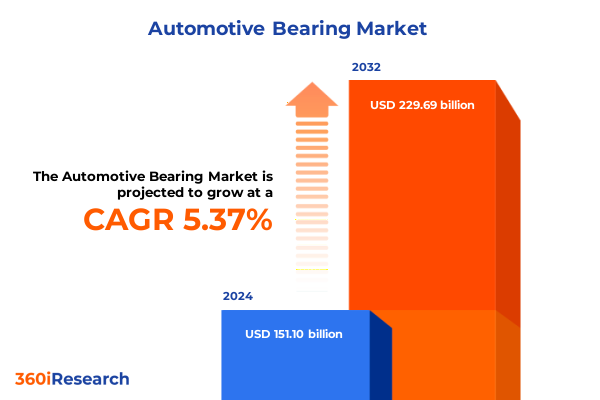

The Automotive Bearing Market size was estimated at USD 158.28 billion in 2025 and expected to reach USD 165.81 billion in 2026, at a CAGR of 5.46% to reach USD 229.69 billion by 2032.

Shifting Gears in Automotive Bearing Markets as Vehicle Electrification and Smart Manufacturing Redefine Performance and Durability Expectations

Paragraph1: The automotive bearing landscape has experienced dynamic evolution over the past decade, with rapid technological progress reshaping core performance metrics. Modern vehicles demand components that deliver the highest levels of efficiency, reliability, and longevity under increasingly stringent operating conditions. This expectation is further heightened by the surge in electric and hybrid powertrain adoption, which imposes unique thermal, acoustic, and load-management challenges. Bearings must now operate seamlessly within compact, high-speed environments, ensuring minimal friction and wear while supporting advanced driveline architectures.

Paragraph2: Simultaneously, advances in manufacturing processes have introduced smart production systems that leverage automation, real-time quality monitoring, and predictive maintenance. These innovations have not only accelerated production cycles but also enhanced consistency and traceability across global supply chains. As a result, bearing providers are compelled to integrate digital sensors, data analytics, and machine learning algorithms to anticipate failure modes and optimize maintenance schedules. This confluence of digital transformation and electrification is driving a fundamental shift in component design philosophy and production strategies.

Paragraph3: Against this backdrop, the following executive summary presents a comprehensive analysis of transformative trends, policy impacts, segmentation insights, regional dynamics, competitive landscapes, and strategic recommendations. The intent is to equip stakeholders with a clear understanding of the forces shaping the automotive bearing sector and to identify viable pathways for sustainable growth and operational excellence. Drawing on rigorous research methodologies, the analysis offers actionable perspectives tailored to the needs of decision makers and industry leaders.

Unprecedented Technological Advancements in Materials Science and Predictive Analytics Are Driving Revolutionary Shifts in Bearing Design and Supply Chains

Paragraph1: In recent years, material science breakthroughs have introduced new alloys and composite materials that significantly outperform traditional steel bearings in strength, weight reduction, and corrosion resistance. Innovations in ceramic and polymer-based formulations have enabled components that withstand extreme temperatures and reduce overall system mass, which is critical for enhancing vehicle efficiency. Moreover, the integration of nanomaterials has paved the way for self-lubricating surfaces and enhanced fatigue life, setting a new benchmark for bearing durability under severe operational stresses.

Paragraph2: Parallel to material enhancements, predictive analytics has emerged as a transformative enabler for both design optimization and supply chain management. By employing machine learning algorithms and advanced sensor networks, manufacturers can now forecast component failures with high accuracy and implement condition-based maintenance strategies. This proactive approach not only reduces unplanned downtime but also extends the service life of critical bearings. Furthermore, real-time data analytics facilitate dynamic demand forecasting, enabling suppliers to streamline inventory levels and minimize lead times across global distribution channels.

Paragraph3: Collectively, these technological shifts are fostering a new era of interconnected bearing ecosystems, where design innovation and digital intelligence converge to deliver superior performance. As a result, industry participants are reevaluating traditional business models, prioritizing R&D investments, and forging strategic collaborations with tech firms to harness the full potential of these advancements. This landscape transformation underscores the imperative for stakeholders to continually adapt and embrace emerging technologies to maintain competitive advantage.

