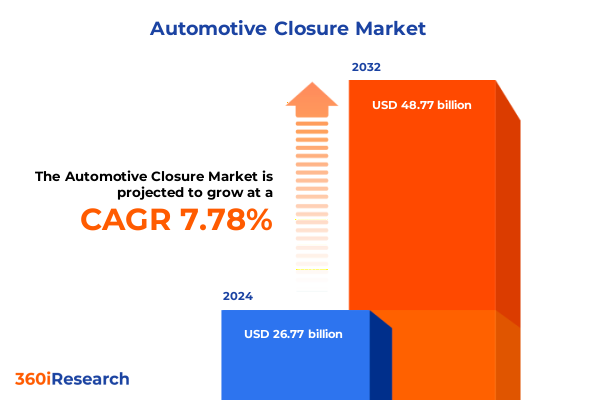

The Automotive Closure Market size was estimated at USD 28.77 billion in 2025 and expected to reach USD 30.92 billion in 2026, at a CAGR of 7.83% to reach USD 48.77 billion by 2032.

Navigating the Future of Automotive Closure Systems as Innovation, Safety Regulations, and Consumer Expectations Drive Rapid Transformation

The automotive closure segment has undergone rapid evolution as industry stakeholders navigate a convergence of technological innovation, regulatory shifts, and shifting consumer expectations. Closure systems-encompassing hoods, doors, sunroofs, and windows-play a pivotal role in ensuring occupant safety, enhancing vehicle aerodynamics, and delivering the seamless user experiences modern drivers demand. Against the backdrop of electrification, autonomous features, and lightweight materials, closures have transformed from purely mechanical components to integrated, software-enabled assemblies.

Today’s industry pioneers are redefining closure architecture to optimize energy efficiency and reinforce structural integrity without compromising on comfort or accessibility. Electrically actuated sunroofs and doors equipped with anti-pinch sensors exemplify this technological pivot, while manufacturers leverage advanced materials to reduce mass. Moreover, tightening global safety regulations and consumer preferences for connected vehicles have elevated closures from ancillary fittings to strategic differentiators in a crowded marketplace.

In this dynamic context, automotive companies face mounting pressure to innovate their closure offerings while containing costs and ensuring compliance. As new mobility models emerge and aftermarket demand evolves, organizations must balance design agility, production scalability, and long-term durability. This introduction sets the stage for an executive summary that delves into how transformative shifts, tariff developments, segmentation insights, and regional dynamics are collectively reshaping the future of automotive closure solutions.

Unraveling the Disruption of Traditional Closure Manufacturing through Electrification, Connectivity, and Sustainable Material Adoption

Automotive closure manufacturing is experiencing a profound transformation driven by the parallel forces of electrification, connectivity, and sustainability imperatives. Electrically actuated closures have redefined user expectations, integrating advanced sensors and actuators to deliver seamless opening and closing mechanisms. Simultaneously, vehicle software platforms now orchestrate these components in concert with advanced driver-assistance systems, enabling collision avoidance and enhanced safety functions.

Meanwhile, material innovation has gained momentum as manufacturers seek to balance weight reduction with structural performance. The increasing adoption of composite panels and high-strength alloys not only contributes to vehicle efficiency but also underpins the integration of complex geometries and modular assemblies. In addition, rising environmental standards are prompting the development of bio-based polymers and recyclable materials to minimize lifecycle impacts.

Moreover, the convergence of digital manufacturing techniques-such as additive printing for hinge prototypes and robotic assembly lines for latches-has accelerated product development cycles. As a result, closure components can be tailored more precisely to meet regional crash regulations, customer preferences, and electric vehicle packaging constraints. Ultimately, these transformative shifts are converging to create a closure landscape that is smarter, lighter, and more responsive to the evolving demands of the automotive value chain.

