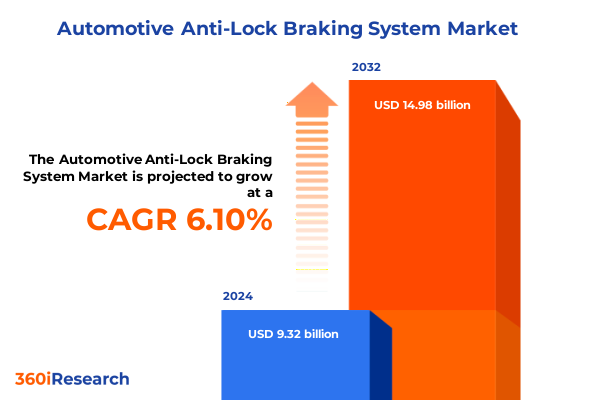

The Automotive Anti-Lock Braking System Market size was estimated at USD 9.80 billion in 2025 and expected to reach USD 10.31 billion in 2026, at a CAGR of 6.24% to reach USD 14.98 billion by 2032.

A Comprehensive Overview of Anti-Lock Braking Systems Shaping Modern Vehicle Safety and Performance Standards in the Rapidly Evolving Automotive Industry

The Anti-Lock Braking System (ABS) has become an indispensable feature in modern vehicles, fundamentally transforming how drivers interact with braking systems under emergency and low-traction conditions. Since its introduction in the late 1970s, ABS technology has continuously evolved to enhance wheel traction, reduce stopping distances, and maintain steering control during hard braking maneuvers. This evolution has been reinforced by the proliferation of advanced electronic control units and software algorithms, positioning ABS as a cornerstone of vehicle safety architecture.

Across North America, the rapid adoption of electronic safety solutions has outpaced many other regions, driven by stringent federal safety regulations and growing demand for electric and autonomous vehicles that rely on integrated braking and stability control systems. These regulatory pressures have compelled OEMs to invest significantly in both hardware refinement and software optimization, ensuring that ABS modules not only meet but exceed emerging safety standards and consumer expectations.

Unprecedented Technological and Regulatory Transformations Driving the Evolution of Anti-Lock Braking Systems Across the Automotive Sector

Anti-lock braking systems are undergoing profound technological transformations, driven by a confluence of digitalization, electrification, and advanced driver assistance requirements. One of the most significant shifts is the emergence of brake-by-wire architectures, which replace traditional hydraulic connections with electronic signal lines to deliver faster, more precise braking commands. These systems, currently undergoing extensive endurance and climate testing for market launch in late 2025, promise to enhance redundancy and enable seamless integration with autonomous driving frameworks.

Concurrently, artificial intelligence and machine learning algorithms are being embedded into electronic control units to enable adaptive modulation of braking pressure based on real-time analysis of road surface conditions, vehicle load, and driver behavior patterns. This intelligent modulation optimizes stopping performance and stability in diverse driving scenarios, laying the groundwork for predictive braking functions that anticipate critical events before they fully develop.

Sensor fusion techniques are also redefining ABS capabilities by combining inputs from radar, lidar, and camera systems to create a comprehensive view of the vehicle’s environment. This multidimensional data integration supports coordinated activation of ABS with emergency braking assist, stability control, and collision mitigation systems, thus forming a seamless safety envelope around the vehicle.

Moreover, as the shift toward electric propulsion accelerates, manufacturers are redesigning ABS modules with lightweight materials and compact form factors to meet EV packaging constraints and efficiency goals. The convergence of eco-friendly hydraulic fluids, optimized thermal management, and recyclable component design further underscores the industry’s commitment to sustainability while preserving critical safety functions.

Assessing the Composite Effects of Recent United States Trade Tariff Measures on Automotive Brake Components and Overall Vehicle Production Dynamics

In early April 2025, the United States implemented a sweeping 25 percent Section 232 tariff on passenger vehicles and light trucks imported from all trading partners, with a subsequent 25 percent duty on critical auto parts-including engines, transmissions, powertrain components, and electrical systems-enforced in early May. These measures, aimed at countering perceived threats to national security, fundamentally altered the cost structure for both OEMs and Tier 1 suppliers, compelling many to reassess production footprints and supply chain dependencies.

