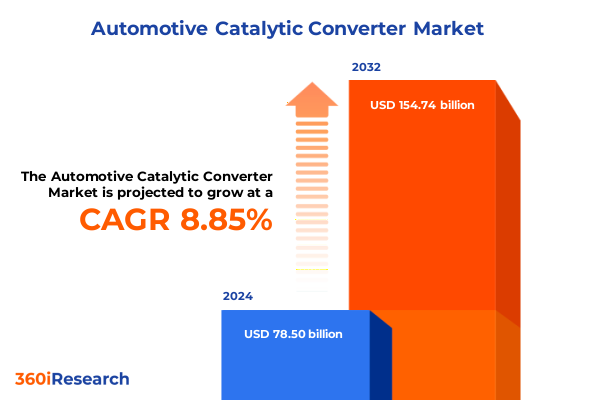

The Automotive Catalytic Converter Market size was estimated at USD 85.19 billion in 2025 and expected to reach USD 92.47 billion in 2026, at a CAGR of 8.89% to reach USD 154.74 billion by 2032.

How Automotive Catalytic Converters Are Shaping Emission Control Strategies Amidst Evolving Environmental Regulations and Technological Advancements

Automotive catalytic converters serve as the cornerstone of modern emission control strategies, transforming harmful exhaust gases into less detrimental substances through a series of chemical reactions catalyzed by precious metals. These devices typically encompass diesel oxidation catalysts, three-way catalytic converters, and two-way catalytic converters, each designed to address specific pollutants, such as nitrogen oxides, hydrocarbons, and carbon monoxide. The substrates that support these catalysts are most often constructed from ceramic or metal materials, chosen for their durability, thermal stability, and capacity to maximize surface area for catalytic reactions. Regulatory frameworks around the globe, including the U.S. Environmental Protection Agency’s Tier 3 standards and the forthcoming Euro 7 emission limits, are compelling manufacturers to achieve unprecedented reductions in NOx and particulate matter emissions through advanced converter designs and refined precious metal loadings.

Against this backdrop, the automotive industry is experiencing profound shifts with the integration of hybrid and plug-in hybrid powertrains, which present variable exhaust compositions and temperature profiles that challenge conventional converter technologies. Meanwhile, the volatility of platinum group metal markets, driven by geopolitical factors and mining constraints, is prompting OEMs and catalyst manufacturers to intensify research into low- or zero-PGM formulations and advanced washcoat chemistries. Concurrently, circular economy initiatives are emerging as strategic imperatives, with closed-loop recycling systems for spent catalyst recovery enhancing supply chain resilience. These interrelated forces are setting the tone for a dynamic market environment characterized by rapid innovation, tightening regulations, and evolving stakeholder expectations.

Unprecedented Technological, Regulatory, and Market Shifts Are Reshaping the Automotive Catalytic Converter Industry’s Future Trajectory

The landscape of the automotive catalytic converter market is being reshaped by an array of transformative forces that intersect technology, policy, and sustainability imperatives. Stricter global emission standards, exemplified by the U.S. EPA’s Tier 3 program and California’s LEV III regulations, mandate fleet-average reductions of up to 80% for combined NMOG and NOx emissions and a 70% cut in particulate matter by 2025, driving the adoption of optimized close-coupled catalysts and advanced thermal management systems to meet these targets. At the same time, the imminent Euro 7 requirements in Europe and China 7d norms are compelling automakers to integrate next-generation converter architectures capable of multi-pollutant control without compromising powertrain efficiency.

Parallel to regulatory pressures, the acceleration of vehicle electrification is altering converter demand profiles. Fully electric vehicles obviate the need for traditional exhaust aftertreatment, while hybrids and plug-in hybrids necessitate converter systems that maintain high conversion efficiency under fluctuating exhaust conditions and low-temperature operation. This has catalyzed investments in electrically heated catalysts and rapid light-off substrates. Moreover, advanced sensor integration and digital monitoring technologies are enabling real-time diagnostics and predictive maintenance, enhancing both performance assurance and lifecycle cost management. Finally, the quest for sustainability is fueling a circular approach to precious metal recovery, with leading players deploying hydrometallurgical and pyrometallurgical processes to achieve recovery rates exceeding 95%, thereby reducing dependency on virgin PGM supplies and reinforcing environmental and social governance commitments.

