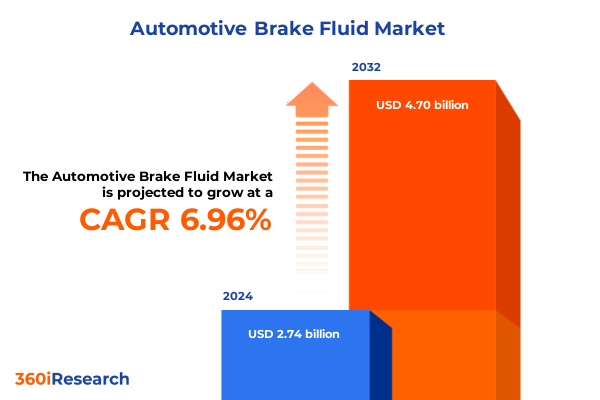

The Automotive Brake Fluid Market size was estimated at USD 2.93 billion in 2025 and expected to reach USD 3.12 billion in 2026, at a CAGR of 6.97% to reach USD 4.70 billion by 2032.

Discover the Critical Role of Brake Fluid Innovations in Maintaining Vehicle Safety and Performance in Modern Automotive Ecosystems

Brake fluid serves as the unsung hero of hydraulic braking systems, translating pedal force into the stopping power essential for vehicle safety. Over the past decade, advancements in fluid chemistry have elevated performance standards, balancing high boiling points, moisture tolerance, and environmental compliance. As regulatory bodies tighten emission and safety requirements, manufacturers have accelerated research into advanced glycol, silicone, and synthetic formulations that prevent brake fade under extreme conditions. This evolution underscores brake fluid’s pivotal role not only in routine maintenance but also in the broader quest for automotive reliability and driver confidence.

In parallel, consumer expectations are shifting. Drivers increasingly demand extended service intervals and compatibility with sophisticated electronic stability control systems, imposing stricter requirements on fluid stability and purity. Consequently, original equipment manufacturers and aftermarket suppliers have intensified collaboration to ensure seamless integration of next-generation brake fluids. This convergence of performance, safety, and sustainability imperatives sets the stage for a transformative trajectory in fluid innovation, compelling industry stakeholders to reimagine product portfolios and distribution strategies.

Witness How Technological Breakthroughs and Evolving Regulations Are Reshaping the Competitive Dynamics of the Brake Fluid Market

The landscape of the automotive brake fluid market has undergone profound transformative shifts driven by technological breakthroughs, evolving regulatory frameworks, and changing mobility paradigms. Advancements in nanotechnology-enabled additives now allow brake fluids to maintain thermal stability even under prolonged heavy-duty braking cycles. At the same time, the integration of Internet of Things–enabled sensor modules within caliper assemblies is beginning to transmit real-time fluid performance metrics, enabling predictive maintenance regimes and reducing downtime for commercial fleets.

Regulatory momentum toward lower global warming potential fluorinated compounds is compelling chemists to explore non-traditional base fluids and bio-derived esters that can meet stringent safety standards without compromising on performance. Furthermore, the rise of autonomous driving architectures has led to increased collaboration between fluid engineers and software developers to ensure compatibility with electro-hydraulic braking systems that can deliver split-second actuation. These converging technological forces are redefining how stakeholders position brake fluid offerings, from driving premiumization strategies to unlocking new service-based revenue models in connected vehicles.

Examine the Ripple Effects of 2025 Tariff Revisions on Global Supply Chains and Sourcing Strategies for Brake Fluid Manufacturers

In response to rising geopolitical complexities and domestic industry protections, the United States enacted a series of tariff adjustments in early 2025 that have reverberated across the brake fluid supply chain. These measures, targeting imported raw materials and finished fluid products, were introduced to bolster domestic chemical manufacturing and safeguard local suppliers from price undercutting. As a result, downstream stakeholders have grappled with recalibrating procurement strategies to mitigate cost inflation without disrupting production schedules.

Automakers and aftermarket distributors have responded by diversifying their vendor portfolios, sourcing key glycol and silicone-based intermediates from non-traditional regions, thereby redistributing global trade flows. Simultaneously, certain suppliers have accelerated capital investments in U.S.-based blending and packaging facilities to circumvent tariff exposure and shorten lead times. Although these adjustments introduced near-term volatility, they also stimulated capacity expansions and innovation hubs within North American chemical clusters, setting the stage for a more resilient, regionally balanced brake fluid ecosystem.

