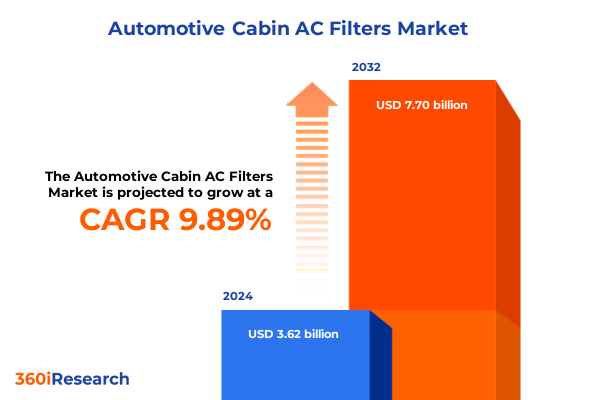

The Automotive Cabin AC Filters Market size was estimated at USD 3.97 billion in 2025 and expected to reach USD 4.36 billion in 2026, at a CAGR of 9.92% to reach USD 7.70 billion by 2032.

Pioneering the Role of Advanced Automotive Cabin Air Filters in Enhancing In-Cabin Air Quality and Passenger Health Across Diverse Vehicle Platforms

Automotive cabin air filters have evolved into critical components that safeguard passenger health and comfort by mitigating exposure to airborne contaminants. Advances in filter media and design have enabled unprecedented removal efficiencies for pollutants such as particulate matter, allergens, and volatile organic compounds, elevating in-cabin air quality standards amid growing regulatory scrutiny. Beyond health considerations, enhanced filtration contributes to occupant comfort and perceived cabin luxury, prompting original equipment manufacturers to integrate multi-layer and specialty media solutions as standard features in newer vehicle platforms. In parallel, rising consumer awareness of air pollution impacts has fueled demand for advanced filtration technologies, driving suppliers to innovate with materials such as activated carbon and nanofibers.

The tightening of emissions regulations in major automotive markets and the pursuit of stringent cabin air quality norms have accelerated the adoption of higher-efficiency filters. As vehicle architectures transition toward electric and autonomous platforms, the emphasis on interior air purity intensifies due to reduced noise masking from powertrains, making audible indications of cabin pollutants more perceptible to occupants. This convergence of regulatory pressure, consumer health consciousness, and vehicle innovation underscores the pivotal role of cabin air filters in the contemporary automotive value chain, setting the stage for dynamic shifts in technology, supply chains, and competitive strategies.

Unveiling Critical Shifts That Are Reshaping the Automotive Cabin Filter Market Through Electrification, Advanced Materials, and Digital Integration Strategies

The automotive cabin air filtration landscape is undergoing transformative upheaval driven by electrification, materials innovation, and digital integration. Electrified powertrains afford designers greater freedom to optimize airflow pathways and integrate compact, high-efficiency filter assemblies without legacy packaging constraints. This has catalyzed the introduction of multi-layer constructs that blend nanofiber membranes with impregnated activated carbon, enabling simultaneous capture of ultrafine particulates and adsorption of gaseous pollutants. Concurrently, the pursuit of lightweight and recyclable materials has elevated interest in biodegradable media and polymer composites that deliver performance parity with conventional substrates while reducing end-of-life environmental impact.

Digital connectivity is further reshaping filtration strategy, as onboard sensors monitor differential pressure and airborne pollutant levels in real time, triggering predictive maintenance alerts and enabling adaptive air quality management. Connected cabin air systems now interface with telematics platforms to optimize filter replacement intervals and calibrate ventilation rates based on occupancy patterns and external air conditions. The integration of sensor-driven analytics and cloud-based diagnostics is forging novel aftermarket service models and subscription-based maintenance offerings that extend OEM engagement beyond point-of-sale. Together, these converging trends illustrate how technological advancements and business model innovation are redefining the boundaries of cabin air filtration, producing a dynamic ecosystem where agility and data-driven differentiation are paramount.