The immediate impact was starkly illustrated by General Motors’ second-quarter 2025 earnings, which saw net income decline by 35 percent due to a $1.1 billion tariff burden. GM reported that while it absorbed these costs without significant price increases to consumers, it anticipates further margin pressure in subsequent quarters and is actively relocating select production operations to domestic facilities to alleviate tariff exposure.

Meanwhile, a recently concluded U.S.–Japan trade agreement adjusted the tariff rate for Japanese automotive exports to 15 percent, creating a competitive disparity that could temporarily favor Japanese automakers in the North American market. Industry observers warn that this preferential treatment may distort supply chain realignment decisions, with longer-term implications for domestic vehicle assembly and investment planning.

On the aftermarket front, independent repair shops and parts distributors have encountered rising procurement costs and constrained inventories. Many are passing these increases along to end consumers or seeking alternative suppliers, intensifying competition among non-traditional parts manufacturers. Industry associations caution that sustained tariff volatility will complicate long-term inventory management and could erode service margins, ultimately affecting repair accessibility and pricing for vehicle owners nationwide.

In-Depth Examination of Component, Vehicle Type, System Channel, and Distribution Channel Segmentations Revealing Key Insights into ABS Market Dynamics

The Anti-Lock Braking System market is delineated by distinct component sub-segments that reveal nuanced adoption patterns and technology trajectories. Electronic control units form the system’s nerve center, encompassing FPGA-based architectures that cater to high-performance applications and microcontroller-based platforms optimized for cost-sensitive models. Hydraulic modulators and pump motors work in tandem to regulate brake fluid pressure, while wheel speed sensors-offered in both active and passive variants-provide the real-time feedback essential for precise wheel slip management. These component variations allow OEMs to tailor ABS implementations to specific vehicle architectures and performance requirements.

Vehicle type segmentation further influences ABS deployment strategies. Passenger cars, with their high production volumes and consumer safety expectations, typically feature four-channel systems integrating full-spectrum sensors and actuators. Light commercial vehicles prioritize durability and ease of maintenance, favoring three-channel solutions that simplify rear-axle control. Heavy commercial vehicles, facing more strenuous operational demands, often utilize two-channel configurations that balance cost, reliability, and functional adequacy under high-load braking conditions.

System type breakdown highlights how the number of controlled channels impacts braking performance and system cost. Four-channel ABS offers the highest degree of individual wheel modulation and stability control, making it the standard for premium passenger vehicles and electric cars. Three-channel systems-commonly configured with independent front-axle control and a combined rear-axle approach-strike a balance that suits a broad range of mainstream vehicle platforms. Two-channel ABS, typically front-axle only, remains prevalent in entry-level and certain light commercial models where cost containment is a primary concern.

Distribution channel distinctions between original equipment manufacture and aftermarket supply chains underscore divergent growth drivers. OEMs integrate ABS modules during assembly, embedding the latest design iterations within new vehicle platforms. The aftermarket segment-divided into replacement and retrofit categories-addresses system failures and enhancements, with retrofit solutions enabling legacy vehicles to attain modern braking performance. This dual-channel dynamic shapes inventory strategies, secondary market pricing, and service network development across global regions.

This comprehensive research report categorizes the Automotive Anti-Lock Braking System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Vehicle Type

- Type

- Distribution Channel

Regional Perspectives on Anti-Lock Braking System Adoption Highlighting Divergent Drivers and Challenges in the Americas, EMEA, and Asia-Pacific Markets

In the Americas, safety mandates from agencies such as the National Highway Traffic Safety Administration have firmly established ABS as a standard requirement on all new passenger vehicles. The United States and Canada also exhibit growing interest in aftermarket retrofits for light truck and commercial fleets, driven by insurer incentives and fleet performance programs aimed at reducing accident liability. Meanwhile, Brazil’s recent legislation mandating ABS on all new motorcycles reflects a broader regional shift toward harmonized safety regulations and consumer awareness campaigns.

Within Europe, the European Union General Safety Regulation has expanded the scope of mandatory electronic braking systems to encompass motorcycles and quadricycles, reinforcing ABS integration across both two- and four-wheeled platforms. Germany, France, and Italy lead in testing adaptive brake modulation and integrated emergency assist features, while Eastern European markets are beginning to adopt entry-level ABS configurations in accordance with EU accession conditions. The region’s focus on advanced driving assistance systems further amplifies demand for high-precision, multi-channel ABS modules.

