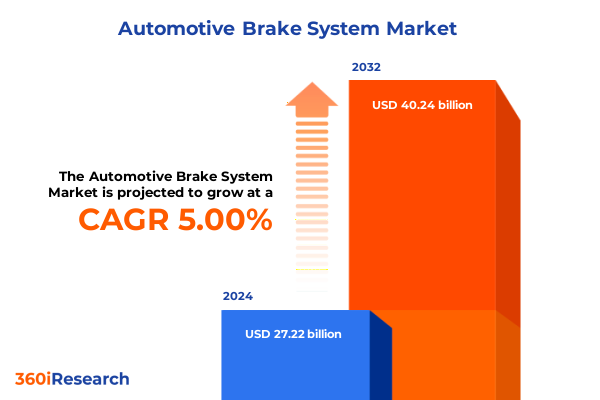

The Automotive Brake System Market size was estimated at USD 28.50 billion in 2025 and expected to reach USD 29.86 billion in 2026, at a CAGR of 5.04% to reach USD 40.24 billion by 2032.

Innovation and Integration Define the Modern Automotive Brake System Landscape as Electrification and Safety Regulations Reshape Industry Dynamics

The automotive brake system stands at the forefront of vehicle safety and performance, representing a fusion of mechanical reliability and digital intelligence. As regulatory bodies tighten safety mandates and emissions standards, brake systems have evolved from purely hydraulic assemblies to integrated platforms that optimize stopping power, energy recuperation, and electronic control. Electrification trends have driven novel regenerative braking mechanisms that recapture energy under deceleration, while advanced driver assistance systems (ADAS) require precise modulation of braking force to ensure collision avoidance and lane-keeping functionalities. These technological synergies underscore the role of the brake system as both a safety enabler and a performance accelerant.

Moreover, the landscape is shaped by complex interactions among OEMs, aftermarket suppliers, and raw material providers. Steel and aluminum procurement, component fabrication, software calibration, and validation testing now occur within a globally orchestrated value chain. North American safety regulations such as FMVSS and IIHS performance tests converge with Euro NCAP protocols to shape universal benchmarks for vehicle deceleration, ABS intervention, and electronic stability. Consequently, original equipment manufacturers and aftermarket players alike must adapt to a regime in which mechanical robustness is intertwined with algorithmic precision.

In this executive summary, we will explore the transformative shifts redefining brake system development, examine the cumulative impact of 2025 U.S. tariffs on raw materials, derive key segmentation and regional insights, highlight competitive strategies, and offer actionable recommendations. Through rigorous methodology informed by primary interviews, secondary literature, and data triangulation, this document aims to equip industry leaders with a holistic understanding of current trends and strategic imperatives.

Breakthrough Technological Advances and Electrification Trends are Catalyzing Transformative Shifts in Automotive Braking Systems Worldwide

The past decade has witnessed seismic shifts in brake system design, driven by the convergence of electrified powertrains, heightened safety expectations, and software-driven control strategies. At the heart of this revolution lies the transition from purely mechanical braking to electro-hydraulic and fully electric brake-by-wire architectures. These configurations enable precise modulation of braking torque, reducing stopping distances while facilitating regenerative energy capture. As a result, vehicles are achieving unprecedented efficiency gains without compromising safety.

Furthermore, the proliferation of advanced driver assistance systems has intensified the demand for rapid-response brake actuators and fail-safe control loops. Electronic stability control modules continuously adjust brake force distribution to maintain lateral stability during evasive maneuvers, while traction control systems intervene to prevent wheel slip under acceleration. This layered architecture transforms the brake system into a dynamic node within the broader ADAS network, requiring seamless integration of sensor data, actuator commands, and embedded software.

In addition to technological breakthroughs, material science advancements are redefining component longevity and thermal management. High-performance friction materials and composite rotors offer improved wear resistance and heat dissipation, addressing challenges associated with repeated heavy braking in SUVs and commercial vehicles. Meanwhile, predictive maintenance algorithms leverage real-time data from brake pad wear sensors to alert drivers before performance degradation occurs. Collectively, these transformative shifts are setting new benchmarks for safety, efficiency, and user experience.

