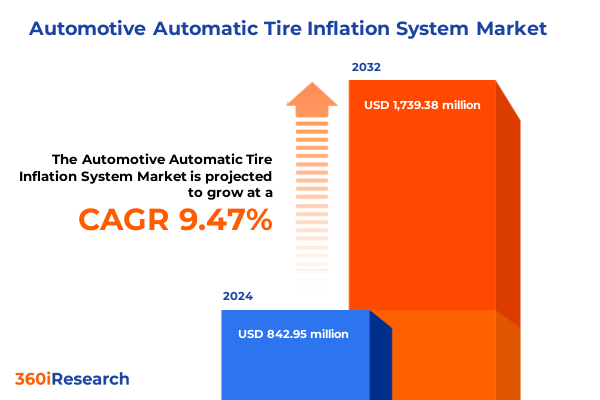

The Automotive Automatic Tire Inflation System Market size was estimated at USD 918.22 million in 2025 and expected to reach USD 1,004.91 million in 2026, at a CAGR of 9.55% to reach USD 1,739.37 million by 2032.

Charting the Evolution of Automated Tire Inflation Technologies Transforming Fleet Operations with Enhanced Safety Efficiency and Operational Resilience

In an era defined by relentless pursuit of safety, sustainability, and operational efficiency, the role of tire pressure management has never been more critical. Automatic Tire Inflation Systems (ATIS) represent a transformative advancement in vehicular technology, delivering real-time control over tire pressure to optimize performance across diverse driving conditions. By continuously monitoring and regulating tire inflation, these systems not only enhance fuel efficiency and reduce greenhouse gas emissions but also significantly extend tire life and minimize unplanned downtime. As fleet managers and vehicle manufacturers contend with mounting regulatory pressures and rising operational costs, ATIS offers a proactive solution that aligns with both environmental mandates and business objectives.

The convergence of digital sensors, advanced pneumatic designs, and cloud-based analytics has propelled ATIS from niche military and off-highway applications into mainstream commercial and passenger vehicle segments. Growing awareness of the impact of tire under-inflation on safety-underscored by industry reports linking tire pressure anomalies to a notable percentage of roadway accidents-has catalyzed adoption across fleet operators, logistics providers, and original equipment manufacturers (OEMs). Moreover, the shift toward electrification and autonomous mobility amplifies the importance of precise tire inflation, as electric vehicles demand optimized rolling resistance for range extension and automated platforms rely on consistent handling characteristics for reliable navigation.

Unveiling Key Drivers Redefining Automatic Tire Inflation Dynamics Fueled by Digital Integration Electrification and Regulatory Imperatives Shaping Industry

Over the past three years, the landscape for automatic tire inflation has undergone seismic changes driven by the integration of telematics and Internet of Things (IoT) platforms. Sensors embedded within air delivery modules, compressors, and pressure gauges now transmit live tire status to centralized dashboards, enabling continuous performance tuning and proactive maintenance alerts. This digital infusion empowers stakeholders to transition from reactive service models to predictive maintenance regimes, curbing unplanned downtime and drastically reducing total cost of ownership.

Simultaneously, the acceleration of vehicle electrification has reshaped design priorities, with original equipment manufacturers focusing on lightweight materials and energy-efficient pneumatic components. Innovations in compressor technology, including variable-speed and dual-chamber designs, have slashed power draw while maintaining rapid inflation capabilities. Regulatory initiatives targeting carbon emissions and fuel economy standards have further reinforced ATIS as a key enabler of compliance, particularly in commercial trucking and off-highway applications. In essence, the interplay of digital connectivity, electrification trends, and tightening regulatory mandates has coalesced into a powerful catalyst for widespread adoption and continual enhancement across the ATIS ecosystem.

Assessing the Strategic Consequences of 2025 U.S. Tariffs on Automotive Automatic Tire Inflation System Supply Chains and Cost Structures

In early 2025, the United States implemented targeted tariffs on select pneumatic components and sensor imports, aiming to bolster domestic manufacturing and address trade imbalances. These measures have imposed additional duties on critical elements such as precision pressure sensors and specialized compressor assemblies. As a result, OEMs and system integrators have experienced an immediate uptick in input costs, prompting rapid reassessment of global supply chains. Historically reliant on cost-competitive imports, manufacturers are now exploring nearshoring and strategic partnerships with regional suppliers to mitigate tariff implications and preserve margin integrity.

The tariff landscape has also triggered innovation in component sourcing, with several industry players investing in domestic production lines for valve assemblies, housing modules, and sensor calibration equipment. At the same time, aftermarket channels have felt the impact of elevated pricing, spurring a reevaluation of service interval strategies and extended-warranty offerings. In response, fleet operators and maintenance providers are negotiating long-term contracts to secure fixed pricing and inventory commitments. Looking ahead, the interplay between tariffs and evolving trade policies will continue to shape competitive dynamics, compelling stakeholders to prioritize supply chain resilience and localized manufacturing capabilities.

