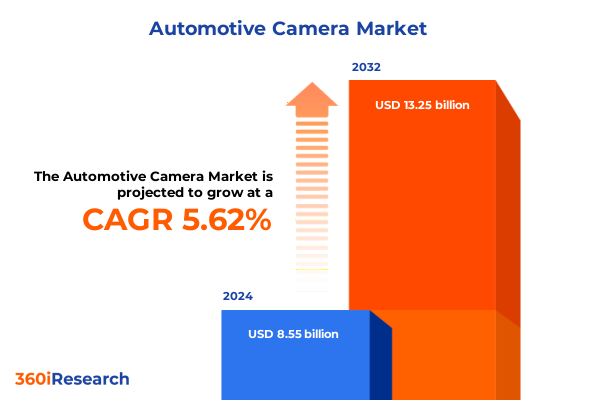

The Automotive Camera Market size was estimated at USD 9.02 billion in 2025 and expected to reach USD 9.52 billion in 2026, at a CAGR of 5.64% to reach USD 13.25 billion by 2032.

Driving Forward the Next Generation of In Vehicle Camera Solutions Through Converging Technological Breakthroughs and Evolving Consumer Expectations

Automotive camera systems have emerged as foundational elements in a new mobility paradigm defined by enhanced safety, driver assistance, and autonomous capabilities. As modern vehicles integrate higher-resolution imaging for cabin monitoring, parking assistance, and 360-degree surround awareness, manufacturers and suppliers are compelled to balance stringent performance requirements with evolving regulatory and cost pressures. In this context, a clear understanding of technological trajectories and market drivers becomes a critical asset for decision-makers navigating a rapidly changing landscape.

This executive summary synthesizes the most significant forces shaping the automotive camera market, beginning with a detailed overview of the transformative shifts influencing design and deployment. We then examine the cumulative impact of recent United States trade measures on component sourcing and pricing structures. Following this, we uncover segmentation insights across camera configurations, sensor technologies, resolution tiers, application scenarios, vehicle classes, and sales channels. Regional adoption patterns are analyzed to reveal opportunities and challenges across the Americas, Europe Middle East and Africa, and Asia Pacific. The spotlight then turns to leading manufacturers, highlighting strategic alliances, innovation pipelines, and competitive positioning. Actionable recommendations guide industry leaders toward resilient supply networks, optimized technology roadmaps, and agile go-to-market strategies. A transparent research methodology outlines the rigorous approach underpinning these findings. The conclusion distills key takeaways and underscores the indispensable role of advanced camera systems in shaping future mobility and safety solutions.

Unveiling Revolutionary Shifts Reshaping Automotive Camera Landscape From Autonomous Driving Platforms to Enhanced Sensing and Safety Architectures

The automotive camera landscape is undergoing a period of profound transformation driven by breakthroughs in sensor miniaturization, computational imaging, and artificial intelligence. What was once a peripheral component for basic parking assistance now serves as an integral platform for advanced driver assistance systems and the initial stages of vehicle autonomy. High dynamic range capabilities coupled with multi-sensor fusion have expanded use cases from simple rear-view monitoring to sophisticated surround view architectures that enhance situational awareness in complex driving environments.

Simultaneously, software-defined imaging has enabled continuous functional upgrades over the vehicle lifecycle, shifting competitive advantage toward those who can deliver seamless over-the-air enhancements. Regulatory mandates for pedestrian detection and lane departure warnings are reinforcing this trend, compelling OEMs to bundle multi-modal camera arrays with robust image processing stacks. Moreover, the growing convergence of camera and radar systems in sensor fusion frameworks is setting new benchmarks for collision avoidance and adaptive cruise control. Against this backdrop, suppliers are racing to integrate next-generation CCD and CMOS solutions capable of 4K resolution, low-light performance, and real-time analytics support. These transformative shifts underscore the critical demand for scalable, resilient, and cost-efficient camera platforms engineered to meet both current and future mobility requirements.

Assessing the Widespread Consequences of Recent United States Tariff Measures on Automotive Camera Cost Structures and Supply Chain Resilience

Recent United States trade measures have introduced a new layer of complexity to automotive camera procurement strategies. Broadly increased duties on imported imaging sensors and assembly components have elevated landed costs and put pressure on established supply networks. As a consequence, many manufacturers are revisiting their global sourcing footprints, exploring relocation of assembly facilities closer to final vehicle production sites or within duty-favored regions to mitigate tariff impacts and optimize total landed cost.

The ramifications extend beyond cost alone. Supply chain agility has become paramount amid ongoing geopolitical uncertainties. Companies that have invested in diversified supplier pools and dual-sourcing agreements are better positioned to absorb duty fluctuations without compromising production schedules. Moreover, the additional cost burdens are accelerating the push toward localized sensor fabrication and camera integration, spurring investments in regional manufacturing clusters across North America. To further offset tariff-related cost pressures, many OEMs are renegotiating long-term contracts with tier-one suppliers, leveraging volume commitments to secure preferential pricing. The interplay between duty structures and supply chain resilience will continue to shape strategic sourcing decisions as the market evolves, necessitating proactive risk management and flexible operational models.

