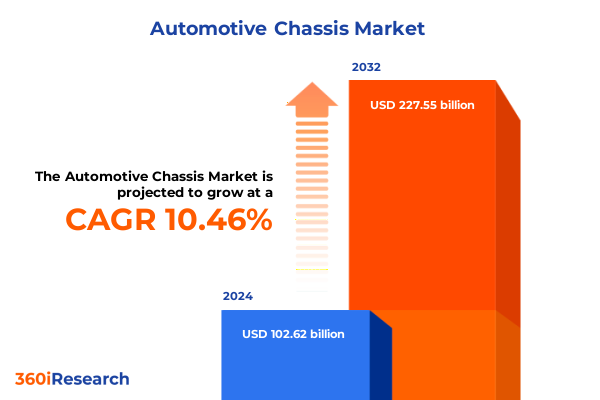

The Automotive Chassis Market size was estimated at USD 111.66 billion in 2025 and expected to reach USD 121.50 billion in 2026, at a CAGR of 10.70% to reach USD 227.55 billion by 2032.

Charting the automotive chassis evolution in the era of electrification digitalization and sustainability to lay the groundwork for understanding market dynamics

The automotive chassis market stands at the crossroads of technological advancement and evolving consumer expectations. Recent years have witnessed a dramatic acceleration in the integration of electrification, digital connectivity, and sustainability requirements, compelling manufacturers to reimagine the foundational structure that supports vehicle architecture. As lightweighting initiatives converge with safety regulations and performance benchmarks, chassis systems have emerged as a critical enabler of next-generation mobility solutions.

In this context, understanding the interplay between material selection, manufacturing processes, and end-use vehicle applications becomes essential. Aluminum alloys, composite blends, and advanced high-strength steels each offer unique benefits in terms of stiffness, weight reduction, and crashworthiness. At the same time, innovations such as space frame and monocoque designs challenge traditional ladder and backbone configurations, opening pathways to more efficient load distribution and assembly efficiencies.

This introductory overview lays the groundwork for exploring how global macroeconomic factors, shifting regulatory landscapes, and the imperative of sustainability are reshaping chassis development. By anchoring our analysis in the current state of material science, production technologies, and end-market expectations, the following sections offer a cohesive narrative that illuminates both the catalysts of change and the emerging opportunities for industry stakeholders seeking to achieve competitive differentiation.

Unveiling the transformative shifts driving chassis design innovation from lightweight materials and electrification integration to advanced manufacturing techniques across the value chain

The automotive chassis sector is undergoing transformative shifts driven by converging forces of lightweight material adoption, electrification integration, and advanced manufacturing. Materials science breakthroughs in carbon fiber reinforced polymers and high strength steel variants are enabling chassis designs that balance rigidity with weight savings, catering to both performance and efficiency targets. Simultaneously, the rapid proliferation of electric powertrains is imposing new structural requirements, from accommodating battery packs within monocoque shells to optimizing crash energy management under altered weight distributions.

Moreover, the transition to digital twins and Industry 4.0 ecosystems has accelerated the refinement of chassis through data-driven simulation and additive manufacturing techniques. Real-time analytics feed back into iterative design loops, enhancing component reliability while reducing prototype cycles. In parallel, modular frame architectures, such as space frames, are becoming more prevalent as automakers seek to deploy versatile platforms across multiple vehicle segments, shortening development timelines and lowering production costs.

These transformative shifts underscore a broader trend toward integrated value chains, where material suppliers, design studios, and OEMs collaborate more closely. Cross-industry partnerships are emerging as organizations leverage expertise from aerospace, consumer electronics, and advanced materials sectors to pioneer chassis solutions that align with zero-emission targets and evolving safety standards. The resulting blueprint for chassis innovation not only addresses current market demands but also anticipates future applications in autonomous and shared mobility scenarios.