Illuminating Critical Segmentation Insights Across Types Components Tire Variants Vehicles End Users and Distribution Pathways

The automatic tire inflation market exhibits distinct dynamics when examined through the lens of system type, component architecture, tire construction, vehicle application, end-user profile, and distribution pathway. Centralized systems, which deliver controlled air flow via manifold and valve networks, remain prevalent in heavy-duty off-highway environments, where durability and high flow-rate performance are paramount. Conversely, continuous inflation designs tailored to on-road fleets emphasize compact compressor units and automated feedback loops to sustain optimal pressure during extended highway travel.

Within these systems, air delivery modules and compressors serve as the operational heart, requiring robust housings and precision-engineered seals to withstand harsh environmental conditions. Pressure gauges and sensor arrays provide critical data for closed-loop control, with next-generation designs integrating digital signal processing for enhanced accuracy. When considering tire variants, bias-ply configurations continue to dominate select agricultural and military platforms, while radial and tubeless constructions are preferred across commercial and passenger vehicle segments for their superior ride comfort and puncture resistance.

Vehicle segmentation further underscores divergent requirements: off-highway machinery demands rugged, self-leveling inflation mechanisms capable of rapid pressure adjustments under heavy loads, whereas commercial trucks rely on energy-efficient compressors to maintain fleet uptime. Passenger and light commercial vehicles, by contrast, benefit from low-noise modules and seamless integration with telematics. Meanwhile, end users ranging from public transport operators and lease fleets to individual drivers exhibit varying priorities around cost per mile, maintenance predictability, and retrofit compatibility. Finally, the choice between OEM supply and aftermarket service channels hinges on considerations of installation timelines, warranty coverage, and long-term service contracts.

This comprehensive research report categorizes the Automotive Automatic Tire Inflation System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- Tire Type

- Vehicle Type

- End-User

- Distribution Channel

Deciphering Regional Growth Patterns and Demand Drivers Shaping the Automated Tire Inflation Landscape Across Major Global Territories

Regional demand for automatic tire inflation solutions reflects a complex interplay of regulatory frameworks, infrastructure maturity, and fleet composition. In the Americas, stringent safety mandates and robust highway networks have accelerated uptake within commercial trucking and intercity bus operations. Meanwhile, the presence of advanced manufacturing clusters in the United States and Canada has supported domestic production of key pneumatic components, while South American markets explore retrofit solutions to address aging heavy-duty fleets.

Across Europe, Middle East, and Africa, regulatory initiatives such as the European Union’s Smart Mobility Strategy have catalyzed investments in digital tire management platforms, particularly for long-haul logistics and public transport services. Infrastructure challenges in emerging EMEA regions underscore the value of centralized inflation solutions, which help maintain equipment performance amid variable road conditions. The Africa corridor, in particular, presents opportunities for ruggedized systems in mining and oil-and-gas applications, where load-bearing requirements are substantial.

In Asia-Pacific, the rapid expansion of e-commerce has driven growth in light commercial vehicle fleets, fostering demand for continuous inflation systems that optimize uptime and delivery efficiency. China’s emphasis on advanced manufacturing has fostered a growing domestic supplier ecosystem, while markets in India and Southeast Asia prioritize cost-effective retrofit options to boost fuel economy and reduce emissions. Australia and New Zealand continue to leverage agricultural expertise, integrating central tire inflation to enhance productivity in large-scale farming operations.

This comprehensive research report examines key regions that drive the evolution of the Automotive Automatic Tire Inflation System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Pioneering Innovative Solutions and Strategic Collaborations in the Automated Tire Inflation Ecosystem

Several leading manufacturers and integrators have emerged at the forefront of innovation, forging partnerships to bring advanced inflation technologies to market. Timco has solidified its position by expanding compressor production capacity and launching a new line of modular air delivery systems optimized for medium-duty trucks. Hendrickson has leveraged its expertise in axle and suspension assemblies to introduce integrated inflation solutions that synchronize tire pressure with load-sensing data.

Lincoln Industrial continues to advance sensor technology, unveiling high-precision gauges that interface seamlessly with fleet telematics platforms. Continental has strengthened its market presence through strategic collaborations with aftermarket service providers, introducing retrofit kits compatible with a broad range of radial and tubeless tires. Meanwhile, ZF Friedrichshafen has invested in joint ventures to localize production of housing components and digital control units in key logistics hubs across Europe and Asia-Pacific.

Emerging challengers, including Smart Tire Systems and select compressor specialists, are differentiating through cloud-native analytics platforms that benchmark performance across global fleets. By combining real-time inflation data with route and load metrics, these companies enable predictive maintenance scheduling and dynamic tire pressure adjustments. The result is a vibrant ecosystem where established OEMs and agile specialists compete on product versatility, integration capability, and service excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Automatic Tire Inflation System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AIR CTI

- Airgo Systems, LLC

- Aperia Technologies, Inc.

- Bigfoot Equipment Ltd.

- Bridgestone Corporation

- CLAAS KGaA mbH

- COLVEN USA LLC

- Continental AG

- Dana Incorporated

- Denso Corporation

- Eaton Corporation

- Goodyear Tire & Rubber Company

- Haltec Corporation

- Hendrickson Holdings, L.L.C.

- IDEX Corporation

- Meritor, Inc. by Cummins Inc.