Asia-Pacific remains the most dynamic region, propelled by robust automotive manufacturing hubs in China, Japan, and India. Regulatory milestones-such as India’s ABS mandate for motorcycles over 125cc and China’s joint requirement of ABS and electronic stability control on passenger cars-have accelerated local ECU and sensor production investments. Japanese and South Korean OEMs continue to pioneer integration of ABS with proprietary hybrid powertrain controls, while emerging Southeast Asian markets are updating safety regulations to elevate new vehicle safety standards.

Across the Middle East and Africa, nascent safety frameworks and an influx of premium imports are gradually increasing ABS penetration, particularly in the Gulf Cooperation Council countries. Local content requirements and government-led road safety initiatives are catalyzing pilot programs, where premium vehicle imports equipped with advanced braking suites set benchmarks for regional fleet operators and aftermarket service providers.

This comprehensive research report examines key regions that drive the evolution of the Automotive Anti-Lock Braking System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Strategic Initiatives and Innovations from Leading Automotive Suppliers Shaping the Future of Anti-Lock Braking Technology Worldwide

Major global suppliers are charting divergent paths to capture the next wave of ABS demand. Bosch, long recognized for pioneering active driving safety solutions, has transitioned toward software-defined brake architectures. Its generation nine ABS module features a modular software framework, optimized microprocessor design, and a compact hardware footprint that reduces weight by up to 30 percent compared to previous generations. Concurrently, its forthcoming hydraulic brake-by-wire system, validated in extreme climate testing across diverse environments, is slated for market rollout in late 2025, positioning Bosch at the forefront of by-wire adoption.

Continental is undergoing a strategic realignment to enhance agility and focus. The company’s decision to spin off its Automotive division by the end of 2025 underscores its commitment to creating a lean, technology-driven entity capable of accelerated innovation. Concurrent restructuring efforts have streamlined business areas, while simulation-based pre-adjustment processes leverage artificial intelligence to optimize brake-by-wire calibration before physical prototyping-a critical capability amid intensifying system complexity.

ZF has consolidated its chassis solutions portfolio, integrating electro-mechanical brake actuators, integrated brake control units, and steer-by-wire modules under its newly formed Chassis Solutions Division. A 2025 contract to supply brake-by-wire technology for nearly five million light vehicles demonstrates ZF’s ability to deliver hybrid braking systems that blend by-wire and hydraulic actuation, supporting advanced driver assistance features up to Level 2 and beyond. The company’s aftermarket arm is also expanding its TRW chassis and braking portfolio, extending OE-quality coverage and reinforcing service network loyalty.

Other leading players, including Brembo, Hitachi Astemo, and Aisin, are investing in sensor fusion platforms, enhancing inertial measurement integration within ABS modules to reduce wiring complexity and improve rollover estimation. Partnerships with semiconductor firms are driving development of high-performance microcontrollers and ASICs tailored for automotive safety applications, ensuring future ABS systems remain responsive, reliable, and cost-effective.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Anti-Lock Braking System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADVICS Co., Ltd.

- Aisin Corporation

- Akebono Brake Industry Co., Ltd.

- Aptiv PLC

- Autoliv Inc.

- Brembo S.p.A.

- BWI Group

- Continental AG

- DENSO Corporation

- Haldex AB

- Hitachi Astemo, Ltd.

- Hyundai Mobis Co., Ltd.

- Knorr-Bremse AG

- Magna International Inc.

- Mando Corporation

- Nissin Kogyo Co., Ltd.

- Robert Bosch GmbH

- ZF Friedrichshafen AG

Strategic Imperatives and Actionable Recommendations for Industry Leaders to Navigate Tariffs, Embrace Technological Advances, and Strengthen Supply Chain Resilience

To mitigate ongoing tariff volatility, industry leaders should diversify component sourcing and prioritize reshoring critical ABS sub-assembly operations in alignment with Section 232 compliance requirements, thereby reducing exposure to unpredictable duty structures while reinforcing supply chain resilience.

Investment in brake-by-wire and electronic braking actuation capabilities is imperative, as these technologies not only streamline system redundancy but also enable seamless integration with software-defined vehicle architectures. Collaboration with ECU software specialists and Tier 1 electronics partners will accelerate time-to-market for novel braking solutions.

