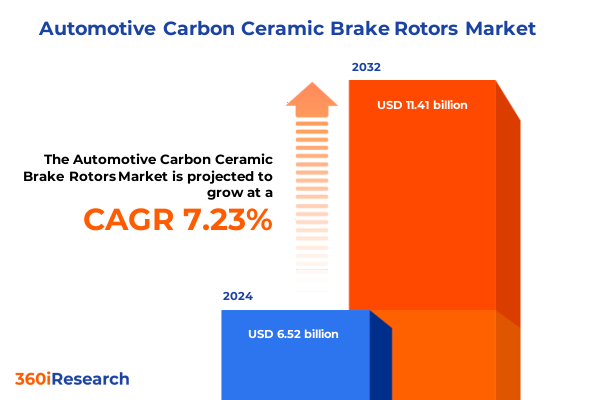

The Automotive Carbon Ceramic Brake Rotors Market size was estimated at USD 6.99 billion in 2025 and expected to reach USD 7.50 billion in 2026, at a CAGR of 7.24% to reach USD 11.41 billion by 2032.

Groundbreaking Introduction to the Transformative Potential and Competitive Advantages of Carbon Ceramic Brake Rotors in Modern Automotive Applications

The expanding complexity of automotive safety systems and the relentless pursuit of performance optimization have propelled carbon ceramic brake rotors into the industry spotlight. Pioneered in high-performance and luxury vehicles to address extreme braking demands, these advanced rotors now promise broader applications, driven by their exceptional thermal stability, reduced unsprung weight, and resistance to wear. In this introductory overview, the focus shifts to defining the unique material properties that distinguish carbon ceramic from traditional cast iron alternatives, setting the stage for an exploration of how this technology is redefining standards of reliability and efficiency in modern transportation.

Amid intensifying regulatory requirements around emissions and fuel economy, manufacturers are increasingly compelled to adopt lightweight materials without compromising safety. Carbon ceramic brake rotors, composed of silicon carbide fibers embedded in a carbon matrix, undergo high-temperature processing to achieve exceptional hardness and stability. This combination of attributes enables significant reductions in rotor mass, directly enhancing vehicle agility and energy efficiency. As the automotive sector pivots toward electrification and multimodal mobility solutions, the integration of carbon ceramic systems emerges as a key differentiator, offering both OEM and aftermarket stakeholders a competitive edge.

Looking ahead, the interplay of technological innovation, material science breakthroughs, and evolving performance expectations will continue to drive demand. This introductory discourse frames the subsequent sections, which delve into transformative market shifts, tariff impacts, segmentation insights, regional dynamics, and strategic imperatives. Ultimately, understanding the foundational advantages of carbon ceramic brake rotors provides critical context for assessing their long-term role in a rapidly advancing automotive landscape.

Exploring the Pivotal Industry Transformations Driven by Electrification Performance Demands and Advanced Manufacturing in Carbon Ceramic Brake Rotors

Recent years have witnessed a profound reconfiguration of the automotive braking systems arena, as stakeholders navigate the convergence of electrification, lightweighting imperatives, and next-generation materials. For OEMs, the surge in electric vehicle production demands solutions that can handle regenerative braking heat loads while minimizing energy losses. At the same time, consumer expectations for spirited driving dynamics and refined safety performance exert upward pressure on braking technology capabilities. Against this backdrop, carbon ceramic brake rotors have transitioned from niche exotic components to viable mainstream options, empowered by manufacturing advances and scaling production processes.

Material innovation plays a pivotal role in this transformation. Enhanced fiber architectures and optimized matrix compositions have enabled greater durability under cyclic thermal stresses, reducing the historically prohibitive cost barriers. Meanwhile, additive manufacturing landscapes and precision machining advancements bolster yield and consistency, making it possible to target broader vehicle segments. Additionally, the introduction of hybrid rotor designs, which combine carbon ceramic surfaces with metallic carriers, further expands application possibilities by balancing performance gains with cost considerations.

Beyond the technical sphere, strategic alliances between material suppliers, OEMs, and tier-one integrators have accelerated adoption cycles. Collaborative research initiatives focus on addressing end-of-life recycling challenges and establishing standardized testing protocols, thereby mitigating risk perceptions associated with new material deployment. As digital twins and AI-driven quality control techniques take hold, production yields improve and cycle times shrink, reinforcing the market’s confidence in carbon ceramic solutions. Ultimately, these cumulative shifts reflect an ecosystem pivot-one in which carbon ceramic brake rotors occupy a central role in unlocking the next frontier of automotive performance and sustainability.