Assessing the Ripple Effects of 2025 United States Automotive Tariffs on Closure Component Supply Chains and Cost Structures

In 2025, the United States implemented a series of safeguard tariffs on specific closure components imported from key trading partners, with the intent of reinforcing domestic manufacturing capabilities. These levies have introduced added cost layers throughout the supply chain, compelling OEMs and tier-one suppliers to reassess procurement strategies and regional sourcing footprints. Consequently, procurement teams have accelerated efforts to diversify supplier networks and negotiate long-term contracts to mitigate tariff exposure.

Amidst rising input costs, many suppliers have initiated cost-containment programs, including production optimization and lean manufacturing practices. Meanwhile, the prospect of further tariff escalations has spurred conversations around nearshoring and reshoring, especially for critical components like electronic control units and high-precision actuators. As local sourcing commitments gain traction, partnerships with domestic metal and polymer manufacturers are evolving to support flexible production volumes.

Furthermore, these tariff dynamics have influenced pricing negotiations and product roadmaps. Automakers are evaluating the trade-offs between higher upfront costs and the potential benefits of a resilient domestic supply chain. At the same time, suppliers are exploring incremental automation investments to offset labor cost pressures. Collectively, the 2025 tariff measures have catalyzed a recalibration of cost structures and strategic priorities in the automotive closure sector.

Delving into Market Segmentation Dynamics across Products, Components, Materials, Closure Types, Applications, and End-Users for Closure Solutions

A nuanced understanding of market segments reveals differentiated growth drivers across products, components, materials, closure types, applications, and end users in the automotive closure sphere. The product dimension covers a range of systems, from bonnets and sunroofs to windows and doors, with the latter category further subdivided into back doors, front doors, fuel doors, and rear doors to capture distinct functional and design requirements influencing manufacturing complexity.

Component-based segmentation highlights core assemblies such as actuators and electronic control units alongside mechanical elements like hinges, latches, relays, and switches. This lens underscores the growing importance of electromechanical integration and software calibration in modern closure architectures. Material segmentation further refines the analysis by differentiating composite materials, metals, and polymers. Composite subcategories include carbon fiber and glass fiber reinforced plastic, metals branch into aluminum and steel variants, while polymer focus areas encompass nylon, polycarbonate, and PVC grades.

Closure types are categorized into automatic/electric and manual variants, reflecting divergent cost and performance profiles. Application segmentation distinguishes between commercial and passenger vehicles, with the former covering heavy and light commercial platforms and the latter encompassing hatchbacks, sedans, and SUVs. Finally, the market’s end-user split between aftermarket channels and OEMs illuminates contrasting service models and procurement cycles. This segmentation framework provides strategic insight into how tailored product offerings, material choices, and component configurations align with evolving mobility use cases.

This comprehensive research report categorizes the Automotive Closure market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Products

- Component Type

- Material Type

- Type

- Application

- End-User

Illuminating Regional Trajectories in the Americas, Europe Middle East Africa, and Asia Pacific for Automotive Closure Innovations and Adoption

Regional dynamics in the automotive closure market reflect distinct regulatory regimes, production ecosystems, and consumer preferences across the Americas, EMEA, and Asia-Pacific. In the Americas, the maturity of automotive manufacturing in North America, coupled with trade agreements like USMCA, underpins a well-established supplier base for metal and polymer closures. Furthermore, growing interest in nearshoring has prompted cross-border investments between the United States and Mexico, particularly for assembly of electronic control units and high-precision door modules.

Within Europe, the Middle East, and Africa, stringent safety and environmental regulations have elevated demand for advanced sensor-enabled closures and lightweight alloys. Germany and France remain epicenters of innovation in electric vehicle closures, while emerging markets in Eastern Europe and North Africa are attracting investment in component stamping and coating facilities. Additionally, the region’s logistical networks facilitate efficient distribution across diverse submarkets, supporting a wide range of application requirements.

