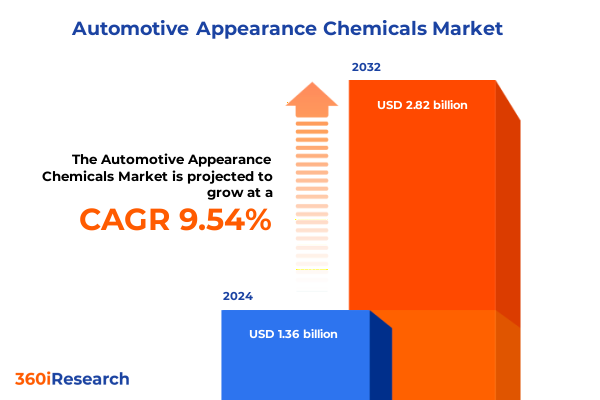

The Automotive Appearance Chemicals Market size was estimated at USD 1.45 billion in 2025 and expected to reach USD 1.55 billion in 2026, at a CAGR of 9.92% to reach USD 2.82 billion by 2032.

Exploring the Dynamic Intersection of Industry Evolution and Consumer Demand Driving the Automotive Appearance Chemicals Landscape

The automotive appearance chemicals market is experiencing profound shifts driven by evolving consumer expectations, stringent environmental regulations, and rapid technological innovations. In recent years, vehicle owners have placed increasing emphasis on durability, aesthetic appeal, and eco-friendliness, prompting manufacturers and suppliers to innovate beyond traditional formulations. At the same time, regulatory bodies across major economies have implemented increasingly rigorous volatile organic compound (VOC) limits, nudging the industry toward the widespread adoption of waterborne and high-solids technologies. Furthermore, the rise of electric and hybrid powertrains is reshaping material requirements for coatings and surface treatments, while digital color-matching and robotic application systems are enhancing precision and reducing waste. These dynamics coalesce to create a complex landscape where agility and foresight are imperative for stakeholders seeking to maintain competitive advantage.

Against this backdrop, strategic decision-makers must grasp the interplay between market drivers, regulatory forces, and technological enablers. Sustainability has emerged not just as a compliance requirement but as a growth vector, with eco-conscious vehicle buyers willing to pay a premium for green credentials. Simultaneously, supply chain volatility-exacerbated by geopolitical tensions and fluctuating raw material costs-has underscored the need for diversified sourcing strategies and robust risk management. By situating this analysis within the broader context of end-market trends, this section establishes a foundation for understanding how the automotive appearance chemicals market is being reshaped and what that implies for future innovation pathways and investment opportunities.

Identifying the Transformative Technological, Regulatory, and Sustainability Shifts Redefining the Automotive Appearance Chemicals Sector

As the automotive appearance chemicals sector evolves, three transformative shifts are redefining competitive boundaries and strategic imperatives. First, sustainability imperatives are at the forefront: stringent environmental regulations and growing consumer demand for low-VOC, high-performance products are accelerating the migration from solventborne to waterborne systems. Waterborne coatings, once viewed as a niche solution, now represent a critical technology pillar, offering both compliance and performance advantages. Second, digital transformation is revolutionizing formulation design and application methods. Advanced analytics and artificial intelligence enable predictive color matching, real-time quality monitoring, and process optimization, reducing waste and improving throughput on assembly lines. Third, the electrification of vehicles demands novel chemistries to address unique substrate challenges, such as battery casings and thermal management surfaces, prompting R&D investment in multifunctional coatings that combine appearance with protective performance against heat and chemical exposure.

Together, these shifts are generating a new innovation paradigm that extends beyond incremental improvements. Companies that integrate lifecycle assessments into product development, leverage Industry 4.0 capabilities in manufacturing, and collaborate across the value chain are gaining first-mover advantage. In turn, these advanced capabilities are enabling the commercialization of next-generation solutions-such as self-healing coatings, nano-engineered sealants, and multifunctional adhesives-that address cross-cutting performance requirements. Consequently, the market is becoming increasingly segmented by technology sophistication and sustainability credentials, with leading players forging partnerships and investing in digital ecosystems to unlock value across the entire product lifecycle.