Assessing How United States Tariff Adjustments in 2025 Are Reshaping Supply Chains Pricing Strategies and Market Dynamics for Carbon Ceramic Brake Rotors

In 2025, modifications to United States trade policy ushered in a new chapter of tariff structures affecting high-technology automotive components, including carbon ceramic brake rotors. The imposition of adjusted duties on ceramic composites imported from certain regions aimed to protect domestic manufacturing interests but simultaneously introduced complexity into global supply chains. For domestic OEMs dependent on specialized rotor substrates, the increased input costs necessitated renegotiation of supplier contracts and the pursuit of alternative material sources, creating both challenges and unexpected opportunities.

Tariff revisions prompted supplier diversification strategies, as manufacturers explored partnerships with North American composites producers to partially offset cost escalations. At the same time, some leading material firms responded by investing in local production capabilities, establishing kiln and machining facilities closer to key automotive manufacturing hubs. These shifts not only aligned with policies favoring onshore value generation but also reduced lead times and enhanced quality control oversight. Consequently, while initial price pressures were palpable, the long-term effect may be a more resilient, regionally balanced supply chain network.

From an aftermarket standpoint, tariff-induced pricing dynamics have had a bifurcated impact. Premium performance replacements for luxury and sports cars saw modest mark-ups to reflect higher landed costs, yet aftermarket distributors leveraged inventory strategies and value-added installation services to retain consumer interest. Conversely, standard replacements for commuter and mass-market vehicles experienced tighter margins, compelling distributors to optimize logistics and explore bundled service offerings. As policy stability remains a fluid factor, stakeholders continue to monitor legislative developments and industry advocacy efforts aimed at refining tariff frameworks to support sustainable growth.

In-Depth Analysis of Market Segmentation Revealing Insights Across Vehicle Types Distribution Channels and Axle Positions in Brake Rotor Demand

A nuanced understanding of market segmentation reveals differentiated trajectories of carbon ceramic brake rotor adoption, shaped by vehicle type, distribution channel nuances, and axle position requirements. Within the passenger car category, luxury vehicles sustain the technology’s high-end reputation, where enthusiasts and original equipment specifications prioritize superior thermal performance. Similarly, sports cars capitalize on reduced unsprung mass to achieve sharper handling, while sedans and SUVs begin to incorporate carbon ceramic systems as premium trim options that underscore a brand’s commitment to performance pedigree. In the heavy commercial vehicle domain, carbon ceramic rotors address the need for longevity and heat resistance under immense payload stress, whereas light commercial vehicles benefit from weight savings that translate into improved fuel efficiency.

Transitioning to distribution channels, the aftermarket segment is bifurcated between offline and online avenues, each responding differently to consumer purchasing behaviors. Specialty stores and direct stores provide hands-on expertise and installation support for discerning performance buyers, whereas e-commerce platforms and manufacturer websites introduce streamlined ordering experiences and digital content that educates consumers on the long-term advantages of carbon ceramic upgrades. The original equipment manufacturer channel maintains strict adherence to qualification protocols, integrating rotors directly into assembly lines with exacting tolerances and just-in-time delivery schedules.

Finally, axle position insights highlight distinct usage patterns: front axle installations absorb the bulk of deceleration energy, making carbon ceramic materials an ideal solution to mitigate heat fade during repeated braking cycles in high-demand scenarios. Rear axle applications, while less thermally taxed, nonetheless benefit from rotor durability and consistent performance, particularly in all-wheel-drive configurations where balanced braking torque distribution is critical. Collectively, these segmentation perspectives guide strategy development for product positioning, channel engagement, and targeted marketing communications.

This comprehensive research report categorizes the Automotive Carbon Ceramic Brake Rotors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Axle Position

- Distribution Channel

Regional Market Dynamics and Growth Drivers Highlighting Opportunities and Challenges Across the Americas EMEA and Asia-Pacific Brake Rotor Markets

Regional performance of carbon ceramic brake rotors exhibits distinct characteristics across the Americas, Europe, Middle East & Africa, and Asia-Pacific markets, each influenced by unique regulatory landscapes, automotive culture, and infrastructure maturity. In North America, consumer affinity for high-performance SUVs and muscle cars supports robust aftermarket demand, while leading OEMs integrate carbon ceramic options as part of premium packages aimed at discerning buyers who prioritize both braking excellence and driver experience.

Europe’s stringent emissions and safety regulations, coupled with a high penetration of luxury and sports car manufacturers, position the region as a growth epicenter for advanced braking technologies. Performance credentials are a central marketing theme among European marques, driving OEMs to collaborate closely with materials innovators to fine-tune rotor specifications for diverse driving conditions, from urban commutes to high-speed autobahn travel.

