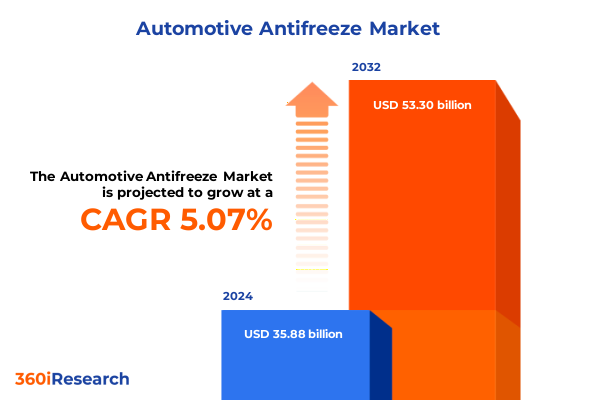

The Automotive Antifreeze Market size was estimated at USD 37.55 billion in 2025 and expected to reach USD 39.31 billion in 2026, at a CAGR of 5.12% to reach USD 53.30 billion by 2032.

Pioneering the Future of Engine Cooling: Comprehensive Overview of Innovations, Drivers, and Challenges Shaping the Antifreeze Industry Landscape

The evolution of engine cooling solutions remains at the forefront of automotive performance and reliability. As powertrain technologies advance, the critical role of antifreeze in thermal regulation and corrosion protection has never been more pronounced. Modern formulations blend glycol bases with sophisticated inhibitor packages to address the demands of extreme temperature cycles, extended service intervals, and increasingly stringent emission standards. In this landscape, understanding the interplay between fluid chemistry, system design, and operational stressors is essential for both component manufacturers and vehicle producers.

Moreover, the global shift toward electrification and hybridization introduces fresh cooling challenges, as electric drive systems generate heat profiles that differ markedly from internal combustion engines. This has spurred innovation in low-conductivity fluids and specialized additives, while simultaneously elevating the importance of cross-compatibility with existing infrastructure. Against this backdrop, market participants must navigate regulatory requirements, raw material supply dynamics, and evolving end-user expectations. By examining these converging factors, this report presents a comprehensive overview of the antifreeze sector’s current state, emerging trends, and strategic imperatives for stakeholders intent on driving value and performance.

Unveiling the Paradigm Shift in Thermal Management: Analysis of Technological, Regulatory, and Sustainability Trends Redefining Antifreeze Solutions

In recent years, the antifreeze landscape has undergone a dramatic transformation fueled by technological advances and heightened regulatory scrutiny. Industry players are developing hybrid organic additive technologies that combine the longevity of organic acid inhibitors with the robustness of inorganic compounds, thereby extending fluid life while maintaining corrosion control. Simultaneously, phosphated hybrid organic packages have gained traction for their balanced performance in mixed-metal cooling circuits.

Furthermore, sustainability considerations are reshaping raw material selection, as manufacturers explore bio-based glycols and recyclable inhibitor chemistries to reduce environmental footprints. Regulatory frameworks in key jurisdictions now limit phosphate content and restrict the use of certain amine-based inhibitors, accelerating the shift toward environmentally optimized formulations. At the same time, digital integration within engine management systems has created opportunities for smart coolant monitoring, enabling predictive maintenance and real-time thermal optimization. Collectively, these developments are redefining the parameters of product development and supply chain collaboration within the antifreeze market.

Examining the Effects of 2025 U.S. Tariffs on the Antifreeze Industry: Trade Dynamics, Supply Chain Shifts, and Cost Structure Implications

The implementation of new U.S. tariff measures in 2025 has exerted significant pressure on the import costs of key glycol feedstocks, particularly ethylene glycol derived from international petrochemical complexes. As duties incrementally phased in, suppliers faced margin compression, prompting many to reassess sourcing strategies and accelerate domestic production expansions. Consequently, North American manufacturers have increased capital investments in dedicated glycol purification lines, aiming to mitigate the cost volatility introduced by the trade levies.

At the same time, downstream formulators adjusted procurement timelines and diversified their supplier bases to balance the impact of elevated fees. Some providers negotiated long-term off-take agreements to secure preferential raw material pricing, while others explored backward integration opportunities. Although these measures introduced short-term logistical complexities, they have also spurred industry consolidation and encouraged collaboration on R&D platforms to share the burden of material innovation. Ultimately, the 2025 tariff regime has reinforced the importance of agile supply chain planning and strategic partnership frameworks.