Unlock the Strategic Imperative of Tailoring Brake Fluid Portfolios to Complex Distribution, Application, and Vehicle Type Requirements

A nuanced understanding of market segmentation reveals critical pathways for tailored product development and distribution. When analyzing fluid demand through the lens of distribution channel dynamics, it becomes apparent that original equipment provides a platform for high-performance, long-life formulations aligned with OEM quality mandates, whereas the aftermarket segment prioritizes affordable, universally compatible solutions that cater to routine maintenance cycles. This dual-channel framework underscores the necessity for differentiated packaging, branding, and technical service support.

Shifting focus to braking system application, disc brake assemblies dominate passenger car platforms due to their superior heat dissipation, prompting fluid developers to optimize boiling point elevation and moisture resistance. However, legacy drum brake systems persist in commercial and emerging market vehicles, sustaining demand for graded glycol blends that mitigate corrosion and maintain consistent viscosity across temperature extremes. Beyond application, vehicle type profoundly influences formulation specificity. Heavy commercial carriers demand brake fluids that can withstand rigorous duty cycles and heavy payloads, while two-wheelers require lower-viscosity grades to ensure rapid response and reduced line resistance. Light commercial and passenger vehicles occupy an intermediary spectrum, necessitating balanced hydrolytic stability and performance.

Finally, fluid chemistries ranging from traditional DOT3 to advanced DOT5.1 classes offer a roadmap for product innovation. DOT3 formulations fulfill entry-level requirements, whereas DOT4 variants deliver enhanced boiling point performance for high-speed applications. Silicone-based DOT5 fluids, though less common, address niche needs for non-corrosive, moisture-immune systems, and the hybrid DOT5.1 category merges silicone’s stability with glycol’s compatibility. Mastering this multidimensional segmentation empowers companies to align R&D portfolios with distinct market niches, ensuring resonance with end-user requirements and distribution partner expectations.

This comprehensive research report categorizes the Automotive Brake Fluid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Type

- Distribution Channel

- Application

Reveal How Regional Trends and Regulatory Harmonization Are Driving Diverse Brake Fluid Demand Patterns Worldwide

Regional dynamics continue to sculpt the competitive terrain, with distinct drivers emerging across the Americas, Europe, Middle East & Africa, and Asia-Pacific markets. North America’s mature automotive infrastructure, underpinned by extensive aftermarket networks and stringent safety regulations, propels demand for premium fluid grades and connected maintenance services. Meanwhile, Latin America’s expanding light commercial and passenger vehicle fleets are catalyzing opportunities for cost-effective glycol-based blends that match the region’s varied climatic conditions.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts, such as UNECE brake fluid standards, are fostering cross-border fluid trade and elevating quality benchmarks. In Western Europe, the push toward electrified powertrains amplifies the need for fluids compatible with regenerative braking systems, while in the Middle East, extreme temperature tolerances dictate the adoption of high boiling point formulations. Africa’s diverse vehicle park, encompassing both modern passenger cars and robust commercial trucks, sustains a broad spectrum of fluid requirements.

The Asia-Pacific region represents the fastest-growing frontier, driven by robust two-wheeler penetration in Southeast Asia, surging passenger car ownership in China, and burgeoning light commercial vehicle production in India. This growth trajectory demands scalable manufacturing outputs and agile supply chains to service heterogeneous end-use applications. Confluence of evolving regulatory landscapes and localized manufacturing partnerships within each region continues to shape portfolio prioritization and go-to-market strategies.

This comprehensive research report examines key regions that drive the evolution of the Automotive Brake Fluid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Explore How Leading Suppliers Are Forging Partnerships and Mergers to Elevate Brake Fluid Performance and Distribution Reach

Within this competitive arena, leading chemical producers and lubricant specialists are deploying strategic initiatives to secure market leadership. Global conglomerates have leveraged integrated supply chain capabilities to align raw material sourcing with proprietary additive technologies, enhancing product differentiation and margin resilience. Emerging specialty players, conversely, have focused on rapid product innovation cycles and targeted technical support to carve out niche segments in high-performance and telematics-enabled brake fluids.

Strategic partnerships between fluid formulators and braking system OEMs are proliferating, enabling co-development of custom blends that optimize compatibility with advanced caliper geometries and electronic safety protocols. Concurrently, acquisitions and joint ventures have accelerated in regions with fragmented aftermarket landscapes, consolidating distribution channels and strengthening service network coverage. These maneuvers underscore a broader trend toward end-to-end solution offerings, wherein suppliers not only provide fluids but also predictive maintenance analytics and branded service packages to foster customer loyalty and recurring revenue streams.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Brake Fluid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- BP p.l.c.

- Castrol Limited

- Chevron Corporation

- China Petrochemical Corporation

- ExxonMobil Corporation

- FUCHS PETROLUB SE

- Granville Oil & Chemicals Ltd.

- HKS Co., Ltd.

- Liqui Moly GmbH

- MOTUL S.A.

