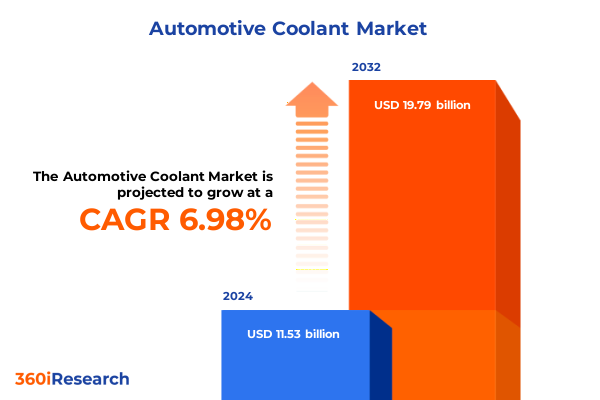

The Automotive Coolant Market size was estimated at USD 12.24 billion in 2025 and expected to reach USD 12.99 billion in 2026, at a CAGR of 7.10% to reach USD 19.79 billion by 2032.

Exploring the Critical Role and Evolving Dynamics of Automotive Coolants in Modern Vehicle Performance and Emissions Management

Automotive coolants have evolved beyond simple heat transfer fluids to become integral components of modern vehicle performance, reliability, and regulatory compliance. Today’s formulations not only manage engine temperatures to prevent overheating under extreme conditions but also protect cooling systems against corrosion, cavitation, and thermal breakdown. Advances in material science have enabled the development of specialty additives that extend drain intervals, reduce maintenance costs, and enhance compatibility with emerging engine architectures. As internal combustion engines coexist with hybrid and electric powertrains, the role of coolant solutions has expanded to include battery thermal management and cabin climate control systems, thereby underscoring their critical influence on overall vehicle efficiency and passenger safety.

Within this dynamic environment, both original equipment manufacturers and aftermarket suppliers are prioritizing coolant technologies that align with stringent emissions regulations and electrification strategies. Regulatory bodies around the world are tightening requirements for reduction of greenhouse gas emissions, driving OEMs to seek fluids that contribute to lower engine friction and optimized thermal performance. At the same time, the aftermarket is responding to rising consumer expectations for lower total cost of ownership, longer service intervals, and compatibility with a wider array of engine platforms. Such multifaceted demands are catalyzing innovation across the coolant value chain, from raw material sourcing to end-of-life recycling processes.

This executive summary provides a concise overview of the critical dynamics influencing the automotive coolant market. It highlights transformative shifts driven by technological breakthroughs and policy changes, examines the impact of recent U.S. tariffs, offers insights derived from key segmentations and regional variations, and concludes with strategic recommendations for industry leaders seeking to thrive amid intensified competition and evolving regulatory landscapes.

Examining the Pivotal Technological and Regulatory Accelerators Reshaping the Automotive Coolant Ecosystem Across Vehicle Electrification and Sustainability

The automotive coolant landscape is undergoing transformative shifts propelled by the convergence of electrification, sustainability mandates, and digitalization trends. As hybrid and battery electric vehicles reshape thermal management requirements, coolant formulators are compelled to innovate systems that manage both internal combustion engine heat and battery pack temperatures. This dual-function approach demands formulations with enhanced thermal conductivity, biodegradability, and compatibility with advanced heat exchanger materials, marking a departure from conventional antifreeze mixtures.

Simultaneously, regulatory frameworks are tightening worldwide to curb emissions and promote resource efficiency. Legislative measures in key markets now incentivize the adoption of long-life coolants that minimize fluid top-ups and reduce packaging waste. In response, manufacturers are integrating organic acid inhibitors and hybrid additive chemistries to deliver extended service intervals while adhering to environmental guidelines. Digital technologies further catalyze this evolution, as real-time monitoring systems embedded within cooling circuits provide predictive maintenance alerts, ensuring peak performance and minimizing unscheduled downtime.

Collectively, these technological and regulatory accelerators are redefining value propositions for automotive coolants. Established players and new entrants alike are investing in research partnerships and strategic alliances to co-develop next-generation fluids. This accelerated pace of innovation signals a shift toward high-performance, eco-friendly coolant solutions that will underpin vehicle electrification and sustainable mobility initiatives for years to come.