Revealing Critical Segmentation Across Product Type, Technology, Vehicle Class, Packaging, Form, End User, and Distribution Tiers Shaping Market Nuances

Segmentation based on glycol type reveals a clear dichotomy: ethylene glycol remains the preferred choice for high-performance applications where superior freeze protection and heat transfer are critical, whereas propylene glycol offers a lower-toxicity alternative that appeals to end-users prioritizing environmental and safety considerations. Transitioning to inhibitor technology, hybrid organic additive solutions occupy the premium tier for extended drain intervals, while inorganic acid technology delivers rugged protection for legacy platforms. Organic acid formulations serve as a middle ground, balancing cost and performance, and phosphated hybrid blends cater to mixed-metal architectures requiring enhanced phosphate buffering.

Regarding vehicle type, commercial applications often demand heavy-duty coolant cycles with specialized additive strengtheners to counter high load factors, while passenger vehicle specifications emphasize compact system compatibility and aesthetic clarity. Packaging choices further differentiate market approaches: bulk deliveries to OEM assembly lines optimize economies of scale, whereas bottled offerings-distributed in both bottles and drums-target repair shops and retail channels with convenience and dosage accuracy. In terms of product form, liquid concentrates dominate for immediate system fill, yet solid block variants provide logistical efficiencies for remote applications. End-user segmentation underscores the strategic divergence between the aftermarket channel, which relies on rapid product availability, and original equipment manufacturers, which integrate coolant specifications into vehicle warranties. Finally, the distribution spectrum spans offline networks-from auto part stores to specialty outlets-to online platforms encompassing company websites and e-commerce marketplaces, reflecting evolving procurement behaviors across the value chain.

This comprehensive research report categorizes the Automotive Antifreeze market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Inhibitor Technology

- Vehicle Type

- Packaging

- Product Form

- Distribution Channel

- End User

Illuminating Regional Dynamics of Cooling Fluids Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Reveal Growth Drivers

In the Americas, extreme seasonal temperature swings create a robust demand for high-performance antifreeze formulations, with North American markets gravitating toward concentrated and extended-life products. Latin American regions, by contrast, prioritize cost-effective solutions compatible with diverse vehicle ages and maintenance capabilities. Moreover, aftermarket channels in the Americas have matured to support professional service networks as well as DIY consumers, reinforcing the need for clear dosage instructions and user-friendly packaging.

Turning to Europe, Middle East and Africa, regulatory landscapes vary significantly: European Union directives have driven the adoption of phosphate-free and nitrite-free inhibitors, while Middle Eastern markets weigh thermal stability in searing climates. In Africa, the aftermarket is fragmented, often relying on nonstandardized fluid blends, which underscores opportunities for standardized, quality-assured products. Across Asia-Pacific, rapid vehicle production and expanding fleets of electric and hybrid vehicles demand coolants tailored to diverse drive systems. Stringent emissions standards in key Asia-Pacific economies have also catalyzed the use of advanced organic acid technology, paving the way for long-life formulations that reduce maintenance intervals and total cost of ownership.

This comprehensive research report examines key regions that drive the evolution of the Automotive Antifreeze market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players in the Engine Coolant Arena: Evaluation of Strategic Initiatives and Competitive Positioning Driving Industry Leadership Dynamics

Leading players are strategically bolstering their coolant portfolios through targeted acquisitions, joint ventures, and in-house innovation. One global chemical manufacturer has expanded its inhibitor technology pipeline by securing partnerships with specialty additive firms, thereby accelerating the introduction of next-generation organic acid packages. A major lubricant brand has leveraged its distribution network to bundle antifreeze solutions with complementary products, enhancing customer retention through integrated thermal management kits.

At the same time, independent coolant specialists are differentiating via customization services, offering bespoke formulations that address unique OEM specifications. Several firms have invested in digital infrastructure to provide customers with real-time coolant condition monitoring, combining IoT sensors with predictive analytics to extend fluid service life. This trend toward smart cooling systems highlights the competitive edge that technological integration can deliver, as companies seek to move beyond commodity supply into value-added service models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Antifreeze market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arteco NV

- BASF SE

- Castrol Limited

- Chevron Corporation

- China Petroleum & Chemical Corporation

- Cummins Inc.

- Exxon Mobil Corporation

- Fuchs Petrolub SE

- Gulf Oil International

- Indian Oil Corporation Limited

- Motul

- Old World Industries, LLC

- Prestone Products Corporation

- Recochem Corporation

- Royal Dutch Shell plc

- The Dow Chemical Company

- TotalEnergies SE

- Valvoline Inc.