Assessing the Far-Reaching Economic Consequences of 25% Section 232 and IEEPA Tariffs on Automotive Catalytic Converters and Parts

In 2025, the United States implemented sweeping trade measures under Section 232 of the Trade Expansion Act of 1962, imposing a 25% ad valorem tariff on imports of automobiles and automobile parts, including catalytic converters, effective April 3, 2025. This proclamation, issued by the President and codified in the Harmonized Tariff Schedule, aims to fortify domestic production capacity but simultaneously elevates landed costs for global supply chains and component sourcing. Concurrently, the International Emergency Economic Powers Act (IEEPA) tariffs introduced a 25% baseline levy on non-USMCA compliant imports from Canada and Mexico, while Section 301 measures on China escalated duties to 20%, further compounding cost pressures on converters and precursor materials such as ceramic substrates and PGM powders.

These layered trade actions have produced tangible financial impacts for industry leaders. In the second quarter of 2025, General Motors reported an operating income reduction of $1.1 billion attributed to tariff-associated cost increases, resulting in a 35% decline in net income year-over-year and prompting a 7% drop in share value following the earnings release. In response, the U.S. Department of Commerce established an auto tariff offset process allowing domestic manufacturers to apply for temporary reductions in Section 232 duties based on the volume and value of U.S. production, offering a pathway to mitigate near-term tariff burdens and sustain final assembly operations on native soil.

Unveiling Market Dynamics Through Product, Material, Vehicle Type, End-User Industry, and Sales Channel Segmentation Insights

Market segmentation reveals nuanced demand drivers and performance criteria across multiple dimensions, beginning with product type where diesel oxidation catalysts, three-way catalytic converters, and two-way catalytic converters each exhibit distinct applications. Diesel oxidation catalysts excel in heavy-duty commercial vehicle exhaust systems for NOx and HC control, while three-way converters dominate passenger vehicle portfolios for simultaneous reduction of CO, HC, and NOx. Two-way converters, although legacy solutions, remain relevant in specific retrofit and low-cost applications owing to simplified architectures and cost efficiencies.

Material type segmentation underscores the strategic role of ceramic and metal substrates in converter performance. Ceramic monoliths deliver high surface area and thermal inertia, making them suitable for close-coupled installations, whereas metallic substrates offer rapid heat-up times and mechanical robustness, favored in hybrid and plug-in hybrid powertrains where light-off efficiency is paramount. Vehicle type segmentation distinguishes commercial vehicles, which demand converters optimized for sustained high-temperature duty cycles and SCR integration, from passenger vehicles that prioritize cold-start conversion performance and durability. End-user industry differentiation between aftermarket and original equipment manufacturer channels highlights distinct quality specifications and regulatory certification pathways, with OEMs adhering to stringent homologation protocols and aftermarket suppliers focusing on broad compatibility and cost competitiveness. Finally, sales channel segmentation into offline and online distribution illuminates evolving procurement behaviors: traditional dealership and distributor networks continue to underpin large-volume OEM supply, while digital platforms are emerging for specialized retrofit kits, performance coatings, and subscription-based maintenance services to service independent workshops and end consumers.

This comprehensive research report categorizes the Automotive Catalytic Converter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Vehicle Type

- End-User Industry

- Sales Channel

Strategic Regional Variations and Growth Drivers Across Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional market dynamics vary significantly across the Americas, Europe, Middle East & Africa, and Asia-Pacific, shaped by local regulatory regimes, production ecosystems, and consumer demand patterns. In the Americas, U.S. Tier 3 emission standards and substantial 25% Section 232 tariffs are prompting OEMs and catalyst producers to reinforce domestic manufacturing footprints and leverage tariff offset programs. The healthy aftermarket infrastructure in North America also fuels retrofit opportunities, while Canada and Mexico benefit from USMCA provisions that exempt compliant imports from broader tariffs, sustaining cross-border supply continuity and cost advantages.