Unraveling the Complex Effects of 2025 United States Steel and Aluminum Tariffs on Automotive Brake Component Supply Chains and Cost Structures

In 2025, the United States maintained tariffs of 25 percent on steel and 10 percent on aluminum imports, a policy framework extended from prior trade measures. These levies have had a pronounced effect on brake component supply chains, particularly for rotors, drums, and calipers, which require specialized steel grades to meet stringent fatigue and thermal performance standards. Consequently, domestic producers have borne higher raw material costs, prompting them to explore alternative alloys and strategic procurement partnerships to preserve margin structures.

Meanwhile, offshore manufacturers servicing the U.S. market have adjusted their pricing strategies to reflect the tariff burden, leading to selective onshoring of value-added operations such as machining and coating. This partial repatriation of downstream processes aims to mitigate additional duties while capitalizing on local labor efficiencies. Additionally, suppliers have ramped up collaboration with steel mills in duty-free trade zones and leveraged bonded warehousing to defer tariff liabilities until just-in-time consumption.

Notably, the tariff environment has accelerated the adoption of lightweight aluminum-intensive designs in braking assemblies, as suppliers seek to offset steel cost escalations. While aluminum drums and hubs offer reduced mass, they necessitate advanced surface treatments to withstand wear and corrosion. Overall, the cumulative impact of U.S. tariffs in 2025 has driven strategic realignment across the brake system value chain, fostering innovation in material sourcing, production footprint, and cost containment.

Deep Insights into Disc and Drum Brake Applications Technology Adoption Component Assemblies Vehicle Applications and Distribution Dynamics

The brake system market encompasses diverse brake types, technologies, components, vehicle applications, end-user preferences, and sales channels, each contributing unique dynamics. Disc brakes deliver superior heat dispersion and stopping consistency under high-speed conditions, while drum brakes remain prevalent in cost-sensitive rear-axle applications due to their inherent self-energizing characteristics. This dichotomy influences global adoption patterns, particularly in emerging economies where total cost of ownership is paramount.

Within technologies, anti-lock brake systems form the baseline for modern vehicle safety, preventing wheel lock-ups during emergency stops. Electronic brake-force distribution further refines braking balance between axles, optimizing stability under variable loads. Electronic stability control modules deliver lateral control during evasive maneuvers, and traction control systems enhance drivability on low-friction surfaces by regulating wheel slip. These technologies often layer within a unified electronic control unit, generating incremental value through modular scalability.

Component assemblies span brake hoses that channel hydraulic pressure, friction materials such as pads and shoes that create stopping force, rotors and drums that absorb kinetic energy, calipers that clamp friction elements, and wheel cylinders that actuate rear drum brakes. Vehicle applications bifurcate between commercial trucks, which demand high durability for repeated deceleration cycles, and passenger cars, where hatchbacks, sedans, and SUVs prioritize a balance of ride comfort, noise reduction, and thermal stability. Meanwhile, aftermarket channels cater to maintenance and performance upgrades, and original equipment channels address first-fit assembly. Finally, distribution networks range from traditional brick-and-mortar parts retailers to digital platforms that offer real-time inventory tracking and home delivery, reflecting evolving buyer preferences.

This comprehensive research report categorizes the Automotive Brake System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Brake Type

- Brake Technology

- Brake Components

- Vehicle Type

- End-User

- Distribution Channel

Geographic Nuances and Regional Drivers in the Americas EMEA and Asia-Pacific Shaping Automotive Brake System Adoption and Innovation

Regional dynamics exert a profound influence on brake system development, consumption patterns, and innovation trajectories. In the Americas, stringent North American safety regulations and mature OEM ecosystems drive adoption of advanced electronic control technologies and premium friction materials. The United States, in particular, emphasizes ABS, ESC, and tire pressure monitoring integration, while Latin American markets often adopt a blend of disc-drum configurations tailored to cost sensitivity and road-condition variability.

Across Europe, the Middle East, and Africa, regulatory convergence toward Euro NCAP and GCC safety mandates catalyzes continuous upgrades to electronic stability and autonomous emergency braking systems. European automakers leverage lightweight steel-aluminum hybrid rotors to meet aggressive emissions targets, whereas Middle Eastern fleets prioritize dust-resistant braking materials designed for desert environments. In Africa, infrastructural challenges spur demand for robust drum-brake assemblies that can withstand variable load cycles and minimal maintenance regimes.