Assessing the Comprehensive Implications of 2025 United States Tariff Adjustments on Automotive Cabin Air Filter Procurement Costs and Supply Chain Dynamics

The introduction of new United States tariffs in early 2025 has engendered multifaceted repercussions across the automotive cabin air filter supply chain. Higher duties on imported activated carbon media, filter frames, and subcomponents have elevated input costs for both original equipment and aftermarket segments, compelling manufacturers to reassess sourcing strategies. Faced with increased landed costs, several tier suppliers have accelerated nearshore production initiatives and diversified material suppliers to mitigate tariff exposure. This reorientation toward regionalized manufacturing hubs has intensified competition among domestic and foreign players vying for local content contracts.

Moreover, the tariff-induced cost inflation has reshaped inventory management practices, with companies expanding buffer stocks of critical media grades to hedge against duty volatility and freight uncertainties. Some filter assemblers have renegotiated long-term supply agreements to secure fixed-price commitments, while others have consolidated purchase orders to achieve scale-based discounts. The cumulative impact extends to aftermarket distribution, where price-sensitive repair shops and end consumers are encountering noticeably higher replacement filter retail prices. In response, certain aftermarket brands have begun to introduce cost-optimized product lines featuring simplified media constructions and modular frame designs. Collectively, these adaptations illuminate the profound influence of tariff policy on procurement economics and strategic decision-making within the cabin air filtration ecosystem.

Uncovering Segmentation Insights to Illuminate Filter Types, Vehicle Classes, Applications, Distribution Channels, and Sales Channels in Cabin Air Filtration

The diversity of filter media available in the cabin air filtration market underlines the need for precise segmentation analysis. Filters constructed with activated carbon media encompass both granular carbon that offers high adsorption surface area and impregnated carbon variants engineered for targeted pollutant adsorption. True HEPA and ULPA filters deliver ultrafine particle capture for applications demanding the utmost air purity, whereas standard filters composed of paper or polyester substrates address basic particulate removal requirements at a lower cost threshold. These media distinctions directly influence application fit and replacement cycles, driving differentiated value propositions across OEM and aftermarket channels.

Vehicle type segmentation further nuances strategic positioning, as passenger vehicles typically demand higher aesthetic and acoustic integration for cabin components, while commercial vehicle filters prioritize durability and extended service intervals under variable operating conditions. Application segmentation bifurcates into aftermarket alternatives-which include OEM-equivalent offerings that align with original specifications and performance-focused variants designed for enhanced airflow and contaminant capture-and original equipment flows managed through tier one and tier two supplier networks. Distribution channels exhibit comparable tiering: branded chain auto parts stores and independent outlets cater to do-it-yourself service demographics, authorized dealerships and independent franchise locations deliver OEM-backed replacements, and specialized e-commerce shops service niche enthusiasts with premium filter kits.

Sales channels overlay these distribution networks with further granularity, as offline sales through authorized service centers and traditional brick-and-mortar retailers continue to capture established loyalty, while online platforms-including manufacturer websites and third-party e-commerce marketplaces-enable direct-to-consumer access, rapid fulfillment, and data-driven upsell of maintenance packages. Understanding these layered segmentation dynamics is essential for crafting product portfolios and channel strategies that resonate with end users’ performance expectations, purchasing behaviors, and service preferences.

This comprehensive research report categorizes the Automotive Cabin AC Filters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Filter Type

- Vehicle Type

- Application

- Sales Channel

Revealing How Regional Dynamics in the Americas, Europe Middle East & Africa, and Asia-Pacific Are Driving Divergent Trends in Cabin Air Filter Adoption

Regional regulatory frameworks and consumer preferences impart distinct momentum to cabin air filter adoption across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, particularly the United States and Canada, heightened awareness of wildfire smoke and urban air pollution has spurred demand for enhanced particulate and gas-phase filtration in both passenger and commercial fleets. Incentive programs and federal guidelines around in-cabin air quality have further elevated the strategic importance of filter performance, prompting OEMs to integrate advanced media solutions as standard equipment in mid- and high-end vehicle segments.

