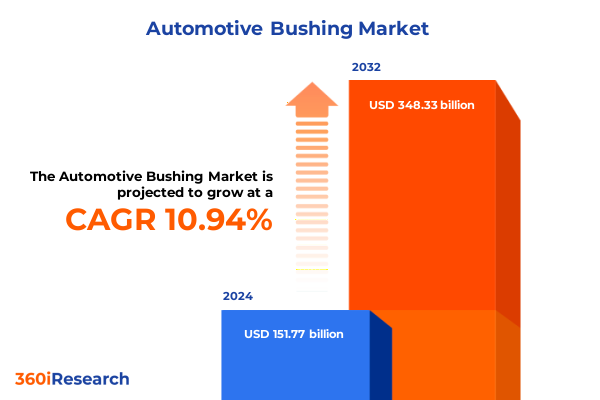

The Automotive Bushing Market size was estimated at USD 167.28 billion in 2025 and expected to reach USD 184.39 billion in 2026, at a CAGR of 11.04% to reach USD 348.33 billion by 2032.

Unveiling Foundational Perspectives on Automotive Bushings Amidst Advancements in Vehicle Electrification Materials and Global Supply Chain Realignments

The automotive bushing sector stands at the intersection of rapid technological advancement and evolving regulatory imperatives, marking an inflection point for suppliers, OEMs, and aftermarket specialists. As foundational components that isolate vibration, dampen noise, and enable controlled articulation within suspension and drivetrain systems, bushings are now subject to heightened scrutiny for performance optimization and durability enhancement. Furthermore, the acceleration of vehicle electrification, paired with stringent emissions and noise ordinances, has elevated bushings from passive hardware to critical enablers of ride comfort, safety, and efficiency. In this dynamic environment, stakeholders must align product development with multifaceted demands, from mitigating NVH challenges in battery-electric powertrains to adhering to emerging global trade policies impacting raw material access.

Against this backdrop, this executive summary weaves together an integrated analysis, starting with transformative market shifts, through to the granular influence of 2025 tariff actions, and extending into segmentation, regional dynamics, and competitive landscapes. Complementing these insights are strategic imperatives and a transparent research methodology designed to validate our findings. Collectively, this introduction sets the stage for an exploration of how automotive bushing suppliers can harness advanced materials, digital innovations, and resilient supply chain strategies to thrive amid unprecedented industrial change.

Exploring the Pivotal Technological Innovations and Market Disruptors Shaping the Future of Automotive Bushing Performance and Durability Standards

Technological evolution and shifting consumer expectations have propelled the automotive bushing market into a phase of accelerated innovation. The industry’s pivot toward electric and hybrid vehicles demands materials capable of addressing higher battery mass and thermal loads, as well as combating pronounced noise, vibration, and harshness without the masking effect of an internal combustion engine. In response, manufacturers are adopting composite and polymeric formulations that deliver both lightweight construction and superior damping characteristics, harmonizing weight reduction goals with NVH control objectives. Additionally, polyurethane has emerged as a front-runner, not only for its robustness under thermal stress but also for a lifespan advantage that outpaces natural rubber by up to 40%, a gain particularly valued in high-torque EV suspension systems.

Beyond material science, the integration of sensor technologies within bushings is redefining functional boundaries. Smart bushings embedded with microelectromechanical (MEMS) sensors can transmit real-time data on load stress, temperature, and degradation, facilitating predictive maintenance and dynamic suspension tuning. This convergence of IoT connectivity and bushing design underscores a broader transition from static components to intelligent, data-driven systems, reflecting the automotive sector’s commitment to connected, autonomous, and electrified mobility solutions.

Assessing the Aggregate Consequences of Recent United States Steel and Component Tariffs on Automotive Bushing Supply Chains and Cost Structures

In early 2025, a presidential proclamation invoked Section 232 of the Trade Expansion Act of 1962 to impose a 25% tariff on imported automobiles and key automotive parts, including suspension and powertrain components, aiming to bolster national security by strengthening domestic manufacturing. While USMCA-compliant parts remain temporarily exempt pending content certification processes, the extension of tariffs to non-compliant imports fundamentally alters cost structures for both OEMs and Tier 1 suppliers. The Vehicle Suppliers Association (MEMA) has warned that 78% of its members are directly exposed to steel duties and 63% to aluminum levies, with over 80% facing derivative material tariffs that could disrupt multi-tier supply chains and erode profitability.

Moreover, comprehensive analyses indicate that these duties may translate into an incremental cost burden of approximately $240 per vehicle when accounting for both direct tariffs and domestic price escalation. As a result, automotive manufacturers are compelled to revisit sourcing strategies, renegotiate supplier contracts with surge pricing clauses, and explore cost mitigation through nearshoring and vertical integration. The cumulative impact of these policies underscores the necessity for agile procurement frameworks, advanced material substitution, and robust supplier diversification to safeguard production timelines and margin stability.

