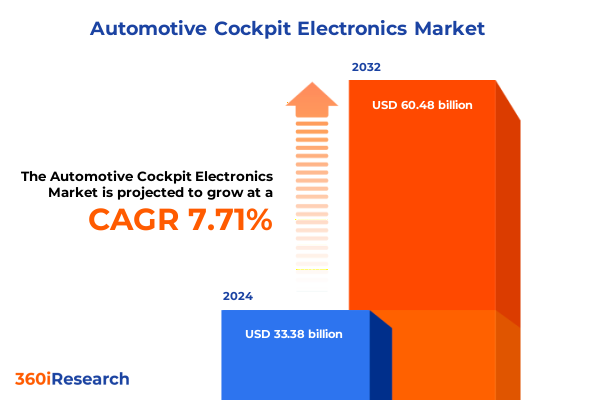

The Automotive Cockpit Electronics Market size was estimated at USD 35.81 billion in 2025 and expected to reach USD 38.41 billion in 2026, at a CAGR of 7.77% to reach USD 60.48 billion by 2032.

Unlocking the Future of Automotive Cockpit Electronics Through Rapid Technological Advancements and User-Centric Innovation

The automotive cockpit has transformed from a simple driver interface into a sophisticated digital ecosystem that serves as the nerve center of modern vehicles. Over the past decade, dramatic shifts in consumer expectations, coupled with leaps in sensor integration, display technologies, and software intelligence, have redefined what drivers and passengers expect from their in-vehicle experience. This report commences by tracing these foundational changes, examining how the cockpit has evolved from basic instrumentation clusters into immersive environments that prioritize safety, convenience, and personalization.

As technology convergence accelerates, the cockpit is no longer just a set of controls and gauges; it has become a hub for continuous connectivity, real-time data exchange, and enhanced human–machine interaction. This section introduces the multi-faceted nature of today’s cockpit electronics, setting the stage for subsequent analysis of market drivers, regulatory impacts, and segmentation insights. With a focus on the interplay between hardware innovations and software-enabled value propositions, the introduction underscores the importance of understanding this ecosystem holistically to make informed strategic decisions.

Navigating the Dawn of Software-Defined Cabins and Immersive Display Technologies That Are Revolutionizing Driver Engagement

Automotive cockpit electronics are undergoing transformative shifts that are reshaping the competitive landscape and challenging established value chains. From the rise of high-definition instrument clusters to the integration of augmented reality head-up displays, OEMs and suppliers are racing to deliver experiences that blur the lines between the physical cabin and the digital realm. This evolution is driven not only by consumer demand for greater convenience and personalization but also by the imperative to enhance safety through more intuitive human–machine interfaces.

In addition, the proliferation of software-defined vehicles has elevated the importance of over-the-air updates and cybersecurity frameworks, prompting cockpit electronics providers to form strategic alliances with technology firms and semiconductor specialists. Consequently, traditional boundaries between Tier 1 suppliers and technology companies are dissolving, as collaborations become vital for integrating advanced processors, responsive sensors, and adaptive software architectures. These shifts underscore the need for stakeholders to rethink product roadmaps, forge new partnerships, and invest in scalable platforms capable of supporting continuous feature enhancements, ensuring that cockpit systems remain relevant in an era of rapid innovation.

Assessing the Strategic Ripple Effects of Elevated 2025 U.S. Tariffs on Global Cockpit Electronics Supply Chains

The United States’ decision in early 2025 to recalibrate tariffs on automotive components has had ripple effects across the global cockpit electronics supply chain. By elevating duties on certain semiconductor modules, display assemblies, and wiring harnesses, regulators aimed to incentivize domestic manufacturing and strengthen supply chain resilience. Yet, these measures have also led to increased production costs and prompted several international Tier 1 suppliers to reassess their U.S. footprints.

In response, many leading companies have expedited investments in local assembly and testing facilities, while simultaneously exploring alternative sourcing strategies throughout North America. This reorientation has created both challenges and opportunities: manufacturers face headwinds from higher input costs but benefit from reduced logistics complexity and improved lead-time predictability. Moreover, the tariff adjustments have catalyzed innovation in modular design, as suppliers strive to standardize platforms that can be easily localized to different manufacturing sites, thereby mitigating tariff exposure. As such, the U.S. trade policy shifts of 2025 have served as a catalyst for supply chain optimization and renewed domestic collaboration.