Within the Middle East & Africa, extreme ambient temperatures and challenging terrain spur interest in brake systems capable of withstanding severe thermal loads without compromise. Infrastructure development and growing luxury vehicle ownership further stimulate demand, although adoption rates vary significantly between urbanized hubs and emerging markets. Meanwhile, the Asia-Pacific region presents a complex mosaic: automotive giants in Japan and South Korea pursue high-precision manufacturing excellence, whereas emerging markets in Southeast Asia and China deliver accelerating aftermarket growth as vehicle fleets expand and performance-oriented subcultures flourish.

Collectively, these regional insights underscore the importance of tailored approaches to distribution, marketing, and collaboration with local stakeholders. By aligning product development roadmaps with region-specific performance requirements and regulatory standards, industry participants can unlock new avenues for growth and reinforce their competitive positions on a global scale.

This comprehensive research report examines key regions that drive the evolution of the Automotive Carbon Ceramic Brake Rotors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers and Strategic Collaborations Shaping the Competitive Landscape of Carbon Ceramic Brake Rotor Innovation and Production Excellence

The competitive environment in the carbon ceramic brake rotor segment is characterized by a blend of established material science pioneers and agile specialty producers, each advancing distinct innovation pathways. Leading manufacturing entities leverage decades of R&D investment to refine ceramic composite formulations, focusing on fiber alignment techniques and matrix densification processes that elevate thermal capacity and fracture toughness. Concurrently, emerging companies introduce proprietary treatments and surface texturing methods designed to optimize pad-to-rotor interaction and reduce brake dust generation.

Strategic partnerships further amplify capabilities as tier-one automakers collaborate with rotor specialists to co-develop next-generation systems. These alliances often entail joint research facilities, shared testing platforms, and co-investment in localized production lines, allowing for rapid iteration of design modifications and alignment with evolving vehicle architectures. Moreover, consolidation activities have intensified, with larger conglomerates acquiring niche startups to broaden their technology portfolios and streamline supply chain integration.

Parallel to manufacturing advances, technology integrators and test laboratories play a vital role in validating performance claims and ensuring compliance with international safety standards. Through rigorous dyno testing, real-world pilot programs, and accelerated life-cycle assessments, these stakeholders provide critical data that informs both OEM acceptance criteria and aftermarket certification schemes. The interplay of these varied players underscores a dynamic landscape in which collaboration, innovation, and quality assurance form the pillars of competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Carbon Ceramic Brake Rotors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akebono Brake Industry Co., Ltd.

- BMW AG

- Brembo S.p.A.

- EBC Brakes

- LeMyth technology co. ltd.

- M.Z Group Dortmund GmbH

- MAT Foundry Group Ltd

- Max Advanced Brakes

- Okmad Int'l Auto Parts

- Screening Eagle Technologies S.A.

- SGL Group AG

- Shenzhen CMC Composite Co., Ltd

- Sichuan Brake Rotor Merchandise Co. Ltd.

- SICOM Automotive GmbH

- Surface Transforms plc

- TMD Friction Group by Nisshinbo Holdings Inc.

- Volkswagen AG

- Wilwood Engineering, Inc.

Strategic Imperatives and Actionable Recommendations for Industry Leaders to Capitalize on Emerging Trends and Optimize Carbon Ceramic Brake Rotor Investments

To thrive in the evolving carbon ceramic brake rotor market, industry leaders must adopt a multi-faceted strategy that harmonizes product innovation, supply chain resilience, and customer engagement. First, companies should invest in modular production platforms that allow rapid customization of rotor geometries and composite formulations, catering to bespoke OEM specifications and performance tiers. This approach not only accelerates time to market but also enhances cost efficiency through shared processing infrastructure.

Simultaneously, forging partnerships with regional material suppliers can mitigate tariff impacts and logistics bottlenecks. By establishing localized manufacturing or assembly nodes, firms gain greater control over quality assurance protocols and respond agilely to policy fluctuations. A proactive approach to supply chain mapping and risk assessment enables leaders to identify alternative sourcing pathways and maintain continuity amid geopolitical shifts.

From a commercial standpoint, crafting educational outreach initiatives for technical buyers and end consumers will demystify the total cost of ownership advantages inherent to carbon ceramic technology. Case studies showcasing reduction in maintenance intervals, improved vehicle dynamics, and lifecycle sustainability reinforce the value proposition. In parallel, premium service models that integrate installation, calibration, and performance tuning create differentiated revenue streams and foster long-term brand loyalty.

Finally, embedding advanced analytics and digital twin capabilities into product development workflows empowers continuous improvement. Real-time performance data harvested from connected vehicles feeds back into design optimizations, driving incremental enhancements in rotor life and effectiveness. By embracing these strategic imperatives, industry participants can secure leadership positions and capture the full potential of this high-performance braking revolution.