Analyzing the Far-Reaching Consequences of 2025 United States Tariff Adjustments on Automotive Coolant Supply Chains, Costs, and Global Trade Relationships

In 2025, a wave of new tariff measures enacted by the United States government has significantly influenced international trade dynamics for automotive coolants and their key raw materials. The adjusted duty rates on imported glycol derivatives and specialty corrosion inhibitors have prompted supply chain realignments, as companies reassess sourcing strategies to mitigate increased landed costs. Many producers are now pursuing vertical integration, securing domestic manufacturing partnerships to preserve margin stability and ensure uninterrupted supply for both OEM and aftermarket channels.

These tariff adjustments have also triggered strategic reviews of value-added service offerings. Coolant formulators are expanding technical support and blending services at regional distribution hubs to offset the impact of import duties on finished goods. By localizing production closer to end-user markets, they reduce logistical complexity and buffer inventory against potential border delays. At the same time, some suppliers are renegotiating long-term contracts with feedstock providers to lock in favorable pricing and maintain competitiveness in the face of protectionist trade policies.

While short-term cost pressures have emerged, the cumulative effects of U.S. tariffs have accelerated a broader industry shift toward resilient supply networks. Companies that strategically adjust procurement, production, and distribution footprints stand to gain a sustained advantage, even as global trade tensions continue to influence market dynamics.

Uncovering Core Segmentation Drivers Identifying How Product Types, Coolant Forms, Base Fluids, Distribution Channels, End Users, and Vehicle Classes Influence Demand

Understanding the diverse needs of the automotive ecosystem requires a detailed examination of how product type, coolant form, base fluid composition, distribution channel preferences, end-user segments, and vehicle classifications impact market priorities. Hybrid organic acid technology coolant formulations are increasingly valued for their balanced protection and extended durability, while inorganic additive technology coolants remain indispensable for applications requiring robust corrosion resistance. Organic acid technology coolants appeal to cost-sensitive segments that prioritize basic thermal management without ultra-long drain intervals.

The choice between concentrated and pre-mixed coolants shapes inventory strategies for both distributors and end users, with concentration offering logistical advantages and flexibility for custom blending, while pre-mixed solutions cater to convenience and reduced handling risk. Base fluid selection further refines product positioning: ethylene glycol continues to dominate performance-critical applications, propylene glycol addresses demand for lower toxicity, and glycerin-based blends are gaining traction in niche markets that emphasize renewable feedstocks.

Across channels, offline retail remains a key touchpoint for professional technicians seeking technical support, whereas online retail is expanding rapidly as consumers embrace digital purchasing. Aftermarket demand contrasts with original equipment manufacturer requirements, with the former driven by cost-effective maintenance solutions and the latter by strict compliance with vehicle warranties and OEM specifications. Vehicle type introduces another layer of complexity: heavy commercial vehicles often require ultra-robust formulations, while passenger vehicles-from hatchbacks and sedans to SUVs-demand coolants tailored to optimize efficiency, comfort, and long-term reliability.

These segmentation insights guide product development and channel strategies, enabling stakeholders to precisely address the performance, operational, and sustainability needs of each distinct market slice.

This comprehensive research report categorizes the Automotive Coolant market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Coolant Form

- Base Fluid

- Vehicle Type

- End User

- Distribution Channel

Delving into Regional Variations to Highlight How Americas, Europe Middle East and Africa, and Asia Pacific Markets Diverge in Automotive Coolant Dynamics

Regional dynamics in the automotive coolant sphere reveal distinct competitive landscapes, regulatory pressures, and customer expectations. In the Americas, mature OEM ecosystems and extensive aftermarket networks drive demand for technologically advanced formulations that meet stringent emission targets while offering extended service life. The United States remains a leading innovator in coolant chemistries, supported by robust domestic feedstock production and an expansive distribution infrastructure that spans from coast to coast.

In contrast, the Europe, Middle East & Africa region exhibits a fragmented approach, where rigorous environmental regulations in Europe coexist with rapidly developing markets in the Middle East and Africa. European nations prioritize sustainable coolant solutions aligned with circular economy principles, whereas emerging markets seek affordable and reliable fluids adapted to high-temperature conditions. Cross-regional partnerships and technology transfer initiatives have become critical to harmonize quality standards and expand access to premium formulations.