Assessing the Ripple Effects of 2025 United States Tariff Adjustments on Automotive Bearing Supply Chains Cost Structures and Supplier Relationships

Paragraph1: The implementation of revised tariff measures in the United States during early 2025 has introduced notable complexities to the automotive bearing market. Adjustments under Section 301 have resulted in elevated duties on selected imported bearing assemblies and subcomponents, particularly those sourced from specific Asian markets. These increased cost burdens have compelled OEMs and tier-1 suppliers to reassess procurement strategies, diversify material sourcing, and explore nearshoring alternatives to mitigate financial exposure. In turn, manufacturers have accelerated their evaluation of domestic suppliers and regional production hubs to preserve margin integrity.

Paragraph2: Beyond direct cost implications, the tariff landscape has also influenced supplier dynamics and commercial negotiations. Bearing providers are renegotiating long-term contracts to incorporate duty escalation clauses, while service agreements increasingly feature flexible supply provisions. Such contractual adaptations aim to accommodate potential fluctuations in tariff policy, ensuring continuity of supply and fostering greater resilience against trade uncertainties. Additionally, partnerships with regional logistics providers have gained prominence, as stakeholders seek to optimize shipping routes and inventory buffers in response to levy unpredictability.

Paragraph3: These cumulative effects underscore the strategic importance of supply chain agility and policy awareness for automotive bearing stakeholders. By proactively monitoring regulatory developments and engaging in scenario planning, industry participants can reduce vulnerability to external shocks and sustain competitive positioning. The forthcoming analysis delves into how these tariff-driven shifts are reshaping operational priorities and investment decisions across the value chain.

Paragraph4: Additionally, aftermarket and repair networks are adapting service pricing models to account for the increased imported component costs, often offering bundled maintenance packages or value-added support to preserve customer loyalty. In parallel, some bearing manufacturers have initiated joint ventures with local foundries to develop tariff-exempt domestic production lines, thereby securing preferential duty treatment and reinforcing supply assurance.

Unveiling Strategic Segmentation Insights That Illuminate Diverse Bearing Market Niches from Material Composition to Application Requirements

Paragraph1: The automotive bearing market encompasses a multifaceted range of product categories defined by bearing type, including ball, plain, roller, and tapered roller variants. Within the ball bearing category, specialized configurations such as angular contact, deep groove, and self-aligning designs address specific load and alignment challenges. Plain bearings branch into journal and sleeve bearings, offering cost-effective solutions for high-load, low-speed applications. Roller bearings further diversify with cylindrical, needle, and spherical rollers, each tailored to distinct stress profiles and operational scenarios.

Paragraph2: Material selection plays a critical role in market segmentation, spanning ceramic, polymer, and steel constructs. Ceramic bearings excel in high-temperature and high-frequency environments, while polymer-based components deliver enhanced corrosion resistance and lightweight performance. Steel bearings dominate with carbon steel options for general automotive applications and stainless steel for corrosive operating conditions. Arrangement segmentation distinguishes between single row and double row configurations, balancing load capacity and space constraints to meet diverse engineering requirements.

Paragraph3: Distribution channels influence market accessibility, where traditional offline networks continue to serve established OEM and aftermarket channels alongside emerging online platforms that cater to smaller volume buyers and rapid delivery needs. Application-based segmentation captures the functional diversity of bearings utilized in chassis components, engine systems, steering assemblies, transmissions, and wheel hubs. Vehicle type segmentation further refines the market landscape, accounting for passenger cars, commercial vehicles, off-road machinery, and two-wheelers. Each vehicle class subdivides to address unique performance demands, ranging from heavy and light commercial platforms to agricultural, construction, hatchback, sedan, SUV, motorcycle, and scooter applications.

This comprehensive research report categorizes the Automotive Bearing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Bearing Type

- Material

- Arrangement

- Vehicle Type

- Distribution Channel

- Application

Decoding Regional Dynamics That Shape Automotive Bearing Demand Patterns across the Americas Europe Middle East & Africa and Asia-Pacific Markets

Paragraph1: The Americas region exhibits a dual focus on aftermarket growth and electrification-driven OEM demand. North American markets are witnessing substantial adoption of electric and hybrid powertrains, which emphasize bearings optimized for noise reduction and thermal management. In parallel, Latin American territories are experiencing rising aftermarket requirements as aging vehicle fleets necessitate replacement components, driving opportunities for both local manufacturers and international suppliers.

