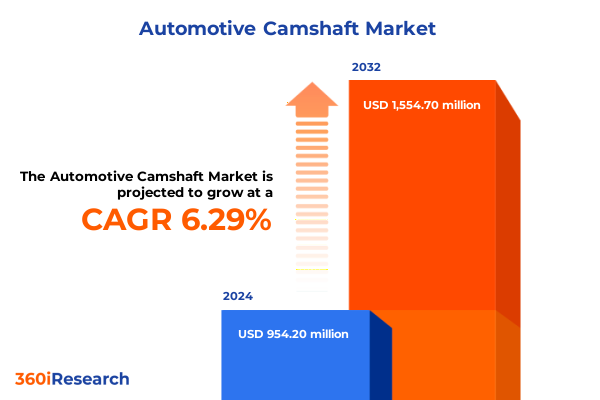

The Automotive Camshaft Market size was estimated at USD 1.00 billion in 2025 and expected to reach USD 1.06 billion in 2026, at a CAGR of 6.41% to reach USD 1.55 billion by 2032.

Setting the Stage for In-Depth Analysis of the Automotive Camshaft Sector by Exploring Fundamental Market Dynamics, Technological Drivers, and Industry Significance

The automotive camshaft component has long stood at the core of internal combustion engine performance, driving valve actuation and influencing power delivery, fuel economy, and emissions control. As engine architectures evolve to meet stringent environmental standards and consumer expectations for efficiency, the role of the camshaft has expanded beyond its traditional mechanical function, integrating with advanced modulation systems to optimize valve timing dynamically.

Over the past decade, innovations in materials science, precision machining, and digital control have reshaped the camshaft landscape. High-strength alloys and composite blends now reduce rotational mass, while microfinishing processes enhance surface durability under high-stress conditions. Simultaneously, variable valve timing systems have become critical differentiators for engine OEMs targeting tiered performance and regulatory benchmarks.

Within this evolving environment, a comprehensive understanding of the market dynamics, technological trajectories, and competitive strategies is essential for industry participants. This executive summary introduces the foundational context, outlines the transformational shifts influencing design and manufacturing, and sets the stage for a deeper exploration of segmentation patterns, regional nuances, and strategic priorities. By framing the discussion through multiple analytical lenses, decision-makers can navigate the complexities of the camshaft sector with clarity and precision.

Uncovering Transformative Shifts Powering the Evolution of Automotive Camshaft Design, Manufacturing, and Integration into Emerging Powertrain Architectures

In recent years, the automotive camshaft sector has experienced sweeping transformations driven by the integration of variable valve timing mechanisms and the push toward electrified propulsion. Conventional fixed-profile camshafts have given way to adaptive architectures capable of modulating lift and duration on demand, enabling manufacturers to achieve a finer balance between torque output, fuel economy, and emission targets. Furthermore, the rise of electric and hybrid powertrains has prompted camshaft suppliers to innovate modular designs that seamlessly interface with electric actuation modules, ensuring compatibility across diverse engine configurations.

Moreover, materials engineers have shifted toward lightweight alloys and surface treatments to meet weight reduction imperatives without compromising fatigue life. Advanced forging and precision machining techniques now support increasingly complex geometries, including multi-lobe camshafts with integrated sensors for real-time performance feedback. Simultaneously, Industry 4.0 practices-such as digital twins and predictive analytics-have enhanced process control during production, reducing cycle times and improving yield consistency.

Consequently, collaboration between OEMs, Tier 1 suppliers, and specialized technology partners has intensified. Companies are establishing co-development agreements to accelerate the commercialization of electric variable valve timing systems and camless actuation concepts. As a result, the landscape is shifting from a supplier-centric model toward an ecosystem-driven approach, where cross-functional innovation accelerates time to market and fosters scalability across global manufacturing footprints.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Automotive Camshaft Supply Chains, Component Costs, and Strategic Sourcing Decisions

The introduction of new United States tariffs in 2025 has introduced another layer of complexity for automotive camshaft supply chains. Designed to address trade imbalances and protect domestic manufacturing, these measures have targeted key steel and aluminum imports as well as selected precision components. As tariffs took effect, suppliers reliant on cross-border procurement faced immediate cost pressures, compelling purchasing teams to reconsider sourcing strategies and absorb incremental expenses or pass them along to assemblers.

