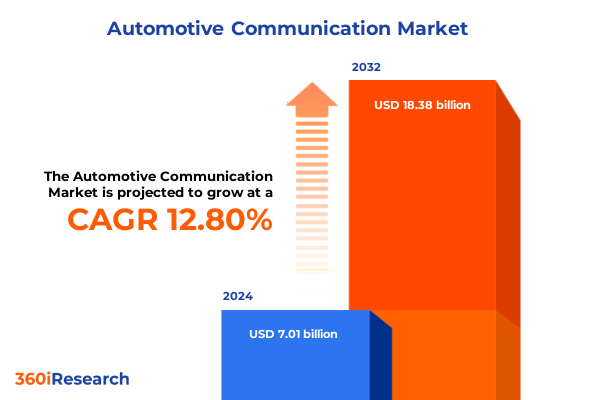

The Automotive Communication Market size was estimated at USD 7.79 billion in 2025 and expected to reach USD 8.66 billion in 2026, at a CAGR of 13.04% to reach USD 18.38 billion by 2032.

Shaping the Future of In-Vehicle Connectivity and Communication Strategies in an Era of Rapid Technological Transformation

The automotive sector is undergoing a fundamental transformation driven by electrification, autonomy, and increasing consumer demand for connectivity. Modern vehicles have evolved into sophisticated data centers on wheels, featuring an unprecedented number of sensors, electronic control units, and networked subsystems. The proliferation of advanced driver assistance systems (ADAS), powertrain electrification, and in-cabin infotainment solutions has exponentially increased the volume and velocity of data exchanged within and beyond the vehicle.

At the core of this evolution lies the electrical/electronic (E/E) architecture, which has grown from simple point-to-point wiring harnesses to complex multi-domain networks. Traditional communication protocols such as Controller Area Network (CAN) continue to support fundamental functions like powertrain control and diagnostics, with CAN-FD variants enhancing data throughput up to 8 Mbps in diagnostic and update scenarios. Simultaneously, high-speed solutions such as automotive Ethernet have emerged to meet the bandwidth requirements of camera arrays, lidar sensors, and real-time ADAS coordination, leading to strategic acquisitions like Infineon’s purchase of Marvell’s automotive Ethernet business in April 2025.

Against this backdrop, the industry is shifting toward software-defined vehicles that decouple functionality from hardware through virtualized architectures and over-the-air (OTA) update capabilities. This shift demands communication frameworks that are not only high-performance but also modular, secure, and cost-effective. The following sections of this executive summary delve into the transformative forces reshaping the automotive communication landscape, evaluate the cumulative impact of United States tariffs in 2025, and uncover key segmentation and regional insights to guide strategic decision-making.

Navigating the Electrical/Electronic Architecture Revolution and Software-Defined Vehicle Paradigm Transforming Automotive Connectivity

The automotive electrical/electronic architecture is undergoing a profound revolution as manufacturers transition from traditional domain-based frameworks toward zonal and centralized computing topologies. In legacy designs, discrete domains such as powertrain, chassis, and infotainment each operated on dedicated control units and bespoke wiring harnesses. However, mounting complexity and weight constraints have driven a consolidation trend in which multiple functions are integrated onto fewer, more capable central domain controllers, reducing the overall ECU count by an average of 15 percent per vehicle and optimizing electronic system efficiency.

Emerging zonal architectures further advance this consolidation by grouping electronic functions geographically within the vehicle into networked zones, connected via high-bandwidth backbone networks. Automotive Ethernet is increasingly favored for these backbone links, supporting speeds from 100 Mbps to 1 Gbps with time-sensitive networking extensions that guarantee deterministic data delivery for safety-critical applications. Leading semiconductor firms have responded to this demand; for instance, Infineon’s acquisition of Marvell’s automotive Ethernet division underscores the strategic importance of high-speed network solutions in future vehicle platforms.

Moreover, the integration of vehicle-to-everything (V2X) communication channels is reshaping how vehicles interact with infrastructure, other road users, and energy management systems. Cellular V2X (C-V2X) and dedicated short-range communication protocols facilitate real-time exchange of safety messages, traffic data, and grid participation signals, laying the groundwork for connected and autonomous mobility ecosystems. Concurrently, the proliferation of software-defined vehicles has elevated the role of over-the-air update capabilities, demanding robust middleware and cybersecurity frameworks to manage function deployment, data orchestration, and threat mitigation in distributed software architectures.

Through these transformative shifts, the automotive industry is redefining the principles of vehicle connectivity, emphasizing scalable network fabrics, unified compute platforms, and resilient security measures. This architecture revolution not only enhances performance and safety but also underpins new business models in mobility services, subscription features, and continuous innovation pipelines.