Embracing AI-driven adaptive braking algorithms and sensor-fusion techniques will differentiate ABS offerings in an increasingly competitive landscape. Suppliers should establish cross-functional teams to co-develop advanced driver assistance features that leverage ABS data streams for predictive diagnostics and real-time performance tuning.

Finally, aligning product development roadmaps with evolving regional regulatory mandates-particularly in emerging markets-will maximize addressable opportunities. Proactive engagement with standards bodies and regulatory agencies can help shape favorable requirements, ensuring new ABS configurations are compliant upon launch and positioned for broad adoption.

Detailed Methodological Framework Combining Primary Interviews, Expert Consultations, and Robust Secondary Research to Ensure Analytical Rigor and Validity

This report’s findings are underpinned by a hybrid research methodology that integrates both primary and secondary data sources. Primary insights were gathered through structured interviews with senior engineering and procurement executives at leading OEMs and Tier 1 suppliers, as well as consultations with regulatory agency representatives and aftermarket service providers. These interviews provided firsthand perspectives on technological priorities, tariff impacts, and regional deployment strategies.

Secondary research encompassed an exhaustive review of government proclamations, trade agreements, and industry publications to map regulatory developments such as Section 232 tariff implementations and U.S.–Japan trade accords. Proprietary press releases, corporate filings, and technical whitepapers from major ABS suppliers enriched the analysis of innovation trajectories and strategic realignments.

Data triangulation was employed to validate key observations, cross-referencing interview findings with published financial results, supplier press statements, and independent news reports. This multi-source verification approach ensured analytical rigor and minimized potential bias. Furthermore, thematic coding of qualitative data facilitated the identification of recurring trends and strategic themes, providing a robust framework for actionable recommendations.

Throughout the research process, all sources adhered to ethical collection and reporting standards, ensuring confidentiality of interview participants and accuracy of cited materials. The resulting synthesis of diverse inputs offers a comprehensive, reliable overview of the ABS market’s technological, regulatory, and competitive dimensions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Anti-Lock Braking System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Anti-Lock Braking System Market, by Component

- Automotive Anti-Lock Braking System Market, by Vehicle Type

- Automotive Anti-Lock Braking System Market, by Type

- Automotive Anti-Lock Braking System Market, by Distribution Channel

- Automotive Anti-Lock Braking System Market, by Region

- Automotive Anti-Lock Braking System Market, by Group

- Automotive Anti-Lock Braking System Market, by Country

- United States Automotive Anti-Lock Braking System Market

- China Automotive Anti-Lock Braking System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing Critical Findings on Technological, Regulatory, and Market Developments Reinforcing the Imperative for Advanced Anti-Lock Braking Integration

The convergence of robust regulatory mandates, rapid technological innovation, and dynamic trade environments has punctuated the evolution of anti-lock braking systems from standalone safety modules to integral components of the modern vehicle ecosystem. Brake-by-wire architectures, AI-enabled adaptive algorithms, and sensor fusion approaches are redefining the performance envelope of ABS, while emerging tariff landscapes compel supply chain realignment and production reshoring.

Segmentation insights underscore the diversity of ABS configurations tailored to component capabilities, vehicle classes, channel complexities, and distribution pathways. Regional variations in adoption drivers highlight the importance of market-specific strategies that align with safety regulations, production hubs, and aftermarket service networks.

Leading suppliers are responding with targeted investments in digital control units, sustainable materials, and collaborative innovation ecosystems. Yet, the path forward demands a balanced emphasis on cost mitigation, regulatory engagement, and forward-looking technology integration to seize growth opportunities and reinforce vehicular safety standards.

As automotive platforms accelerate toward electrification and autonomy, ABS will remain a foundational safety technology, evolving in tandem with broader system architectures. Stakeholders equipped with a nuanced understanding of market dynamics and strategic imperatives will be best positioned to influence future developments and achieve competitive differentiation.

Unlock Comprehensive Anti-Lock Braking System Insights by Engaging with an Expert to Access the Full Market Research Report

For further in-depth analysis and to unlock comprehensive insights into the evolving anti-lock braking system landscape, connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise and guidance will ensure you secure the precise research package tailored to your strategic needs. Engage now to equip your organization with the actionable intelligence required to navigate complex regulatory environments, technological disruptions, and competitive dynamics in the global automotive market.

- How big is the Automotive Anti-Lock Braking System Market?

- What is the Automotive Anti-Lock Braking System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?