Assessing the cumulative impact of 2025 United States tariffs on automotive chassis materials supply chains cost structures and global competitiveness

United States tariff policies enacted in early 2025 have created significant reverberations throughout automotive chassis supply chains. New duties imposed on imported aluminum and certain steel categories have driven up procurement costs, prompting manufacturers to reassess sourcing strategies and re-evaluate the balance among domestically produced cold rolled steel, high strength steel, extruded aluminum, and composite materials. The ripple effects have extended into downstream production, leading some chassis fabricators to explore vertical integration or establish joint ventures with material suppliers to secure cost stability.

These tariff adjustments have also intensified the focus on alternative materials such as carbon fiber reinforced polymers and glass fiber reinforced polymers, which currently face lower trade barriers. The relative affordability of composites, combined with their superior strength-to-weight ratios, has made them a more attractive proposition for certain specialty chassis components. At the same time, exporters of ladder frames and backbone chassis systems have contended with reduced competitiveness in the U.S. market, spurring shifts in regional manufacturing footprints and logistical flows.

Despite these challenges, the industry’s adaptive response underscores its resilience. Domestic production capacities for cast aluminum and advanced steel treatments are scaling up, with investments in plant modernization and lean manufacturing practices. Moreover, OEMs and tier suppliers are leveraging predictive analytics to forecast material price volatility and optimize inventory strategies, thereby mitigating the cumulative impact of tariff-driven cost pressures and maintaining continuity of supply for critical chassis parts.

Extracting critical segmentation insights across material types frame structures drive configurations vehicle classes and distribution channels shaping the chassis market landscape

Critical segmentation insights reveal the nuanced dynamics governing chassis design and application. When viewed through the prism of material type, aluminum variants bifurcate into cast aluminum components favored for their complex geometries and extruded aluminum elements prized for uniform strength and lightweight profiles. Composite options further segment into carbon fiber reinforced polymer for ultra-high performance applications and glass fiber reinforced polymer where cost efficiencies are paramount. Meanwhile, steel continues to play a foundational role with cold rolled steel providing consistency in sheet applications and high strength steel enabling thinner gauges without compromising structural integrity.

Frame architecture segmentation highlights the divergence between backbone chassis systems, which offer a robust central beam for heavy load bearings; ladder frames that balance simplicity and ruggedness in commercial vehicle platforms; traditional monocoque designs applauded for their integrated body-on-frame efficiencies; and space frames that distribute loads across a network of welded or bonded nodes. Drive type considerations bifurcate market opportunities between two wheel drive vehicles, which dominate certain regional passenger car segments, and four wheel drive configurations that are essential for off-road capabilities, light commercial pickups, and performance-oriented SUVs.

Vehicle type segmentation further delineates opportunities across heavy commercial vehicles such as buses and trucks requiring chassis longevity under high payloads, light commercial vehicles including pickups and vans where flexibility and cost are critical, and passenger cars spanning hatchbacks, sedans, and SUVs that demand a balance of ride comfort, safety, and aesthetic integration of chassis structures. Finally, distribution channels segregate aftermarket demand-driven by repair, customization, and refurbishment-from original equipment manufacturing needs that hinge on production scale, engineering partnerships, and just-in-time delivery within OEM assembly operations.

This comprehensive research report categorizes the Automotive Chassis market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Frame Type

- Drive Type

- Vehicle Type

- Distribution Channel

Decoding regional market dynamics across the Americas EMEA and Asia Pacific to reveal growth hot spots and strategic opportunities in chassis development

Regional market dynamics illustrate diverse trajectories across the Americas, Europe Middle East Africa, and Asia Pacific landscapes. In the Americas, North American automakers are bolstering domestic chassis production by investing in high strength steel press lines and composite manufacturing hubs, while Latin American markets are gradually integrating lightweight frames to enhance fuel efficiency amid increasing environmental regulations. The localized focus on regional content has also spurred collaborative programs between suppliers and OEMs to align chassis capabilities with North American safety and emissions standards.

Across Europe, the Middle East, and Africa, stringent carbon reduction targets have accelerated the adoption of aluminum intensive monocoque designs and hybrid material blends. European manufacturers continue to pioneer modular space frame platforms for premium segments, whereas emerging markets in the Middle East and Africa are primarily characterized by ladder frame variants for commercial vehicles, reflecting infrastructure demands and cost sensitivities. Cross-border trade agreements and localized manufacturing incentives further influence chassis sourcing decisions, compelling stakeholders to navigate regulatory complexity and leverage free trade corridors.