Asia-Pacific continues to lead in both manufacturing scale and rapid adoption of cutting-edge closure technologies. China’s vast production base is complemented by Japan’s expertise in high-precision hinge and latch assemblies, as well as South Korea’s advancements in electronic actuator integration. Meanwhile, India’s burgeoning OEM sector and ASEAN’s evolving trade partnerships are driving demand for cost-effective, manually operated closure solutions and entry-level automatic systems. Together, these regional insights inform targeted market entry and expansion strategies for suppliers and automakers alike.

This comprehensive research report examines key regions that drive the evolution of the Automotive Closure market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Competitive Landscape and Strategic Positioning of Leading Multinational Manufacturers in the Automotive Closure Ecosystem

The competitive landscape of automotive closure systems is defined by a mix of established multinational suppliers and emerging specialized innovators. Several global tier-one players have consolidated their market positions through strategic acquisitions, enabling broader product portfolios that span electronic control units, actuators, hinges, and latches. Investments in research laboratories and pilot production lines have accelerated the development of smart closure modules tailored to electric and autonomous vehicles.

In parallel, niche suppliers focusing on advanced composite and polymer materials have captured attention by delivering lightweight, high-performance components. These specialists often collaborate with premium OEMs to co-develop novel closures featuring carbon fiber-reinforced plastics or bio-based polymers, enhancing both vehicle efficiency and sustainability credentials. Moreover, partnerships between technology firms and traditional hardware manufacturers are emerging to embed connectivity platforms and over-the-air update capabilities into closure systems.

Competitive differentiation increasingly hinges on integration capabilities, intellectual property portfolios, and global manufacturing footprints. Companies that effectively combine mechanical expertise with software control and materials science are securing long-term contracts with leading automakers. As electrification and autonomy continue to penetrate mainstream vehicle segments, suppliers that demonstrate agility in scaling production, customizing designs, and supporting rigorous validation processes will gain a decisive edge.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Closure market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AISIN CORPORATION

- Aptiv PLC

- ATS Global B.V.

- Brose Fahrzeugteile GmbH & Co. KG

- Cebi International S.A.

- Continental AG

- Denso Corporation

- Gentex Corporation

- GRUPO ANTOLIN IRAUSA, S.A.

- HELLA GmbH & Co KgaA,

- Huf Hülsbeck & Fürst GmbH & Co. KG

- Inteva Products, LLC

- Johnson Electric Holdings Limited

- Kiekert AG

- Magna International Inc.

- Mitsuba Corporation

- Nippon Seiki Co., Ltd.

- Omron Corporation

- Panasonic Corporation

- Robert Bosch GmbH

- Tata AutoComp Systems Ltd.

- Toyoda Gosei Co., Ltd.

- Toyota Boshoku Corporation

- Valeo SA

- Visteon Corporation

- Yazaki Corporation

- ZF Friedrichshafen AG

Translating Insight into Actionable Strategies for Automotive Closure Industry Leaders to Drive Growth, Resilience, and Differentiation

Industry leaders seeking to capitalize on the evolving automotive closure market should prioritize an integrated approach that blends technological innovation with supply chain resilience. Investing in electric and automated closure solutions can unlock new revenue streams and align product roadmaps with the trajectory of electric and autonomous vehicles. Moreover, forging co-development partnerships with OEMs and material specialists will accelerate the adoption of advanced composites and sustainable polymers without compromising production timelines.

In addition, it is critical to diversify sourcing strategies to mitigate tariff risks and geopolitical uncertainties. Establishing regional manufacturing hubs in proximity to key vehicle assembly plants will reduce lead times and inventory expenses while fostering collaborative relationships with local suppliers. Concurrently, automating core assembly processes can offset rising labor costs and ensure consistent quality across global facilities.

Finally, embedding data analytics into closure offerings-such as real-time performance monitoring and predictive maintenance algorithms-will enhance the value proposition for end users and create recurring service opportunities. By aligning strategic investments with clear market segmentation priorities and regional dynamics, industry leaders can position themselves at the forefront of this rapidly evolving segment.