Paragraph2: Europe Middle East & Africa (EMEA) presents a heterogeneous landscape characterized by stringent regulatory standards and diverse economic conditions. Western European countries prioritize sustainability and energy-efficient drivetrains, prompting demand for lightweight, low-friction bearings. Middle Eastern economies, buoyed by infrastructure investments, rely on durable bearings for commercial and industrial applications. In contrast, several African markets remain focused on cost-effective solutions to support growing automotive penetration and maintenance of utility vehicles.

Paragraph3: The Asia-Pacific region stands as a central manufacturing hub and a rapidly expanding consumer market. China and India lead in production volumes and domestic consumption, with heightened focus on modular assembly lines and automation. Southeast Asian nations are emerging as key export bases, leveraging competitive labor costs and trade agreements. Meanwhile, advancements in high-precision bearing production in Japan and South Korea continue to influence global standards and innovation benchmarks, reinforcing the region’s pivotal role in the bearing industry ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Automotive Bearing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Global Bearing Manufacturers Competitive Strategies Product Offerings and Innovations Reshaping the Automotive Industry Value Chain

Paragraph1: A cohort of established bearing manufacturers exerts significant influence over market direction through diversified product portfolios and strategic global footprints. Companies have intensified investments in R&D to introduce next-generation ceramic hybrid bearings, polymer-encapsulated variants, and low-noise solutions tailored for electric drivetrains. Strategic partnerships with materials technology firms enable co-development of custom alloys, while targeted acquisitions facilitate consolidation of critical capabilities across regions.

Paragraph2: Competitive differentiation also arises from comprehensive service ecosystems, where manufacturers integrate condition monitoring, predictive maintenance platforms, and lifecycle management services. By deploying advanced sensor arrays and cloud-based analytics, these providers extend their value proposition beyond physical components to encompass performance optimization and risk mitigation. This transition towards outcome-based models underscores a shift in buyer preferences, with OEMs and fleet operators seeking total-cost-of-ownership reduction and enhanced operational transparency.

Paragraph3: Moreover, key players are intensifying efforts to localize production and strengthen regional supply networks. Establishing manufacturing facilities proximal to major automotive clusters reduces lead times and shields operations from global disruptions. Concurrently, digital trade interfaces and e-commerce channels enhance accessibility for aftermarket clientele. Collectively, these strategic initiatives enable industry leaders to capture incremental market share, drive margin improvements, and navigate evolving industry demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Bearing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB SKF

- C&U Group Co., Ltd.

- Cixing Group Co., Ltd.

- Federal-Mogul Holdings Corporation

- GKN Automotive Limited

- Iljin Bearing Co., Ltd.

- JTEKT Corporation

- Luoyang LYC Bearing Co., Ltd.

- MinebeaMitsumi Inc.

- Nachi-Fujikoshi Corp.

- Nippon Thompson Co., Ltd.

- NSK Ltd.

- NTN Corporation

- RBC Bearings Incorporated

- Rheinmetall Automotive AG

- Schaeffler AG

- The Timken Company

- Wafangdian Bearing Group Corporation

Formulating Actionable Strategic Recommendations to Enhance Material Innovation Supply Chain Agility and Digital Transformation in Bearing Production

Paragraph1: To harness emerging growth opportunities, industry leaders should prioritize investment in advanced material development, particularly in ceramic and polymer composites that offer superior performance under high-speed and corrosive conditions. Collaborative initiatives with specialized research institutions and material science startups can accelerate innovation cycles and establish competitive differentiation. Simultaneously, cross-functional teams should drive focused pilot programs to validate novel formulations in real-world vehicle applications before scaling production.

Paragraph2: Supply chain resilience must ascend as a core strategic objective, with diversification of supplier bases across multiple geographies and the integration of nearshore manufacturing options to mitigate tariff-related cost pressures. Forward-thinking companies can leverage predictive analytics to optimize inventory buffers, reduce stockouts, and dynamically adjust procurement schedules. Strengthening relationships with logistics partners and adopting digital supply chain platforms will further streamline operations and bolster transparency.

Paragraph3: Finally, embracing digital transformation throughout bearing production processes will unlock efficiency gains and quality enhancements. Implementing Industry 4.0 technologies, such as smart sensors, digital twins, and automated inspection systems, fosters real-time process control and rapid fault detection. Investing in workforce upskilling ensures that teams can effectively manage these technologies, driving continuous improvement and sustaining a culture of innovation.

