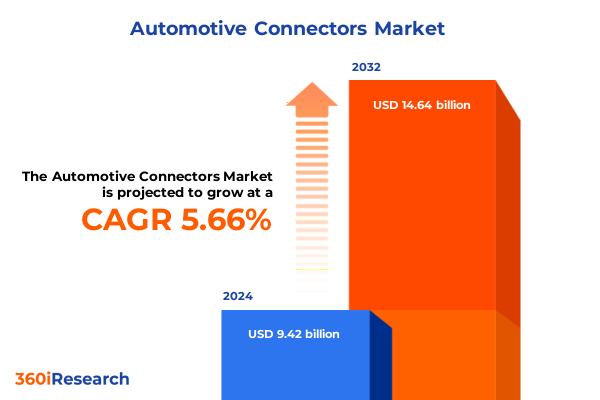

The Automotive Connectors Market size was estimated at USD 9.85 billion in 2025 and expected to reach USD 10.30 billion in 2026, at a CAGR of 5.83% to reach USD 14.64 billion by 2032.

Unveiling How Automotive Connectors Form the Backbone of Modern Vehicle Architectures and Drive Connectivity Trends Across Global Mobility Solutions

Automotive connectors serve as the vital interface that enables electrical and electronic systems to function seamlessly within vehicles. As vehicles become increasingly sophisticated and interconnected, the role of connectors has evolved beyond simple electrical junctions and into critical enablers of safety, performance, and user experience. Modern vehicles integrate a diverse array of subsystems-ranging from advanced driver assistance systems to high-bandwidth infotainment platforms-and each relies on robust connector solutions to maintain signal integrity, manage power distribution, and ensure long-term reliability under demanding environmental conditions.

The evolution of automotive connectors tracks closely with broader trends in the industry. Early generations of vehicles featured relatively simple wiring harnesses and inexpensive, low-density connectors. Over time, the shift toward electronic control units (ECUs) and modular wiring architectures prompted the development of specialized connector types designed for higher contact densities and enhanced protection against vibration, moisture, and temperature extremes. This progression laid the groundwork for the next phase of innovation, in which miniaturization and improved materials would become central to connector design.

Today’s marketplace demands connectors that can accommodate the high-voltage requirements of electrified drivetrains, support the continuous data flows needed by autonomous driving sensors, and integrate seamlessly with in-vehicle networks. As manufacturers and system integrators strive to reduce weight and complexity while enhancing functionality, connector suppliers are tasked with delivering solutions that blend mechanical robustness with electrical performance and design flexibility.

Looking ahead, the introduction of emerging technologies-such as optical data transmission, advanced composite housings, and self-healing materials-promises to redefine connector capabilities. These innovations will shape how future vehicles are designed, manufactured, and maintained, underscoring the strategic importance of connectors as foundational components in the evolving mobility landscape.

Exploring The Transformative Forces Of Electrification, Autonomous Innovations, And Advanced Materials Reshaping The Global Automotive Connector Landscape

The automotive connector landscape is undergoing a period of rapid transformation fueled by three interrelated forces: electrification, autonomous innovations, and advanced materials. Electrification mandates higher voltage handling capabilities, prompting suppliers to develop connectors that safely manage power levels beyond 800 volts. This shift not only changes the electrical architecture of vehicles but also imposes stricter design and testing protocols to ensure occupant safety and system resilience.

Concurrently, the push toward autonomous driving systems has increased demand for high-speed data connectors capable of supporting gigabit-level throughput. Sensors such as LiDAR, radar, and high-definition cameras generate vast amounts of data that must be transmitted reliably and with minimal latency. Connector manufacturers are responding with designs that incorporate shielded coaxial contacts, modular interface systems, and precise signal routing to maintain integrity in noise-prone environments.

Material innovation is the third pillar of transformation. Advanced polymers, composite insulators, and corrosion-resistant metal alloys are now central to connector housings and contacts. These materials offer reduced weight, enhanced durability, and improved thermal performance, addressing the dual goals of vehicle efficiency and longevity. In tandem with these developments, digital design tools and additive manufacturing techniques are being leveraged to accelerate prototyping and enable more complex geometries.

Together, these transformative shifts are redefining supplier–OEM relationships, accelerating development cycles, and raising the bar for quality standards. Organizations that align their product roadmaps with these emerging priorities will be best positioned to meet the next generation of performance and regulatory requirements.

