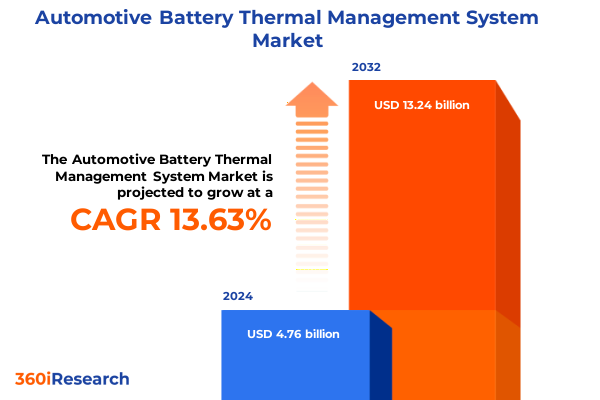

The Automotive Battery Thermal Management System Market size was estimated at USD 5.39 billion in 2025 and expected to reach USD 6.10 billion in 2026, at a CAGR of 13.69% to reach USD 13.24 billion by 2032.

Revealing the Strategic Imperative of Advanced Thermal Management Systems in Electric Vehicle Battery Performance and Longevity

The automotive landscape is undergoing a radical transformation propelled by electrification, energy efficiency mandates, and evolving consumer expectations. At the heart of this evolution lies the battery, whose performance, safety, and longevity hinge on meticulous thermal regulation. Effective thermal management systems serve as the linchpin connecting energy density advances to real-world vehicle range and lifecycle resilience. As electric vehicles (EVs) transition from niche applications to mainstream adoption, manufacturers and suppliers must navigate a complex interplay of technological innovation, regulatory pressures, and cost optimization imperatives.

In this context, thermal management strategies extend beyond conventional cooling jackets and passive heat sinks. They now encompass integrated sensor networks, adaptive control algorithms, and multi-mode cooling architectures designed to maintain optimal cell temperatures under diverse operating conditions. These capabilities not only bolster battery performance but also safeguard against accelerated degradation and thermal runaway events. Transitional partnerships across the value chain-from raw material extraction through system integration-are reshaping conventional silos, enabling co-innovation and accelerated time to market.

This report delves into the engineering breakthroughs, economic drivers, and policy frameworks shaping the automotive battery thermal management ecosystem. It outlines key trends that will influence strategic priorities for OEMs, tier-one suppliers, and new entrants, while illuminating how competitive dynamics and geopolitical shifts are redefining supply chains. By unpacking these critical factors, decision-makers can chart a roadmap for sustainable growth in an increasingly electrified mobility era.

Exploring Paradigm-Shifting Innovations Reshaping Battery Thermal Management Architectures Across Electric Mobility and Energy Storage Applications

Over the past few years, the thermal management landscape has experienced paradigm-shifting innovations that redefine how heat is dissipated and controlled within battery packs. Early reliance on air-based cooling has given way to sophisticated liquid cooling loops and direct integration methods that offer superior thermal conductivity and uniform temperature distribution. Simultaneously, phase-change materials are being embedded at the cell level to absorb transient thermal spikes, enhancing safety margins during high-power discharge and rapid charging events.

Advances in digitalization have further catalyzed this transformation. Real-time monitoring enabled by embedded temperature and pressure sensors allows dynamic adjustments to cooling flow rates and refrigerant cycles. Machine learning algorithms analyze historical performance data to predict temperature excursions before they occur, enabling proactive control strategies. These smart capabilities optimize energy consumption and extend the operational life of battery cells, making systems more reliable and cost-effective.

Looking ahead, emerging architectures that integrate thermal management subsystems with battery management systems (BMS) are promising even greater synergies between thermal and electrical control. Innovations such as dielectric liquids that double as coolants and electrical insulators, as well as modular thermal units that can be swapped or upgraded independently, are poised to redefine system scalability and maintainability. These breakthroughs are setting a new benchmark for performance in both electric vehicles and stationary energy storage installations.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Automotive Battery Thermal Management Supply Chains and Competitiveness

The introduction of targeted tariffs on imported battery components and thermal management materials in early 2025 has reshaped the competitive landscape for system integrators and raw material suppliers. By imposing levies on key inputs such as specialized cooling plates, phase-change compounds, and high-performance adhesives, policymakers aimed to bolster domestic manufacturing capacity. However, these measures have also amplified cost pressures, compelling manufacturers to reevaluate sourcing strategies and accelerate localization efforts.