Comprehensive Research Methodology Outlining Data Collection Analytical Framework and Validation Processes Underpinning the Brake Rotor Market Study

This research study employs a mixed-methodology framework designed to deliver holistic market insights through both quantitative and qualitative lenses. Primary data collection comprised in-depth interviews with C-level executives, procurement managers, and technical R&D specialists across OEMs, tier-one suppliers, and aftermarket distributors. These dialogues provided first-hand perspectives on product performance requirements, adoption barriers, and strategic priorities, ensuring that the analysis is grounded in practical industry realities.

Secondary research synthesis drew upon authoritative sources such as peer-reviewed journals in materials engineering, published white papers from automotive standards bodies, and publicly disclosed corporate disclosures. While specific market sizing metrics are not disclosed in this summary, these sources informed the segmentation logic, regional mapping, and competitive benchmarking exercises. In addition, a rigorous patent landscape analysis identified emerging composite formulations and manufacturing patents, highlighting innovation hotspots and intellectual property dynamics.

Analytical techniques included scenario planning to model the implications of potential tariff adjustments, statistical cross-tabulations to examine distribution channel performance, and thermal-mechanical simulations to validate rotor material behaviors under extreme operating conditions. Findings underwent triangulation via multiple data points to enhance validity and reduce bias. Furthermore, a peer review committee of industry experts provided critical feedback on draft conclusions, reinforcing the robustness of the final recommendations.

The comprehensive research methodology ensures that stakeholders receive a nuanced, evidence-based narrative of the carbon ceramic brake rotor market’s current state and future trajectory, equipping decision-makers with the context needed to drive effective strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Carbon Ceramic Brake Rotors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Carbon Ceramic Brake Rotors Market, by Vehicle Type

- Automotive Carbon Ceramic Brake Rotors Market, by Axle Position

- Automotive Carbon Ceramic Brake Rotors Market, by Distribution Channel

- Automotive Carbon Ceramic Brake Rotors Market, by Region

- Automotive Carbon Ceramic Brake Rotors Market, by Group

- Automotive Carbon Ceramic Brake Rotors Market, by Country

- United States Automotive Carbon Ceramic Brake Rotors Market

- China Automotive Carbon Ceramic Brake Rotors Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Concluding Synthesis Underscoring Key Findings Strategic Implications and Future Outlook for Automotive Carbon Ceramic Brake Rotors Market Evolution

The exploration of automotive carbon ceramic brake rotors reveals a convergence of material science breakthroughs, shifting regulatory landscapes, and evolving end-user expectations that collectively chart a new horizon for braking technology. From understanding the foundational advantages of carbon ceramic composites to assessing the impact of U.S. tariff realignments, each facet of the analysis underscores the transformational potential of this high-performance solution.

Segmentation insights illuminate how vehicle type distinctions, distribution channel dynamics, and axle position requirements shape demand patterns and inform strategic prioritization. Regional considerations further elucidate the diverse market drivers across the Americas, Europe, Middle East & Africa, and Asia-Pacific, highlighting the necessity of customized go-to-market approaches. Additionally, competitive profiling and partnership ecosystems showcase the critical role of collaborative innovation and quality assurance in sustaining growth trajectories.

By synthesizing these dimensions with actionable strategic imperatives and robust methodological validation, the report offers a coherent narrative that maps the complex interplay between technology, policy, and market forces. Ultimately, the findings serve as a catalyst for informed decision-making, guiding stakeholders toward investments and initiatives that will define the next chapter of braking performance excellence.

Engaging Call To Action Directly Addressing Stakeholders to Connect with Ketan Rohom for Exclusive Insights and Market Research Report Acquisition

For organizations seeking to gain an authoritative vantage point on the automotive carbon ceramic brake rotor market and make informed strategic decisions, connecting with Ketan Rohom, Associate Director of Sales & Marketing, offers a direct pathway to exclusive insights and comprehensive data. Engage with Ketan to explore tailored solutions that align with your company’s objectives, whether you require in-depth analysis of tariff implications, segmentation deep-dives, or competitive benchmarking. His expertise and access to the full market research report ensure that your investment in this rapidly evolving sector delivers clear returns.

By reaching out to Ketan Rohom, you will secure personalized support in interpreting findings, implementing recommended strategies, and leveraging the research to optimize product development, supply chain resilience, and market entry planning. Don’t miss the opportunity to arm your leadership team with cutting-edge intelligence and actionable guidance. Reserve your copy of the report today and embark on a data-driven journey toward sustainable growth and competitive excellence in the carbon ceramic brake rotor landscape.

- How big is the Automotive Carbon Ceramic Brake Rotors Market?

- What is the Automotive Carbon Ceramic Brake Rotors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?