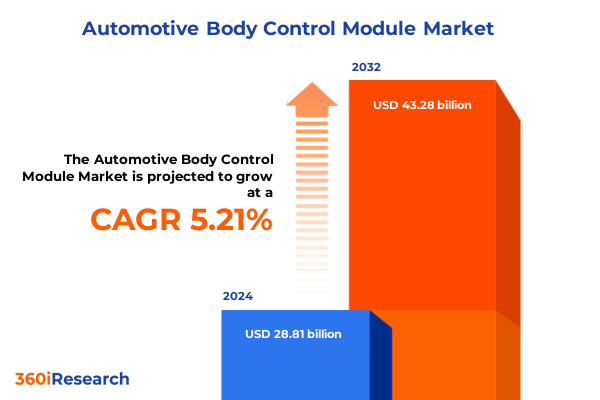

The Automotive Body Control Module Market size was estimated at USD 30.32 billion in 2025 and expected to reach USD 31.83 billion in 2026, at a CAGR of 5.21% to reach USD 43.28 billion by 2032.

Unveiling the Pivotal Role of Body Control Modules in Modern Vehicles and Their Strategic Importance in the Evolving Automotive Ecosystem

Body Control Modules serve as the nerve centers of a vehicle’s nonpowertrain electronic functions, orchestrating critical systems such as door locks, mirror adjustments, lighting arrays, and climate controls. By coordinating these subsystems, the module not only ensures seamless operation but also defines the quality of the in-cabin experience. As the automotive sector advances toward heightened connectivity and autonomy, these units must handle increasingly complex software architectures, robust communication protocols, and stringent cybersecurity measures to manage the growing volume of vehicle data.

Transitioning from basic relay-based control to sophisticated microcontroller-driven solutions, stakeholders view these modules as key enablers of future mobility trends. Automakers rely on them to deliver personalized in-cabin experiences, integrate advanced safety features, and support electrification initiatives through smart power management. In parallel with consumer-driven enhancements, regulatory mandates around lighting performance, intrusion detection, and remote access control have driven continuous innovation. Consequently, supply chain partners are prioritizing scalability and interoperability to address the dual demands of cost optimization and rapid technological advancement.

Mapping the Transformational Shifts Reshaping the Body Control Module Landscape amid Technological Convergence and Connectivity Demands

The landscape of Body Control Modules is undergoing profound transformation, driven by the convergence of electrification, software-defined architectures, and pervasive connectivity demands. Traditional distributed electronic control strategies are giving way to centralized domain controllers that consolidate multiple functions-ranging from access management to lighting control-into unified platforms. These domain controllers not only streamline wiring harnesses but also enable over-the-air software updates, creating a more agile and secure vehicle environment.

Simultaneously, the rise of electric and hybrid vehicle platforms has intensified focus on integrated power distribution functionalities within the module, demanding heat-resilient designs and advanced fault-detection capabilities. Wireless communication protocols are increasingly embedded alongside legacy wired networks, fostering new use cases such as remote diagnostics and predictive maintenance. Moreover, the push toward autonomy has placed unprecedented emphasis on rapid data exchange and real-time system diagnostics, compelling module developers to adopt high-bandwidth architectures and fortified cybersecurity frameworks.

Assessing the Cumulative Impact of United States Tariffs on Automotive Body Control Module Supply Chains and Cost Structures in 2025

Since the inception of Section 301 tariffs on imported Chinese automotive components, Body Control Module manufacturers have contended with elevated input costs that reverberate across the entire supply chain. These levies have applied sustained pressure on raw material procurement and subassembly sourcing, driving many Tier One suppliers to reevaluate their global footprints. In response, a growing number of companies have diversified manufacturing operations into Mexico and relocated critical assembly lines to domestic facilities, seeking to mitigate tariff exposure and optimize total landed costs.

At the same time, aftersales providers have passed incremental cost burdens to end customers, affecting repair and replacement pricing structures. Original equipment manufacturers, aiming to preserve margin integrity, have intensified collaboration with regional suppliers while exploring nearshoring partnerships for both high- and low-voltage control modules. Looking ahead, the cumulative effect of persistent tariff measures underscores the importance of resilient sourcing strategies that balance cost, quality, and regulatory compliance across every stage of module development.