In response, many global suppliers have relocated production facilities closer to end-market centers within the United States, reducing exposure to cross-border duties and lead-time uncertainties. This realignment has sparked a wave of capital investments in local tooling, quality assurance labs, and supply chain infrastructure. Conversely, some smaller tier-two providers have faced margin compression, prompting discussions around strategic alliances, co-manufacturing partnerships, or even vertical integration to retain competitiveness.

Beyond direct cost implications, the tariffs have incited broader shifts in innovation focus. With imported components becoming more expensive, research and development teams are intensifying efforts to identify alternative materials that deliver equivalent thermal performance at lower total landed costs. This era of fiscal headwinds has underscored the resilience of agile teams capable of balancing technical excellence with supply chain adaptability.

Uncovering Critical Insights from Segmentation Dimensions to Navigate Diverse Thermal Management Strategies and Product Offerings Efficiently

Segmentation by product type reveals two primary pathways: active solutions that rely on circulating fluids or refrigerants to extract heat rapidly, and passive approaches that leverage conductive or phase-change mediums without mechanical intervention. Active systems offer precise temperature control under high-load scenarios, albeit with added complexity and energy consumption. In contrast, passive solutions excel in simplicity and reliability but may struggle to maintain uniform cell temperatures during peak discharge cycles. Companies are increasingly blending both approaches within hybrid platforms to achieve optimal trade-offs between performance, efficiency, and cost.

When considering cooling methodology, air-based systems remain appealing due to their minimal ancillary hardware and reduced weight. Yet liquid-based architectures, whether direct junction cooling that places coolant channels in direct contact with cell housings or indirect techniques that route thermal energy through intermediary cold plates, are gaining traction for their superior thermal conductance. Phase-change materials supplement these strategies by absorbing transient heat surges, making them especially valuable during rapid charging. Product roadmaps now frequently integrate multi-mode cooling to adjust dynamically to ambient conditions and duty cycles.

Installation level is another critical dimension. Cell-level thermal management affords exceptional control granularity, enabling individual temperature adjustments for each cell, but imposes high manufacturing complexity. Module-level solutions strike an intermediate balance by grouping cells under shared thermal interfaces, simplifying assembly while preserving reasonable temperature uniformity. At the pack level, overarching thermal jackets or integrated HVAC pathways offer holistic cooling with minimal per-unit customization but may introduce hotspots without careful design. Each tier demands different engineering skill sets and cost considerations.

End-user segmentation highlights divergent requirements between commercial vehicles and passenger cars. Commercial applications prioritize robustness and extended duty cycles, driving demand for heavy-duty liquid cooling loops and redundant safety features. Passenger cars, meanwhile, emphasize packaging efficiency and noise-vibration-harshness targets, favoring lighter, quieter systems. This bifurcation has led to distinct development tracks, where suppliers tailor materials, control algorithms, and form factors to suit the operational profiles of each market segment.

This comprehensive research report categorizes the Automotive Battery Thermal Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Cooling Method

- Installation Level

- End User

Understanding Regional Dynamics and Growth Drivers Shaping the Thermal Management Ecosystem across Americas EMEA and Asia-Pacific Markets

The Americas region remains a strategic stronghold for innovation in battery thermal management, underpinned by extensive R&D investment from leading OEMs and technology companies. Automotive hubs in Michigan, California, and Quebec have become centers of excellence for cooling system prototyping and testing, leveraging local talent pools and proximity to tier-one supply bases. Regulatory initiatives at the federal and state levels, including tax incentives for clean energy manufacturing and zero-emission vehicle mandates, continue to catalyze new pilot projects and scale-up facilities across North America.

Europe, the Middle East & Africa has also emerged as a dynamic arena for thermal management breakthroughs. Stringent emissions regulations and aggressive electrification targets in the European Union have driven rapid adoption of advanced cooling solutions, particularly in densely populated urban markets where range anxiety and charging infrastructure limitations remain critical concerns. Meanwhile, investment flows into battery gigafactories throughout the Middle East and North Africa are creating new corridors for component sourcing and assembly, with regional alliances forming to distribute thermal expertise across inbound assembly lines.

