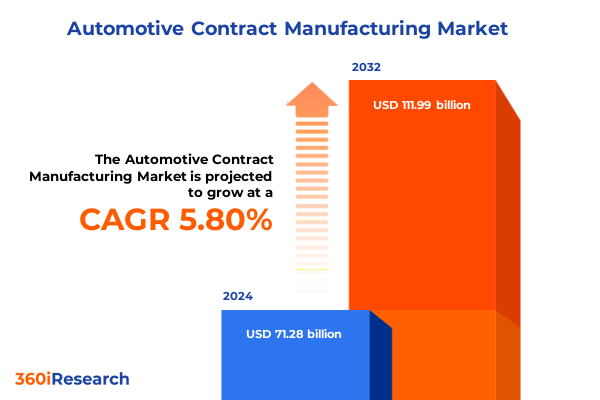

The Automotive Contract Manufacturing Market size was estimated at USD 75.17 billion in 2025 and expected to reach USD 79.36 billion in 2026, at a CAGR of 5.89% to reach USD 112.29 billion by 2032.

Navigating Disruption in Automotive Contract Manufacturing with Strategic Outsourcing and Innovation for Sustainable Growth and Operational Excellence

The automotive contract manufacturing sector has emerged as a critical backbone for original equipment manufacturers aiming to allocate resources toward innovation, research, and brand development while leveraging specialized external partners for production and assembly. As global vehicle programs proliferate in complexity, leading OEMs increasingly rely on contract manufacturing to mitigate the capital intensity of building and operating expansive manufacturing facilities. This strategic outsourcing trend allows companies to rapidly scale production without incurring prohibitive upfront expenditures, and it has become particularly pronounced in the electric vehicle arena where capacity demands can fluctuate dramatically. Moreover, contract manufacturers offer tailored solutions that align with evolving design specifications, ensuring agility in responding to shifting consumer preferences and tightening regulatory requirements for emissions and safety standards.

Driving this shift are the technological revolutions defined by vehicle electrification and digital connectivity, as well as the emergence of autonomous driving capabilities. Electric vehicle startups and established automakers alike are outsourcing critical components such as battery modules, inverters, and powertrains to third-party specialists, enabling rapid market entry without the burden of establishing new production lines. In parallel, the integration of advanced sensors, infotainment systems, and electronic control units has spurred a significant uptick in electronics-focused contract manufacturing partnerships. This collaborative model accelerates time to market, reduces manufacturing cycle length, and improves operational efficiencies through economies of scale.

Concurrently, global supply chain volatility, exacerbated by pandemic-related disruptions and geopolitical tensions, has underscored the necessity for flexible production networks. Multinational companies are increasingly pursuing nearshoring and reshoring initiatives to bolster resilience and minimize logistical risks. By diversifying their manufacturing footprint across strategic locations, industry players can secure continuity of supply and better manage lead times, forging partnerships that integrate local content strategies and comply with stringent regional regulations. Such measures not only enhance responsiveness but also foster sustainable practices and reinforce the integrity of complex automotive ecosystems.

Embracing Electrification Autonomy and Digitalization as the Three Pillars Redefining Contract Manufacturing in the Automotive Landscape

The automotive contract manufacturing landscape is undergoing profound transformation driven by the convergence of electrification, autonomy, and digitalization. Electrification has disrupted traditional assembly paradigms, prompting contract manufacturers to retool facilities and invest in new process capabilities for high-voltage battery systems, electric motors, and lightweight materials. This transition demands not only capital investment but also a skilled workforce adept in battery chemistry, power electronics, and thermal management-core competencies that are reshaping partnerships between OEMs and manufacturing specialists.

Simultaneously, the pursuit of autonomous vehicle technology is elevating the role of contract manufacturers in producing advanced driver assistance systems and sensor arrays. Level 2 through Level 5 autonomy functionalities require precision manufacturing of Lidar, radar, and camera modules. Contract partners are integrating sophisticated quality assurance protocols and leveraging digital twins for simulation-based validation to ensure these safety-critical components meet stringent performance benchmarks. As OEMs seek to navigate the complex regulatory pathways for autonomous systems, these third-party collaborations are becoming indispensable for managing technical risk and accelerating deployment timelines.

Unpacking the Far-Reaching Consequences of 2025’s New U.S. Automotive Tariff Regime on Production Costs and Supply Chain Dynamics

In March 2025, a presidential proclamation invoked Section 232 of the Trade Expansion Act to impose a 25% tariff on imports of passenger vehicles and selected components, amplifying cost pressures across the automotive manufacturing value chain. This tariff initiative, effective April 3 2025 for vehicles and phased on automotive parts by May 3 2025, is estimated to increase per-vehicle production costs by 7–12%, driven by higher pricing on steel, aluminum, semiconductors, and battery-related materials.