Deep Insights into Body Control Module Market Segmentation Across Applications, Vehicle Types, End Users, Voltage Levels, and Emerging Connectivity Technologies

A nuanced examination of market segmentation reveals that application-based distinctions drive distinct development priorities for module vendors. Within the access control domain, emphasis is placed on the reliability and precision of door, mirror, window, and wiper control subsystems, whereas centralized body control units demand advanced gateway functionality and intrusion-detection algorithms. Comfort control modules differentiate along climate, seating, and sunroof functions, each requiring custom calibration and user-interface integration, while lighting control assemblies must accommodate daytime running lamps, headlamps, interior illumination, and tail-lamp coordination under evolving regulatory standards.

Vehicle-type segmentation further influences requirements, as modules designed for heavy and light commercial vehicles must support load-focused power distribution and extended durability, contrasted with those for electric, hybrid, and internal combustion passenger vehicles where weight optimization and energy efficiency take precedence. End-user segmentation underscores divergent distribution channels: aftermarket offerings tailored through authorized dealerships and independent repair shops contrast with original equipment assembly produced by OEM plants and tier-one supplier facilities. Voltage-oriented choices between high- and low-voltage platforms dictate component selection and thermal management strategies, while wired interfaces such as CAN, FlexRay, LIN, and MOST coexist with emerging wireless protocols including Bluetooth, NFC, and Wi-Fi to support next-generation connectivity use cases.

This comprehensive research report categorizes the Automotive Body Control Module market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Vehicle Type

- Voltage

- Application

- End User

Geopolitical and Market Dynamics Driving Regional Variations in Body Control Module Adoption Across Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics are equally pivotal in shaping the evolution of Body Control Modules, as each geography exhibits unique regulatory, economic, and technological influences. In the Americas, nearshoring trends in Mexico and revitalized domestic manufacturing in the United States are coupled with an emphasis on integrated gateway modules that satisfy North American safety and emissions obligations. Local OEMs and tier-one suppliers collaborate on regionally optimized designs to manage cost pressures arising from persistent tariff regimes.

Across Europe, the Middle East, and Africa, stringent safety standards and harmonized lighting regulations drive advanced adaptive headlamp systems and robust intrusion-detection features. The emphasis on vehicle personalization within luxury segments is matched by cost-sensitive volume production in emerging EMEA markets, fostering a dual-track strategy for module developers. In the Asia-Pacific region, high-volume production in China is supported by local content requirements and government incentives for electric mobility, while technology leadership emanates from Japanese and South Korean suppliers pioneering domain controller architectures. India’s rapidly growing passenger vehicle market likewise presents a fertile ground for modular, scalable body-control solutions.

This comprehensive research report examines key regions that drive the evolution of the Automotive Body Control Module market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Body Control Module Suppliers Innovations, Strategic Collaborations, and Competitive Dynamics Shaping the Industry’s Future Trajectory

Leading suppliers are capitalizing on the accelerating shift to domain-centric architectures and increased software complexity. Continental has expanded its portfolio to include high-performance gateway modules that integrate intrusion detection and remote diagnostic functionalities, while Bosch focuses on scalable thermal management within high-voltage comfort control systems. Denso’s collaborations with electric vehicle OEMs underscore its strength in weight-optimized designs and seamless integration with battery-management systems.

Valeo distinguishes itself in adaptive lighting control, investing in LED and laser illumination technologies that enhance safety and energy efficiency. ZF leverages its expertise in mechatronics to deliver centralized body controllers featuring advanced communication interfaces, and Delphi continues to push software-defined solutions that enable over-the-air calibration. Across this competitive landscape, strategic partnerships with semiconductor vendors and software firms are becoming a prerequisite, as suppliers seek to complement hardware expertise with in-vehicle networking stacks and embedded security toolkits.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Body Control Module market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aptiv PLC

- Continental Automotive GmbH

- Denso Corporation

- Hella GmbH & Co. KGaA

- Hitachi Astemo, Ltd.

- Hyundai Mobis Co., Ltd.

- Lear Corporation

- Magneti Marelli S.p.A.

- Marelli Europe S.p.A.

- Mitsuba Corporation

- Mitsubishi Electric Corporation

- Nidec Corporation

- Panasonic Automotive Systems Co., Ltd.

