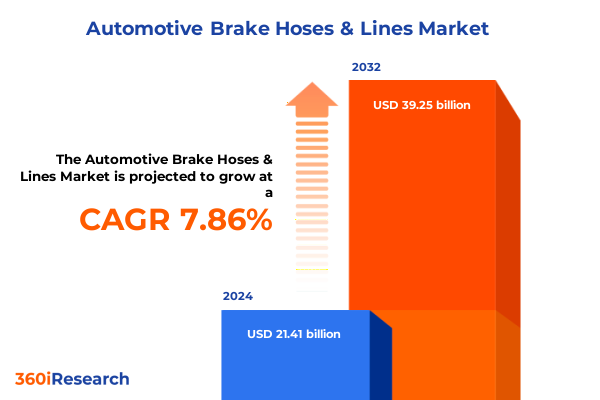

The Automotive Brake Hoses & Lines Market size was estimated at USD 23.09 billion in 2025 and expected to reach USD 24.64 billion in 2026, at a CAGR of 7.87% to reach USD 39.25 billion by 2032.

Understanding the Fundamental Importance of Brake Hoses and Lines for Ensuring Vehicle Safety Reliability and Performance under Diverse Operating Conditions

Understanding the Fundamental Importance of Brake Hoses and Lines for Ensuring Vehicle Safety Reliability and Performance under Diverse Operating Conditions

Brake hoses and brake lines serve as the vital circulatory system of a vehicle’s braking architecture, conveying hydraulic fluid from the master cylinder to the calipers and wheel cylinders with unwavering integrity. Any compromise in this fluid transfer pathway can diminish braking responsiveness, erode driver confidence, and potentially lead to catastrophic system failures. As modern vehicles demand ever-higher performance thresholds and stringent safety benchmarks, these components play an increasingly pivotal role in preserving stopping power and maintaining consistent pedal feel across varied driving scenarios.

In parallel with technological advancements in braking systems, the material composition and design intricacies of brake hoses and lines have evolved to accommodate heavier loads, higher pressures, and broader temperature ranges. Regulatory agencies worldwide continue to tighten performance and durability standards, compelling manufacturers to innovate at both the material science and production process levels. Consequently, the industry has witnessed a convergence of advanced polymers, high-grade metals, and integrated safety features that collectively reinforce the reliability of these critical components under challenging environmental and operational conditions.

Exploring the Major Technological Regulatory and Market Shifts Reshaping the Automotive Brake Hose and Line Landscape Globally

Exploring the Major Technological Regulatory and Market Shifts Reshaping the Automotive Brake Hose and Line Landscape Globally

The automotive brake hose and line sector stands at the nexus of transformative technological innovation and stringent regulatory realignment. Electrification of drivetrains has spurred demand for brake-by-wire and regenerative braking solutions, prompting component designers to integrate electronic sensors and pressure modulators directly within hose assemblies. Meanwhile, digital manufacturing techniques such as automated braid weaving and laser welding have enhanced production precision and throughput, enabling manufacturers to meet rising complexity requirements without sacrificing consistency.

Simultaneously, evolving safety regulations in key markets mandate enhanced burst and abrasion resistance, driving the adoption of next-generation materials like PTFE composites and stainless steel alloys. Environmental imperatives have also accelerated efforts to reduce lifecycle carbon footprints through the use of recyclable polymers and streamlined production processes. These converging forces encourage a shift from traditional rubber hoses and cold-drawn steel lines toward innovative configurations that reconcile durability, weight reduction, and sustainability, laying the groundwork for a more resilient and adaptive supply chain.

Analyzing the Comprehensive Effects of 2025 United States Tariff Measures on Automotive Brake Hose and Brake Line Production and Supply Chains

Analyzing the Comprehensive Effects of 2025 United States Tariff Measures on Automotive Brake Hose and Brake Line Production and Supply Chains

The imposition of new tariff measures by the United States in early 2025 has prompted comprehensive reassessments within the global brake hose and line supply network. Manufacturers have encountered increased input costs for raw materials such as stainless steel tubing and high-performance synthetic polymers, leading to upwards pressure on component pricing. In response, many original equipment suppliers have accelerated initiatives to validate alternative material sources outside of traditional import routes and to renegotiate terms with domestic partners to preserve margin profiles.

Moreover, the heightened import duties have catalyzed a nearshoring trend, with several Tier 1 producers expanding North American manufacturing footprints to mitigate exposure to tariff volatility. This strategic pivot has alleviated some logistical bottlenecks, shortened lead times, and enhanced supply chain visibility. Yet, it has also underscored the importance of robust demand forecasting and scenario planning, as localized production brings new operational complexities in capacity management and workforce training. Ultimately, these tariff-driven dynamics reinforce the imperative for agility and diversified sourcing in maintaining competitive advantage.