Uncovering Critical Segmentation Dimensions Guiding Automotive Bushing Insights Across Material Type Position Manufacturing Process Application Vehicle Type and Sales Channel

The automotive bushing market’s complexity emerges most clearly through its diverse segmentation dimensions, each carrying distinct strategic implications. When evaluated by material type, segments span metal variants-encompassing both high carbon steel and stainless steel-alongside polyurethane and rubber alternatives, with each choice reflecting trade-offs in cost, durability, and performance under thermal and mechanical stress. Position-based segmentation further refines application nuances, distinguishing front suspension from rear suspension deployments, where load cycles and NVH profiles differ substantially and inform tailored bushing designs.

Manufacturing processes introduce an additional layer of differentiation, as fabricated and machined components meet conventional requirements, while molded solutions-encompassing both compression molding and injection molding methods-enable high-volume, precision-optimized geometries. Application segmentation extends from chassis systems and engine mounts through suspension and transmission frameworks, capturing front suspension and rear suspension specialization, and signaling to product developers the criticality of context-specific material formulations. Vehicle type distinctions, contrasting commercial vehicles-divided into heavy and light commercial classes-with passenger cars, reinforce the necessity of resilience and longevity in fleet applications versus dynamic comfort in consumer-oriented models. Finally, sales channel segmentation contrasts OEM partnerships with aftermarket channels, where authorized dealers and independent repair shops vie for replacement and upgrade business, underscoring the importance of supply reliability and performance consistency for end-users.

This comprehensive research report categorizes the Automotive Bushing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Position

- Manufacturing Process

- Application

- Vehicle Type

- Sales Channel

Illuminating Key Regional Variances and Growth Drivers Shaping Automotive Bushing Adoption Across the Americas Europe Middle East Africa and AsiaPacific Markets

Regional dynamics are reshaping automotive bushing demand profiles and supply chain architectures in profound ways. In the Americas, a confluence of nearshoring initiatives, robust EV incentives, and aging vehicle fleets has forged a dual market for OEM-graded components and high-performance replacements. North American chassis suppliers are increasingly forging local partnerships to minimize tariff exposures while tailoring polyurethane solutions to address heightened NVH expectations among discerning consumers.

In Europe, the Middle East, and Africa, stringent Euro 7 emissions and noise regulations are driving premiumization of bushing offerings, with hydraulic and liquid-filled designs capturing market share for their superior ride refinement. Suppliers in this region emphasize sustainability credentials and circular economy practices to align with tightening environmental policies, expanding collaborations with automakers on bio-based polymer research.

Asia-Pacific continues to command the largest production volumes, led by China’s expansive EV rollouts and India’s cost-sensitive vehicle programs. Localized manufacturing hubs leverage low-cost labor and integrated supply ecosystems to pioneer advanced composite bushings while navigating raw material volatility. Southeast Asian nations are rapidly scaling production capacity for heat-resistant and high-torque applications to service both regional OEMs and export markets, reflecting the region’s pivotal role in the global automotive value chain.

This comprehensive research report examines key regions that drive the evolution of the Automotive Bushing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Approaches and Competitive Advantages of Leading Automotive Bushing Manufacturers Driving Innovation and Market Penetration

Market leadership is contested among global tier-one suppliers and specialized innovators, each pursuing distinct strategies to capture share. Prominent players such as Tenneco and Vibracoustic leverage expansive R&D portfolios to deliver next-gen polyurethane and composite bushings, while established Tier 1 suppliers-Continental AG and ZF Friedrichshafen-have introduced smart bushing prototypes integrating sensor feedback for real-time suspension modulation. Cooper Standard and Hutchinson distinguish themselves through vertical integration models, securing raw-material channels to mitigate input cost volatility and ensure supply continuity.

Smaller, agile firms like Carla Group and Lesjöfors focus on niche composite technologies, catering to luxury EV segments with carbon fiber-reinforced and electrically conductive bushings. These companies emphasize collaboration with OEMs on pilot programs, validating performance in extreme thermal and load conditions. Meanwhile, traditional machining specialists such as MOOG and Metaldyne augment their portfolios through strategic acquisitions, broadening service capabilities to encompass both fabricated metal cores and polymer overmolding expertise. Collectively, these competitive narratives highlight a landscape in which differentiation is achieved through material science breakthroughs, digital integration, and supply chain resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Bushing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BOGE Rubber & Plastics GmbH

- BorgWarner Inc.

- Continental AG

- Cooper‑Standard Holdings Inc.