Transforming Insights into Actionable Strategies: Tactics for Leaders to Overcome Regulatory Hurdles, Embrace Technology Evolution, Mitigate Market Disruptions

To navigate the evolving regulatory environment, industry leaders should prioritize the development of phosphate-free inhibitor technologies that meet or exceed emissions standards without compromising performance. Concurrently, forging strategic alliances with glycol producers will mitigate feedstock risk and ensure continuity of supply amidst geopolitical uncertainties. Investment in R&D platforms that explore bio-based glycol alternatives can unlock new sustainability narratives, appealing to environmentally conscious OEMs and end users.

On the commercial front, optimizing packaging strategies-by integrating drum reuse programs and user-friendly concentrate dosing tools-can enhance customer loyalty while reducing logistical footprints. Furthermore, expanding digital engagement via e-commerce channels and real-time fluid monitoring services will position organizations to capture insights and cultivate long-term client relationships. By embedding these recommendations into corporate roadmaps, leaders can achieve resilient growth and maintain competitive advantage in a rapidly shifting marketplace.

Employing Rigorous Multimodal Research Methodologies: Examination of Data Collection, Analytical Frameworks, and Validation Techniques Underpinning Insights

Primary research included in-depth interviews with chemical suppliers, additive specialists, OEM thermal system engineers, and regional distributors to capture nuanced perspectives on formulation trends and distribution practices. Secondary research encompassed peer-reviewed journals, industry white papers, regulatory guidance documents, and patent filings, ensuring a comprehensive aggregation of quantitative and qualitative evidence.

Analytical frameworks employed include a PESTLE evaluation to contextualize macro-environmental forces, a Porter’s Five Forces assessment to gauge competitive intensity, and SWOT analyses for key market segments. Data validation was conducted through triangulation across multiple sources and iterative reviews with subject matter experts to confirm consistency and resolve discrepancies. This rigorous methodological approach provides a transparent foundation for the insights and recommendations presented in the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Antifreeze market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Antifreeze Market, by Type

- Automotive Antifreeze Market, by Inhibitor Technology

- Automotive Antifreeze Market, by Vehicle Type

- Automotive Antifreeze Market, by Packaging

- Automotive Antifreeze Market, by Product Form

- Automotive Antifreeze Market, by Distribution Channel

- Automotive Antifreeze Market, by End User

- Automotive Antifreeze Market, by Region

- Automotive Antifreeze Market, by Group

- Automotive Antifreeze Market, by Country

- United States Automotive Antifreeze Market

- China Automotive Antifreeze Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesis of Core Findings and Strategic Implications: Overview of Key Drivers, Advances, Regulatory Factors, and Emerging Opportunities in Antifreeze

This synthesis of antifreeze market dynamics underscores several core findings: first, the critical role of advanced inhibitor technologies in extending fluid lifecycle and preserving engine health. Second, the influence of regional regulatory frameworks on product composition and market access cannot be overstated. Third, evolving supply chain strategies, driven by tariff pressures and sustainability mandates, are reshaping sourcing paradigms.

Technological advances in additive chemistries and digital monitoring tools present significant opportunities to differentiate in an increasingly commoditized environment. At the same time, market participants must remain vigilant to emerging disruptions, including the growing electrification of vehicle fleets and changing end-user procurement behaviors. By weaving these insights together, stakeholders can forge strategies that balance performance, compliance, and resilience, ensuring that their antifreeze offerings remain vital to the future of engine and thermal management.

Engage with Ketan Rohom to Secure Your Comprehensive Antifreeze Market Report and Unlock In-Depth Insights Tailored to Drive Strategic Decision-Making

Readers seeking to elevate their engineering strategies and commercial operations are encouraged to engage directly with Ketan Rohom, Associate Director, Sales & Marketing, to secure the comprehensive antifreeze market report. You will gain access to proprietary analyses that reveal critical market drivers, technological breakthroughs, and regulatory insights. By partnering with Ketan, you can customize the scope and depth of data to meet your unique decision-making requirements, ensuring that every recommendation aligns with your operational goals and investment priorities. Reach out to initiate a dialogue, explore sample chapters, or request a tailored proposal that accelerates your path to actionable intelligence and strategic advantage

- How big is the Automotive Antifreeze Market?

- What is the Automotive Antifreeze Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?