Unveiling Critical Market Segmentation Layers Shaping Brake Hose and Line Insights across Product Distribution Application Material and Valve Integration

Unveiling Critical Market Segmentation Layers Shaping Brake Hose and Line Insights across Product Distribution Application Material and Valve Integration

In parsing the brake hose and line market through the lens of product type, two principal categories emerge: brake hoses and brake lines. Brake hoses encompass braided synthetic hose variants prized for flexibility and pressure tolerance, convoluted rubber hose designs that balance cost and performance under moderate conditions, and spiral braided PTFE hose configurations that deliver exceptional chemical resistance and durability. Brake lines, in turn, rely on cold drawn steel tubes for their rigidity and corrosion resistance, while seamless copper nickel tubes offer superior malleability and saline environment resilience.

Shifting to distribution channels, aftermarket pathways include Delivered Installed formats favored by convenience-seeking operators, as well as Delivered Uninstalled options that enable end users to perform their own installations. Original equipment channels bifurcate into Tier 1 and Tier 2 suppliers, each navigating distinct contractual frameworks and lead-time expectations. Application segmentation underscores demand variations among heavy commercial vehicles, where robust pressure handling is crucial; light commercial vehicles requiring a balance of performance and serviceability; and passenger cars that increasingly prioritize comfort and noise vibration harshness (NVH) characteristics. Material choices further define market segmentation, with PTFE emerging as the premium option, rubber maintaining a strong presence in cost-sensitive segments, and stainless steel growing in adoption for high-end and off-road applications. Finally, valve integration layers distinguish between assemblies that include built-in pressure regulation or fluid reservoirs versus streamlined designs without integrated valves, reflecting diverse OEM design philosophies and maintenance strategies.

This comprehensive research report categorizes the Automotive Brake Hoses & Lines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Application

- Material

- Valve Integration

Highlighting Distinct Regional Market Dynamics in the Americas Europe Middle East Africa and Asia Pacific for Automotive Brake Hose and Line Demand Trends

Highlighting Distinct Regional Market Dynamics in the Americas Europe Middle East Africa and Asia Pacific for Automotive Brake Hose and Line Demand Trends

In the Americas, established automotive hubs in the United States and Canada continue to underpin robust demand for both aftermarket and original equipment components. This region’s mature dealer networks and vehicle parc expansion sustain aftermarket growth, while nearshoring initiatives triggered by tariff pressures have bolstered domestic manufacturing capacities. Innovative crossover and light truck segments further drive adoption of advanced hose and line technologies, as manufacturers seek to differentiate through improved safety margins and reduced servicing intervals.

Across Europe, the Middle East, and Africa, stringent vehicle safety regulations and an accelerating shift toward electric mobility shape market dynamics. In Western Europe, strict type approval requirements compel rigorous testing and validation of brake assemblies, while the burgeoning EV adoption rate emphasizes lightweight component solutions to maximize battery range. The Middle East’s nascent EV rollout and Africa’s expanding commercial vehicle fleets present incremental opportunities, though infrastructure constraints and cost sensitivity necessitate tailored product offerings and localized service support.

Asia Pacific stands as a high-growth frontier, fueled by robust automotive production in China, India, and Southeast Asia. Rapid urbanization, expanding logistics networks, and government incentives for cleaner vehicle technologies drive demand for both standard and high-performance hose and line configurations. Manufacturers in the region harness economies of scale to offer competitively priced assemblies, while simultaneously investing in automation and material innovation to meet global quality benchmarks and export requirements.

This comprehensive research report examines key regions that drive the evolution of the Automotive Brake Hoses & Lines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Key Industry Players Pioneering Innovation Collaboration and Competitive Strategies in the Global Automotive Brake Hose and Line Sector

Examining Key Industry Players Pioneering Innovation Collaboration and Competitive Strategies in the Global Automotive Brake Hose and Line Sector

Leading automotive component manufacturers continue to shape the brake hose and line market through strategic investments in research and development, forging collaborations with material science experts and university institutions. By establishing joint innovation centers, these organizations accelerate the creation of next-generation polymer blends and metal alloys that enhance pressure resistance and extend service life. They also pilot additive manufacturing techniques to produce prototype fittings and integration modules, significantly reducing time-to-market for custom configurations.

In parallel, partnerships between Tier 1 suppliers and original equipment manufacturers have evolved beyond transactional relationships toward integrated supply models. Such alliances facilitate real-time data sharing on quality metrics and demand forecasts, enabling just-in-time production frameworks that minimize inventory costs. On the aftermarket front, distributors with expansive logistics networks leverage digital platforms to offer predictive maintenance services, bundling hose and line replacements with installation guidance to foster long-term customer loyalty. Through these multifaceted strategies, prominent players maintain differentiated market positions and fortify barriers to entry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Brake Hoses & Lines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advics Co., Ltd.

- Aisin Seiki Co., Ltd.

- Akebono Brake Industry Co., Ltd.

- Brembo S.p.A.

- Bridgestone Corporation

- Continental AG

- Denso Corporation

- Eaton Corporation plc

- Gates Corporation

- Goodyear Tire and Rubber Company

- Haldex AB

- Hitachi Astemo, Ltd.

- Knorr-Bremse AG

- Mando Corporation

- Michelin Group

- Parker Hannifin Corporation

- Sumitomo Rubber Industries, Ltd.