Asia-Pacific exhibits a heterogeneous landscape. Japan and South Korea lead with high-precision ceramic composite brakes and brake-by-wire prototypes, reflecting their advanced R&D investments. Greater China scales technology diffusion rapidly through joint ventures, balancing cost and performance in mid-range passenger vehicles. Southeast Asian markets demonstrate sustained demand for aftermarket retrofit kits, where offline channel networks coexist with emerging online platforms. Overall, region-specific regulations, infrastructure maturity, and consumer preferences shape a multifaceted brake system ecosystem globally.

This comprehensive research report examines key regions that drive the evolution of the Automotive Brake System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Analysis Spotlighting Leading Brake System Manufacturers and Emerging Innovators Driving Market Leadership

The competitive landscape of automotive brake systems features established conglomerates alongside agile specialized suppliers, each carving out unique value propositions. Market leaders leverage economies of scale in stamping, machining, and coating to deliver cost-effective rotors and drums, while simultaneously investing in R&D for brake-by-wire platforms. At the same time, component specialists focus on high-performance friction formulations and sensor integration, aiming to secure design wins in electric vehicle and ADAS applications.

Joint ventures between OEMs and tier-one suppliers have become more prevalent, enabling co-development of bespoke brake modules and accelerated validation cycles. Collaboration extends to software firms for calibration of braking algorithms that maximize regenerative braking efficiency and improve pedal feel consistency. Meanwhile, aftermarket brands differentiate through performance upgrades, offering carbon-ceramic variants and cross-drilled rotors to enthusiast segments.

Emerging players are disrupting traditional supply chains by adopting additive manufacturing for lightweight caliper prototypes and applying predictive analytics to anticipate part failures. In parallel, digital platforms provide just-in-time delivery of brake components, reducing inventory holding costs for repair shops and fleet operators. Competitive positioning now hinges on the ability to integrate mechanical design, material science, and software expertise into a cohesive product offering that aligns with evolving vehicle architectures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Brake System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AISIN Seiki Co., Ltd.

- Akebono Brake Industry Co., Ltd.

- ASK Automotive Limited

- BorgWarner Inc.

- Brembo S.p.A.

- Continental AG

- Denso Corporation

- Eaton Corporation PLC

- EBC Brakes

- FleetPride, Inc.

- GUD Holdings Limited

- Haldex AB

- Hilliard Corporation

- Hitachi Astemo, Ltd.

- HL Mando Corp.

- Jiangxi Lichang Auto Parts Co., Ltd.

- Knorr-Bremse AG

- Performance Friction Corp.

- Robert Bosch GmbH

- Schaeffler AG

- Shandong Alltour Automotive Co., Ltd.

- Sundaram Brake Linings Ltd

- VALEO SA

- ZF Friedrichshafen AG

Strategic Imperatives and Actionable Recommendations for Automotive Brake System Leaders to Navigate Disruption and Catalyze Growth

To thrive in an environment marked by material cost volatility, regulatory complexity, and technology convergence, industry leaders must adopt proactive strategies. Firstly, forging strategic alliances with steel and aluminum producers can secure favorable long-term contracts and collaborative product development agreements that optimize alloy performance for brake components. Additionally, vertical integration of downstream processes such as machining and coating can insulate manufacturers from tariff fluctuations and enhance quality control.

Furthermore, accelerating investment in brake-by-wire and regenerative braking research will position suppliers as preferred partners for electrified vehicle platforms. By building modular electronic control units that serve both passenger car and commercial vehicle applications, companies can achieve scale efficiencies while accommodating diverse regulatory requirements. Concurrently, implementing advanced analytics across the supply chain will enable real-time tracking of raw material availability, manufacturing throughput, and logistics performance, fostering resilient operations.

Moreover, refining aftermarket engagement through digital marketplaces and predictive maintenance offerings will unlock recurring revenue streams. Platforms that integrate sensor data analytics with service scheduling can deliver superior customer experiences and reinforce brand loyalty. Overall, a holistic approach that combines material sourcing, technological innovation, operational resilience, and customer-centric digital services will be essential for navigating disruption and maintaining a competitive edge.