In response, many market participants initiated rapid supplier audits to identify alternate domestic sources capable of meeting technical and volume requirements. Those unable to align with new supply parameters experienced disruptions in just-in-time delivery schedules, creating bottlenecks in assembly operations. At the same time, some forward-thinking organizations leveraged tariff engineering-redesigning components to avoid classification under the imposed duties-thereby mitigating financial impact without compromising performance.

Looking ahead, the cumulative effect of these 2025 tariff adjustments underscores the importance of supply chain agility and strategic redundancy. Manufacturers are increasingly investing in nearshoring initiatives to shorten lead times and reduce exposure to volatility. Parallelly, chemical and metallurgical research efforts have gained momentum as companies explore alternative materials that fall outside the tariff scope, setting the stage for a more resilient, cost-effective procurement strategy.

Illuminating Segmentation Insights on Vehicle Types, Distribution Channels, Technology Variants, End Uses, Manufacturing Methods, and Material Choices Shaping Market

Segmentation analysis reveals that the automotive camshaft market’s dynamics vary substantially by vehicle type. Heavy commercial vehicles demand robust camshaft profiles capable of sustaining high torque loads under constant duty cycles, whereas light commercial vehicles prioritize a balance between durability and cost efficiency for last-mile delivery and utility applications. Off-highway vehicles introduce unique requirements for extreme environmental resilience, prompting specialized material treatments, and passenger cars emphasize refined performance characteristics and NVH (noise, vibration, and harshness) reduction for consumer comfort.

Based on distribution channels, an interesting dichotomy emerges between original equipment manufacturers and the aftermarket. While OEM channels focus on integrated product launches and synchronized powertrain rollouts, the aftermarket underscores the longevity segment, comprising both authorized dealership replacements that guarantee adherence to OEM specifications and independent repair shops that cater to cost-sensitive end users seeking expedited service and flexible inventory options.

In the realm of technology, conventional camshafts maintain relevance in entry-level engines, but variable valve timing has captured industry attention through its ability to enhance engine breathing across operating ranges. Within the VVT category, electric actuation stands out for its precision, subdividing into cam phasing and cam switching systems that toggle between discrete cam profiles. Hydraulic VVT, by contrast, relies on oil pressure modulation and remains a proven solution for mid-tier performance enhancement.

End-use patterns further influence procurement and design choices. Original equipment placements often coincide with OEM vehicle program cycles, favoring camshafts engineered for specific engine calibration and lifecycle commitments. Replacement scenarios divide into scheduled maintenance intervals-where camshafts undergo preventative swaps-and unscheduled needs triggered by failure or upgrade demands, leading to varied aftermarket stocking strategies.

Manufacturing methodologies span cast, forged, machined, and stamped processes. Cast components, primarily gray and nodular iron, address cost-sensitive segments, while forged camshafts-cold or hot forged-offer superior strength for high-stress applications. Machined variants, produced through CNC machining and precision grinding, deliver tight tolerances essential for premium or performance engines, and stamped camshafts optimize production speed for select industrial platforms.

Material selection underscores performance and durability trade-offs. Aluminum alloys support lightweight applications with inherent corrosion resistance, cast iron variants-ductile or gray-provide a cost-efficient balance of strength and machinability, and steel-based camshafts, crafted from alloy or high-carbon grades, deliver exceptional wear resistance and fatigue life for demanding powertrain configurations.