Meanwhile, Asia-Pacific stands out as a high-growth arena characterized by diverse vehicle populations and manufacturing hubs. China’s automotive sector, leading in both internal combustion and electric vehicle production, demands a broad spectrum of coolants, from cost-competitive offerings to advanced heat-transfer fluids for electric powertrains. India and Southeast Asia present opportunities for scale in both OE and aftermarket segments, with local blending plants emerging to serve tier-one automotive clusters and fast-growing passenger vehicle fleets.

Appreciating these regional nuances is vital for companies aiming to tailor market entry strategies, build resilient supply chains, and collaborate with local stakeholders to drive innovation and adoption.

This comprehensive research report examines key regions that drive the evolution of the Automotive Coolant market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Major Market Participants and Strategic Initiatives That Are Defining Competitive Leadership and Innovation in Automotive Coolant Solutions Globally

Leading participants in the automotive coolant market are distinguishing themselves through strategic R&D investments, manufacturing integration, and targeted alliances. Long-standing chemical companies with deep expertise in glycol production are leveraging scale to optimize cost structures, while specialty additive producers focus on next-generation inhibitor packages that deliver superior multi-metal protection. Collaborative ventures between chemical innovators and automotive OEMs have accelerated the validation of bespoke coolant solutions for high-performance applications and emerging electric vehicle platforms.

At the distribution level, service providers and blending partners are expanding footprint through regional blending terminals and mobile mixing units, enhancing their ability to deliver tailor-made formulations just-in-time. These models reduce inventory carrying costs and improve customer service, particularly in aftermarket channels where responsiveness is paramount. Meanwhile, digital platforms are being adopted to streamline order management, track fluid usage in real time, and forecast maintenance cycles, further elevating the value proposition for fleet operators and independent garages.

Competitive differentiation also stems from sustainability initiatives, with top firms investing in renewable feedstock R&D, closed-loop recycling programs, and life-cycle assessments to substantiate environmental claims. Certifications under global eco-label schemes and compliance with emerging regulations on chemical safety are becoming prerequisites for market access, elevating the importance of comprehensive quality management systems and transparent supply chain practices.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Coolant market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Afton Chemical Corporation

- Amsoil Inc.

- BASF SE

- Caltex

- Castrol Limited

- Chevron Corporation

- China Petrochemical Corporation (Sinopec)

- Dow Inc.

- ExxonMobil Corporation

- Fuchs Petrolub SE

- Gulf Oil International Ltd.

- Houghton International Inc.

- Idemitsu Kosan Co., Ltd.

- Indian Oil Corporation Limited

- Kost USA, LLC

- Lubrizol Corporation

- Motul S.A.

- Old World Industries, LLC

- Peak Automotive

- Prestone Products Corporation

- Recochem Inc.

- Royal Dutch Shell plc

- TotalEnergies SE

- Valvoline Inc.

Formulating Strategic Recommendations to Empower Industry Leaders in Optimizing Product Portfolios, Navigating Regulatory Challenges, and Accelerating Coolant Innovations

To maintain a competitive edge, industry leaders should prioritize the integration of advanced additive technologies and invest in modular blending infrastructure that supports rapid product customization. By fostering collaborative research alliances with academic institutions and OEM engineering teams, companies can accelerate the development of novel inhibitors and biodegradable formulations that address next-generation powertrain challenges. Strategic mergers or joint ventures with regional blending specialists will also help mitigate tariff risks and reduce time-to-market in key geographies.

Furthermore, embracing digitalization through predictive analytics and IoT-enabled monitoring systems can transform coolant maintenance from a reactive to a proactive function. Industry players should deploy sensors and data platforms to offer value-added services like condition-based maintenance and fluid performance benchmarking, thereby strengthening customer relationships and unlocking new recurring revenue models. Enhancing online retail channels with technical support resources and interactive product selectors will cater to evolving consumer preferences and complement traditional distribution networks.

