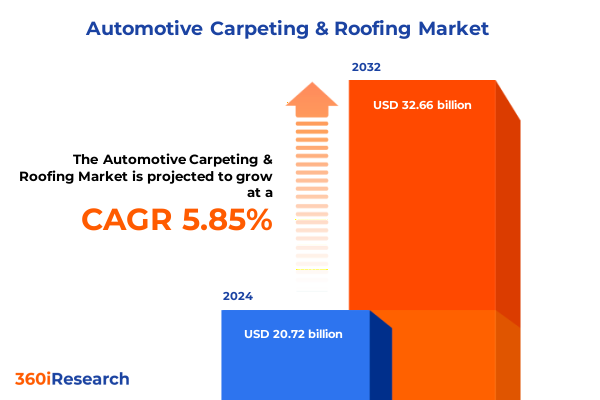

The Automotive Carpeting & Roofing Market size was estimated at USD 21.85 billion in 2025 and expected to reach USD 23.05 billion in 2026, at a CAGR of 5.91% to reach USD 32.66 billion by 2032.

Defining the Strategic Importance of Automotive Carpeting and Roofing in Elevating Comfort Performance and Acoustic Insulation Standards

Automotive carpeting and roofing have emerged as foundational elements that define the in-vehicle experience, serving critical roles in sound absorption, thermal management, and occupant comfort. Carpeting not only cushions the cabin floor against road vibration but also contributes to noise attenuation and aesthetic appeal. Simultaneously, roofing systems, including integrated headliners, play a pivotal role in insulation, bolt‐on sensor integration, and overall structural integrity. These functions have elevated carpets and headliners beyond decorative trim, positioning them as essential contributors to occupant well-being and vehicle performance across diverse driving conditions.

In recent years, the drive for lighter and more environmentally responsible materials has accelerated innovation in both products. Automakers and tier-1 suppliers are investing heavily in recycled fibers, bio‐based foams, and hybrid composites to reduce weight while maintaining durability and acoustic properties. This shift aligns with broader industry imperatives to comply with stringent emissions regulations and to meet consumer expectations for sustainable interiors. Advanced manufacturing techniques such as waterless dyeing and digital printing have further streamlined production, resulting in lower resource consumption and more precise customization capabilities.

Against this backdrop, the market is converging on solutions that balance performance, environmental impact, and cost, reshaping supplier ecosystems and prompting strategic collaborations. As electrification intensifies and new mobility models emerge, the strategic importance of carpeting and roofing continues to grow, making it vital for decision-makers to understand evolving material innovations, regulatory headwinds, and consumer preferences.

Navigating the Confluence of Electrification Lightweighting and Digitalized Supply Chains Transforming Carpeting and Roofing Solutions

As the automotive industry transitions toward electrified powertrains, weight reduction has become an uncompromising priority. In response, material developers are leveraging lightweight thermoplastic composites and bio-based polyurethane foams that negotiate the trade-off between rigidity and mass. Headliners infused with castor oil–derived polyols and carpeting made from recycled PET deliver substantial kilogram savings compared to conventional nylon or polypropylene substrates. These lightweight innovations not only support extended electric vehicle range but also sustain acoustic insulation and improve safety performance metrics during crash events.

Concurrently, procurement strategies for distribution channels are evolving as digital platforms disrupt traditional aftermarket and OEM supply chains. The surge in online automotive parts sales has accelerated omnichannel integration, compelling suppliers to invest in real-time inventory visibility, direct-to-consumer portals, and digital order management systems. This digital transformation enhances agility and responsiveness, enabling rapid adaptation to fluctuating demand and minimizing stock-out risks.

Lastly, the maturation of Industry 4.0 principles is engendering a shift toward predictive logistics and on-demand manufacturing for carpeting and roofing components. Cloud-based analytics and digital twins facilitate proactive maintenance of production lines, while additive manufacturing prototypes reduce lead times for material trials. Such integrated supply‐chain digitalization fosters resilience and positions suppliers to innovate at a pace that matches evolving design and regulatory requirements.