This comprehensive research report categorizes the Automotive Camshaft market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Manufacturing Type

- Material

- Vehicle Type

- Distribution Channel

- End Use

Distilling Regional Insights to Highlight Market Dynamics, Challenges, and Growth Drivers across the Americas, Europe Middle East & Africa and Asia-Pacific

Regional examination uncovers distinct market characteristics across the Americas. In North America, a mature OEM landscape places high value on advanced variable valve strategies and lean production, while South American markets emphasize cost-effective cast solutions and robust aftermarket networks to accommodate extended service intervals. In addition, trade agreements and tariff realignments continue to influence cross-border plant expansions and joint ventures between local producers and global component manufacturers.

Europe, the Middle East, and Africa present a mosaic of regulatory stringency and technical sophistication. Western European automotive hubs demand compliance with Euro 7 emission standards and demonstrate early adoption of camless and fully integrated valve control systems. Meanwhile, Eastern Europe and the Middle East focus on establishing local manufacturing bases to mitigate import dependencies, and African markets prioritize aftermarket availability and spares distribution for sustaining aging vehicle fleets under diverse climatic conditions.

Asia-Pacific remains a hotspot for volume-driven growth and rapid technological adoption. China and India lead in forging domestic capacity for both conventional and advanced camshaft solutions, underpinned by government incentives for local content development. Southeast Asian nations are emerging as assembly hubs for light commercial vehicles, driving demand for mid-tier variable valve timing camshafts, and Oceania’s markets, though smaller, reflect a preference for performance-oriented machined components within premium segments.

This comprehensive research report examines key regions that drive the evolution of the Automotive Camshaft market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Company Insights to Showcase Leading Automotive Camshaft Manufacturers’ Innovations and Competitive Strategies Driving Industry Excellence

A review of leading organization strategies reveals a clear focus on technological differentiation and capacity optimization. Global engine system suppliers are investing heavily in electric variable valve timing platforms, establishing dedicated R&D centers to refine actuator miniaturization and energy efficiency. Concurrently, traditional forging houses are expanding hot forging lines, equipping facilities with multi-axis forging presses to accommodate next-generation cam profiles and alloy variants.

In parallel, several top-tier manufacturers have entered strategic alliances with digital solution providers to implement predictive maintenance capabilities for camshaft production. By embedding sensors within tooling and employing machine learning algorithms, they achieve real-time process adjustments that minimize defects and reduce downtime. Moreover, collaborations with academic institutions have expedited metallurgical breakthroughs, particularly in the development of hybrid composite coatings that bolster wear resistance without significant weight penalties.

Meanwhile, regional specialists are carving out niches by offering tailored aftermarket solutions. These companies enhance their competitive position by maintaining extensive distribution networks that deliver remanufactured camshafts calibrated to specific engine families. Their approach underscores the industry’s shift toward service-centric business models, where ongoing technical support and performance guarantees add value beyond the initial sale.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Camshaft market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aptiv PLC

- BorgWarner Inc.

- Cloyes Gear & Products, Inc.

- Dana Incorporated

- ElringKlinger AG

- JTEKT Corporation

- MAHLE GmbH

- Mondello Performance Products, Inc.

- Musashi Seimitsu Industry Co., Ltd.

- Newman Cams

- NTN Corporation

- Precision Camshaft Ltd

- Schaeffler AG

- Tenneco Inc.

Delivering Actionable Recommendations to Empower Industry Leaders in Adapting to Disruptions, Harnessing Innovation, and Optimizing Camshaft Supply Chain Approaches

Industry leaders should pursue integrated value chain visibility to anticipate disruptions and optimize buffer strategies. By establishing deeper partnerships with steel and aluminum suppliers, camshaft producers can co-invest in material development, ensuring uninterrupted access to critical alloys while aligning product specifications with emerging powertrain demands. Furthermore, adopting digital twins for manufacturing lines will enable rapid scenario planning, reducing changeover times and enhancing responsiveness to order fluctuations.

