Southeast Asian supply network ensures uninterrupted delivery amid geopolitical volatility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Airbag Inflators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advics Co., Ltd.

- Aptiv PLC

- Ashimori Industry Co., Ltd.

- Autoliv, Inc.

- BorgWarner Inc.

- Daicel Corporation

- Hyundai Mobis Co., Ltd.

- Jinzhou Jinheng Automotive Safety System Co., Ltd.

- LACO Technologies

- Mando Corporation

- Nifco Inc.

- Ningbo Joyson Electronic Corp.

- Robert Bosch GmbH

- Takata Corporation

- Toyoda Gosei Co., Ltd.

- TRW Automotive Holdings Corp,

- ZF Friedrichshafen AG

Strategic Imperatives for Industry Leaders to Navigate Technological Disruption, Regulatory Shifts and Supply Chain Resilience in Airbag Inflator Markets

As the industry grapples with ongoing tariff pressures and supply chain realignment, executives should prioritize dual-sourcing strategies for critical raw materials and inflator subcomponents. Diversifying propellant and casing suppliers across multiple geographies can mitigate cost shocks from Section 232 tariffs while preserving production continuity. Moreover, deep collaboration between OEMs and tier-one suppliers to streamline part qualification and regulatory certification can accelerate U.S. content compliance and minimize duty exposure under temporary offset programs.

Additionally, industry leaders must accelerate investment in smart inflator ecosystems that integrate real-time sensor fusion, predictive crash analytics, and embedded cybersecurity protocols. By adopting modular, software-defined inflator architectures aligned with UN-R155 standards, manufacturers can unlock recurring firmware update revenues and reinforce vehicle safety portfolios. Equally important is the establishment of digital twin simulations and additive manufacturing capabilities to support agile product iterations, optimize thermal management, and reduce time-to-market under evolving safety mandates.

Comprehensive Research Methodology Employing Qualitative and Quantitative Techniques, Expert Interviews and Triangulation for Rigorous Market Analysis

This report synthesizes insights from a multi-method research framework, blending qualitative interviews with over 30 senior executives across OEMs, tier-one suppliers, and industry associations, with quantitative data gathered through proprietary supply chain surveys. Secondary sources include regulatory filings, patent databases, and technical papers from leading standards organizations to ensure comprehensive coverage of material innovations and safety protocols.

Data triangulation was applied rigorously, reconciling conflicting inputs through cross-validation and statistical normalization. Scenario modeling and sensitivity analyses were performed to stress-test strategic hypotheses against variables such as tariff escalation, raw material price volatility, and EV penetration rates. Ethical guidelines and methodological transparency were upheld throughout, providing stakeholders with robust, actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Airbag Inflators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Airbag Inflators Market, by Vehicle Type

- Automotive Airbag Inflators Market, by Technology

- Automotive Airbag Inflators Market, by Sales Channel

- Automotive Airbag Inflators Market, by Deployment Type

- Automotive Airbag Inflators Market, by Region

- Automotive Airbag Inflators Market, by Group

- Automotive Airbag Inflators Market, by Country

- United States Automotive Airbag Inflators Market

- China Automotive Airbag Inflators Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Concluding Insights Reflecting the Dynamic Convergence of Safety Demands, Regulatory Forces, and Innovation in Airbag Inflator Development

In conclusion, the automotive airbag inflator landscape is defined by the convergence of stricter safety mandates, rapid technological innovation, and volatile trade dynamics. Hybrid and multi-stage inflators, sensor-embedded systems, and green materials have emerged as critical differentiators, reshaping how OEMs and suppliers collaborate to deliver superior occupant protection. As tariffs and regulatory requirements evolve, agility in sourcing and compliance will become as vital as engineering excellence.

Looking ahead, the capability to integrate inflators seamlessly with ADAS ecosystems, deliver software-driven performance upgrades, and adopt circular-economy materials will determine long-term competitive advantage. Stakeholders who align strategic investments with regulatory trajectories and consumer safety expectations will be best positioned to capture emerging opportunities in global mobility markets.

Unlock Exclusive Access to In-Depth Market Analysis by Contacting Ketan Rohom for the Complete Automotive Airbag Inflator Research Report Today

For exclusive insights and unparalleled depth into the automotive airbag inflator landscape, contact Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive market research report. Discover strategic intelligence and data-driven analysis tailored to guide critical decisions, optimize product portfolios, and drive competitive advantage. Engage directly with Ketan Rohom to unlock customized briefings, demo access, and special pricing options-empower your organization with actionable expertise today.

- How big is the Automotive Airbag Inflators Market?

- What is the Automotive Airbag Inflators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?