Through Europe Middle East & Africa, regulatory mandates on particulate emissions and cabin air recirculation standards have created a competitive environment for suppliers capable of meeting stringent European Union particulate matter thresholds and local air protection directives. This region’s mature dealership networks and established aftermarket channels prioritize certified products, driving tiered certification processes for true HEPA and carbon-impregnated filters. In markets such as the Gulf Cooperation Council countries, extreme temperature differentials challenge filter durability, compelling innovation in thermal-stable media and sealing technologies.

Asia-Pacific markets present a spectrum of drivers, from China’s tightening ambient air pollution controls to India’s ever-growing vehicle parc contending with high dust and smog levels. In China, government-led clean air initiatives have accelerated the proliferation of cabin filter mandates, while digital retail ecosystems enable seamless consumer education and replacement scheduling. Meanwhile, Southeast Asian and Australasian markets exhibit growing interest in aftermarket performance filters among enthusiasts and fleet operators aiming to enhance fuel efficiency and interior air quality under diverse climatic conditions.

This comprehensive research report examines key regions that drive the evolution of the Automotive Cabin AC Filters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Positioning of Leading Manufacturers and Innovative Challenger Brands Shaping the Future of Automotive Cabin Filtration Solutions

Leading manufacturers are leveraging differentiated strategies to secure footholds in the evolving cabin air filter landscape. Global incumbents renowned for extensive OEM partnerships are reinforcing their R&D pipelines, focusing on nanotechnology-enhanced media and integrated sensor capabilities. Collaborative alliances with academic institutions and material science startups are accelerating the adoption of biodegradable and high-efficiency filter substrates that align with sustainability mandates. Additionally, strategic acquisitions of niche aftermarket brands allow major players to broaden their channel coverage and tap into specialized performance segments.

Challenger brands are carving unique value propositions through agile production models and digital-first distribution approaches. These emerging suppliers emphasize modular filter designs that accommodate rapid configuration shifts, enabling swift responses to changing regulatory and consumer demands. Direct-to-consumer e-commerce platforms champion subscription-based filter replenishment services that streamline the purchasing journey and foster brand loyalty through predictive analytics. Meanwhile, regional specialists in emerging economies are capitalizing on local manufacturing expertise and cost-competitive sourcing to deliver tailored product offerings that resonate with specific air quality challenges, from high-humidity tropical environments to high-altitude dust exposure.

This mosaic of established global titans and nimble market entrants underscores a competitive landscape where technological leadership and distribution innovation define the next frontier of cabin air filtration, challenging stakeholders to balance scale, specialization, and digital engagement in their growth strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Cabin AC Filters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Ahlstrom-Munksjö Oyj

- Cummins Inc.

- Denso Corporation

- Donaldson Company, Inc.

- DRiV Incorporated

- Freudenberg & Co. KG

- Hengst SE

- K&N Engineering Inc.

- Lydall, Inc.

- MAHLE GmbH

- MANN+HUMMEL GmbH

- Parker Hannifin Corporation

Providing Practical and Forward-Looking Recommendations for Industry Stakeholders to Capitalize on Emerging Opportunities in Cabin Air Filter Markets

Industry leaders must embrace multifaceted strategies to harness emerging opportunities and mitigate headwinds in cabin air filtration. Diversifying the supplier base through regional alliances and multi-sourcing arrangements can alleviate tariff-related cost pressures and strengthen supply chain resilience. Investing in advanced media R&D, particularly in hybrid nanofiber-carbon composites and biodegradable substrates, will enable differentiation in performance-driven segments while anticipating evolving environmental regulations.

Complementing product innovation with digital capabilities is critical; integrating sensor arrays and telematics connectivity unlocks data-driven maintenance models, fosters recurring revenue streams, and enhances customer engagement. Strategic partnerships with telematics providers and software developers can expedite the deployment of predictive filter replacement services and subscription platforms. Moreover, cultivating direct-to-consumer touchpoints via manufacturer websites and e-commerce partnerships supports brand control and margin capture, while continued collaboration with traditional dealerships and authorized service centers preserves established loyalty channels.