Extracting Fundamental Segmentation Insights to Illuminate Growth Pathways Across Diverse Camera Functionality Technologies Resolutions and Applications

An analysis by camera type reveals distinct growth trajectories. Cabin View cameras are being refined for occupant monitoring and gesture recognition, while Front View modules are increasingly paired with radar and lidar for sensor fusion in advanced driver assistance. Rear View systems remain ubiquitous for reverse parking, but Surround View arrays composed of multiple side and front modules are seeing rapid uptake in premium segments. Side View cameras, once niche elements, now contribute to blind-spot detection and lane-change warning systems.

Examining underlying sensor technologies, the competition between CCD and CMOS solutions tilts in favor of CMOS as power efficiency and integration scalability become decisive factors. CMOS sensors are achieving higher pixel densities and faster frame rates, enabling real-time analytics for safety and security applications. In terms of resolution, the transition from HD to 4K imaging is gaining momentum; 4K systems provide superior object recognition and long-range visibility essential for Level 2 plus driving automation.

Application segmentation indicates that driver assistance features, such as lane-keeping and adaptive cruise control, are primary revenue drivers, while parking assistance remains a baseline requirement. Safety and security applications, including driver drowsiness detection and intrusion alerts, are carving out new value streams. Passenger vehicle installations dominate demand, although the light commercial vehicle sector is embracing high-end surround view and safety arrays. Meanwhile, the aftermarket channel is growing as retrofit solutions enable fleet operators to upgrade existing vehicles without OEM commitments, balancing cost and performance in a dynamic environment.

This comprehensive research report categorizes the Automotive Camera market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Camera Type

- Technology

- Resolution

- Application

- Vehicle Type

- Sales Channel

Highlighting Regional Dynamics That Propel Automotive Camera Adoption Across the Americas Europe Middle East and Africa and the Booming Asia Pacific Markets

Regional adoption patterns of automotive camera technology exhibit pronounced disparities shaped by regulatory frameworks, infrastructure maturity, and consumer preferences. In the Americas, stringent safety standards have spurred widespread integration of rear and surround view systems, with forward-looking mandates for pedestrian detection catalyzing front view camera upgrades. The region’s robust OEM network is concurrently piloting higher resolution imaging for Level 2 plus assistance packages, setting a high bar for suppliers.

Across Europe Middle East and Africa, regulatory pressure on emissions and pedestrian safety is driving camera-based enforcement and advanced driver assistance rollouts. Western European markets lead in adopting surround view and 4K front facing modules, while emerging economies in the region are gradually integrating HD systems for cost-effective compliance. In the Middle East and Africa, a growing premium automotive segment is embracing premium multi-camera arrays for luxury and off-road applications.

Meanwhile, Asia Pacific remains the fastest-evolving landscape, underpinned by aggressive government incentives for connected and autonomous vehicle testing. China’s local suppliers are scaling production of high-performance CMOS sensors, and Japan and South Korea continue to innovate with industry partnerships focusing on sensor fusion and artificial intelligence optimization. Southeast Asian countries are strategically positioning themselves as assembly hubs, leveraging lower labor costs and free-trade zones to service both regional and export markets.

This comprehensive research report examines key regions that drive the evolution of the Automotive Camera market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Moves of Leading Global Manufacturers Driving Innovation Partnerships and Competitive Positioning in the Automotive Camera Sector

The competitive arena of automotive cameras is dominated by a handful of global technology leaders, each leveraging unique capabilities to secure market positioning. Some manufacturers have forged strategic alliances with semiconductor firms to co-develop next-generation CMOS sensors optimized for low-light performance and miniaturized form factors. Others are investing in dedicated R&D centers focused on image processing algorithms that enhance object detection efficacy and functional safety compliance.

A prominent trend is the vertical integration of camera modules within larger sensor suites that include radar and lidar components. This approach simplifies system integration for OEMs and underscores partnerships between imaging specialists and radar technology providers. Leading companies are also expanding their footprint in emerging regions through joint ventures and greenfield manufacturing investments to bypass tariff barriers and meet localized demand more efficiently.

Collaboration with software ecosystem partners is another critical competitive lever. By licensing robust analytics platforms and cloud-based image processing frameworks, key players are elevating their value proposition beyond hardware. This has spurred a wave of acquisitions and minority investments in artificial intelligence startups that specialize in advanced vision recognition and data annotation, ensuring that product roadmaps remain at the cutting edge of industry standards.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Camera market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aptiv PLC

- Autoliv, Inc.

- Continental AG

- Denso Corporation

- Gentex Corporation

- HELLA GmbH & Co. KGaA

- Magna International Inc.

- Mobileye, Inc.

- OmniVision Technologies, Inc.

- Panasonic Corporation

- Robert Bosch GmbH

- Samsung Electro‑Mechanics Co., Ltd.

- Sony Group Corporation

- Valeo S.A.