Finally, firms must embed sustainability at the core of their strategies by adopting renewable base fluids, instituting recovery and recycling programs, and securing eco-certifications that align with global environmental standards. By doing so, they not only comply with tightening regulations but also differentiate their brands in a market that increasingly values transparency and ecological responsibility. Collectively, these strategic actions will equip industry leaders to navigate volatility, capture emerging opportunities, and deliver resilient growth in the automotive coolant domain.

Outlining Rigorous Research Frameworks Combining Primary Interviews, Secondary Data Synthesis, and Analytical Techniques to Ensure Comprehensive Market Coverage

This research employed a structured methodology combining primary and secondary approaches to ensure comprehensive coverage of the automotive coolant market. Primary research consisted of in-depth interviews with senior R&D executives at key additive manufacturers, procurement managers at leading OEMs, and technical service managers within major distribution networks. These expert insights provided qualitative context on formulation strategies, supply chain adaptations to tariff changes, and evolving customer requirements in various regions.

Secondary research encompassed an extensive review of industry publications, patent databases, trade association reports, and regulatory filings to map the competitive landscape and identify technological breakthroughs. Technical papers on inhibitor chemistries, environmental regulations, and vehicle thermal management systems supplemented proprietary databases and historical trend analyses. Cross-validation of data through triangulation ensured the reliability of insights and minimized bias.

Quantitative analyses of segmentation and regional demand patterns were conducted using a bottom-up approach, synthesizing information on production capacities, raw material availability, and channel-specific distribution metrics. The integration of qualitative and quantitative findings facilitated the development of actionable recommendations tailored to the strategic needs of both global incumbents and emerging challengers. Rigorous quality control procedures, including peer reviews by subject-matter experts and methodological audits, underpinned the integrity and credibility of the research findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Coolant market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Coolant Market, by Product Type

- Automotive Coolant Market, by Coolant Form

- Automotive Coolant Market, by Base Fluid

- Automotive Coolant Market, by Vehicle Type

- Automotive Coolant Market, by End User

- Automotive Coolant Market, by Distribution Channel

- Automotive Coolant Market, by Region

- Automotive Coolant Market, by Group

- Automotive Coolant Market, by Country

- United States Automotive Coolant Market

- China Automotive Coolant Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Critical Findings and Insights to Provide a Clear Perspective on the Future Trajectory of Automotive Coolant Technologies and Market Dynamics

In summary, the automotive coolant landscape is at a pivotal juncture, driven by the dual imperatives of enhanced thermal management and sustainability. Technological innovation is accelerating as formulations evolve to meet the demands of electrified powertrains and more stringent environmental standards. Concurrently, geopolitical shifts-most notably U.S. tariff adjustments-have reshaped supply chain configurations, incentivizing local production and strategic partnerships to uphold cost efficiency and reliability.

Key segmentation insights underscore the necessity for fluid portfolios that accommodate a spectrum of performance requirements, from heavy commercial vehicle durability to premium passenger vehicle comfort. Regional variations highlight the importance of tailored strategies, as market maturity, regulatory environments, and customer expectations diverge across the Americas, Europe Middle East & Africa, and Asia-Pacific. Leading companies are capitalizing on these dynamics through targeted R&D, supply chain integration, and digital service models, while prioritizing sustainability to meet emerging eco-label and circular economy benchmarks.

Looking ahead, stakeholders who embrace collaborative innovation, digital enablement, and agile supply chain designs will be best positioned to navigate ongoing volatility. The insights presented here offer a clear perspective on the forces shaping the future of automotive coolant technologies, equipping decision-makers with the knowledge needed to seize growth opportunities and drive long-term competitive advantage.

Engage with Ketan Rohom to Access Comprehensive Automotive Coolant Market Intelligence and Unlock Actionable Insights for Enhanced Competitiveness and Growth

To explore the full depth of these transformational trends, detailed segment analyses, and actionable strategic pathways, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of the comprehensive automotive coolant market research report. Empower your teams with evidence-based insights, competitive intelligence, and future-ready recommendations. Position your organization to capitalize on emerging opportunities, mitigate tariff-induced risks, and drive innovation in coolant formulations and supply chain resilience. Connect with Ketan Rohom today to chart a winning strategy in the rapidly shifting global automotive coolant landscape.

- How big is the Automotive Coolant Market?

- What is the Automotive Coolant Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?