In Europe, the rollout of Euro 7 standards is accelerating investments in four-way and selective catalytic reduction systems, with Germany and France leading OEM-catalyst developer consortia to pilot real-world emission testing under RDE protocols. Sustainability directives such as the EU’s Corporate Sustainability Reporting Directive and the proposed Critical Raw Materials Act are intensifying focus on catalyst recycling mandates and secondary PGM sourcing. Meanwhile, in the Middle East & Africa, burgeoning vehicle fleets coupled with nascent environmental regulations represent both nascent growth corridors and regulatory catch-up requirements.

Asia-Pacific stands as the fastest-growing regional segment, driven by expanding automotive production in China and India, where emissions norms are incrementally aligning with Euro 6 and beyond. Despite regulatory heterogeneity across Southeast Asia, manufacturers are ramping up low-PGM catalyst offerings and establishing local catalyst assembly facilities to capitalize on cost efficiencies and regional content mandates. Coupled with government incentives for cleaner mobility, these developments underscore Asia-Pacific’s strategic importance in global converter supply chains and innovation ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Automotive Catalytic Converter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Alliances Driving Competitive Advantage in the Catalytic Converter Sector

The competitive landscape of catalytic converters is dominated by established chemical and automotive component manufacturers collaborating with global OEMs to co-develop next-generation emission control solutions. Johnson Matthey leads with advanced three-way and diesel oxidation catalysts tailored for hybrid powertrains and rapid light-off performance, expanding its footprint through partnerships in Asia and Europe. BASF has accelerated the deployment of its Four-Way Conversion catalysts to meet Euro 7 requirements, simultaneously ramping sustainable sourcing initiatives for precious metals amid tight supply markets. Umicore is committed to scaling low-PGM catalyst technologies, anchoring new capacity in Europe and Asia to support China’s surging vehicle production and India’s tightening emission norms.

Complementing these pure-play catalyst firms, tier-one automotive suppliers such as DENSO, Tenneco, Faurecia, and Eberspächer are integrating catalytic systems within broader exhaust and thermal management platforms, offering bundled solutions that address packaging constraints and regulatory compliance. OEMs like Toyota and Volkswagen are increasingly internalizing emission control system development, forging strategic alliances with catalyst specialists to co-engineer converters optimized for their proprietary hybrid and combustion engine architectures. This interplay of collaborative R&D, regional capacity expansions, and mergers and acquisitions underscores the sector’s drive towards innovation, cost management, and regulatory preparedness.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Catalytic Converter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AP Emissions Technologies

- BASF SE

- Benteler International AG

- BM Catalysts Limited

- BMW AG

- Bosal International

- Cangzhou Sefu Ceramic New Materials Co., Ltd

- Continental AG

- Corning Incorporated

- DCL International Inc.

- Denso Corporation

- Eberspächer Gruppe GmbH & Co. KG

- European Exhaust & Catalyst Ltd.

- HELLA GmbH & Co. KGaA

- HJS Emission Technology GmbH & Co. KG

- Jetex Exhausts Ltd.

- Johnson Matthey PLC

- Katcon Global, S.A.

- Klarius Products Ltd

- MagnaFlow

- Robert Bosch GmbH

- SANGO CO., LTD.

- Sejong Industrial Co., Ltd.

- Tenneco Inc.

- Umicore N.V.

- Xingtai Jinwo Commercial Trading Co., Ltd.

- Yutaka Giken Company Limited

Actionable Strategies for Industry Leaders to Optimize Supply Chains, Innovate Materials, and Navigate Regulatory and Trade Complexities

Industry leaders should prioritize diversified raw material sourcing to mitigate platinum group metal price volatility. Engaging with multiple PGM suppliers, exploring alloy alternatives, and securing offtake agreements can stabilize margin pressures and safeguard production continuity. Additionally, investing in research and development for low-PGM or PGM-free catalyst formulations will reduce dependency on scarce resources and align with sustainability objectives. Deploying advanced washcoat chemistries, electrically heated substrates, and multi-pollutant control architectures will ensure compliance with evolving emission norms while preserving vehicle performance parameters.