- ZF Friedrichshafen AG

Navigating Supply Disruptions Enhancing Technological Capabilities and Strengthening Competitive Market Position in Automotive Vision Solutions

Industry leaders must proactively fortify supply chain networks to counteract tariff volatility and component shortages. Establishing dual-sourcing arrangements with geographically diverse suppliers and leveraging regional manufacturing clusters will provide the flexibility needed to maintain production continuity. Integrating advanced demand forecasting tools that harness real-time market signals can further optimize inventory levels and mitigate risk exposure.

On the technology front, prioritizing modular camera architectures will streamline integration across multiple vehicle platforms, accelerating time-to-market for new assistance and safety features. Investing in software-defined upgrades and over-the-air update capabilities can extend product lifecycles and generate recurring revenue streams. Additionally, collaborating with semiconductor partners to co-develop customized sensor arrays will ensure differentiated performance in low-light and high-resolution scenarios.

To capture emerging growth pockets, industry players should tailor go-to-market strategies that address regional nuances-from compliance demands in the Americas to autonomous testing incentives in Asia Pacific. Engaging with local regulatory bodies and forging alliances with software and hardware specialists will accelerate certification processes and reinforce competitive positioning. By embracing a holistic approach encompassing supply chain resiliency, technological modularity, and regional adaptability, organizations can unlock sustainable growth in the automotive camera market.

Detailing a Rigorous Methodological Framework That Integrates Primary Research Secondary Validation and Comprehensive Analytical Approaches for Robust Insights

This research is grounded in a meticulous combination of primary and secondary sources. Primary insights were gathered through structured interviews with key stakeholders including OEM procurement leaders, tier-one module suppliers, and technology innovators, ensuring an authentic perspective on current challenges and strategic priorities. These qualitative engagements were supplemented by an extensive survey of engineering teams to quantify adoption rates of evolving camera and sensor fusion technologies.

Secondary analysis involved a systematic review of technical white papers, regulatory filings, and patent databases to validate emerging trends in sensor performance and software-defined imaging. Proprietary databases tracking global production volumes, trade flows, and duty classifications were leveraged to assess the impact of tariff measures on supply chain economics. Cross-referencing multiple data streams allowed for triangulation of findings and minimization of bias.

All quantitative and qualitative data were synthesized using advanced analytical frameworks, including scenario analysis for tariff impact projections and comparative benchmarking of sensor capabilities across leading manufacturers. This rigorous approach ensures that the insights presented in this executive summary are robust, reliable, and actionable for stakeholders seeking a comprehensive understanding of the automotive camera ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Camera market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Camera Market, by Camera Type

- Automotive Camera Market, by Technology

- Automotive Camera Market, by Resolution

- Automotive Camera Market, by Application

- Automotive Camera Market, by Vehicle Type

- Automotive Camera Market, by Sales Channel

- Automotive Camera Market, by Region

- Automotive Camera Market, by Group

- Automotive Camera Market, by Country

- United States Automotive Camera Market

- China Automotive Camera Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Summarizing Key Takeaways That Highlight the Critical Role of Advanced Camera Technologies in Shaping Future Mobility Ecosystems and Safety Standards

In sum, advanced camera systems are positioned at the heart of the next mobility revolution, enabling enhanced safety, driver convenience, and initial steps toward autonomy. Technological shifts such as the migration from CCD to advanced CMOS sensors, the rise of 4K resolution, and the integration of multi-sensor fusion architectures are redefining performance benchmarks. Simultaneously, recent trade policies have reshaped supply dynamics, underscoring the necessity for resilient and diversified sourcing strategies.

Segmentation analysis highlights that while passenger vehicles remain the primary ADAS market, commercial fleets and aftermarket retrofits are gaining momentum through value-added safety and security offerings. Regional insights reveal distinct adoption curves, with the Americas and Europe leading on regulatory compliance, and Asia Pacific pushing the frontiers of autonomous testing and localized manufacturing. Competitive moves by key players-ranging from semiconductor collaborations to software acquisitions-illustrate a landscape where hardware excellence must be matched by software agility.

As the market continues to evolve, stakeholders who align strategic investments with modular technology platforms, agile supply networks, and targeted regional approaches will secure a sustainable competitive edge. The findings presented here offer a clear roadmap for navigating the complexities of cost pressures, performance demands, and regulatory expectations in the automotive camera domain.

Encouraging Strategic Engagement to Secure Comprehensive Automotive Camera Market Insights and Empower Decision Makers with Tailored Research Solutions

To gain unparalleled visibility into evolving technological breakthroughs, regulatory shifts, and competitive landscapes within the automotive camera sphere, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. By partnering with an expert who comprehensively understands both OEM and aftermarket dynamics, you will be equipped to accelerate innovation cycles, mitigate supply chain volatility, and optimize product portfolios. Secure a tailored market research report that delves into camera type distinctions such as cabin and surround views, addresses the implications of recent tariffs on cost structures, and highlights regional adoption trends across the Americas, Europe Middle East and Africa, and Asia Pacific. Leverage actionable recommendations designed for forward-thinking industry leaders to refine sourcing strategies and bolster technology roadmaps. Position your organization at the forefront of advanced vision solutions-reach out today to unlock insights that drive informed decisions and sustainable growth.

- How big is the Automotive Camera Market?

- What is the Automotive Camera Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?