The financial ramifications for contract manufacturers and OEMs are substantial. General Motors reported a $1.1 billion hit to operating income in Q2 2025 attributable to tariff-related expenses, with anticipated annual profit reductions of up to $5 billion. Concurrently, Stellantis forecasts a €2.3 billion net impact in the first half of 2025, underscoring the pervasive strain on global manufacturing networks and the imperative to reassess sourcing strategies and local production incentives.

Beyond direct cost increments, the tariff-induced supply chain disruptions have catalyzed inventory stockpiling, margin compression, and the redirection of capital investments toward domestic capacity expansion. While some companies have absorbed initial expenses to shield consumers from immediate price hikes, sustained tariff exposure is likely to trigger broader pricing adjustments, elongate lead times, and incentivize strategic reshoring. As manufacturers grapple with these headwinds, they are accelerating efforts to forge resilient, dual-sourced supply chains and investing in regional manufacturing hubs to mitigate future trade policy volatility.

Revealing the Critical Segmentation Patterns Driving Automotive Contract Manufacturing across Vehicle Types Components Services and Technology Solutions

An in-depth segmentation analysis reveals how different market vectors are reshaping outsourcing demand and guiding strategic resource allocation. Vehicle type segmentation underscores that demand for contract manufacturing services is highest among electric and hybrid vehicles, where specialized battery systems and powertrain assemblies are critical. Autonomous vehicle projects, segmented by autonomy levels from Level 2 to Level 5, require intricate assembly of sensing arrays and specialized sub-assemblies. Commercial vehicles, including heavy and light categories, present stable volume opportunities, while passenger vehicle segments-spanning compact, mid-size, and luxury-drive bespoke interior trim and advanced comfort systems.

This comprehensive research report categorizes the Automotive Contract Manufacturing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Manufacturing Service Type

- Vehicle Type

- Contract Type

- Propulsion Type

- Technology Level

- End User

Assessing Regional Variations in Automotive Contract Manufacturing Demand and Capacities across Americas Europe Middle East Africa and Asia-Pacific

Regional analysis highlights divergent growth trajectories and strategic imperatives across the globe. In the Americas, manufacturers are enhancing production capacity to leverage nearshoring benefits, driven by robust EV adoption in the U.S. and governmental incentives aimed at revitalizing domestic vehicle assembly operations. Contract manufacturers in Mexico and Canada are scaling operations to serve North American OEMs, while U.S. players are expanding facilities to comply with content requirements tied to trade agreements and tariff offsets.

Europe, the Middle East, and Africa are navigating a dual imperative: bolstering local EV battery production and safeguarding critical component supply chains. European authorities are proposing stricter local content mandates for batteries, underscoring the need for technology transfer in exchange for state aid. These regulations, coupled with environmental mandates on CO2 emissions, have prompted contract manufacturers to establish or expand facilities in regions such as Poland and Hungary, where infrastructure and skilled labor are readily available.

Across Asia-Pacific, low-cost production hubs in China and India continue to dominate high-volume components outsourcing, particularly for body panels, chassis modules, and powertrain subsystems. Concurrently, emerging markets such as Southeast Asia and Eastern Europe are gaining traction as cost-competitive destinations for high-mix, low-volume prototyping and tooling services, driven by improvements in digital manufacturing technology and government-backed infrastructure investments.

This comprehensive research report examines key regions that drive the evolution of the Automotive Contract Manufacturing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Contract Manufacturers and Tier One Suppliers Shaping the Future of Automotive Production through Strategic Partnerships

Industry leaders exemplify the evolving dynamics of contract manufacturing through strategic partnerships and facility expansions. Foxconn has rapidly transitioned from electronics to automotive production, acquiring a former Lordstown Motors plant in Ohio and forging agreements to produce the Lordstown Endurance pickup and the Fisker PEAR crossover. These initiatives illustrate Foxconn’s ambition to leverage its scale and manufacturing expertise to deliver over 250,000 vehicles annually while navigating the complexities of automotive assembly for the first time.

Magna International continues to solidify its position as a premier contract manufacturer, notably through its Graz, Austria facility, which will assemble Fisker’s Ocean electric SUV. Magna’s flexible manufacturing platforms accommodate high-mix production and integrate advanced stamping, welding, and additive techniques to support both legacy combustion models and emerging EV architectures. This dual capability enables OEMs to streamline global production networks without significant capital expenditure in new plants.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Contract Manufacturing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alchemy MFG

- AM General LLC

- Asteelflash Group

- Astro Machine Works

- Avalon Technologies Limited

- Avtec Inc. by Motorola Solutions, Inc.

- Benteler International AG

- Brabus automotive GmbH

- Bunty LLC

- Continental AG

- Edison Manufacturing & Engineering, Inc.

- Foxconn Technology Group

- HANA Technologies Inc.