Assessing the Comprehensive Effects of United States Section 232 Tariffs on Automotive Carpeting and Roofing Supply Chains

In March 2025, the U.S. presidential proclamation invoked Section 232 of the Trade Expansion Act to impose a 25% tariff on imports of passenger vehicles and certain automotive parts, including key components for carpeting and roofing assemblies. Passenger cars and light trucks faced new duties effective April 3, 2025, while automotive parts tariffs commenced by May 3, 2025. Exclusions were provided for USMCA-compliant imports, permitting tariff exceptions for parts with certified local content.

These elevated duties disrupted long-standing cross-border supply chains, creating bottlenecks as critical components awaited customs clearance and origin verification. Within days, reports surfaced of delayed shipments and production slowdowns, with some North American assembly lines experiencing sporadic line stops due to missing carpeting and headliner parts. Companies reliant on Canadian, Mexican, and Asian suppliers faced additional administrative burdens, as new documentation requirements and customs checks increased lead times and costs significantly.

To mitigate the impact, the U.S. Department of Commerce launched an offset program in June 2025, enabling domestic assemblers to apply for temporary tariff reductions based on their production volumes and U.S. content thresholds. While this measure provided targeted relief, the overall tariff framework remains in place indefinitely, prompting industry stakeholders to reevaluate supplier networks, onshore critical processes, and accelerate the exploration of alternative material sources to preserve margin and production continuity.

Unveiling Comprehensive Critical Segmentation Insights Across Material Distribution Channel and Vehicle Type Dynamics in the Market

The market’s material landscape is defined by a quartet of core polymers: nylon, polyester, polypropylene, and polyurethane. Each presents distinct value propositions; nylon offers superior abrasion resistance for high-wear zones, polyester balances cost-efficiency with dye versatility, polypropylene delivers inherent stain resistance for cargo and heavy-duty applications, and polyurethane foams enable advanced acoustic and thermal insulation. Supply and innovation trajectories for these substrates have diverged, as sustainability mandates propel rPET and bio-based polyol adoption, forcing suppliers to recalibrate raw material sourcing and production methodologies.

Distribution channels remain bifurcated between traditional offline networks-encompassing OEM tier-1 contracts and aftermarket repair shop partnerships-and burgeoning online platforms that offer direct-to-end-user fulfillment. While the offline channel continues to capitalize on long-standing service agreements and consolidated logistics, online channels distinguish themselves through rapid fulfillment, modular customization options, and data-driven customer engagement strategies, collectively reshaping market accessibility and supplier outreach models.

Vehicle type segmentation underscores distinct usage profiles and design criteria. Commercial vehicles, spanning heavy and light-duty classes, prioritize durability, chemical resistance, and ease of maintenance, driving material choices toward heavy-gauge polypropylene weaves and robust underlays. In contrast, passenger vehicles-across hatchbacks, sedans, and SUVs-demand a nuanced balance of premium aesthetics, soft-touch textures, and acoustic refinement, motivating the integration of micro-fiber polyester felts and multi-layer polyurethane composites to meet end-user comfort expectations.

This comprehensive research report categorizes the Automotive Carpeting & Roofing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Vehicle Type

- Distribution Channel

- Application

Evaluating Pivotal Regional Market Characteristics and Growth Drivers Across Americas EMEA and Asia Pacific Automotive Interiors Landscape

The Americas market is characterized by a well-established automotive ecosystem that converges mature OEM presence with a robust aftermarket infrastructure. Consumer preferences in the United States and Canada emphasize premium textures and eco-friendly substrates, while regulatory drivers-such as U.S. emissions standards and vehicle safety mandates-motivate continuous improvements in material performance. Additionally, the region’s extensive highway networks impose stringent durability requirements for carpeting and roofing components, guiding suppliers toward high-performance polypropylene blends and reinforced underlays to withstand prolonged usage.