Evaluating the Multifaceted Consequences of 2025 United States Automotive Tariffs on Supply Chains, Costs, and Industry Strategy

In March 2025, the United States administration announced sweeping 25 percent import duties on all passenger vehicles and light trucks, set to take effect on April 2, 2025, under a presidential proclamation invoking Section 232 of the Trade Expansion Act of 1962. Shortly thereafter, a parallel 25 percent levy was scheduled for key automotive components-including engines, transmissions, and electrical subsystems-beginning May 3, 2025, introducing a blanket tariff framework that spans finished vehicles and critical parts. Automakers operating under the United States–Mexico–Canada Agreement (USMCA) retain temporary exemptions for compliant parts pending origin certification processes, yet these protections are transitional as non-US-sourced content faces the same duties in subsequent phases.

The immediate financial repercussions have been stark for major global OEMs. Volkswagen disclosed an operating profit hit of €1.3 billion in the second quarter due to elevated import levies, which eroded its premium brand margins and prompted a downward revision of its 2025 profitability targets. Corporate America more broadly absorbed nearly $55 billion in additional tariff collections in 2025, as companies spanning automotive, consumer goods, and industrial sectors opted to shoulder a significant share of duties rather than transfer full costs to end customers, reflecting strategic aversion to immediate retail price escalations and market share erosion.

Beyond direct cost burdens, the tariffs have disrupted meticulously optimized supply chains that rely on free cross-border flow for just-in-time manufacturing and component integration. With portions of the supply chain traversing the US–Mexico border multiple times during production, new customs checks and documentation requirements have introduced bottlenecks and inventory delays, jeopardizing production schedules and driving temporary plant shutdown risks. Analysts warn that prolonged uncertainty around tariff permanence could impede long-term investment decisions, delay product launches, and constrain OEMs’ ability to realign sourcing strategies without incurring substantial lead-time penalties.

In response, industry leaders are exploring diversified production footprints, including increased domestic assembly for affected models and expanded footprint in non-tariff regions, while government lobbying efforts intensify for sector-specific relief or revised trade agreements. Automakers and suppliers are also recalibrating pricing strategies, leveraging contract negotiations and hedging instruments to mitigate input cost volatility. As the tariff landscape evolves, the capacity to adapt supply chain architecture and maintain competitive cost structures will delineate winners and laggards in the global automotive arena.

Unveiling Segmentation Dynamics Across Bus Modules, Components, Vehicle Types and Applications Driving Automotive Communication Evolution

A nuanced understanding of the automotive communication domain emerges when examined through the lens of multiple segmentation criteria, each revealing distinct technological priorities and growth vectors. At the protocol level, Controller Area Network (CAN) continues to underpin core vehicle functions, with over 74 million vehicles employing traditional CAN networks for powertrain management and diagnostics, and its flexible data-rate (FD) variant gaining traction for higher throughput demands in firmware updates and sensor integration. Meanwhile, Ethernet is rapidly ascending as the high-bandwidth backbone of zonal architectures, facilitating advanced driver assistance data streams and over-the-air update channels. FlexRay’s deterministic dual-channel design remains reserved for safety-critical systems requiring ultra-low latency, while cost-effective protocols such as Local Interconnect Network (LIN) and Media-Oriented Systems Transport (MOST) optimize in-vehicle comfort and infotainment networks with minimal jitter and resource overhead.

When dissecting the market by component, hardware platforms encompass a broad spectrum of microcontrollers, transceivers, and gateway modules engineered to support multi-protocol stacks, whereas software solutions bifurcate into middleware platforms that orchestrate data flows across electronic control units and security frameworks that safeguard communication channels against unauthorized access and cyberattacks. This dual focus on physical and logical systems underscores the imperative of cross-disciplinary integration, as modern vehicles demand both robust silicon foundations and agile software layers capable of rapid feature deployment and real-time analytics.

Applying a vehicle-type perspective reveals divergent communication imperatives between commercial and passenger segments. In the commercial arena, heavy and light commercial vehicles prioritize telematics for fleet diagnostics, predictive maintenance, and logistics optimization, often integrating multi-protocol networks to accommodate sensors, actuators, and remote monitoring tools. Passenger cars-whether hatchbacks, sedans, or SUVs-are increasingly defined by differentiated infotainment clusters, advanced driver assistance packages, and seamless smartphone integration, driving a heterogeneous mix of legacy bus systems and next-generation Ethernet backbones to support premium user experiences.

