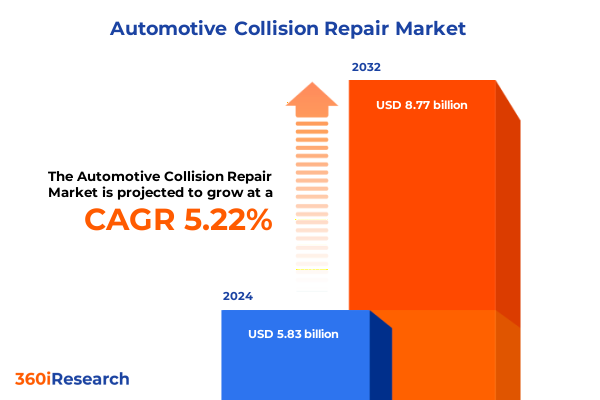

The Automotive Collision Repair Market size was estimated at USD 6.11 billion in 2025 and expected to reach USD 6.41 billion in 2026, at a CAGR of 5.28% to reach USD 8.77 billion by 2032.

Setting the Roadmap for Collision Repair Amidst Rapid Technological Innovations Shifting Consumer Expectations and Regulatory Imperatives in 2025

The collision repair sector stands at a critical juncture where the convergence of regulatory mandates, evolving vehicle complexity, and shifting consumer expectations is reshaping how repairs are conceived and delivered. In the United States, transportation authorities require vehicle owners to maintain active insurance coverage, ensuring that repair costs are addressed promptly following an incident-a mandate that underpins the industry’s fundamental value proposition and fosters a steady flow of repair demand. Meanwhile, aging vehicle populations amplify service volumes: data indicates that nearly three-quarters of total loss valuations in the first half of 2024 involved vehicles seven years or older, reflecting an aging fleet that requires more frequent collision interventions as components reach end-of-life and safety standards evolve.

Against this backdrop, the integration of advanced driver assistance systems in modern vehicles has introduced a layer of complexity that directly influences repair costs and technical requirements. A recent study by AAA found that ADAS components can add up to nearly 38% to repair expenses, with sensor-equipped mirrors alone exceeding a thousand dollars in replacement costs, underscoring the need for specialized calibration equipment and highly trained technicians. Concurrently, electric vehicles have emerged as a distinct sub-segment, representing a growing share of repairable claims; while they currently account for a modest 2.4% of all claims, their repair costs are nearly 47% higher than those of conventional vehicles, driven largely by battery management and high-voltage components.

Moreover, the digital expectations of today’s consumers have elevated convenience and transparency as critical differentiators. Online scheduling, real-time repair tracking, and digital estimate tools have transitioned from optional enhancements to necessities, compelling repair providers to adopt integrated platforms that connect vehicle owners, repair facilities, insurers, and parts suppliers. As shops modernize their digital engagement capabilities, they position themselves to improve customer satisfaction, reduce cycle times, and strengthen insurer partnerships-elements that will define competitive success over the coming years.

Navigating the Intersection of Advanced Driver Assistance Systems Sustainability Demands and Digital Disruption Revolutionizing Collision Repair Processes

The collision repair landscape has undergone transformative shifts driven by the adoption of advanced driver assistance systems, sustainability imperatives, and digital disruption. As ADAS features-ranging from camera-based lane keeping to sensor-driven emergency braking-become standard across new vehicles, repair facilities must invest in calibration stations and certify technicians to maintain system integrity following a collision. This technological leap has redefined shop floor operations, with remote diagnostics and sensor recalibration emerging as critical milestones in every repair workflow.

Simultaneously, sustainability has become a strategic anchor, propelled by regulatory pressures and consumer preferences for eco-friendly practices. Collision centers are transitioning to water-based paints and low-VOC coatings, implementing recycling programs for plastics and metals, and optimizing energy use through LED lighting and efficient drying systems. These green initiatives not only reduce environmental impact but also build brand equity among environmentally conscious consumers who increasingly factor sustainability into their service provider choices.