Assessing the Cumulative Impact of United States Tariffs Introduced in 2025 on Raw Material Supply and Competitive Dynamics

In 2025, the imposition and extension of United States tariffs on key chemical feedstocks and finished components have had a cumulative effect on cost structures and supply chain configurations within the automotive appearance chemicals market. The increased duties on imported resins, solvents, and pigment dispersions have elevated input costs, prompting manufacturers to reevaluate sourcing strategies and negotiate long-term contracts to mitigate price volatility. At the same time, some domestic producers have scaled up capacity to capitalize on the reshoring trend, although critical technology and expertise gaps still necessitate strategic partnerships with international innovators.

Moreover, higher tariff burdens have intensified competitive pressures in the U.S. market. Domestic formulators with integrated supply chains have leveraged operational scale to absorb some of the cost increases, while smaller specialist suppliers have faced margin compression, accelerating consolidation. Importers have responded by adjusting their product portfolios toward higher-value, differentiated chemistries that justify premium pricing. In parallel, the threat of retaliatory tariffs in key export markets has reshaped go-to-market tactics, spurring companies to diversify regional sales channels and invest in local production capabilities. As a result, the landscape of suppliers serving U.S. OEMs and aftermarket channels is undergoing a strategic realignment, reflecting the broader geopolitical influences on raw material availability and cost competitiveness.

Uncovering Critical Insights Across Product, Vehicle, Technology, Sales Channel, and Application Segmentation Dimensions

Deep insights into the automotive appearance chemicals landscape emerge when one considers how the market can be parsed across multiple segmentation dimensions. Looking first at product classes, the cleaners category encompasses degreasers and surface cleaners that prepare substrates for subsequent treatment, while coatings split into original equipment manufacturer and refinish segments, each further segmented into powder, solventborne, and waterborne systems. Sealants and adhesives range from bonding tapes to sealants that protect joints against moisture intrusion, and the waxes and polishes arena spans multifunctional polymers for finish enhancement. Across these product classes, formulation complexity and value vary with the performance demands of each end use.

Vehicle type segmentation reveals distinct growth profiles for passenger cars, commercial trucks, and two-wheeled vehicles, with each category driving unique formulation requirements in terms of film thickness, durability, and regulatory compliance. From a technology standpoint, powder, solventborne, and waterborne platforms offer trade-offs in environmental impact, application efficiency, and cost, necessitating tailored investment decisions. Sales channels bifurcate into OEM and aftermarket routes, the latter further decomposed into distributor and retail networks that influence pricing, brand positioning, and technical support models. Finally, application insights highlight that exterior domains, such as body panel coatings and trim, demand robust weatherability and color stability, whereas interior surfaces like dashboards and seats call for scratch resistance and chemical resistance properties. Recognizing how these segmentation layers intersect enables stakeholders to target high-value niches and align R&D pipelines with market demand vectors.

This comprehensive research report categorizes the Automotive Appearance Chemicals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Class

- Vehicle Type

- Technology

- Application

- Sales Channel

Analyzing Nuanced Regional Dynamics in the Americas, Europe Middle East & Africa, and Asia Pacific to Guide Strategic Market Engagement Efforts

Regional market dynamics present divergent challenges and opportunities for stakeholders in the automotive appearance chemicals domain. In the Americas, evolving emissions standards and heightened focus on electric vehicle adoption are driving reformulation toward low-VOC additives and advanced thermo-reflective coatings, with North America serving as a testbed for sustainable product launches. Meanwhile, Europe, the Middle East, and Africa display a complex regulatory mosaic-ranging from the European Union’s chemical safety directives to emerging markets in North Africa-fueling demand for modular coatings systems that can be adapted across diverse compliance regimes. In these regions, consolidation among key raw material suppliers and coating manufacturers is creating scale advantages and integrated service offerings.