From an application standpoint, in-vehicle communication frameworks extend across body control and comfort systems that regulate lighting, climate, and seat functions, through infotainment interfaces that deliver high-fidelity audio and video, onto powertrain controllers that manage electric motor torque and battery charging, and safety and ADAS modules that coordinate radar, lidar, and camera inputs for collision avoidance. Beyond the vehicle’s perimeter, vehicle-to-external communication envisions a connected ecosystem comprising vehicle-to-grid interfaces that support energy exchange with smart charging infrastructure, vehicle-to-infrastructure linkages enabling traffic signal coordination, vehicle-to-pedestrian alerts enhancing urban safety, and vehicle-to-vehicle exchanges that form the backbone of cooperative driving strategies. This multi-layered segmentation approach illuminates how distinct protocol families, hardware-software configurations, vehicle classes, and application domains converge to shape the future of automotive communications.

This comprehensive research report categorizes the Automotive Communication market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Bus Module

- Component

- Vehicle Type

- Application

Analyzing Regional Disparities and Growth Drivers in Americas, Europe Middle East & Africa, and Asia-Pacific Automotive Communication Markets

Regional market dynamics underscore the varied pace and priorities of automotive communication adoption across the globe, shaped by regulatory frameworks, infrastructure investments, and manufacturer strategies. While universal trends like electrification and autonomy are reshaping the industry, the regional context determines which technologies gain traction and how quickly OEMs and suppliers orient their roadmaps.

In the Americas, the United States spearheads connectivity initiatives through expansive C-V2X trials and a burgeoning over-the-air update infrastructure designed to support software-defined vehicle platforms. Federal support for 5G rollout and collaborative ventures between automakers, telecommunications firms, and government agencies have catalyzed pilot deployments of vehicle-to-infrastructure networks and dynamic charging demonstrations. Canadian and Mexican facilities, integrated under the USMCA framework, are also adapting to these connectivity innovations, though the shadow of import tariffs continues to temper near-term investment decisions and supply chain realignments.

In Europe, the Middle East, and Africa region, stringent safety and emissions regulations have accelerated the integration of deterministic communication channels for advanced driver assistance and electrification. European OEMs are championing hybrid network architectures that blend CAN-FD with Ethernet backbones to satisfy both legacy reliability and modern bandwidth demands, particularly in premium vehicle segments. Government incentives, such as the European Union’s C-ITS (Cooperative Intelligent Transport Systems) directive, have fostered public-private partnerships in infrastructure trials, while Middle Eastern countries invest in smart city frameworks that leverage vehicle connectivity for traffic management and public safety applications.

Asia-Pacific stands out for its rapid proliferation of connected electric vehicles and supportive policy environments, led by China’s comprehensive EV subsidies and homegrown standards that prioritize cost-effective CAN FD and Ethernet solutions for battery management and autonomous testbeds. Japan and South Korea, boasting mature automotive ecosystems, focus on seamless V2X integration and 6G research initiatives to underpin next-generation mobility services. Meanwhile, emerging markets in Southeast Asia are scaling urban mobility projects, beckoning IoT-driven fleet management and ride-hailing platforms that depend on resilient communication infrastructures. This regional mosaic illustrates that while the core drivers of connectivity are global, localized regulatory push, infrastructure readiness, and market maturity shape the unique contours of each region’s automotive communication journey.

This comprehensive research report examines key regions that drive the evolution of the Automotive Communication market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Automotive Communication Pioneers and Strategic Moves Shaping Semiconductor, Software and Tier-1 Supplier Landscapes

A constellation of semiconductor manufacturers, software innovators, and tier-one suppliers is steering the evolution of automotive communication, each advancing distinct strategic initiatives to capture rising demand. Infineon Technologies’ acquisition of Marvell’s automotive Ethernet assets for $2.5 billion exemplifies the consolidation in the semiconductor space, broadening its microcontroller portfolio and positioning its automotive division at the forefront of high-speed network solutions. NXP Semiconductors has similarly escalated investment in Ethernet PHY and MAC integration, expanding its production capacity across European and Southeast Asian facilities to meet OEM requirements for domain controllers, data aggregators, and gateway hardware.

In parallel, software-centric enterprises are carving out a competitive edge through middleware suites and cybersecurity platforms designed to facilitate seamless data orchestration and protect against escalating threat vectors. Companies such as Vector Informatik and Elektrobit have rolled out integrated toolchains that support AUTOSAR-compliant communication stacks, enabling swift protocol transitions from CAN to Ethernet and simplifying calibration workflows. Additionally, cybersecurity specialists are embedding hardware-rooted secure elements and anomaly detection algorithms into communication gateways to preempt unauthorized access and ensure end-to-end data integrity.