Finally, proactive engagement with regulatory bodies and standards organizations will ensure early awareness of proposed cabin air quality requirements and particulate thresholds, affording companies the lead time to adapt product designs and certification processes. By orchestrating a synchronized approach that aligns supply chain optimization, media innovation, digital transformation, and regulatory foresight, industry stakeholders can position themselves at the vanguard of a rapidly evolving cabin air filtration market.

Detailing the Rigorous Research Framework and Methodological Approach That Underpins the Comprehensive Analysis of Automotive Cabin Air Filter Trends

The research framework underpinning this analysis integrates both primary and secondary methodologies to ensure comprehensive coverage and validity. Primary research involved in-depth interviews with procurement directors at leading OEMs, supply chain executives at tier one and tier two filter assemblers, and distribution managers across automotive aftermarket channels. These qualitative engagements provided nuanced insights into sourcing trends, material preferences, and channel strategies.

Secondary research encompassed an extensive review of technical literature, material science journals, and patent filings to capture technological advancements in filter media and sensor integration. Regulatory databases and government publications were analyzed to map evolving emissions and cabin air quality standards across major regions. Trade association reports and equipment certification bodies supplied critical data on particulate testing protocols and filter performance benchmarks.

Data triangulation was achieved by cross-referencing interview findings with supplier product literature and publicly disclosed procurement policies, ensuring consistency and reliability. External validation was sought through consultation with academic experts in environmental engineering and corporate sustainability officers to confirm technical accuracy and assess long-term strategic implications.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Cabin AC Filters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Cabin AC Filters Market, by Filter Type

- Automotive Cabin AC Filters Market, by Vehicle Type

- Automotive Cabin AC Filters Market, by Application

- Automotive Cabin AC Filters Market, by Sales Channel

- Automotive Cabin AC Filters Market, by Region

- Automotive Cabin AC Filters Market, by Group

- Automotive Cabin AC Filters Market, by Country

- United States Automotive Cabin AC Filters Market

- China Automotive Cabin AC Filters Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing the Key Insights to Illuminate Strategic Imperatives and Future Directions in the Evolving Automotive Cabin Air Filtration Landscape

In synthesizing the multifarious insights presented herein, it becomes evident that the cabin air filtration market is navigating a period of pronounced transformation. Technological breakthroughs in filter media and digital integration, coupled with shifting vehicle architectures and stringent regulatory mandates, are redefining performance benchmarks and supply chain imperatives. The 2025 tariff adjustments have added complexity to procurement economics, accelerating regional production realignment and strategic sourcing decisions.

Segmentation analysis reveals differentiated value drivers across filter types, vehicle applications, and distribution channels, underscoring the importance of precise product positioning and tailored channel strategies. Regional dynamics further compound these nuances, as localized regulatory landscapes and consumer behaviors shape adoption trajectories in the Americas, Europe Middle East & Africa, and Asia-Pacific.

Against this backdrop, competitive dynamics are characterized by both the dominance of global incumbents advancing media and sensor-led innovations and the emergence of agile disruptors leveraging digital distribution models. The recommended strategic imperatives emphasize supply chain diversification, R&D investment in next-generation media, digital service enablement, and proactive regulatory engagement. By aligning these priorities with organizational capabilities and market demands, industry participants can confidently navigate the evolving cabin air filtration landscape and secure sustainable growth.

Drive Your Strategic Decision Making with Personalized Insights from Ketan Rohom to Secure Detailed Automotive Cabin Air Filter Market Intelligence

Take the decisive step toward a healthier and more efficient cabin air environment by engaging directly with Ketan Rohom, Associate Director, Sales & Marketing, to secure your comprehensive automotive cabin air filter report tailored to your strategic needs. Reach out today to explore customized insights, delve into the granular segmentation analyses, and uncover practical recommendations crafted to support your organization’s competitive positioning. Harness the depth of our investigative rigor and the clarity of our forward-looking perspectives by partnering with Ketan Rohom to purchase the complete report and empower your team with actionable intelligence for the dynamic cabin filtration market

- How big is the Automotive Cabin AC Filters Market?

- What is the Automotive Cabin AC Filters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?