Digital disruption further accelerates this transformation, as repair operators integrate online estimating platforms, mobile apps for status updates, and data analytics to optimize parts inventory and labor scheduling. The emergence of on-demand repair networks enables mobile technicians to perform windshield replacements and minor paintless dent removal at customer locations, reducing vehicle downtime and expanding service footprints beyond fixed-bay limitations. At the same time, consolidation among multi-shop operators is reshaping competitive dynamics, with larger chains leveraging scale to invest in proprietary digital infrastructure, forge deeper insurer alliances, and replicate best practices across their networks, signaling a new era of data-driven service excellence.

Assessing the Ripple Effects of 2025’s U.S. Automotive Tariff Policies on Parts Costs Supply Chains and Repair Shop Strategies

In 2025, the introduction of new U.S. tariffs on assembled vehicles and imported automotive parts has created significant headwinds for collision repair stakeholders. A sweeping 25% levy on fully assembled vehicle imports took effect in April, with an equal tariff on select parts commencing in May; these measures have injected uncertainty into parts sourcing and triggered urgent requests from trade groups for extended implementation timelines to reroute global supply chains. Repair shops and parts distributors are already absorbing elevated import costs as the tariffs apply at the point of entry, leaving limited recourse to blunt their impact given the absence of exemptions for non-OEM aftermarket components.

The ramifications extend across the sector: parts constitute up to half of total repair claim costs, and with approximately 50% of those parts being imported-40% from Mexico, 10% from Canada and China-a 25% tariff could yield a 3% to 6% uptick in mechanical repair claim expenses before considering ripple effects from labor or rental car cost increases. Meanwhile, steel and aluminum tariffs have driven domestic mills to raise prices, further constraining profit margins for collision repair parts suppliers and intensifying pressure on insurers facing higher claim payouts and potential premium adjustments.

While some importers have delayed passing costs to end customers in hopes of tariff relief or supply chain realignment, recent data reveals that U.S. businesses collectively paid an additional $55 billion in tariff duties, with manufacturers and logistics firms shouldering most expenses amid stagnant foreign supplier contributions. Consequently, repair shops are reevaluating their sourcing strategies, exploring domestic vendor partnerships where capacities exist, and investing in inventory buffers to mitigate future volatility. These strategic responses underscore the critical need for scenario planning and supply chain resilience as tariff policies remain subject to negotiation and revision.

Decoding the Multifaceted Service Vehicle Type Part Sourcing Channel and Severity Segmentation That Shapes Collision Repair Strategies and Opportunities

An effective collision repair strategy requires a nuanced understanding of market segmentation across multiple dimensions-from the types of services delivered to the severity of collision events. Service categories span ADAS calibration, where camera and sensor realignment is critical; traditional body repair services encompassing dent removal, frame straightening, and panel replacement; glass restoration that includes crack repair and windshield replacement; mechanical systems work across cooling, engine and suspension components; and painting services for both full refinishes and targeted spot repairs. Similarly, the vehicle landscape demands tailored approaches for commercial bus and truck fleets versus passenger sectors covering light trucks, cars and SUVs, each with distinct downtime considerations and regulatory requirements.

Parts sourcing further differentiates offerings, as repair providers decide among aftermarket, OEM and recycled components, striking a balance between cost, lead time and manufacturer warranties. Distribution models range from fixed collision center bays to mobile repair units that enable on-site service and multi-brand workshops that offer flexibility for diverse customer needs. End users-ranging from vehicle owners and fleet managers to insurers-exert unique influences on repair timelines, pricing negotiations and quality standards. Finally, the spectrum of collision severity, from minor cosmetic dings to moderate structural impacts and severe frame distortions, shapes resource allocation, operator expertise requirements and cycle time expectations. Harmonizing these segmentation layers empowers service providers to tailor operational models, prioritize investments and differentiate their value proposition across competitive targets.

This comprehensive research report categorizes the Automotive Collision Repair market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Vehicle Type

- Parts Type

- Severity

- Distribution Channel

- End User

Unearthing Regional Nuances Across the Americas Europe Middle East Africa and Asia Pacific Driving Divergent Collision Repair Market Dynamics

Regional dynamics exert a profound influence on collision repair markets, yielding unique growth patterns and competitive pressures in the Americas, Europe Middle East and Africa (EMEA) and Asia-Pacific. In the Americas, the United States and Canada benefit from robust insurance mandates, high vehicle ownership levels and advanced repair infrastructure, with multi-shop operators leading consolidation trends. Consumers expect rapid cycle times and digital transparency, prompting providers to invest in both fixed-floor facilities and mobile units to meet evolving service preferences.