- IWN GmbH & Co. KG

- Machinemaze Integration Services Private Limited

- Magna International Inc.

- Providence Enterprise

- SGK India Engineering Pvt. Ltd.

- Steyr Automotive GmbH

- SVI Public Company Limited.

- Valmet Automotive Group

- VDL Groep

- Voestalpine AG

- W Motors

- ZF Friedrichshafen AG

Implementing Actionable Strategies to Enhance Resilience Agility and Competitiveness for Stakeholders in Automotive Contract Manufacturing

To thrive amid rapid technological and regulatory shifts, industry stakeholders should evaluate near-term actions and long-term strategic investments. First, diversifying supply chains through regional hubs and dual-sourcing agreements mitigates the impact of trade policy fluctuations and ensures continuity of supply. Companies should leverage predictive analytics and digital twin simulations to optimize inventory levels and anticipate disruption patterns while enhancing visibility across multi-tier networks.

Second, adopting sustainable manufacturing practices and circular economy principles will align operational processes with evolving environmental regulations and consumer expectations. Contract providers and OEMs must collaborate on lightweight materials, energy-efficient processes, and end-of-life recycling frameworks to maintain regulatory compliance and reduce total cost of ownership. Implementing transparent traceability systems, as seen in Catena-X and similar digital procurement initiatives, will be critical for verifying sustainable sourcing and building trust across the automotive ecosystem.

Finally, investing in workforce upskilling and industry-4.0 capabilities-including robotics, AI-driven quality control, and additive manufacturing-will enable contract manufacturers to deliver higher levels of customization and rapid prototyping. Strategic partnerships with technology providers and academic institutions can foster innovation ecosystems that drive continuous improvement, accelerate new model introductions, and maintain competitiveness in a landscape defined by agility and precision.

Detailing a Comprehensive Mixed-Methodology Approach Combining Primary Interviews Secondary Data and Expert Validation for Rigorous Market Insights

This research employs a robust mixed-methodology framework, integrating primary qualitative interviews with senior executives and engineering leads across contract manufacturers, OEMs, and supply chain partners. Complementing these insights, secondary data sources-including regulatory filings, industry white papers, and trade association reports-were analyzed to validate market trends and policy impacts. Quantitative data triangulation was conducted using published financial statements, customs import/export records, and technology adoption metrics to ensure accuracy and consistency.

Furthermore, an expert validation panel comprising automotive industry consultants and academic researchers was convened to review preliminary findings and provide scenario-based assessments. Continuous iterative feedback loops enabled refinement of segmentation definitions, ensuring the report’s structural frameworks reflect the nuances of vehicle type, component complexity, service modalities, production scales, and contractual arrangements. This comprehensive approach delivers a high degree of confidence in the insights and strategic recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Contract Manufacturing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Contract Manufacturing Market, by Manufacturing Service Type

- Automotive Contract Manufacturing Market, by Vehicle Type

- Automotive Contract Manufacturing Market, by Contract Type

- Automotive Contract Manufacturing Market, by Propulsion Type

- Automotive Contract Manufacturing Market, by Technology Level

- Automotive Contract Manufacturing Market, by End User

- Automotive Contract Manufacturing Market, by Region

- Automotive Contract Manufacturing Market, by Group

- Automotive Contract Manufacturing Market, by Country

- United States Automotive Contract Manufacturing Market

- China Automotive Contract Manufacturing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Consolidating Key Takeaways Highlighting the Strategic Imperatives for Industry Leaders in Automotive Contract Manufacturing

This executive summary underscores the pivotal role of contract manufacturing as OEMs navigate technological disruption, evolving regulatory landscapes, and supply chain volatility. The convergence of electrification, autonomy, and digitalization demands agile partnerships capable of delivering specialized assemblies and scalable production networks. As trade policies introduce new cost variables, regional diversification and resilient sourcing strategies become imperative. Strategic segmentation analysis highlights targeted opportunities across vehicle types, components, services, and technologies, enabling informed decision-making. Leading industry players exemplify successful collaborations, while actionable recommendations provide a roadmap for enhancing competitiveness and sustainability. Ultimately, contracting with specialized manufacturing experts represents a strategic lever for OEMs and suppliers seeking to optimize capital allocation, accelerate time to market, and secure long-term operational resilience.

Contact Our Associate Director to Secure Exclusive Automotive Contract Manufacturing Insights and Elevate Your Strategic Decision-Making

Are you ready to transform your strategic planning with unparalleled insights into the automotive contract manufacturing market? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to access the full report, engage in a detailed briefing, and discover how these insights can drive your business forward. Secure your competitive advantage today by partnering with our expert team and unlocking the data-driven intelligence that will shape the future of your organization.

- How big is the Automotive Contract Manufacturing Market?

- What is the Automotive Contract Manufacturing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?