Decoding the Multi-Dimensional Structure of Cockpit Electronics Through Type, Component, Vehicle, and Distribution Lenses

Analyzing cockpit electronics through multiple lenses reveals distinct pathways for value creation and innovation. When differentiated by type, the ecosystem encompasses both advanced cockpit electronics-featuring multifunctional displays and adaptive interfaces-and basic electronics, which deliver fundamental controls and safety alerts. Moreover, a component-centric perspective distinguishes hardware elements-from control units and sensors to processors and wiring-from software modules such as navigation and vehicle-to-everything communication applications. This dual hardware–software taxonomy highlights the importance of integrated development approaches.

Further segmentation by product type uncovers the diverse functional domains such as climate control systems that enhance passenger comfort, infotainment architectures that deliver multimedia content, and lighting and ambiance solutions that set cabin mood. The fuel type dimension contrasts offerings tailored for battery electric vehicles, where energy efficiency is paramount, against those for internal combustion models with established electrical architectures. Added complexity arises when considering levels of autonomy; conventional vehicle cockpits prioritize driver feedback loops, whereas semi-autonomous platforms demand enhanced sensor integration and real-time decision-support interfaces.

Finally, vehicle type and distribution channel analyses shed light on market dynamics: commercial segments, including heavy-duty and light-duty vehicles, often emphasize reliability and scalability, while passenger cars-from hatchbacks to SUVs-focus on personalization and connectivity. Distribution mixes span original equipment manufacturers and aftermarket channels, each with unique service models and upgrade cycles. These layered segmentation insights enable stakeholders to tailor strategies to specific market niches and technological trajectories.

This comprehensive research report categorizes the Automotive Cockpit Electronics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Components

- Product Type

- Fuel Type

- Level of Autonomous Driving

- Vehicle Type

- Distribution Channel

Mapping Regional Drivers and Collaborative Ecosystems Shaping Cockpit Electronics Innovation Across Major Global Markets

Regional dynamics in automotive cockpit electronics reflect a tapestry of regulatory priorities, consumer preferences, and industrial capabilities. In the Americas, a blend of established OEMs and innovative startups is accelerating the adoption of fully digital clusters and voice-activated control schemes, driven by strong consumer appetite for connected experiences. Collaboration among U.S. automakers and Canadian semiconductor foundries has been particularly instrumental in localizing production and reducing geopolitical exposure.

Across Europe, the Middle East, and Africa, stringent safety and emissions standards are steering cockpit innovations toward advanced driver assistance interfaces and augmented-reality head-up displays. Meanwhile, an emerging emphasis on green credentials in the Middle East is fostering early adoption of cockpit solutions optimized for alternative fuel vehicles. These regional priorities are supported by cooperative frameworks between automakers and regulatory bodies, facilitating pilots of next-gen cockpit prototypes.

In the Asia-Pacific, rapid urbanization and a burgeoning middle-class have catalyzed demand for premium in-cabin experiences, with consumers expecting seamless smartphone integration and real-time traffic analytics. Local manufacturers in China, Japan, and South Korea are scaling production of both hardware modules and proprietary software ecosystems, further intensified by government initiatives that incentivize electric mobility and smart vehicle architectures. Collectively, these regional nuances underscore the importance of geographically tailored strategies that address diverse regulatory and consumer landscapes.

This comprehensive research report examines key regions that drive the evolution of the Automotive Cockpit Electronics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling the Strategic Alliances and Technology-Driven Moves Redefining Leadership in Cockpit Electronics

Leading participants in the cockpit electronics arena are redefining competitive benchmarks through strategic collaborations, proprietary platform development, and vertical integration initiatives. Established OEM suppliers are leveraging their deep automotive expertise to expand software service portfolios, offering subscription-based navigation and connectivity suites that generate recurring revenue. Concurrently, semiconductor firms are penetrating the cockpit landscape by providing high-performance processors and AI accelerators tailored for in-vehicle computing.

Innovative software players are establishing footholds via over-the-air update capabilities and robust cybersecurity frameworks, creating new standards for feature delivery and data privacy. Notably, partnerships between component manufacturers and cloud service providers are streamlining infotainment content distribution, while specialist vendors are piloting modular sensor architectures that can be rapidly reconfigured for different vehicle platforms. These strategic moves exemplify how ecosystem players are aligning their R&D efforts to deliver cohesive cockpit solutions that balance hardware robustness with software agility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Cockpit Electronics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analog Devices, Inc.

- Aptiv PLC

- Continental AG

- Delphi Technologies PLC

- Denso Corporation

- Fujitsu Limited

- Garmin Ltd.

- Hyundai Mobis Co., Ltd.

- Intel Corporation

- LG Electronics Inc.

- Magna International Inc.

- Mitsubishi Electric Corporation

- NXP Semiconductors N.V.

- Panasonic Corporation

- Renesas Electronics Corporation

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Texas Instruments Incorporated

- Valeo S.A.