Assessing The Far Reaching Effects Of Newly Imposed United States Tariffs In 2025 On Automotive Connector Supply Chains, Cost Structures, And Market Dynamics

In 2025, newly implemented United States tariffs are exerting a substantial influence on the economics of automotive connector supply chains. These levies, targeting key electronic components and raw materials, have introduced additional cost layers that extend from international manufacturers through to OEM assembly lines. As a result, companies are reevaluating their sourcing strategies, with some opting to localize production or diversify supplier bases to mitigate tariff-induced expense.

Tariff-related cost increases have a cascading effect on product pricing and procurement cycles. Component vendors face pressure to absorb a portion of the added expense through process optimization or margin compression, while vehicle manufacturers reassess contract terms and seek more favorable payment structures. In many cases, these dynamics have led to lengthened lead times as suppliers recalibrate production schedules and material inventories to hedge against potential tariff escalations.

Beyond direct cost implications, the tariffs have prompted a strategic realignment of supply networks. Firms are exploring nearshoring options, investing in regional manufacturing footprints that sidestep punitive duties and reduce logistical complexity. Partnerships with domestic contract manufacturers and assembly houses have gained traction, enabling stakeholders to maintain continuity of supply while adapting to evolving trade policies.

As the industry navigates these tariff-driven challenges, a proactive approach that combines cost modeling, supplier risk assessments, and scenario planning will be crucial. Companies that adopt agile procurement frameworks and foster deeper collaboration with key suppliers will be better equipped to sustain competitive positioning despite the trade headwinds of 2025.

Diving Deep Into Market Segmentation Perspectives Spanning Product Type Variants Connector Styles Current Ratings Mounting Methods Applications And End User Channels

Insights into the automotive connector market emerge most vividly when viewing the landscape through multiple segmentation lenses. Based on product type, variations such as board-to-board, ECU connectors, sensor connectors, wire-to-board, and wire-to-wire illustrate how connection requirements change with functional complexity and environmental exposure. In scenarios demanding high-speed data transmission or harsh operational resilience, sensor connectors often outpace traditional wire connections in adoption due to their specialized contact designs.

Connector type segmentation-circular, coaxial, and rectangular-reveals distinct usage patterns driven by spatial constraints and performance criteria. Circular interfaces, prized for their sealing capabilities, dominate underhood and chassis applications, while coaxial connectors excel in infotainment and telematics subsystems that require signal fidelity. Rectangular connectors, with their modular form factors, serve as versatile standards across body electronics and ECU interfaces.

Current rating segmentation further underscores the diversity of electrical demands. High-current connectors rated above 50A are intrinsic to powertrain and electrification systems, supporting traction motors and onboard chargers. In contrast, low-current options under 5A find broad application in body electronics and sensor arrays, where signal integrity rather than power delivery is paramount. Medium-current connectors spanning 5A to 50A bridge these domains, enabling multifunctional nodes within distributed electrical architectures.

Mounting type delineation into free-hanging, surface mount, and through-hole formats impacts production methods and assembly efficiency. Surface-mount solutions facilitate automated PCB integration in compact modules, whereas free-hanging connectors provide flexibility in wiring harness applications. Through-hole connectors remain vital for high-retention connections in power electronics modules.

Application segmentation captures the specificity of use cases across body electronics, chassis, infotainment, powertrain, and telematics. Infotainment subcategories reveal divergent demands between audio systems that prioritize signal clarity and video systems that require bandwidth. Telematics splits into emergency systems-where reliability can be life-critical-and vehicle tracking solutions that focus on connectivity and data transmission.

Vehicle type insights distinguish between passenger cars and commercial vehicles, with the latter subdividing into heavy and light segments that reflect varying durability and load requirements. End user perspectives, segmented into aftermarket and original equipment, highlight distinct purchasing cycles and quality expectations. Taken together, these segmentation insights illuminate the nuanced requirements that drive connector design, production, and deployment across the automotive ecosystem.

This comprehensive research report categorizes the Automotive Connectors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Connector Type

- Current Rating

- Mounting Type

- Application

- Vehicle Type

- End User

Unraveling Regional Market Dynamics In The Automotive Connector Sector Across The Americas EMEA And Asia Pacific To Reveal Key Growth Drivers And Challenges

Regional dynamics play a pivotal role in shaping the automotive connector market, with each geopolitical area displaying unique drivers and constraints. In the Americas, robust demand for electrification and advanced driver assistance systems is fueling growth in high-current and high-speed data connectors. Local content regulations and incentives for domestic manufacturing have spurred investment in North American production capabilities, while integration with Latin American supply chains continues to evolve under shifting trade frameworks.