Robust Research Methodology Leveraging Primary and Secondary Data Sources for Comprehensive Analysis of Brake System Market Dynamics

This analysis is grounded in a rigorous research framework that synthesizes primary interviews, secondary literature review, and quantitative data triangulation. Primary inputs were obtained through structured interviews with R&D engineers, product managers, and procurement executives across OEMs, tier-one suppliers, and aftermarket distributors. These discussions provided firsthand perspectives on emerging technologies, material challenges, and supply chain adaptations in response to tariff environments.

Secondary research encompassed industry white papers, regulatory filings, and publicly available patent databases to map innovation trajectories and benchmark technology adoption rates. Trade association reports and standards documentation were reviewed to ensure alignment with the latest safety regulations and performance testing protocols. Additionally, proprietary databases were leveraged to analyze historical trends in raw material pricing, trade flows, and manufacturing capacities.

Quantitative data points were validated through triangulation, cross-referencing multiple sources to confirm consistency and accuracy. Regional market dynamics were contextualized with macroeconomic indicators and vehicle production statistics. The resulting insights are presented through thematic synthesis, capturing the interplay between technological evolution, regulatory pressures, and competitive strategies. This methodology ensures a comprehensive, fact-based view of the automotive brake system landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Brake System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Brake System Market, by Brake Type

- Automotive Brake System Market, by Brake Technology

- Automotive Brake System Market, by Brake Components

- Automotive Brake System Market, by Vehicle Type

- Automotive Brake System Market, by End-User

- Automotive Brake System Market, by Distribution Channel

- Automotive Brake System Market, by Region

- Automotive Brake System Market, by Group

- Automotive Brake System Market, by Country

- United States Automotive Brake System Market

- China Automotive Brake System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Concluding Perspectives on the Current State and Future Trajectory of Automotive Brake Systems in a Rapidly Evolving Mobility Ecosystem

In conclusion, the automotive brake system sector is undergoing a profound transformation characterized by electrification, digital integration, and material innovation. Regulatory imperatives are elevating safety and emissions standards, prompting a shift toward brake-by-wire architectures and advanced friction materials. Concurrently, trade policies such as the 2025 U.S. steel and aluminum tariffs are reshaping supply chain strategies, driving regional realignments and production optimization.

Segmentation analysis reveals distinct behavior across brake types, technologies, component assemblies, vehicle segments, and distribution channels, underscoring the importance of tailored offerings that address specific use-case requirements. Regional insights highlight how maturity levels, infrastructure conditions, and regulatory landscapes influence product specifications and go-to-market approaches. Meanwhile, competitive dynamics are intensifying as traditional tier-one suppliers integrate software capabilities and emerging manufacturers leverage additive technologies.

Looking forward, the convergence of mechanical engineering and digital control systems will define the next frontier of brake system innovation. Companies that proactively secure raw material partnerships, invest in scalable electronic brake architectures, and harness data analytics for maintenance and supply chain resilience will emerge as market leaders. This executive summary provides the strategic foundation needed to capitalize on these trends and to navigate an increasingly complex and opportunity-rich landscape.

Empower Your Decision-Making with Expert Insights and Connect with Ketan Rohom to Access the Latest Automotive Brake System Research Report

For decision-makers seeking to translate cutting-edge insights into competitive advantage, securing the full market research report is essential. Ketan Rohom, Associate Director of Sales & Marketing, is your dedicated partner in navigating complex brake system dynamics and unlocking actionable intelligence. His expertise will ensure you receive a tailored brief that aligns with your strategic objectives and operational requirements. Reach out to Ketan to discuss customized data solutions, licensing options, and bundled services that deliver unparalleled depth and clarity. By engaging directly with him, you’ll gain early access to interpretive analyses on technology integration, tariff implications, regional nuances, and competitive benchmarking. Don’t miss the opportunity to drive innovation, optimize your supply chain resilience, and sharpen your go-to-market strategies with insights crafted for leaders in the automotive brake system domain. Contact Ketan Rohom today to accelerate your journey toward informed decision-making and sustained market leadership.

- How big is the Automotive Brake System Market?

- What is the Automotive Brake System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?