Outlining Rigorous Research Methodology Employing Primary Interviews Secondary Data Triangulation and Quality Assurance Processes

Paragraph1: This analysis is grounded in a robust methodology that combines qualitative and quantitative research techniques to deliver comprehensive insights. The primary research phase encompassed structured interviews with OEM engineering leaders, tier-1 suppliers, aftermarket distribution executives, and industry analysts, providing firsthand perspectives on market dynamics, technological priorities, and emerging challenges. These interviews were documented, coded, and synthesized to extract actionable themes.

Paragraph2: Secondary data sources included peer-reviewed journals, technical white papers, industry association reports, and trade data. Each piece of information underwent cross-validation against multiple independent sources to ensure accuracy and minimize bias. Data triangulation methods were applied to reconcile discrepancies and establish consensus viewpoints, while advanced filtering techniques eliminated outdated or irrelevant references, maintaining the analysis’s currency.

Paragraph3: Quality assurance processes featured iterative peer reviews and fact-checking protocols. Subject matter experts in materials engineering, supply chain management, and trade policy scrutinized the findings to verify technical validity and contextual relevance. The final deliverables underwent editorial review to ensure clarity, consistency, and adherence to professional standards, guaranteeing that decision makers receive reliable and insightful guidance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Bearing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Bearing Market, by Bearing Type

- Automotive Bearing Market, by Material

- Automotive Bearing Market, by Arrangement

- Automotive Bearing Market, by Vehicle Type

- Automotive Bearing Market, by Distribution Channel

- Automotive Bearing Market, by Application

- Automotive Bearing Market, by Region

- Automotive Bearing Market, by Group

- Automotive Bearing Market, by Country

- United States Automotive Bearing Market

- China Automotive Bearing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Synthesis of Key Findings Reinforcing the Crucial Role of Advanced Materials Smart Manufacturing and Strategic Partnerships in Bearing Market Evolution

Paragraph1: The convergence of advanced materials innovation and smart manufacturing platforms has emerged as the primary catalyst for transformative value creation in the automotive bearing sector. Material enhancements, including ceramic and nanocomposite formulations, have elevated performance benchmarks, while digital tools and data-driven maintenance strategies have optimized operational lifecycles and reduced total cost of ownership.

Paragraph2: Strategic partnerships, both across the supply chain and with technology providers, have proven essential for unlocking rapid innovation and market responsiveness. Collaborative R&D initiatives and joint ventures have accelerated the development of specialized bearing solutions, aligning technological capabilities with evolving application requirements. Furthermore, supply chain agility and regional footprint expansion have provided critical buffers against geopolitical tensions and trade policy shifts.

Paragraph3: These findings underscore the need for stakeholders to adopt a holistic approach that integrates material, digital, and strategic dimensions. By aligning R&D, manufacturing, and supply chain priorities around common performance and sustainability goals, industry participants can navigate emerging challenges and capitalize on growth opportunities. Moving forward, continuous adaptation and proactive investment will define competitive success in this dynamic landscape.

Paragraph4: Looking ahead, the interplay between material innovation, digital integration, and strategic alliances will continue to evolve as market participants respond to emerging mobility trends and regulatory frameworks. Continuous monitoring of technological breakthroughs and policy shifts will be crucial to sustaining competitive positioning in an increasingly complex global marketplace.

Empowering Decision Makers with Direct Liaison to Associate Director Sales & Marketing to Acquire the Full Automotive Bearing Market Research Report

Paragraph1: For executives and strategic planners seeking in-depth analysis, bespoke data visualizations, and tailored consulting support, direct engagement with Ketan Rohom, Associate Director, Sales & Marketing, offers a streamlined path to acquire the comprehensive market research report. This report provides granular insights into segmentation dynamics, regional trends, competitive benchmarks, and regulatory impacts, equipping leaders with the information necessary to make informed decisions.

Paragraph2: By partnering with the sales and marketing leadership, organizations can access customized briefings, sample data extracts, and pilot consulting engagements to align the research deliverables with specific business objectives. This collaborative approach ensures that the insights incorporated into strategic roadmaps and investment plans are directly relevant to company priorities and operational contexts.

Paragraph3: To initiate a consultation and obtain the full report, decision makers are encouraged to connect with Ketan Rohom to explore tailored options and secure immediate access to critical automotive bearing market intelligence. Empowered with this knowledge, stakeholders can confidently chart a course toward innovation, resilience, and sustained competitive advantage.

- How big is the Automotive Bearing Market?

- What is the Automotive Bearing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?