Within the Europe, Middle East & Africa region, regulatory rigor around safety and emissions, coupled with the rapid rollout of electric mobility initiatives in Western Europe, has elevated the importance of connectors that meet stringent performance standards. Meanwhile, emerging markets in the Middle East and Africa are prioritizing cost-effective, durable connector solutions to support expanding automotive assembly plants and aftermarket service networks.

Asia-Pacific stands as the largest and most dynamic market, driven by strong automotive production in China, Japan, South Korea, and India. The region’s emphasis on high-volume manufacturing has cultivated a competitive environment where speed to market and cost leadership are paramount. Simultaneously, governments are fostering local research and development ecosystems that advance connector innovation in areas such as miniaturization, composite housings, and integrated sensor modules.

Collectively, these regional insights reveal how divergent regulatory environments, production paradigms, and end-user expectations influence connector technology adoption. Organizations that tailor their regional strategies-aligning product development, manufacturing footprints, and supply partnerships with local market realities-will secure the agility needed to thrive in this heterogenous landscape.

This comprehensive research report examines key regions that drive the evolution of the Automotive Connectors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Innovative Industry Leaders Shaping The Competitive Landscape Through Technological Breakthroughs Strategic Collaborations And Expansion Initiatives

Leading companies in the automotive connector sector are distinguished by their mastery of innovation, strategic collaboration, and global footprint optimization. These enterprises invest heavily in research and development to pioneer next-generation connector architectures, including compact, high-density modules that support the convergence of power and data transmission in electrified and autonomous vehicles. Collaboration with OEMs and tier-one suppliers enables co-development of customized solutions that address precise application requirements, from harsh underhood environments to high-speed in-cabin networks.

In addition to technological advancement, top-tier connector manufacturers have embraced digital transformation initiatives to streamline design, testing, and manufacturing processes. Adoption of advanced simulation tools accelerates product validation cycles, while Industry 4.0–powered production lines enhance yield rates and flexibility. This integration of digital capabilities supports rapid response to changing market demands and regulatory updates, ensuring that product offerings remain ahead of competitive and compliance curves.

Supply chain resilience has also become a strategic differentiator. Market leaders have established multi-regional manufacturing hubs to mitigate trade risks and reduce lead times, complemented by robust inventory management systems that balance responsiveness with cost efficiency. Partnerships with specialized logistics providers further bolster the ability to deliver just-in-time solutions to global customers.

Finally, corporate sustainability goals increasingly shape provider strategies, with initiatives spanning eco-friendly materials sourcing, carbon footprint reduction in manufacturing, and end-of-life connector recycling programs. These commitments not only align with broader automotive decarbonization agendas but also strengthen brand equity among stakeholders who prioritize environmental stewardship.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Connectors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amphenol Corporation

- Amphenol SVP

- Aptiv PLC

- AVIC Jonhon Optoelectronics Technology Co., Ltd.

- BizLink Technology Inc.

- DDK Ltd.

- Furukawa Electric Co., Ltd.

- HARTING Technology Group Germany GmbH & Co. KG

- Hirose Electric Co., Ltd.

- ITT Cannon LLC

- J.S.T. Mfg. Co., Ltd.

- Japan Aviation Electronics Industry, Ltd.

- Korea Electric Terminal Co., Ltd.

- Kyocera Corporation

- LEMO Manufacturing Co.

- Leoni AG

- LITE-ON Technology Corporation

- Luxshare Precision Industry Co., Ltd.

- Molex LLC

- Rosenberger Hochfrequenztechnik GmbH & Co. KG

- Samtec Inc.

- Sumitomo Electric Industries, Ltd.

- TE Connectivity Ltd.

- Yazaki Corporation

Formulating Actionable Strategies For Industry Stakeholders To Capitalize On Emerging Trends Regulatory Evolutions And Technological Advancements In Automotive Connectivity

To navigate the complex, evolving terrain of the automotive connector market, industry stakeholders must adopt a set of strategic imperatives that align with emerging trends and regulatory landscapes. First, cultivating deep engagements with OEM and tier-one partners through joint development agreements will ensure early access to product specifications and integration requirements for electrification and autonomous systems. Such collaborations foster co-innovation and reduce time-to-market for critical connector solutions.

Second, investing in regional manufacturing capabilities and flexible production architectures is essential to mitigate the impacts of trade policy fluctuations and localized demand surges. Nearshoring or regional center-of-excellence models can provide the agility needed to adapt quickly to tariff changes and supply chain disruptions while maintaining cost competitiveness.

Third, accelerating digitalization across the value chain-including digital twin simulations, predictive analytics for quality control, and advanced robotics in assembly-will enhance operational efficiency and support rapid product iteration. Data-driven insights from connected factory systems enable continuous improvement and greater alignment between design specifications and real-world performance.