- Robert Bosch GmbH

- VALEO SAS

- Visteon Corporation

- ZF Friedrichshafen AG

Strategic Recommendations for Automotive Industry Leaders to Navigate Technological Disruption, Tariff Pressures, and Supply Chain Complexities in Body Control Modules

In light of persistent tariffs and accelerating technological innovation, industry leaders should prioritize diversification of manufacturing footprints by integrating nearshore and domestic production capabilities. Investing in flexible assembly lines that can pivot between high- and low-voltage module fabrication will help balance EV-specific demands against ICE and hybrid platforms. Moreover, strengthening partnerships with semiconductor and software providers can accelerate the development of robust, software-defined gateway architectures that support over-the-air updates and predictive maintenance.

To address rising cybersecurity risks, module designers must embed advanced encryption standards and intrusion-detection systems directly into hardware platforms. Embracing wireless connectivity protocols alongside traditional wired networks will open new opportunities for remote diagnostics and user personalization, but this requires rigorous validation environments to ensure reliability. Finally, fostering collaborative ecosystems with OEMs and aftermarket channels will streamline regulatory compliance and speed product launch cycles, enabling stakeholders to convert market insights into sustained competitive advantage.

Comprehensive Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Advanced Segmentation Techniques for Robust Market Insights

This analysis is founded on a comprehensive research methodology that blends primary and secondary approaches. Primary research included in-depth interviews with module design engineers, supply chain executives, and aftermarket service managers to capture real-world challenges and technology requirements. Parallel secondary research encompassed a review of trade data, regulatory filings, patent landscapes, and cybersecurity standards to map evolving compliance imperatives.

Segmentation modeling was developed through rigorous analysis of application-specific and vehicle-type criteria, supplemented by voltage and technology considerations. Regional market assessments leveraged customs statistics, OEM production figures, and government incentive programs. Competitive profiling combined company filings, press releases, and patent-application trends. Finally, draft findings were validated through expert panel workshops, ensuring that conclusions reflect both strategic foresight and operational realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Body Control Module market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Body Control Module Market, by Technology

- Automotive Body Control Module Market, by Vehicle Type

- Automotive Body Control Module Market, by Voltage

- Automotive Body Control Module Market, by Application

- Automotive Body Control Module Market, by End User

- Automotive Body Control Module Market, by Region

- Automotive Body Control Module Market, by Group

- Automotive Body Control Module Market, by Country

- United States Automotive Body Control Module Market

- China Automotive Body Control Module Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Conclusive Perspectives on Emerging Opportunities, Challenges, and Strategic Imperatives for Body Control Module Stakeholders in a Rapidly Evolving Automotive Sector

The examination of Body Control Module evolution underscores a dynamic interplay between technological convergence, regulatory imperatives, and shifting trade landscapes. As vehicle architectures migrate toward software-defined domain controllers, module suppliers must enhance their hardware and software co-development capabilities. Persistent tariff measures have accelerated supply chain realignment, underscoring the need for flexible manufacturing networks and strategic nearshoring.

Segmentation insights reveal that nuanced application requirements-from access and comfort to lighting and safety-will continue to drive specialized module enhancements. Concurrently, regional market dynamics demand tailored solutions that align with local regulations and production incentives. Competitive analysis highlights the critical role of strategic partnerships, as hardware expertise must be complemented by advanced communication stacks and cybersecurity frameworks. In this context, agile decision-making and collaborative ecosystems will distinguish industry leaders poised to capitalize on emerging opportunities.

Unlock Exclusive Strategic Support and Tailored Market Intelligence by Engaging Directly with Ketan Rohom, Associate Director of Sales & Marketing

For organizations seeking to deepen their understanding of Body Control Module dynamics and secure a competitive edge, direct engagement can unlock unparalleled strategic insights. By partnering with Ketan Rohom, Associate Director, Sales & Marketing, you gain personalized access to comprehensive analyses covering market segmentation, regional nuances, tariff impacts, and emerging technology trajectories. This collaboration ensures that decision-makers receive tailored recommendations and actionable intelligence aligned with their unique objectives.

Whether you aim to refine sourcing strategies, optimize product roadmaps, or fortify supply chain resilience, this expert consultation will guide you through the intricate landscape of module manufacturing and integration. Take the next step toward informed decision-making and sustained growth by initiating a dialogue with Ketan Rohom. Elevate your strategic planning with data-driven clarity and transform insights into decisive actions.

- How big is the Automotive Body Control Module Market?

- What is the Automotive Body Control Module Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?