- DuPont de Nemours, Inc.

- Freudenberg SE

- Hutchinson SA

- KYB Corporation

- Mahle GmbH

- Oiles Corporation

- SKF Group AB

- Sumitomo Riko Company Limited

- Tenneco Inc.

- Vibracoustic SE & Co. KG

- ZF Friedrichshafen AG

Proposing Targeted Strategic Initiatives for Industry Leaders to Enhance Resilience Agility and Sustainability in the Automotive Bushing Value Chain

To navigate the evolving automotive bushing environment, industry leaders should prioritize a multi-pronged strategic agenda. First, diversifying raw-material sourcing by incorporating alternative polymers and recycled composites can insulate operations from tariff-induced price shocks and supply disruptions. Secondly, accelerating R&D in smart bushing technologies-leveraging IoT and MEMS sensors-will unlock predictive maintenance capabilities, enhancing service-cycle optimization and differentiating offerings in OEM partnerships.

Simultaneously, nearshoring critical manufacturing steps and forging strategic alliances with regional automotive clusters can reduce logistical complexity and tariff exposures, thereby preserving margin integrity. Furthermore, adopting circular economy practices, such as reclaiming and reprocessing polymer waste, will not only align with tightening environmental regulations but also lower input costs. Finally, embedding digital twin simulations within product development cycles can compress innovation timelines, enabling rapid iteration of bushing geometries to meet bespoke NVH targets and vehicle weight constraints.

Detailing the Comprehensive Research Framework and Analytical Techniques Employed to Derive Robust Insights into the Automotive Bushing Landscape

This analysis draws upon a rigorous blend of primary and secondary research modalities. Primary insights were garnered through structured interviews with OEM supply chain executives, Tier 1 component managers, and aftermarket distribution experts, enabling nuanced understanding of performance requirements and procurement dynamics. Sequentially, a comprehensive review of industry publications, trade association briefings, and regulatory filings informed the contextual framing of material trends and policy impacts.

Quantitative data were triangulated using top-down assessments of global vehicle production metrics and bottom-up evaluations of supplier output capacities. Validation steps included cross-referencing tariff schedules from the Office of the U.S. Trade Representative with cost-impact models provided by MEMA and S&P Global. Advanced analytical techniques, such as scenario stress-testing and Monte Carlo simulations, were applied to forecast potential supply chain disruptions under varying tariff and material-price trajectories. Collectively, these methodologies ensure the robustness and actionability of the insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Bushing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Bushing Market, by Material Type

- Automotive Bushing Market, by Position

- Automotive Bushing Market, by Manufacturing Process

- Automotive Bushing Market, by Application

- Automotive Bushing Market, by Vehicle Type

- Automotive Bushing Market, by Sales Channel

- Automotive Bushing Market, by Region

- Automotive Bushing Market, by Group

- Automotive Bushing Market, by Country

- United States Automotive Bushing Market

- China Automotive Bushing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesizing Critical Findings and Strategic Implications to Chart a Forward-Looking Path for Diverse Stakeholders in the Evolving Automotive Bushing Sector

The automotive bushing market is undergoing a pivotal transformation driven by electrification, material innovation, and trade policy realignment. Key developments-from the rise of composite and sensor-integrated bushings to the impact of Section 232 tariffs-underscore the imperative for suppliers to adopt agile sourcing, strategic R&D, and regionalized manufacturing footprints. Segmentation analysis reveals multiple vectors for differentiation, while regional insights highlight the varied pace of regulatory and technological adoption.

As competition intensifies, companies that seamlessly integrate advanced material science with digital capabilities, and that proactively mitigate supply chain risks, will secure sustainable advantage. These strategies will be critical to meeting the evolving demands of OEMs focused on EV and hybrid platforms, as well as aftermarket channels seeking high-performance, long-life replacements. Ultimately, the sector’s trajectory will be defined by the ability to reconcile cost efficiency with performance optimization in pursuit of superior vehicle dynamics and regulatory compliance.

Connect Directly with Ketan Rohom Associate Director Sales Marketing to Access Exclusive Automotive Bushing Market Research and Accelerate Your Business Growth

Elevate your strategic initiatives by securing in-depth market intelligence that illuminates the nuances of material innovations, regulatory shifts, and supply chain transformations shaping the future of automotive bushings. Engage directly with Ketan Rohom Associate Director Sales Marketing to customize data-driven insights, refine product roadmaps, and accelerate competitive positioning within the evolving automotive landscape. Begin a conversation that will empower your organization to anticipate emerging trends, optimize sourcing strategies, and drive sustainable growth through precise, actionable research.

- How big is the Automotive Bushing Market?

- What is the Automotive Bushing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?