Tier-one systems integrators and automotive electronics suppliers like Bosch, Continental, and Aptiv are leveraging their deep OEM relationships to co-develop zonal architectures, offering turnkey solutions that integrate sensors, actuators, and central compute modules into unified communication ecosystems. Bosch’s recent expansion of its CAN-FD and Ethernet switch production lines underscores the critical role of flexible network hardware in supporting both legacy functions and emerging ADAS features. Continental’s partnerships with vehicle manufacturers to pilot cooperative adaptive cruise control and connected traffic management services further illustrate the blurring lines between component suppliers and mobility service enablers.

Looking ahead, strategic alliances and joint ventures continue to proliferate as players seek to combine silicon expertise, software agility, and integration capabilities. Collaborations between chipset vendors and cloud service providers aim to extend vehicle connectivity into broader digital ecosystems, supporting real-time telematics, remote diagnostics, and usage-based insurance offerings. This convergence of competencies is shaping an automotive communication landscape defined by interoperability, scalability, and resilience, setting the stage for next-generation mobility experiences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Communication market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Micro Devices

- AutoTalks Ltd.

- Continental AG

- Daimler AG

- Delphi Technologies PLC

- General Motors Company

- Harman International Industries, Inc.

- Infineon Technologies AG

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- Qualcomm Incorporated

- Renesas Electronics Corporation

- Robert Bosch GmbH

- Rohm Co., Ltd.

- Semiconductor Components Industries, LLC

- Siemens AG

- STMicroelectronics International N.V.

- Tata Communications Limited

- Texas Instruments Incorporated

- Toshiba Electronic Devices & Storage Corporation

- Toyota Motor Corporation

Charting Actionable Strategies for Automotive Industry Leaders to Capitalize on Connectivity Trends, Navigate Tariffs, and Accelerate Innovation

To thrive amid accelerating connectivity demands and evolving trade dynamics, automotive industry leaders must adopt a multifaceted strategic approach that spans architecture optimization, supply chain resilience, and technology partnerships. First, organizations should prioritize the implementation of zonal E/E architectures underpinned by scalable Ethernet backbones and time-sensitive networking protocols. Strategic investments in high-speed communication infrastructure will not only support advanced driver assistance and autonomous functions but also streamline ECU consolidation and reduce system complexity, as evidenced by leading semiconductor deals like Infineon’s acquisition of Marvell’s automotive Ethernet assets.

Simultaneously, mitigating the repercussions of 2025 United States tariffs requires proactive supply chain realignment and localization. Automakers and suppliers should identify critical non-US content within vehicle and component shipments, pursue USMCA origin certifications where applicable, and evaluate near-shoring opportunities to minimize duty exposure. Flexible contractual frameworks that incorporate tariff escalation clauses and hedging mechanisms can help absorb cost fluctuations without transferring the full burden to consumers, reflecting the broader trend of corporate tariff absorption documented in recent studies.

Elevating software capabilities and cybersecurity resilience is equally imperative. Industry players ought to integrate middleware platforms that abstract protocol complexities, enabling seamless interoperability across CAN, FlexRay, and Ethernet networks. Partnering with specialized cybersecurity firms to embed hardware-rooted secure elements and real-time threat detection algorithms will safeguard data integrity and maintain compliance with evolving regulatory standards. These efforts are critical to building consumer trust and protecting connected vehicle ecosystems from emerging threat vectors.

Engagement in collaborative standard-setting and infrastructure development initiatives is also paramount. OEMs and suppliers should actively participate in cooperative intelligent transport systems trials, municipal smart city deployments, and industry consortiums to shape normative frameworks and ensure interoperability. Close collaboration with governmental agencies can facilitate pilot projects, secure funding for connectivity infrastructure, and influence policy refinements that balance trade protection with technological advancement.

Finally, embracing the software-defined vehicle paradigm demands the establishment of agile development pipelines and over-the-air update platforms. By adopting continuous integration and continuous deployment (CI/CD) methodologies, automotive organizations can accelerate feature rollout schedules, respond swiftly to security advisories, and deliver incremental enhancements that extend vehicle lifecycles and unlock recurring revenue streams. This holistic strategy will position industry leaders to harness connectivity trends, navigate tariff uncertainties, and drive sustained innovation across the automotive value chain.