- Tenneco Inc.

- Toyoda Gosei Co., Ltd.

- Trelleborg AB

- Valeo SA

- WABCO Holdings Inc.

- Yokohama Rubber Company, Limited

- ZF Friedrichshafen AG

Delivering Actionable Strategic Recommendations to Drive Supply Chain Agility Innovation and Regulatory Excellence in Automotive Brake Hoses and Lines

Delivering Actionable Strategic Recommendations to Drive Supply Chain Agility Innovation and Regulatory Excellence in Automotive Brake Hoses and Lines

Industry leaders should prioritize the diversification of raw material sourcing to safeguard against tariff fluctuations and geopolitical disruptions. By qualifying multiple suppliers for key inputs, organizations can shift production volumes seamlessly and negotiate more favorable terms. Concurrently, investing in material substitution studies-exploring bio-based polymers or advanced thermoplastic elastomers-can yield both cost advantages and environmental benefits that resonate with OEM sustainability mandates.

Organizations must also accelerate digital transformation initiatives across procurement, manufacturing, and aftermarket channels. Implementing integrated enterprise resource planning systems that sync with supplier networks provides real-time visibility into inventory positions and production bottlenecks. In the aftermarket domain, deploying telematics-driven predictive maintenance algorithms can forecast hose and line replacement intervals, reducing downtime for fleet operators. Moreover, proactive engagement with regulatory bodies to shape forthcoming brake system safety standards will position members as industry authorities and facilitate smoother compliance pathways.

Outlining the Rigorous Research Methodology Combining Qualitative and Quantitative Techniques for In-Depth Automotive Brake Hose and Line Market Analysis

Outlining the Rigorous Research Methodology Combining Qualitative and Quantitative Techniques for In-Depth Automotive Brake Hose and Line Market Analysis

This study leverages a hybrid research framework that integrates primary interviews with leading OEM engineers, Tier 1 supplier executives, and aftermarket distributors, alongside extensive secondary data gathering from publicly available technical standards and industry white papers. Expert consultations provided nuanced perspectives on emerging material technologies, regulatory trajectories, and application-specific performance requirements. Complementary quantitative insights stem from a proprietary database of supplier shipments, regional trade flows, and tariff schedules, enabling cross-validation of qualitative findings.

Furthermore, the analysis incorporates scenario modeling to anticipate the implications of evolving trade policies and electrification adoption rates on component demand patterns. Supply chain mapping exercises identified critical nodes of vulnerability-such as single-source raw material providers-while competitive benchmarking elucidated best-practice innovation pathways. The resulting multi-layered approach ensures the findings deliver robust, defensible intelligence for strategic planning in the brake hose and line domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Brake Hoses & Lines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Brake Hoses & Lines Market, by Product Type

- Automotive Brake Hoses & Lines Market, by Distribution Channel

- Automotive Brake Hoses & Lines Market, by Application

- Automotive Brake Hoses & Lines Market, by Material

- Automotive Brake Hoses & Lines Market, by Valve Integration

- Automotive Brake Hoses & Lines Market, by Region

- Automotive Brake Hoses & Lines Market, by Group

- Automotive Brake Hoses & Lines Market, by Country

- United States Automotive Brake Hoses & Lines Market

- China Automotive Brake Hoses & Lines Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Insights and Strategic Imperatives to Secure Competitive Advantage in the Evolving Automotive Brake Hose and Line Ecosystem

Synthesizing Core Insights and Strategic Imperatives to Secure Competitive Advantage in the Evolving Automotive Brake Hose and Line Ecosystem

The convergence of stricter safety regulations, material innovation, and shifting trade landscapes underscores the urgent need for stakeholders to adopt a proactive stance. Manufacturers must balance cost pressures from tariff measures with the imperative to invest in advanced polymer and metal solutions that elevate system reliability. At the same time, digitalization and data-driven aftermarket services represent critical levers for differentiation and customer retention.

By aligning regional manufacturing strategies with localized demand drivers-whether through nearshoring in North America, compliance excellence in Europe, or volume-driven automation in Asia Pacific-organizations can optimize their global footprint. Collaboration across the value chain, from raw material suppliers to distribution networks, will remain instrumental in maintaining resilience against market fluctuations. Ultimately, those who integrate strategic sourcing, technological agility, and regulatory foresight will position themselves at the forefront of the brake hose and line industry’s next growth phase.

Connect with Ketan Rohom Associate Director Sales and Marketing to Acquire the Comprehensive Market Research Report on Automotive Brake Hoses and Lines

Ready to elevate your strategic decision-making with unparalleled depth and clarity on the automotive brake hose and line market? Reach out directly to Ketan Rohom Associate Director Sales and Marketing to explore how this comprehensive research report can empower your organization. Secure the insights you need to stay ahead of emerging trends, mitigate supply chain risks, and capitalize on transformative innovations by acquiring your copy today.

- How big is the Automotive Brake Hoses & Lines Market?

- What is the Automotive Brake Hoses & Lines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?