In Europe Middle East & Africa (EMEA), the interplay between stringent EU regulations and diverse climatic conditions steers material innovation toward lightweight and recyclable composites. The European Circular Economy Action Plan has compelled suppliers and OEMs to target elevated recycled content thresholds, accelerating the uptake of rPET-based carpets and bio-based polyurethane foams for headliners. In Middle Eastern markets, extreme temperature resilience becomes paramount, while African markets prioritize cost-competitive, easily maintainable materials compatible with local repair ecosystems.

Asia-Pacific presents a dual narrative: rapid EV adoption in China and Southeast Asia spurs demand for lightweight carpeting and thermally insulating roofing systems that extend battery range, while established markets in Japan and South Korea focus on precision craftsmanship and multi-functional headliner integration. Government incentives for green manufacturing catalyze supplier investments in closed-loop recycling and digital material traceability, positioning the region at the vanguard of sustainable interior solutions.

This comprehensive research report examines key regions that drive the evolution of the Automotive Carpeting & Roofing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves Innovations and Collaborations Shaping the Competitive Landscape Among Leading Automotive Carpeting and Roofing Suppliers

Leading suppliers have pursued strategic acquisitions and joint ventures to expand material portfolios and geographic reach. Companies such as Lear Corporation and Adient have deepened their presence in Asia through partnerships with local molding and textile firms, securing direct pipelines for recycled fiber and composite formulations. Meanwhile, Freudenberg Group has invested in advanced insulation technologies, enabling the integration of nano-enhanced acoustic felts that outperform legacy substrates. Such moves underscore the competitive imperative to control proprietary material platforms and sustain robust global production footprints in the face of supply-chain volatility.

Simultaneously, several Tier-1 and specialty providers are intensifying R&D efforts to pioneer high-differentiation offerings. Toyota Boshoku and Faurecia (now Forvia) are collaborating with chemical partners to deploy bio-derived polyurethane foam systems that deliver equivalent performance to petroleum-based resins while achieving lower carbon intensity. On the carpeting front, Milliken & Company and Mohawk Industries have introduced digital print technologies for rapid pattern customization, catering to OEM demand for limited-edition colorways and bespoke trim packages. These initiatives illustrate how material and process innovation serve as primary vectors of competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Carpeting & Roofing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGM Automotive, Inc.

- Alliance Interiors LLC

- Auria Solutions Ltd.

- Auto Custom Carpets Inc.

- Automobile Trimmings Company

- Autoneum Holding AG

- Dorsett Industries

- Dräxlmaier Group

- Faurecia S.A.

- Grupo Antolin

- Hayashi Telempu Co., Ltd.

- IAC Group

- Inteva Products, LLC

- Lear Corporation

- Magna International, Inc.

- Orotex Belgium NV

- Sage Automotive Interiors

- Toyota Boshoku Corporation

- UGN, Inc.

- Unitex India Pvt Ltd

Proposing Targeted Strategic Initiatives to Enhance Resilience Sustainability and Growth for Industry Leaders in Automotive Interior Solutions

To fortify supply‐chain resilience, industry leaders should diversify raw material sources and evaluate strategic onshoring of critical processes such as fiber extrusion and composite lamination. By establishing dual‐source contracts across geographies and incorporating tariff‐alignment clauses, companies can mitigate the risks posed by trade policy fluctuations and rapid shifts in raw material pricing. Moreover, investing in localized manufacturing hubs adjacent to key assembly plants will reduce transit times and customs dependencies.

Embracing sustainable material innovations is essential for long‐term competitiveness. Suppliers should accelerate development of certified recycled-content carpets and bio-based roofing substrates, collaborating with chemical companies to scale up supply of rPET, castor-derived foams, and natural fiber composites. Integrating life‐cycle assessment tools into product development will enable clear ESG reporting and support compliance with evolving regional sustainability regulations.