Detailing Rigorous Research Approach: Data Collection, Primary Interviews, Secondary Analysis and Market Segmentation Techniques Ensuring Robust Insights

The research methodology underpinning this executive summary integrates both primary and secondary research techniques to ensure a rigorous, data-driven analysis of the automotive communication market. Initially, an extensive secondary research phase was conducted, encompassing an examination of corporate disclosures, semiconductor industry reports, government tariff proclamations, and technical white papers. Key sources included Automotive Logistics for detailed tariff rollout timelines and implementation dates, GM Insights for protocol adoption and segmentation trends, and company press releases such as Infineon’s acquisition announcement for strategic investment insights.

Complementing the secondary data, a series of primary interviews were held with senior executives and subject-matter experts at leading OEMs, tier-one suppliers, semiconductor vendors, and regulatory agencies. These discussions focused on evolving E/E architectures, software-defined vehicle roadmaps, tariff mitigation strategies, and emerging V2X initiatives. The insights gleaned from these engagements were systematically validated against published statistics to reconcile differing perspectives and ensure consistency.

Data triangulation techniques were employed to cross-verify findings across multiple sources, reconciling quantitative metrics such as protocol deployment volumes with qualitative inputs from industry practitioners. Segmentation analyses were structured around four key criteria-bus modules, component classifications, vehicle types, and communication applications-as delineated in established market frameworks, allowing for comprehensive coverage of market dynamics without overlapping domains.

To ensure methodological rigor, each research stage underwent peer review and quality checks by independent analysts. Data integrity protocols, including source auditing and validation against third-party databases, were applied to minimize bias and enhance reliability. This blended approach of secondary research, expert interviews, and stringent validation protocols yields a robust and actionable understanding of the automotive communication landscape, poised to inform decision-makers and stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Communication market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Communication Market, by Bus Module

- Automotive Communication Market, by Component

- Automotive Communication Market, by Vehicle Type

- Automotive Communication Market, by Application

- Automotive Communication Market, by Region

- Automotive Communication Market, by Group

- Automotive Communication Market, by Country

- United States Automotive Communication Market

- China Automotive Communication Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings and Vision for Future Automotive Connectivity Trajectory Amid Technological Advances and Policy Dynamics

This executive summary highlights the confluence of technological, regulatory, and market forces reshaping the automotive communication landscape. The shift from domain-centric to zonal E/E architectures, underpinned by high-speed Ethernet backbones and time-sensitive networking capabilities, is accelerating the transition toward software-defined vehicles capable of continuous innovation and remote update delivery. Concurrently, the implementation of 25 percent tariffs on imported vehicles and components in 2025 has introduced new cost pressures and supply chain complexities, compelling industry leaders to reconfigure sourcing strategies and negotiate adaptive trade frameworks.

A multi-dimensional segmentation analysis reveals that established protocols like CAN and LIN remain indispensable for powertrain and body control, even as FlexRay occupies a niche in safety-critical applications and Ethernet emerges as the enabler of bandwidth-intensive functions. Regional insights demonstrate that while the Americas forge ahead in C-V2X trials and domestic production realignment, Europe prioritizes hybrid network integration to meet stringent emissions and safety mandates, and Asia-Pacific balances aggressive EV and AV initiatives with localized standards development.

Key company profiles underscore a landscape marked by strategic semiconductor acquisitions, middleware platform expansion, and tier-one systems integration, showcasing how players like Infineon, NXP, Bosch, and Continental are forging the future of connected mobility. The recommended strategies for industry leaders emphasize architectural optimization, tariff mitigation, cybersecurity hardening, and collaborative ecosystem engagement to secure competitive advantage and resilience.

Looking forward, the trajectory of automotive communication will hinge on the industry’s ability to harmonize interoperable network standards, embed robust security frameworks, and navigate evolving policy landscapes. Continued investments in zonal computing, V2X infrastructure, and agile software platforms will unlock new mobility services and sustainable growth pathways, charting a transformative course for the next generation of connected vehicles.

Engage with Ketan Rohom to Access Comprehensive Market Intelligence and Transform Automotive Communication Strategies with Tailored Research Solutions

For automotive executives seeking deeper insights into connectivity architectures, tariff implications, and strategic opportunities, our specialized research services offer a customized engagement tailored to your unique market requirements. By partnering directly with Ketan Rohom, Associate Director, Sales & Marketing, you will benefit from expert guidance on interpreting data, refining strategic roadmaps, and identifying high-impact initiatives that drive competitive differentiation in the evolving mobility landscape.

To unlock the full potential of this market research report and explore bespoke consulting packages, reach out to Ketan Rohom to schedule a complimentary briefing. Leverage our proprietary methodologies and actionable intelligence to anticipate disruptive trends, optimize supply chain resilience, and accelerate the development of next-generation automotive communication solutions.

- How big is the Automotive Communication Market?

- What is the Automotive Communication Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?