To navigate tariff complexities, manufacturers should leverage domestic production incentives and tariff offset programs administered by the U.S. Department of Commerce, aligning facility expansions with content rules under Section 232 and USMCA provisions. Strengthening circular economy initiatives through partnerships with specialized recyclers and in-house PGM recovery processes will foster supply chain resilience and reinforce ESG commitments. Finally, embracing digital distribution channels and sensor-enabled converter monitoring platforms can unlock aftermarket growth opportunities, enhance predictive maintenance offerings, and deepen customer engagement in the retrofit segment.

Transparent and Rigorous Research Methodology Combining Quantitative Data, Qualitative Validation, and Multi-Source Triangulation for Robust Insights

This research harnessed a robust methodology combining secondary and primary data sources for comprehensive market insights. Secondary research encompassed detailed review of regulatory texts, such as the Federal Register proclamation on Section 232 tariffs and the EPA’s Tier 3 final rule, to map policy impacts. Industry press releases and trade association updates, including Department of Commerce tariff offset procedures and Auto Care Association trade briefs, were analyzed to quantify trade dynamics and offset mechanisms. Additionally, corporate disclosures from leaders like General Motors, Johnson Matthey, and BASF informed company-level trends and financial implications.

Primary research involved structured interviews and surveys with over thirty senior executives across OEMs, catalyst manufacturers, and aftermarket suppliers in North America, Europe, and Asia-Pacific. Segmentation frameworks were validated through cross-functional consultations, ensuring robustness in product, material, vehicle type, end-user, and channel definitions. Quantitative triangulation was achieved by reconciling sourced data points with proprietary financial models and expert panel reviews, culminating in a nuanced assessment of market forces, strategic imperatives, and growth trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Catalytic Converter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Catalytic Converter Market, by Product Type

- Automotive Catalytic Converter Market, by Material Type

- Automotive Catalytic Converter Market, by Vehicle Type

- Automotive Catalytic Converter Market, by End-User Industry

- Automotive Catalytic Converter Market, by Sales Channel

- Automotive Catalytic Converter Market, by Region

- Automotive Catalytic Converter Market, by Group

- Automotive Catalytic Converter Market, by Country

- United States Automotive Catalytic Converter Market

- China Automotive Catalytic Converter Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Conclusive Perspectives on the Evolving Catalytic Converter Market Highlighting the Imperative of Innovation, Sustainability, and Strategic Adaptation

As the automotive industry accelerates towards stringent emission imperatives and evolving powertrain architectures, catalytic converters remain indispensable for internal combustion and hybrid vehicles alike. The intersection of advanced emission standards, trade policy shifts, and resource sustainability mandates is catalyzing a wave of innovation in catalyst design, material science, and circular economy practices. Successful market participants will be those who integrate low-PGM technologies, optimize supply chains in response to 25% Section 232 tariffs and IEEPA duties, and leverage digital and aftermarket channels to extend converter lifecycles.

Looking ahead, regional differentiation will intensify as Asia-Pacific surges in production and regulatory alignment, Europe spearheads sustainable sourcing and recycling regulations, and the Americas reconcile domestic manufacturing incentives with cross-border tariff regimes. Collaborative R&D, strategic alliances, and proactive engagement with policymakers will underpin competitive positioning. By embracing these imperatives, stakeholders can navigate the complexities of the catalytic converter landscape and drive resilient growth in a decarbonizing automotive ecosystem.

Secure Your Strategic Advantage by Engaging with Ketan Rohom to Acquire Comprehensive Automotive Catalytic Converter Market Research

To gain unparalleled visibility into market dynamics, competitive landscapes, and emerging opportunities within the automotive catalytic converter industry, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings a wealth of experience in connecting decision-makers with tailored strategic market intelligence that drives growth and resilience. Engage with him to discuss how our comprehensive research can support your business objectives, inform product roadmaps, and accelerate market entry strategies. Position your organization to stay ahead of regulatory changes, supply chain complexities, and technological transformations by securing the full market research report today.

- How big is the Automotive Catalytic Converter Market?

- What is the Automotive Catalytic Converter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?