Across EMEA, Europe commands the largest revenue share globally-exceeding 40% in 2024-driven by stringent vehicle safety regulations, widespread adoption of ADAS technologies and a mature network of certified OEM-approved repairers. This region’s deep emphasis on OEM alignment and certification programs sustains high repair quality standards, while ongoing expansion in the U.K., Germany and France reflects strong insurer partnerships and supportive government frameworks for sustainable operations.

In the Asia-Pacific, market growth outpaces other regions at a CAGR above 3.5%, fueled by surging vehicle sales in India and China, rising urban accident rates, and expanding insurance penetration. However, capacity constraints in high-volume parts manufacturing and the rapid influx of electric and hybrid vehicles create both opportunities and challenges. Repairers are differentiating by building specialized EV repair bays, forging alliances with local parts producers, and accelerating technician training to address evolving business demands in this dynamic region.

This comprehensive research report examines key regions that drive the evolution of the Automotive Collision Repair market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Collision Repair Consolidators Technology Partners and Innovators That Are Shaping Customer Experiences and Operational Excellence

The competitive landscape is increasingly characterized by consolidation among multi-shop operators and deepening partnerships with technology providers and insurers. Caliber Collision, the largest MSO in the U.S. with over 1,800 locations, has extended its relationship with CCC Intelligent Solutions to leverage CCC ONE® platforms and diagnostic workflows that streamline repair planning, parts procurement and insurer collaboration, underscoring the value of technology alliances in driving operational efficiency. Similarly, the Boyd Group Services has pursued strategic acquisitions to expand its geographic footprint and enhance cross-sell capabilities for glass, mechanical and customization services.

On the parts distribution front, LKQ Corporation remains a critical supplier, leveraging its global aftermarket network to offer collision providers a broad portfolio of OEM and recycled components with rapid delivery capabilities. In parallel, top paint and coating manufacturers such as PPG and Axalta continue to innovate with eco-friendly formulations and sensor-optimized materials that cater to the evolving needs of ADAS-equipped vehicles. Digital estimating and claims platforms-led by CCC, Mitchell International and Solera-are redefining the insurer-repairer interface, enabling real-time data exchange, automated approvals and transparent cost validations that reduce cycle times and enhance customer experience.

These converging trends highlight how market leaders are differentiating through scale, technology integration, sustainable product lines and strategic insurer alliances, setting benchmarks for operational excellence and customer-centric service delivery in collision repair.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Collision Repair market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ABRA Auto Body & Glass, Inc.

- Boyd Group Services Inc.

- Caliber Collision, Inc.

- CARSTAR International Franchise Systems, LLC

- Continental AG

- Crash Champions, LLC

- Denso Corporation

- Faurecia SE

- Federal-Mogul LLC

- Fix Network World, Inc.

- Gerber Collision & Glass, LLC

- Gerber Collision & Glass, LLC

- Honeywell International Inc.

- International Automotive Components Group LLC

- Johnson Controls International plc

- MAACO Franchising, Inc.

- Magna International Inc.

- Mann+Hummel Group

- Mitsuba Corporation

- Robert Bosch GmbH

Implementing Tactical Recommendations for Technology Investment Process Optimization and Supply Chain Resilience to Elevate Collision Repair Performance

To thrive amidst rising complexity and cost pressures, collision repair executives should prioritize targeted investments in ADAS calibration infrastructure and technician certification programs that ensure compliance with evolving OEM specifications. Augmenting parts sourcing strategies by cultivating relationships with domestic and near-shored suppliers can mitigate tariff-driven cost volatility, while maintaining a lean inventory buffer to reduce backorders.

Embracing digital platforms for estimating, customer communication and insurer engagement not only enhances transparency but also drives process efficiencies; repair shops should integrate data analytics to optimize labor allocation and parts ordering, ultimately reducing cycle times and cost per repair. Pursuing sustainability initiatives-such as waterborne paints, energy-efficient equipment and material recycling programs-will resonate with eco-conscious consumers and support regulatory adherence, creating a distinct market advantage.