In Asia-Pacific, the convergence of leading battery manufacturers in China, Korea, and Japan has fueled unprecedented scale and standardization. Integrated manufacturing clusters are experimenting with next-generation thermal materials, such as graphene-enhanced heat spreaders and silicon-based cooling modules, at pilot line volumes. Government-backed programs in Southeast Asia are incentivizing local content requirements, prompting multinational system developers to establish joint ventures and technical centers in emerging markets. These collaborative ecosystems are accelerating time-to-market for novel thermal architectures and driving competitive differentiation.

This comprehensive research report examines key regions that drive the evolution of the Automotive Battery Thermal Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Driving Innovation Partnerships and Competitive Differentiation in Thermal Management Technology

Industry leaders are forging strategic partnerships to accelerate technological differentiation and secure stable supply chains. Major automotive OEMs have established co-development agreements with specialist cooling providers to engineer solutions embedded within their bespoke battery pack designs. Leading tier-one electronics suppliers are leveraging their thermal expertise from adjacent industries, such as data center cooling, to introduce scalable liquid-based modules adapted for vehicular use.

Simultaneously, pure-play thermal management companies are expanding their footprints through mergers and acquisitions, integrating proprietary phase-change composites and microchannel heat exchangers into broader product portfolios. These moves are reshaping competitive boundaries, enabling diversified service offerings that span from component manufacturing to turn-key system integration. Even within the supplier tier, a clear divide is emerging between those that emphasize lightweight, passive solutions for urban mobility applications and those that focus on heavy-duty active systems for commercial fleets.

These strategic maneuvers underscore a landscape in which collaboration, intellectual property consolidation, and scalable manufacturing capabilities define competitive advantage. Companies that successfully marry deep materials science expertise with global production agility are poised to capture a disproportionate share of emerging opportunities as electrification accelerates across all vehicle segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Battery Thermal Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Behr GmbH & Co. KG

- BorgWarner Inc.

- BYD Company Limited

- Continental AG

- Dana Incorporated

- DENSO Corporation

- Gentherm Incorporated

- Grayson Thermal Systems Ltd.

- Hanon Systems

- LG Energy Solution, Ltd.

- MAHLE GmbH

- Marelli Corporation

- Modine Manufacturing Company

- Robert Bosch GmbH

- Samsung SDI Co., Ltd.

- Setra Systems Inc.

- Valeo SA

- VOSS Automotive GmbH

- Webasto SE

Formulating Actionable Strategic Recommendations to Strengthen Market Position and Drive Sustainable Growth in Battery Thermal Management

Leaders should prioritize cross-functional collaboration between thermal engineers, battery chemists, and data science teams to unlock synergistic gains in system efficiency. By integrating predictive analytics into thermal control algorithms, organizations can reduce energy consumption while extending cell lifespans, which will differentiate their offerings in a crowded market. It is equally essential to establish flexible manufacturing lines capable of accommodating both cell- and module-level thermal assemblies, ensuring rapid adaptation to evolving customer requirements.

Supply chain resilience must be addressed through multi-sourcing strategies and regionalized production hubs to mitigate tariff impacts and logistical disruptions. Engaging in co-investment partnerships with raw material producers or specialized material science firms can secure preferential access to next-generation phase-change and composite materials. Additionally, pursuing strategic alliances with OEMs for early validation programs accelerates design cycles and de-risks large-scale implementation.

To stay ahead of regulatory shifts, companies should maintain active dialogue with policy-making bodies and participate in industry consortia that shape thermal performance standards. Investing in sustainability assessments-such as life cycle analyses of cooling fluids and thermal interface materials-can pre-empt future environmental requirements. Finally, adopting an open innovation mindset, including targeted start-up scouting and academic collaborations, will help organizations continuously infuse fresh ideas into product pipelines and drive breakthrough advancements.