- Yazaki Corporation

- ZF Friedrichshafen AG

Driving Competitive Advantage with Integrated Platforms, Agile Supply Chains, and Data-Centric Cockpit Innovations

To capitalize on emerging opportunities in cockpit electronics, industry leaders should first prioritize end-to-end platform architectures that seamlessly integrate hardware control units, advanced displays, and intelligent software modules. By adopting open standards and scalable frameworks, organizations can reduce development cycles and foster interoperability across new vehicle lines. Additionally, forging cross-industry partnerships-spanning semiconductor manufacturers, cloud providers, and cybersecurity experts-will accelerate feature rollouts while ensuring stringent data protection.

Second, companies must invest in agile manufacturing capabilities to adapt rapidly to shifting trade policies and supply chain disruptions. Embracing modular design principles and localized assembly strategies will mitigate tariff impacts and enhance responsiveness to market fluctuations. Third, it is critical to cultivate a robust analytics infrastructure that leverages cockpit-generated data for predictive maintenance, usage-based services, and personalized in-cabin experiences. This data-centric approach will unlock new monetization models and deepen customer engagement.

Finally, executive teams should establish dedicated innovation forums to pilot human–machine interface prototypes and gather user feedback early in the development cycle. By iterating on design concepts in collaboration with end users and regulatory stakeholders, organizations can refine product attributes and maintain a competitive edge in a rapidly evolving landscape.

Leveraging Triangulated Research Techniques Combining Expert Interviews, Literature Analysis, and Comparative Case Studies

This research employs a mixed-methods approach combining qualitative expert interviews, secondary literature review, and comparative case analysis to ensure a comprehensive understanding of automotive cockpit electronics. Primary insights were gathered through in-depth discussions with senior R&D executives, system architects, and design leads across leading OEMs, Tier 1 suppliers, and emerging technology firms. These interviews provided firsthand perspectives on strategic priorities, technological roadmaps, and partnership dynamics.

Complementing primary research, a rigorous secondary review of industry white papers, patent filings, and regulatory documents was conducted to contextualize recent advancements in sensor technologies, display modules, and software architectures. Comparative case studies of successful cockpit deployments in electric, conventional, and semi-autonomous vehicles were analyzed to identify best practices and common pitfalls. Findings were then validated through expert workshops and peer review sessions to ensure accuracy and relevance. This triangulated methodology underpins the insights presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Cockpit Electronics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Cockpit Electronics Market, by Type

- Automotive Cockpit Electronics Market, by Components

- Automotive Cockpit Electronics Market, by Product Type

- Automotive Cockpit Electronics Market, by Fuel Type

- Automotive Cockpit Electronics Market, by Level of Autonomous Driving

- Automotive Cockpit Electronics Market, by Vehicle Type

- Automotive Cockpit Electronics Market, by Distribution Channel

- Automotive Cockpit Electronics Market, by Region

- Automotive Cockpit Electronics Market, by Group

- Automotive Cockpit Electronics Market, by Country

- United States Automotive Cockpit Electronics Market

- China Automotive Cockpit Electronics Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Charting a Strategic Course Through Converging Technologies and Policy Dynamics in Automotive Cockpit Electronics

The automotive cockpit electronics landscape stands at a pivotal juncture, where technological breakthroughs and shifting trade policies converge to create unprecedented opportunities and challenges. As vehicles become more connected, electrified, and autonomous, the cockpit will continue to evolve into a dynamic gateway between drivers, passengers, and the digital world. Organizations that embrace integrated hardware–software platforms, agile manufacturing practices, and data-driven service models will be best positioned to lead this transformation.

In closing, the ability to anticipate regulatory shifts, tailor offerings to regional nuances, and foster cross-sector partnerships will separate the front-runners from the followers. By synthesizing the insights contained within this report, industry stakeholders can chart a course toward sustained innovation and competitive resilience. The journey ahead promises to redefine mobility experiences; success will favor those who navigate the complexity with strategic foresight and collaborative agility.

Secure Your Competitive Edge in Automotive Cockpit Electronics by Engaging with Our Associate Director for Exclusive Research Access

For a deeper dive into the evolving dynamics of automotive cockpit electronics and to secure strategic insights that will drive your next innovation roadmap, connect with Ketan Rohom, Associate Director of Sales & Marketing, who will guide you through tailored report packages and enterprise licensing options. Explore how cutting-edge cockpit solutions can elevate user experience, strengthen your market position, and catalyze growth in an era defined by connectivity and autonomy. Reach out today to obtain your comprehensive study and partner with an expert who can align research findings with your organizational objectives, ensuring you harness every opportunity in this dynamic sector

- How big is the Automotive Cockpit Electronics Market?

- What is the Automotive Cockpit Electronics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?