In addition, investing in variable valve timing platforms-both electric and hydraulic-will position organizations to capture higher-margin opportunities within the premium and performance segments. Firms should prioritize modular actuator designs that facilitate cross-platform integration, thereby accelerating time to market and maximizing return on development spend. Simultaneously, broadening aftermarket support through authorized and independent channels will drive revenue resilience, particularly in regions subject to tariff volatility.

Finally, companies must refine tariff mitigation strategies by engaging in tariff engineering and nearshoring initiatives. Redesigning camshaft geometries and exploring alternative materials can help avoid adverse duty classifications, while establishing assembly or machining operations closer to end markets will reduce exposure to trade disruptions. These combined measures will deliver both cost discipline and supply chain flexibility.

Presenting a Research Methodology Integrating Primary Interviews, Secondary Data Analysis, Rigorous Validation Protocols to Ensure Comprehensive Market Insights

The research methodology underpinning this report integrates multiple data acquisition and validation techniques to ensure reliability and depth of insight. Initially, primary interviews were conducted with senior executives at original equipment manufacturers, Tier 1 and Tier 2 suppliers, and key aftermarket distributors to capture firsthand perspectives on technological trends, procurement challenges, and market drivers.

Subsequently, extensive secondary data analysis drew upon industry journals, patent databases, technical whitepapers, and regulatory filings to contextualize primary findings. Trade association reports and publicly available financial disclosures supplemented this research, furnishing historical benchmarks and corroborating emerging themes.

Data triangulation formed a critical validation layer, where insights from disparate sources were cross-checked to identify inconsistencies and reinforce key conclusions. Quantitative analysis of manufacturing output and import-export statistics further substantiated qualitative observations. Throughout this process, rigorous peer review protocols were applied by independent subject-matter experts to verify methodological integrity and analytical rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Camshaft market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Camshaft Market, by Technology

- Automotive Camshaft Market, by Manufacturing Type

- Automotive Camshaft Market, by Material

- Automotive Camshaft Market, by Vehicle Type

- Automotive Camshaft Market, by Distribution Channel

- Automotive Camshaft Market, by End Use

- Automotive Camshaft Market, by Region

- Automotive Camshaft Market, by Group

- Automotive Camshaft Market, by Country

- United States Automotive Camshaft Market

- China Automotive Camshaft Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Concluding Insights Synthesizing Key Findings on Market Dynamics, Technological Advances, Tariff Impacts, and Segmentation Drivers for Informed Decision-Making

In summary, the automotive camshaft sector stands at a juncture where material innovation, manufacturing excellence, and strategic supply chain management converge to define competitive advantage. Technological advancements in variable valve timing and emerging digitalization practices underpin the industry’s trajectory, while newly imposed 2025 tariffs underscore the necessity for adaptive sourcing strategies.

Segmentation analysis illuminates how vehicle type, distribution channel, technology tier, end-use requirement, manufacturing method, and material selection collectively shape market dynamics. Regional insights reveal distinct priorities and growth drivers, from the mature OEM ecosystems of North America and Western Europe to the high-volume, cost-sensitive environments of Asia-Pacific.

By synthesizing these findings, decision-makers can navigate evolving regulations, capitalize on innovation pathways, and construct resilient supply chain frameworks. The synthesis of primary and secondary research provides the clarity required to make informed choices and sustain growth amid industry disruption.

Empower Your Strategy with Direct Access to the Comprehensive Automotive Camshaft Market Research Report by Connecting with Ketan Rohom Today

To gain immediate and comprehensive insights into the automotive camshaft market, reach out to Ketan Rohom, Associate Director, Sales & Marketing, and secure access to the full market research report. Whether you are evaluating new product introductions, assessing supply chain strategies, or benchmarking technology roadmaps, this report delivers actionable intelligence tailored to your strategic objectives. Contact Ketan Rohom to arrange a personalized briefing and unlock the data-driven analysis necessary to outpace competitors and shape your next moves with confidence.

- How big is the Automotive Camshaft Market?

- What is the Automotive Camshaft Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?