Collaboration with insurance partners on bundled service agreements and performance-based metrics can unlock preferential referrals and expedite claim approvals. Meanwhile, exploring M&A opportunities with complementary service providers or independent shops may accelerate network growth and market reach. Finally, establishing robust workforce development pipelines-through apprenticeship programs, vocational partnerships and AR-enabled training-will address ongoing technician shortages and ensure the skills needed for advanced collision repair tasks are available today and tomorrow.

Outlining a Robust Mixed Methodology Combining Primary Interviews Secondary Data Analysis and Quantitative Triangulation for Market Insight Validation

This analysis synthesizes rigorous primary and secondary research methodologies to deliver reliable market insights. Primary data was gathered through in-depth interviews with collision repair executives, insurer representatives and parts suppliers, enabling nuanced understanding of operational challenges and strategic priorities. Secondary research involved an extensive review of industry publications, government tariff notices, trade association reports and financial disclosures to contextualize macroeconomic and policy impacts.

Quantitative validation was achieved through data triangulation, comparing multiple sources such as trade group tariff analyses, crash-data studies and regional market breakdowns, ensuring consistency and credibility. Segmentation logic was developed to align service types, vehicle categories, parts sourcing channels, end users and severity tiers, facilitating detailed evaluation of growth opportunities and cost drivers. Regional insights draw upon country-level statistical data, while company profiling leverages public announcements, partnership disclosures and consolidation trends. Finally, findings were peer-reviewed by industry subject-matter experts to confirm accuracy, identify blind spots and refine strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Collision Repair market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Collision Repair Market, by Service Type

- Automotive Collision Repair Market, by Vehicle Type

- Automotive Collision Repair Market, by Parts Type

- Automotive Collision Repair Market, by Severity

- Automotive Collision Repair Market, by Distribution Channel

- Automotive Collision Repair Market, by End User

- Automotive Collision Repair Market, by Region

- Automotive Collision Repair Market, by Group

- Automotive Collision Repair Market, by Country

- United States Automotive Collision Repair Market

- China Automotive Collision Repair Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Concluding with Strategic Imperatives Emphasizing Innovation Collaboration and Foresight to Navigate the Future of Collision Repair with Confidence

As the collision repair industry advances into a new era defined by sophisticated vehicle technologies, evolving tariff environments and heightened sustainability expectations, stakeholders must adopt a proactive stance. The integration of ADAS calibration, digital customer engagement platforms and eco-friendly materials is no longer optional but fundamental to maintaining competitive relevance and financial resilience.

Regional divergences-from the technology-driven markets of North America and EMEA to the high-growth dynamics of Asia-Pacific-demand tailored strategies that consider regulatory frameworks, insurer partnerships and local supply chain capacities. Leading companies demonstrate that scale, strategic technology alliances and a focus on workforce development are decisive factors in capturing market share and optimizing operational performance.

By embracing the actionable recommendations outlined herein-spanning technology investments, supply chain diversification, digital transformation and collaborative partnerships-industry leaders can navigate the complexities of 2025 and seize emerging opportunities. The convergence of innovation, operational excellence and sustainability will determine which organizations succeed in delivering safe, reliable and customer-centric collision repair services in the years to come.

Take Action Today to Connect with Ketan Rohom and Secure Exclusive Insights to Propel Your Collision Repair Business toward Sustained Competitive Advantage

To unlock the full potential of these insights and ensure your organization leads rather than follows in the collision repair arena, reach out to Ketan Rohom, Associate Director of Sales & Marketing, who can guide you through tailored report options. This conversation will help you identify which segments and regions deserve your immediate strategic focus, outline the specific methodologies that underpin our findings, and discuss how your company can harness emerging trends to drive growth. By engaging directly, you’ll gain clarity on the ROI of strategic investments in technology, talent development, and sustainable practices-equipping your leadership team with the evidence-backed intelligence needed to make critical decisions.

- How big is the Automotive Collision Repair Market?

- What is the Automotive Collision Repair Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?