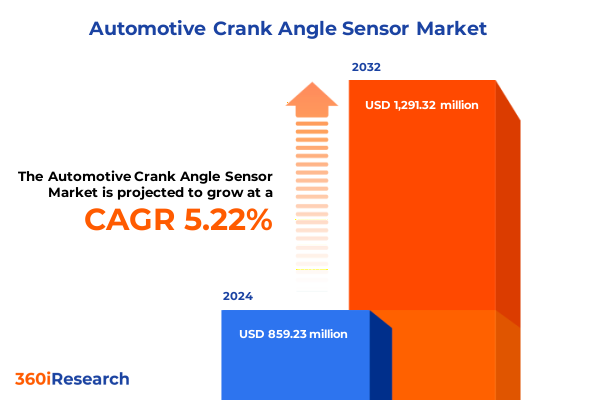

The Automotive Crank Angle Sensor Market size was estimated at USD 903.35 million in 2025 and expected to reach USD 950.28 million in 2026, at a CAGR of 5.23% to reach USD 1,291.31 million by 2032.

An authoritative exploration into the pivotal role and evolving dynamics of crank angle sensors shaping modern automotive performance

The crank angle sensor serves as a cornerstone of modern internal combustion engine management systems, providing real-time data on the crankshaft’s angular position and rotational speed to the engine control unit. This precision information enables the ECU to orchestrate ignition timing and fuel injection sequences with pinpoint accuracy, optimizing combustion efficiency and power delivery across multiple operating conditions.

By continuously monitoring the crankshaft’s motion, the sensor allows the ECU to detect misfires and adjust parameters on the fly, enhancing engine responsiveness and reducing emission levels. In the absence of accurate crank angle feedback, engines can suffer from rough idling, increased fuel consumption, and elevated pollutant output, underscoring the sensor’s vital role in regulatory compliance and performance consistency.

As automotive powertrains evolve to accommodate hybridization and alternative fuels, the demand for robust, miniaturized sensors has intensified. Innovations in sensor materials and integrated signal processing have elevated durability in harsh thermal and vibrational environments while reducing overall system weight. These advancements ensure that even as engines become more complex, the core function of providing precise rotational data remains uncompromised.

Revolutionary shifts in electrification, connectivity, and advanced manufacturing redefining the automotive sensor landscape for next generation vehicle innovation

The shift toward electrification has redefined the sensor landscape, with electric and hybrid powertrains relying on accurate position feedback to manage range-extender engines and regenerative braking systems. This transition has heightened the importance of crank angle sensors even as primary propulsion systems evolve, bridging legacy internal combustion architectures with next-generation electric modules. Advanced signal filtering and temperature-compensated designs have emerged to meet these demands, ensuring consistent performance across diverse drive modes.

Simultaneously, the proliferation of advanced driver-assistance systems and connected vehicle platforms has driven the integration of sensor networks that fuse data from radar, LiDAR, and inertial modules. Within this multi-sensor ecosystem, crank angle sensors provide foundational rotational context, enabling precise synchronization of engine, transmission, and braking subsystems. Such interconnected architectures are redefining vehicle safety and autonomy benchmarks, requiring resilient sensors that maintain accuracy under high electromagnetic interference and rapid load changes.

On the manufacturing front, digital transformation initiatives, including Industry 4.0 methodologies and additive production techniques, are streamlining sensor fabrication. Industrial-scale 3D printing of sensor housings and the adoption of digital twins for quality control are reducing production lead times while maintaining stringent performance tolerances. Coupled with strategic acquisitions-illustrated by STMicroelectronics’ acquisition of NXP’s sensor business-this trend is consolidating technological expertise and enabling greater customization of sensor solutions for automotive OEMs.

Assessing the multifaceted consequences of the 2025 United States tariff implementations on global supply chains and sensor manufacturing ecosystems

The United States’ implementation of new tariffs in 2025 has reverberated across the global crank angle sensor ecosystem, targeting key raw materials and electronic components. These measures have heightened cost pressures for both domestic producers and import-dependent suppliers, particularly those sourcing rare earth elements and semiconductor wafers. The levies have prompted stakeholder vigilance as businesses navigate elevated input expenses and fluctuating inventory valuations.

In response to the revised tariff structure, many OEMs and tier-one suppliers are renegotiating long-term procurement agreements to anchor material costs and maintain supply continuity. Stakeholders are increasingly localizing manufacturing processes, establishing regional hubs within the United States to mitigate import duties. Conversely, smaller aftermarket entities with constrained scale have encountered margin compression, leading some to pivot into specialized diagnostics and retrofit services where tariffs exert less direct influence.

Amid these challenges, the tariff landscape has catalyzed innovation, accelerating research into alternative sensor alloys and streamlined assembly methods to offset additional duties. Agile manufacturers focusing on regionalized production have leveraged this environment to capture market share from larger incumbents, demonstrating that strategic realignment can unlock competitive differentiation even under restrictive trade regimes.