Finally, leaders must capitalize on digital channels to unlock new revenue streams and enhance customer engagement. Developing robust e-commerce capabilities-complete with real-time part configurators, augmented reality visualization tools, and data-driven recommendation engines-will position suppliers to meet growing B2B and B2C demand. Collaborative platforms that link OEMs, retailers, and end-users will streamline order fulfillment, reduce inventory overhead, and foster deeper brand loyalty.

Detailing the Rigorous Research Methodology Combining Primary Expert Interviews Secondary Data Analysis and Triangulation Techniques

The research methodology underpinning this report combines comprehensive secondary analysis, primary interviews, and rigorous data triangulation to ensure accuracy and relevance. Secondary sources include government trade databases, industry association publications, and peer-reviewed materials to establish a robust contextual and historical foundation. Primary research encompasses structured interviews with key stakeholders across OEMs, tier-1 suppliers, procurement executives, and materials experts, facilitating nuanced insights into market drivers and pain points.

Data triangulation techniques synthesize quantitative and qualitative inputs, aligning industry forecasts with real-world production and procurement trends. Statistical cross-validation and scenario modeling enhance the reliability of directional analysis, while expert workshops and peer reviews provide critical validation. This integrative approach ensures that findings reflect both macro-level trade policies and micro-level operational realities, equipping decision-makers with a holistic view of the market landscape.

Report compilation adheres to stringent quality standards, with iterative peer reviews by domain specialists and continuous updates to capture emerging developments up to mid-2025. The structured framework enables reproducibility and transparency, allowing users to trace data sources, analytical models, and underlying assumptions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Carpeting & Roofing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Carpeting & Roofing Market, by Material

- Automotive Carpeting & Roofing Market, by Vehicle Type

- Automotive Carpeting & Roofing Market, by Distribution Channel

- Automotive Carpeting & Roofing Market, by Application

- Automotive Carpeting & Roofing Market, by Region

- Automotive Carpeting & Roofing Market, by Group

- Automotive Carpeting & Roofing Market, by Country

- United States Automotive Carpeting & Roofing Market

- China Automotive Carpeting & Roofing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Summarizing Key Findings Underscoring Industry Evolution and Emphasizing Strategic Imperatives for Automotive Carpeting and Roofing Stakeholders

This executive summary has illuminated the multifaceted evolution of automotive carpeting and roofing markets, highlighting pivotal shifts in material innovation, distribution strategies, and trade policy impacts. The confluence of electrification imperatives, sustainability obligations, and digital supply-chain advancements is reshaping both product portfolios and operational models. Strategic segmentation insights reveal that material type, channel dynamics, and vehicle classifications each demand tailored approaches to capture value and manage risk effectively.

The imposition of U.S. Section 232 tariffs in 2025 underscores the need for agile supply-chain strategies and targeted offset mechanisms to preserve production continuity and margin integrity. Concurrently, regional analyses affirm that while mature markets in the Americas and EMEA grapple with regulatory and durability demands, Asia-Pacific leads in green manufacturing and EV-driven material efficiencies. Competitive intelligence indicates that leading suppliers are leveraging M&A, joint ventures, and R&D to secure proprietary materials and digital capabilities.

Ultimately, industry stakeholders that align resilience, sustainability, and digital innovation within their core strategies will be best positioned to thrive amid ongoing disruption. The insights and recommendations herein offer a strategic roadmap for navigating the complexities of the evolving market, enabling decision-makers to invest with confidence and capture emergent growth opportunities.

Encouraging Engagement with Associate Director Sales and Marketing to Secure Access to Comprehensive Market Intelligence and Drive Informed Decisions

To explore the full depth of strategic insights and actionable data that will empower your organization to navigate evolving market dynamics and capitalize on emerging opportunities in automotive carpeting and roofing, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Ketan is ready to provide tailored guidance, detailed report excerpts, and partnership opportunities to ensure you and your team have the intelligence required to make confident, future-focused decisions.

Contact Ketan today to unlock comprehensive market intelligence and drive your next wave of innovation and growth.

- How big is the Automotive Carpeting & Roofing Market?

- What is the Automotive Carpeting & Roofing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?