Asia Pacific remains the engine of chassis volume growth, underpinned by expanding passenger car production in China and rising demand for light commercial vehicles in Southeast Asia. The region’s established steel and aluminum industries enable competitive production costs, while an increase in EV assembly plants is driving demand for novel frame adaptations to accommodate battery modules. Strategic partnerships between local material producers and global design firms are fostering innovation centers focused on region-specific chassis solutions.

This comprehensive research report examines key regions that drive the evolution of the Automotive Chassis market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading automotive chassis manufacturers strategic partnerships technology investments and competitive positioning in a rapidly evolving industry

Leading companies in the automotive chassis arena are differentiated by their commitment to technological leadership, strategic collaborations, and robust manufacturing footprints. Global steel conglomerates have expanded into high strength and ultra-high strength steel production, working closely with OEMs to co-develop tailored alloys that meet evolving safety and lightweighting mandates. Aluminum specialists have invested in extrusion and casting capabilities, leveraging digital process controls to deliver complex chassis subassemblies with tight tolerances and repeatable performance metrics.

Simultaneously, innovative composite manufacturers are forging alliances with research institutions to refine resin formulations and fiber layup techniques, driving down cycle times in advanced polymer matrix component fabrication. Tier one suppliers are integrating additive manufacturing, robotic welding, and laser joining into their chassis assembly lines, enabling just-in-time production and rapid prototyping. These technology investments reinforce a competitive advantage by facilitating flexible platform architectures that can be reconfigured across multiple vehicle programs.

Strategic joint ventures between material innovators and frame fabricators are also noteworthy, illustrating a shift toward vertically integrated ecosystems. Such collaborations not only secure raw material supply but also foster co-innovation in multi-material bonding techniques and modular frame designs. As these companies sharpen their focus on sustainability and cost efficiency, the competitive landscape is being reshaped by players that can seamlessly marry material expertise with advanced manufacturing to meet the complex demands of next-generation mobility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Chassis market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Corporation

- American Axle & Manufacturing, Inc.

- Benteler International AG

- CIE Automotive, S.A.

- Continental AG

- Dana Incorporated

- F-TECH Inc.

- Gestamp Automoción, S.A.

- Hyundai Mobis Co., Ltd.

- Magna International Inc.

- Martinrea International Inc.

- Schaeffler Technologies AG

- Thyssenkrupp AG

- Tower International, Inc.

- ZF Friedrichshafen AG

Delivering actionable recommendations for industry leaders to capitalize on emerging trends optimize supply chains and drive innovation in chassis engineering

Industry leaders must prioritize material diversification strategies to mitigate tariff-induced cost pressures and capitalize on the performance benefits of composites alongside advanced steel grades. By establishing strategic supplier alliances and exploring co-investment opportunities in local production facilities, organizations can secure stable access to critical inputs while benefiting from regional incentives that offset tariff burdens.

In parallel, embracing digital transformation across chassis design and manufacturing processes will be essential. Deploying digital twins, high-fidelity simulation tools, and predictive maintenance analytics can accelerate development cycles and enhance quality control. This integration of data-driven methodologies not only reduces time-to-market but also facilitates continuous improvement in component durability and functional integration with emerging electrification platforms.

Furthermore, adopting a platform-centric approach to frame architectures will enable greater modularity and economy of scale. Designing universal substructures that accommodate multiple vehicle segments-from passenger cars to light and heavy commercial vehicles-can unlock production flexibility and cost efficiencies. Collaboration with R&D partners to refine multi-material joining techniques will be a differentiator, ensuring seamless integration of aluminum, composite, and high strength steel elements within unified chassis frameworks.

Outlining a rigorous research methodology combining primary interviews secondary data analysis and advanced modeling approaches to ensure data validity

Our research methodology applies a multi-tiered approach to ensure comprehensive coverage and analytical rigor. Primary data collection involved in-depth interviews with senior executives, product engineers, and procurement specialists across OEMs, tier suppliers, and material vendors. These qualitative insights were triangulated with secondary sources, including regulatory documents, trade association reports, and peer-reviewed academic studies, to validate emerging trends and material performance claims.