Finally, embedding sustainability into core business strategies through the adoption of recyclable materials, eco-conscious packaging, and energy-efficient manufacturing practices will not only meet tightening environmental regulations but also resonate with customers whose purchasing decisions are increasingly influenced by corporate responsibility. By taking these actions, connector suppliers and vehicle manufacturers will position themselves for sustained success in a market defined by technological complexity and global interdependencies.

Detailing The Comprehensive Research Methodology Employing Primary Interviews Secondary Data Analysis And Rigorous Validation Frameworks For Market Clarity

The research methodology underpinning this analysis integrates multiple layers of primary and secondary investigation to ensure robust, actionable insights. Primary research involved structured interviews with key stakeholders across the automotive connector ecosystem, including design engineers, procurement leaders, and product development executives at OEMs and tier-one suppliers. These interviews facilitated firsthand understanding of evolving specifications, collaboration models, and strategic priorities.

Secondary research complemented these insights through comprehensive evaluation of industry publications, regulatory filings, patent databases, and trade association reports. Comparative analysis of technical standards, such as those governing connector voltage ratings, sealing performance, and EMI shielding, provided a foundational understanding of benchmarking criteria and quality thresholds.

Quantitative data collection included compiling material pricing trends, trade flow statistics, and manufacturing capacity metrics across major production regions. Advanced statistical techniques were applied to validate correlations between tariff policies and supply chain adjustments, as well as to model adoption curves for emerging connector technologies.

Finally, a rigorous validation phase cross-referenced primary findings with secondary data points and industry expert reviews. This multi-tiered approach ensured that conclusions reflect current market realities, technological advancements, and regulatory trajectories, providing a reliable basis for strategic decision-making within the automotive connectivity domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Connectors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Connectors Market, by Product Type

- Automotive Connectors Market, by Connector Type

- Automotive Connectors Market, by Current Rating

- Automotive Connectors Market, by Mounting Type

- Automotive Connectors Market, by Application

- Automotive Connectors Market, by Vehicle Type

- Automotive Connectors Market, by End User

- Automotive Connectors Market, by Region

- Automotive Connectors Market, by Group

- Automotive Connectors Market, by Country

- United States Automotive Connectors Market

- China Automotive Connectors Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings To Illuminate The Strategic Significance And Evolving Trajectory Of Automotive Connectors In A Rapidly Advancing Mobility Ecosystem

As the automotive industry accelerates toward a future characterized by electrified propulsion, autonomous driving capabilities, and ubiquitous connectivity, automotive connectors stand at the intersection of these transformative trends. The synthesis of our analysis underscores the indispensable role that connector technologies play in enabling reliable power delivery, high-speed data transmission, and seamless integration of advanced sensor networks.

Key shifts-driven by electrification demands, autonomous system requirements, and material innovations-have elevated the strategic importance of connector design and supply chain resilience. Meanwhile, the 2025 United States tariffs have prompted companies to reassess sourcing strategies, fortify regional manufacturing footprints, and adopt agile procurement frameworks to mitigate cost and delivery disruptions.

Segmentation and regional analyses further reveal the nuanced interplay between product specifications, application contexts, and geographical distinctions. These insights guide suppliers and OEMs in tailoring offerings that meet stringent performance standards while addressing divergent market needs across the Americas, EMEA, and Asia-Pacific.

Collectively, the findings highlight the critical need for collaboration, innovation, and strategic foresight. Organizations that embrace joint development partnerships, digital transformation, and sustainability initiatives will not only navigate current challenges but also harness the opportunities presented by the ongoing evolution of the automotive connectivity landscape.

Seize Exclusive Premium Insights On The Automotive Connector Market By Engaging With Ketan Rohom For Customized Research Solutions And Strategic Consultation

To gain unparalleled insights into the multifaceted dimensions of the automotive connector sector, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His extensive expertise ensures that your organization acquires a tailored, in-depth market research report designed to address your strategic priorities and accelerate decision-making. Engage directly with a dedicated specialist who understands the nuances of supply chain complexities, tariff impacts, and technology-driven transformations in connectivity solutions. By partnering with Ketan, you secure access to exclusive data, customized analyses, and bespoke recommendations that empower you to navigate competitive pressures and capitalize on emerging opportunities. Take the next step in future-proofing your product roadmaps and align your growth initiatives with actionable intelligence. Connect today to customize your research package and unlock strategic guidance that drives measurable value.

- How big is the Automotive Connectors Market?

- What is the Automotive Connectors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?