- Michelin Group

- Parker Hannifin Corporation

- Pressure Systems International, LLC

- PTG Reifendruckregelsysteme GmbH

- Robert Bosch GmbH

- SAF-HOLLAND GmbH

- STEMCO Products Inc. by EnPro Industries, Inc.

- ti.systems GmbH

- Tire Pressure Control International Ltd.

Delivering Actionable Strategic Imperatives to Drive Competitive Advantage and Sustainable Growth in the Automatic Tire Inflation Sector

Industry leaders seeking to capitalize on the momentum of automatic tire inflation technologies should prioritize investments in digital and cloud-enabled infrastructures. Establishing seamless integration with existing fleet management systems will be critical to unlocking the full value of real-time tire pressure data. Concurrently, diversifying supplier networks to include regional manufacturers can mitigate exposure to tariff volatility and reduce lead times for key components.

Collaborative partnerships between compressor, sensor, and telematics providers can accelerate product innovation and broaden addressable markets. Firms that tailor solutions to specific tire constructions and vehicle operations-such as ruggedized kits for mining applications or low-noise modules for passenger fleets-will gain competitive advantage. Additionally, adopting flexible distribution strategies that balance OEM collaboration with aftermarket service offerings can enhance market reach and customer retention.

Finally, embedding sustainability principles into system design-through energy-efficient compressor operation, recyclable materials, and lifecycle performance reporting-will align offerings with evolving regulatory and corporate responsibility standards. By pursuing these strategic imperatives, industry stakeholders can drive differentiation, bolster profitability, and ensure long-term relevance in a rapidly evolving mobility landscape.

Detailing an Integrated Research Methodology Combining Multisource Data Triangulation Qualitative Expert Engagement and Rigorous Analytical Frameworks

This research leverages a dual-phased approach, commencing with an extensive secondary review of technical papers, regulatory filings, and publicly available financial disclosures to map the competitive landscape. Building on this foundation, primary interviews were conducted with senior executives from OEMs, system integrators, fleet operators, and component suppliers to capture nuanced perspectives on market dynamics and emerging opportunities.

Data triangulation techniques were employed to validate insights, cross-referencing interview findings with corporate announcements, patent filings, and trade association reports. An analytical framework encompassing technology readiness, regulatory impact assessment, and supply chain resilience was applied to evaluate each segment and region. Scenario modeling was utilized to test the effects of trade policy shifts, electrification trends, and digital adoption rates, while sensitivity analyses helped quantify the relative importance of key drivers.

Finally, a validation workshop was convened with subject-matter experts and independent consultants to challenge assumptions, refine projections, and ensure methodological rigor. The outcome is a robust, evidence-based study that offers actionable intelligence for decision-makers seeking to navigate the evolving Automatic Tire Inflation System market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Automatic Tire Inflation System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Automatic Tire Inflation System Market, by Type

- Automotive Automatic Tire Inflation System Market, by Component

- Automotive Automatic Tire Inflation System Market, by Tire Type

- Automotive Automatic Tire Inflation System Market, by Vehicle Type

- Automotive Automatic Tire Inflation System Market, by End-User

- Automotive Automatic Tire Inflation System Market, by Distribution Channel

- Automotive Automatic Tire Inflation System Market, by Region

- Automotive Automatic Tire Inflation System Market, by Group

- Automotive Automatic Tire Inflation System Market, by Country

- United States Automotive Automatic Tire Inflation System Market

- China Automotive Automatic Tire Inflation System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Concluding Reflections on the Strategic Imperatives and Future Outlook of the Automated Tire Inflation Market Landscape

As the automotive ecosystem pivots toward heightened efficiency, resilience, and sustainability, automatic tire inflation systems are poised to play an indispensable role. The convergence of advanced pneumatic architectures, digital connectivity, and dynamic regulatory environments has created a fertile ground for continued innovation. Stakeholders who embrace holistic strategies-spanning product development, strategic partnerships, and supply chain optimization-will be best positioned to capitalize on emerging opportunities.

Throughout this report, the criticality of segmentation, regional differentiation, and tariff impacts has been underscored. By aligning product offerings with the distinct needs of off-highway versus on-highway fleets, integrating sensor and telematics capabilities, and preemptively addressing trade policy shifts, industry participants can forge a sustainable competitive edge. Ultimately, mastering the complexities of automatic tire inflation transcends mere technology deployment; it demands strategic vision, cross-functional collaboration, and relentless commitment to value creation.

Empowering Stakeholders to Unlock Strategic Advantages and Drive Informed Decision-Making with a Comprehensive Automotive Automatic Tire Inflation System Report

Ready to transform fleet efficiency and gain a strategic edge with the most comprehensive insights available on the Automotive Automatic Tire Inflation System market? Reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure your copy of the full report and explore tailored solutions designed to drive safety, cost optimization, and operational excellence. Let’s connect to equip your organization with the data, analysis, and recommendations needed to stay ahead in this fast-evolving industry and unlock new growth opportunities.

- How big is the Automotive Automatic Tire Inflation System Market?

- What is the Automotive Automatic Tire Inflation System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?