Quantitative analysis leveraged a proprietary database tracking chassis component shipments by material type, frame architecture, drive configuration, vehicle class, and distribution channel. Advanced statistical techniques, such as regression modeling and time series analysis, were employed to identify correlations between tariff shifts, raw material price movements, and production volumes. Geospatial mapping tools further enriched the regional segmentation by illustrating manufacturing clusters, logistics networks, and emerging investment corridors.

Data quality assurance protocols were rigorously enforced throughout the research process. Cross-verification of interview transcripts, data normalization across disparate sources, and iterative review by subject matter experts ensured consistency and reliability. Ethical guidelines were upheld in all primary research activities, including informed consent and data anonymization where required. This robust methodology underpins the credibility of our insights and supports strategic decision-making for stakeholders across the automotive chassis ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Chassis market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Chassis Market, by Material Type

- Automotive Chassis Market, by Frame Type

- Automotive Chassis Market, by Drive Type

- Automotive Chassis Market, by Vehicle Type

- Automotive Chassis Market, by Distribution Channel

- Automotive Chassis Market, by Region

- Automotive Chassis Market, by Group

- Automotive Chassis Market, by Country

- United States Automotive Chassis Market

- China Automotive Chassis Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing core findings on market shifts material innovations tariff impacts and strategic imperatives to guide stakeholders toward informed decision making

The comprehensive analysis of the automotive chassis market reveals a landscape in flux, shaped by material breakthroughs, regulatory pressures, and geopolitical dynamics. Lightweight materials such as extruded aluminum and advanced composites are redefining performance benchmarks, while high strength steel continues to deliver critical structural integrity. The synergy between these materials and evolving frame architectures-from monocoque to space frame-underscores the innovation imperative for meeting safety, efficiency, and cost targets.

Tariff interventions in 2025 have highlighted the importance of supply chain resilience and regional production capabilities. Industry stakeholders that proactively diversified sourcing strategies and invested in domestic manufacturing capacity demonstrated greater agility in navigating cost fluctuations. In parallel, the growing emphasis on modular platform design and digital engineering tools sets the stage for more responsive, customer-centric product development.

Ultimately, success in the chassis market will be determined by the ability to integrate material science advancements, flexible manufacturing processes, and data-driven design methodologies. Organizations that cultivate strategic partnerships across the value chain and adopt a forward-looking posture toward electrification, autonomy, and sustainability will be poised to lead the next wave of mobility innovation.

Unlock strategic chassis insights by engaging with Ketan Rohom to access the comprehensive research report driving your market leadership journey

Engaging in a dialogue with Ketan Rohom, Associate Director of Sales & Marketing, offers an opportunity to explore tailored solutions that address your organization’s unique challenges and objectives. Through a personalized conversation, you will discover how in-depth research on material innovations, regulatory impacts, and competitive landscapes coalesces into a strategic roadmap for chassis development and deployment. This direct engagement ensures that your questions receive attentive responses, supporting precise application of insights to real-world business scenarios and enabling you to stay ahead of industry shifts.

By contacting Ketan Rohom, you gain privileged access to the full suite of findings, data visualizations, and executive interviews that underpin the automotive chassis research. This includes expert analysis of material tradeoffs, implications of evolving tariff structures, and segmentation intelligence across material types, frame configurations, drive systems, vehicle classes, and distribution pathways. With this comprehensive information in hand, your leadership team can confidently evaluate strategic investments, partnership opportunities, and supply chain optimizations that drive sustainable growth.

Act now to transform ambiguity into opportunity. Schedule a consultation with Ketan Rohom to receive a complimentary executive briefing and learn how detailed, actionable intelligence can accelerate your market entry, product innovation, or partnership negotiations. Reach out today to secure your copy of the definitive automotive chassis market report and position your organization for competitive advantage in the dynamic landscape ahead

- How big is the Automotive Chassis Market?

- What is the Automotive Chassis Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?