Across the Asia-Pacific region, rapid urbanization, rising vehicle ownership in emerging markets, and government incentives for green mobility are spurring investment in high-performance coatings and surface treatments. Local players are leveraging lower production costs and proximity to raw material sources to challenge established global suppliers, while joint ventures and licensing agreements are proliferating as a means to access technology and distribution infrastructure. Furthermore, digitalization of sales channels-including online configurators and e-commerce platforms-has gained traction in markets such as China and India, reshaping aftermarket purchasing behaviors and service delivery models. These regional dynamics underscore the importance of tailoring product portfolios, compliance strategies, and partnership approaches to geographic nuances.

This comprehensive research report examines key regions that drive the evolution of the Automotive Appearance Chemicals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Initiatives Shaping the Competitive Topography of Appearance Chemicals Market

Major players across the automotive appearance chemicals landscape are deploying diverse strategic levers to drive growth and innovation. Global coatings giants are accelerating investments in waterborne technology platforms and leveraging cross-industry partnerships to integrate smart functionality-such as self-cleaning and antimicrobial properties-into flagship products. Simultaneously, mid-tier specialist suppliers are carving out niches by focusing on high-margin refinish and aftermarket segments, where technical service and brand equity can justify premium pricing. Leading firms are also streamlining their global manufacturing footprints, investing in capacity expansions in high-growth regions while optimizing legacy plants through process automation.

In parallel, collaboration between chemical producers and OEMs has intensified, with co-development agreements aimed at aligning formulations with next-generation vehicle architectures and sustainability benchmarks. Strategic acquisitions and equity alliances are reshaping competitive boundaries, as companies seek to close gaps in technology capabilities-most notably in powder coatings and advanced sealants. At the same time, the rise of digital platforms for order management, inventory forecasting, and technical support is enhancing customer engagement and driving operational efficiencies. Collectively, these corporate maneuvers illustrate how the interplay of scale, specialization, and innovation agendas is shaping the competitive topography of the appearance chemicals sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Appearance Chemicals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ACE DYNAMICS

- Autca

- BASF SE

- Blue Ribbon Inc.

- Bullsone Co., Ltd.

- Chemical Guys

- CRC Industries

- Dar-Tech, Inc.

- Dazlo by Waterloo Products Co.

- Griot's Garage Inc.

- Hibrett Puratex

- Jax Wax

- Jopasu Systems Pvt. Ltd.

- Koch-Chemie GmbH

- MA-FRA S.p.A.

- Malco Products Inc.

- Mothers Polishes Waxes Cleaners

- Niteo Products, LLC

- Simoniz USA, Inc.

- Splash by Elliott Auto Supply Co., Inc.

- Stinger Chemical

- Tetrosyl Limited

- Turtle Wax Inc.

- Wavex

Charting Practical and Impactful Recommendations to Drive Growth, Sustainability, and Resilience in the Appearance Chemicals Industry

To thrive in the rapidly evolving automotive appearance chemicals market, industry leaders should pursue a multidimensional strategy. Foremost, investing in advanced waterborne and high-solids chemistries will not only ensure regulatory compliance but also cater to sustainability-minded customers. In conjunction, building digital capabilities-such as AI-driven color matching and predictive maintenance analytics-can enhance production efficiency and quality control. Additionally, companies should diversify their raw material supply chains by establishing strategic reserves and forging partnerships in stable jurisdictions to mitigate tariff-related risks.

Moreover, engaging in collaborative R&D with OEMs and leveraging open innovation platforms can accelerate the development of multifunctional coatings that address emerging vehicle design trends, including lightweight composites and battery enclosure requirements. Tailored go-to-market approaches, which align sales channel strategies with segmentation insights-for example, differentiating technical support offerings between distributor networks and direct-to-retail models-can unlock new revenue streams. Finally, adopting a region-specific lens when launching products and allocating investment will maximize returns, balancing mature market saturation in North America with high-growth potential in Asia-Pacific. By integrating these tactical initiatives into a cohesive roadmap, companies can secure resilience, drive innovation, and position themselves as front-runners in the automotive appearance chemicals arena.