Outlining Rigorous Research Methodology Integrating Qualitative Interviews, Supply Chain Analysis, and Market Trend Corroboration Techniques

The research underpinning this executive summary integrates a multi-faceted methodology designed to ensure robust and reliable insights. Primary research included in-depth interviews with senior executives and subject matter experts across OEMs, tier-one suppliers, and material producers. These conversations provided qualitative perspectives on technology roadmaps, procurement challenges, and regulatory expectations.

Secondary research efforts involved comprehensive analysis of patent filings, trade databases, regulatory directives, and technical whitepapers. Supply chain mapping and production flow studies were conducted to quantify material flows and identify potential bottlenecks. Furthermore, industry events and specialist conferences served as real-time observatories for emerging trends in actuator electronics, composite materials, and automated assembly techniques.

To validate and triangulate findings, a cross-verification process was applied whereby quantitative data from trade statistics and production volumes was aligned with qualitative insights from field surveys. This iterative approach ensured that the final conclusions and recommendations rest on convergent evidence, delivering a high degree of confidence to decision-makers. Rigorous quality control measures and expert reviews further strengthened the overall credibility of the analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Closure market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Closure Market, by Products

- Automotive Closure Market, by Component Type

- Automotive Closure Market, by Material Type

- Automotive Closure Market, by Type

- Automotive Closure Market, by Application

- Automotive Closure Market, by End-User

- Automotive Closure Market, by Region

- Automotive Closure Market, by Group

- Automotive Closure Market, by Country

- United States Automotive Closure Market

- China Automotive Closure Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings and Strategic Implications for Stakeholders Navigating the Evolving Landscape of Closure Technologies

This executive summary has illuminated the transformative forces reshaping automotive closure systems, from the integration of electrified mechanisms to the influence of 2025 tariffs on supply chain strategies. Through detailed segmentation analysis, it has highlighted the divergent trajectories across product categories, component types, materials, and end-user channels. Regional insights further underscored the importance of tailoring approaches to the unique manufacturing ecosystems of the Americas, EMEA, and Asia-Pacific.

Key competitive dynamics were identified, revealing that success in this segment hinges on combining mechanical craftsmanship with electronics integration, materials innovation, and digital services. Actionable recommendations emphasized the need for strategic partnerships, regional manufacturing diversification, and investment in automated and data-driven capabilities. Collectively, these findings offer a coherent roadmap for industry leaders to navigate regulatory complexities, address cost pressures, and capture emerging opportunities in electric and autonomous mobility.

As the automotive sector continues its shift toward smarter, lighter, and more sustainable vehicles, closures will remain a critical touchpoint for safety, efficiency, and user experience. Stakeholders equipped with a holistic understanding of market dynamics will be best positioned to drive innovation, mitigate risks, and secure competitive advantage in this pivotal component market.

Engage with Ketan Rohom to Unlock Customized Market Intelligence and Propel Your Automotive Closure Strategy to the Forefront

Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure an exclusive, in-depth market research report on automotive closure systems. Discover how emerging trends, regulatory changes, and tariff impacts intersect to reshape the competitive landscape for door, bonnet, sunroof, and window mechanisms. Gain first-hand guidance on leveraging strategic segmentation insights and regional dynamics to inform product development, supply chain strategies, and partnership decisions.

This tailored research package offers decision-makers the clarity needed to navigate supply chain complexities, materials selection, and advanced closure technology integration. By engaging with Ketan Rohom, you will unlock personalized support in interpreting data, benchmarking against competitors, and aligning your roadmap with future market transformations. Elevate your strategic planning with actionable findings and collaborate directly on custom analyses designed to address your unique priorities.

Secure your copy of the report today and position your organization at the forefront of automotive closure innovation. Reach out to Ketan Rohom to explore special offerings, receive a detailed briefing, and embark on a partnership that drives measurable business impact in this rapidly evolving sector.

- How big is the Automotive Closure Market?

- What is the Automotive Closure Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?