- Prestone Products Corporation

- Qingdao Copton Technology Co., Ltd.

- RAVENOL Group

- Robert Bosch GmbH

- Royal Dutch Shell plc

- Sinopec Lubricant Co., Ltd.

- TotalEnergies SE

- Valvoline Inc.

- Zhejiang Luyuan Chemical Co., Ltd.

Implement a Holistic Strategy Combining Agile Manufacturing, Collaborative R&D, and Digital Services to Drive Brake Fluid Market Leadership

To navigate the rapidly evolving brake fluid landscape, industry leaders must adopt a proactive, multidimensional strategy. First, investing in modular blending facilities near major vehicle manufacturing clusters will reduce logistics costs and tariff exposure, ensuring supply chain agility. Second, fostering collaborative R&D ecosystems that integrate additive chemists, OEM engineers, and telematics experts will accelerate the commercialization of next-generation formulations tailored for autonomous and electric vehicles. Third, harnessing digital platforms to deliver real-time fluid condition monitoring and predictive maintenance alerts will differentiate service offerings and deepen customer engagement.

Additionally, forging strategic alliances with aftermarket distributors and service chains can streamline brand penetration, particularly in high-growth emerging markets. Equally important is cultivating sustainability credentials by transitioning to bio-based esters and low-GWP co-solvents, aligning with global decarbonization commitments. Finally, implementing tiered pricing models that reflect formulation complexity and service integration will optimize revenue capture across distinct customer segments. Through these concerted actions, organizations can not only mitigate evolving regulatory and tariff risks but also secure a competitive foothold in a sector poised for technological disruption.

Understand the Comprehensive Research Framework That Combines Qualitative Interviews, Quantitative Surveys, and Advanced Data Analytics

The insights contained within this analysis derive from a rigorous research methodology encompassing primary and secondary data sources. Our approach began with in-depth interviews with chemical formulators, braking system OEM engineers, and aftermarket service providers to validate emerging performance requirements and market challenges. Concurrently, we conducted a systematic review of regulatory filings, trade tariff documentation, and industry white papers to map the evolving policy landscape.

Quantitative data was gathered through a structured survey of global distributors and end users to gauge fluid preferences, end-market applications, and purchasing behaviors. This was complemented by an exhaustive examination of company annual reports, patent filings, and financial disclosures to benchmark supplier strategies and investment priorities. Advanced analytics tools were employed to identify segmentation patterns, regional growth differentials, and competitive positioning, ensuring that our narrative reflects both macro trends and ground-level realities. Together, these methodologies provide a robust foundation for the actionable insights presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Brake Fluid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Brake Fluid Market, by Vehicle Type

- Automotive Brake Fluid Market, by Type

- Automotive Brake Fluid Market, by Distribution Channel

- Automotive Brake Fluid Market, by Application

- Automotive Brake Fluid Market, by Region

- Automotive Brake Fluid Market, by Group

- Automotive Brake Fluid Market, by Country

- United States Automotive Brake Fluid Market

- China Automotive Brake Fluid Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesize the Critical Factors Shaping Future Brake Fluid Innovations and Competitive Advantage Across Global Markets

As the automotive industry accelerates toward electrification, connectivity, and autonomous mobility, brake fluid formulations must evolve in tandem to ensure safety, reliability, and regulatory compliance. The interplay between distribution dynamics, system application requirements, and vehicle typologies underscores the complexity of product portfolio management. Concurrently, tariff shifts and regional growth disparities demand agile supply chain configurations and regionally attuned go-to-market strategies.

Leading companies that invest in localized manufacturing, collaborative innovation, and digital service integration will be best positioned to capitalize on emerging opportunities. By embracing sustainability imperatives and delivering tailored solutions for diverse braking architectures, stakeholders can differentiate their offerings and foster long-term loyalty. Ultimately, the capacity to anticipate regulatory shifts, leverage partnerships, and harness data-driven insights will define leadership in the brake fluid market moving forward.

Unlock Exclusive Strategic Insights and Gain a Competitive Edge in the Automotive Brake Fluid Market by Partnering with Ketan Rohom for Your Next Research Investment

To explore the full breadth of insights, competitive benchmarks, and strategic opportunities within the global automotive brake fluid market, connect directly with Ketan Rohom, Associate Director, Sales & Marketing. Whether your focus is on distribution dynamics, emerging formulation technologies, tariff impacts, or region-specific growth drivers, you’ll gain access to a comprehensive report that equips your organization with actionable intelligence. Engage today to secure your copy and empower your decision-making with robust data, forward-looking analysis, and tailored recommendations designed to drive market leadership and sustainable growth

- How big is the Automotive Brake Fluid Market?

- What is the Automotive Brake Fluid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?