Detailing Rigorous Research Methodologies Employed to Ensure Data Integrity, Validity, and Comprehensive Market Analysis Rigor

This analysis is underpinned by a rigorous research methodology designed to ensure data integrity, consistency, and comprehensive coverage. Primary research involved in-depth interviews with key stakeholders-including formulation scientists, procurement directors at OEMs and major aftermarket distributors, and regulatory experts-providing firsthand perspectives on technology adoption, supply chain resilience, and compliance challenges. These qualitative insights were complemented by extensive secondary research, encompassing trade publications, patent filings, regulatory filings, and financial statements from leading corporations to validate trends and triangulate market developments.

The research approach further employed comparative benchmarking of product portfolios against performance metrics, while supply chain mapping elucidated the provenance and logistics flows of critical raw materials. Advanced analytics techniques, such as cluster analysis and scenario modeling, were utilized to interpret segmentation dynamics and forecast pathway sensitivities under varying tariff and regulatory scenarios. Quality assurance processes, including peer review by domain specialists and cross-validation of primary data against independent third-party publications, ensured that findings reflect the most accurate and up-to-date insights. This robust methodology provides decision-makers with a high-confidence foundation for strategic planning and risk assessment within the automotive appearance chemicals sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Appearance Chemicals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Appearance Chemicals Market, by Product Class

- Automotive Appearance Chemicals Market, by Vehicle Type

- Automotive Appearance Chemicals Market, by Technology

- Automotive Appearance Chemicals Market, by Application

- Automotive Appearance Chemicals Market, by Sales Channel

- Automotive Appearance Chemicals Market, by Region

- Automotive Appearance Chemicals Market, by Group

- Automotive Appearance Chemicals Market, by Country

- United States Automotive Appearance Chemicals Market

- China Automotive Appearance Chemicals Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Drawing Together Critical Findings and Strategic Implications to Illuminate the Path Forward in the Automotive Appearance Chemicals Domain

The automotive appearance chemicals market stands at a pivotal juncture, shaped by the convergence of sustainability mandates, technological breakthroughs, and geopolitical influences. This executive summary has highlighted how shifts toward waterborne and high-solids technologies, coupled with digitalization, are driving product innovation, while the implications of United States tariffs underscore the importance of supply chain agility and diversified sourcing. Segmentation analysis reveals that nuanced demand patterns across product classes, vehicle types, technologies, channels, and applications require tailored strategies to capture value effectively. Additionally, the regional and competitive landscapes illustrate that leading players must continuously adapt their footprints and forge partnerships to remain ahead.

Collectively, these findings underscore a clear strategic mandate: to embrace sustainability not only as a compliance imperative but as a differentiator; to harness digital tools for operational excellence; and to safeguard supply chain resilience against evolving trade regulations. By aligning R&D investments with emerging vehicle architectures and consumer preferences, stakeholders can unlock new performance frontiers and foster long-term growth. Ultimately, the companies that integrate these insights into cohesive, forward-looking strategies will be best positioned to navigate uncertainties and lead the automotive appearance chemicals industry into its next phase of evolution.

Engage with Ketan Rohom to Secure the Comprehensive Market Research Report and Propel Your Automotive Appearance Chemicals Strategy

To access the detailed insights, data visualizations, and strategic frameworks that will empower your organization to anticipate market shifts and capitalize on emerging opportunities, reach out directly to Ketan Rohom. As the Associate Director of Sales & Marketing, Ketan brings deep knowledge of the automotive appearance chemicals domain and a commitment to guiding decision-makers toward actionable outcomes. By securing the full market research report, your team will gain unparalleled visibility into competitive positioning, regulatory trends, and innovation pipelines. Engage with Ketan to arrange a personalized walkthrough of key findings, discuss tailored subscription options, and embark on a partnership that positions your business at the forefront of industry evolution. Take this definitive step to transform strategic intent into market-leading results by contacting Ketan Rohom and unlocking the comprehensive research toolset designed to accelerate your growth trajectory.

- How big is the Automotive Appearance Chemicals Market?

- What is the Automotive Appearance Chemicals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?