Detailing a Comprehensive Research Methodology Combining Primary Interviews Secondary Data Sourcing and Analytical Validation Techniques

This report combines insights from extensive primary interviews with senior executives at OEMs, tier-one suppliers, and technology start-ups. Structured conversations focused on design priorities, material innovations, and supply chain challenges, enabling deep qualitative understanding of strategic imperatives. Secondary data sources, including patent databases, regulatory filings, and industry white papers, provided quantitative context and validated emerging trend hypotheses. These datasets were cross-validated through a rigorous triangulation process, ensuring alignment between stakeholder perspectives and documented developments.

Analytical frameworks such as SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis and PESTLE (Political, Economic, Social, Technological, Legal, Environmental) evaluation underpinned the strategic assessment of market dynamics. Scenario planning exercises were conducted to explore potential implications of tariff changes, technology breakthroughs, and regulatory shifts over multiple time horizons. Each scenario was stress-tested through sensitivity analyses, examining how variations in input parameters-such as material costs or consumer adoption rates-could influence industry trajectories.

The research methodology adheres to ANSI and ISO guidelines for market intelligence, emphasizing transparency, reproducibility, and stakeholder confidentiality. Report findings were subjected to peer review by independent subject-matter experts to ensure technical accuracy and objective interpretation. Throughout the process, ethical considerations and data integrity protocols were strictly maintained to deliver reliable insights for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Battery Thermal Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Battery Thermal Management System Market, by Product Type

- Automotive Battery Thermal Management System Market, by Cooling Method

- Automotive Battery Thermal Management System Market, by Installation Level

- Automotive Battery Thermal Management System Market, by End User

- Automotive Battery Thermal Management System Market, by Region

- Automotive Battery Thermal Management System Market, by Group

- Automotive Battery Thermal Management System Market, by Country

- United States Automotive Battery Thermal Management System Market

- China Automotive Battery Thermal Management System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Summarizing Core Takeaways Reinforcing the Critical Role of Advanced Thermal Management Solutions in Future Mobility and Energy Systems

In summary, advanced thermal management is emerging as a pivotal enabler for the next wave of electrified mobility and energy storage solutions. The integration of active and passive cooling modalities, coupled with predictive control systems, is reshaping expectations around battery safety, performance, and total cost of ownership. As tariff policies and regional incentives influence supply chain configurations, organizations must remain agile in sourcing materials and adapting production footprints.

Distinct segmentation pathways offer clear strategic choices, from high-precision cell-level cooling to scalable pack-level architectures tailored for commercial fleets or passenger vehicles. Regional dynamics underscore the importance of local partnerships and regulatory engagement in harnessing market opportunities across the Americas, EMEA, and Asia-Pacific. Furthermore, leading companies are distinguishing themselves through collaborative innovations, strategic M&A activity, and investments in proprietary thermal materials.

Moving forward, enterprises that embrace holistic strategies-integrating cross-functional R&D, supply chain resilience, and proactive policy advocacy-will secure competitive differentiation and sustainable growth. This report’s insights provide a foundational roadmap for navigating complex market forces and shaping the future of battery thermal management.

Seize Exclusive Insights Today and Partner with Ketan Rohom to Unlock Customized Thermal Management Market Intelligence for Strategic Decision Making

Seize exclusive insights today by engaging directly with Ketan Rohom to secure your comprehensive market research report focusing on advanced battery thermal management. Ketan Rohom, Associate Director of Sales & Marketing, brings deep expertise in translating complex technical analyses into strategic business opportunities. Through a personalized consultation, you can discuss tailored data requirements, explore bespoke research add-ons, and align findings with your organization’s unique objectives. By partnering at this critical juncture, you will gain early visibility into emerging thermal management technologies, potential supply chain vulnerabilities, and actionable market entry strategies.

To initiate this collaboration, reach out to coordinate a detailed briefing session that will outline report contents, customization options, and delivery timelines. By moving swiftly, you will position your team to make informed investment decisions, strengthen competitive positioning, and capitalize on the momentum of electrification trends. Transform raw data into strategic intelligence under the guidance of an industry veteran. Contact Ketan Rohom today to unlock unparalleled insights and accelerate your roadmap to thermal management excellence.

- How big is the Automotive Battery Thermal Management System Market?

- What is the Automotive Battery Thermal Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?