In-depth segmentation analysis unveiling the strategic market breakdown by sales channels, vehicle categories, applications, fuel types, and sensor technologies

The market encompasses a structured study across distinct distribution channels, examining original equipment placements by automakers alongside aftermarket sales for service and replacement. Each channel presents unique requirements: OEM integration demands rigorous qualification cycles and volume certifications, whereas the aftermarket prioritizes modular compatibility and simplified installation.

Vehicle classifications offer a granular lens into market dynamics, spanning heavy and light commercial segments that necessitate robust, high-temperature sensors for trucks and vans. Passenger vehicles-from compact through mid-size to luxury classes-place emphasis on noise, vibration, and harshness (NVH) parameters alongside power efficiency. Two-wheelers similarly rely on sensor accuracy to ensure smooth ignition timing and rapid throttle response in diverse riding conditions.

Functional applications reveal differentiated sensor utilization across engine control units, safety systems including misfire detection, and transmission management for both manual and automatic gearboxes. Each application imposes distinct thermal, spatial, and electromagnetic constraints, guiding sensor architecture and materials engineering.

Fuel type delineation captures diesel and gasoline platforms executing combustion cycles with high injection pressures, while hybrid architectures incorporate full and mild hybrid strategies requiring adaptive sensing to balance electric and mechanical drive sources. Across all configurations, sensor type selection-from Hall effect and inductive to magnetoresistive and optical-aligns with accuracy, cost, and durability trade-offs.

This comprehensive research report categorizes the Automotive Crank Angle Sensor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Vehicle Fuel Type

- Sensor Type

- Sales Channel

- Application

Comprehensive regional examination revealing key market drivers, growth pockets, and strategic imperatives across Americas, EMEA, and Asia-Pacific territories

In the Americas, strong government incentives for electric vehicle adoption and stringent safety regulations are fueling sensor integration across new passenger car models. The region’s robust aftermarket network supports component replacement and retrofitting, maintaining stable demand for crank angle sensors even as powertrains diversify. Strategic investments in North American manufacturing hubs are further anchoring sensor production closer to OEM assembly lines, reducing lead times and enhancing supply resilience.

Europe, Middle East & Africa are characterized by rigorous emission standards like Euro 7 and regional mandates for advanced driver-assistance systems. Automakers are accelerating sensor deployment to comply with these regulations, bolstered by collaborative R&D initiatives in Germany, France, and the United Kingdom. Government subsidies for hybrid and full electric vehicles, combined with partnerships between automotive and semiconductor sectors, are reinforcing the region’s position as an innovation nexus for advanced sensor technologies.

Asia-Pacific continues to outpace global growth rates, driven by sizable volume production in China, India, and Japan. Government stimulus for EV infrastructure in China and supportive policies in Japan’s autonomous driving programs are expanding sensor requirements across passenger and commercial fleets. Regional OEMs are working closely with technology partners to localize sensor supply chains, accelerating time to market for new vehicle platforms and enabling rapid scaling of smart mobility solutions.

This comprehensive research report examines key regions that drive the evolution of the Automotive Crank Angle Sensor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the leading innovators and strategic alliances shaping the competitive terrain of the global crank angle sensor market ecosystem

Robert Bosch GmbH maintains its leadership through expansive R&D investments, leveraging its deep expertise in Hall effect and inductive sensor design to deliver highly accurate crank angle modules. Bosch’s close collaboration with Tier 1 OEMs ensures early access to vehicle architecture changes, refining sensor integration for next-generation engine management systems.

Continental AG leverages its proprietary materials science capabilities to enhance sensor durability under extreme thermal and vibrational conditions. Focused on sustainability, Continental is advancing recyclable sensor housings and low-power signal processing architectures, addressing both environmental mandates and energy efficiency goals.

Denso Corporation stands out for its rigorous quality control frameworks, supporting high-precision sensor calibration that meets stringent Japanese automotive reliability standards. Denso’s adaptive manufacturing lines deliver flexible batch sizes, accommodating rapid model changeovers without sacrificing performance consistency.

Delphi Technologies continues to expand its offerings with hybrid-optimized crank angle sensors, integrating advanced signal multiplexing to balance electrical and mechanical drive phases. The company’s strategic partnerships with powertrain OEMs reinforce its position in emerging hybrid and range-extender vehicle platforms.

STMicroelectronics’ acquisition of NXP’s automotive sensor business in July 2025 underscores a trend toward semiconductor consolidation. This move augments STMicro’s MEMS portfolio, strengthening its footprint in safety-critical and industrial applications, and promising enhanced miniaturization for future sensor generations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Crank Angle Sensor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allegro MicroSystems, Inc.

- BorgWarner Inc.

- Continental AG

- Delphi Group

- DENSO Corporation

- Dorman Products

- Feddermann & Lankau GmbH

- Fujikura Europe Ltd.

- HELLA GmbH & Co. KGaA

- Hitachi, Ltd.

- Infineon Technologies AG

- Magna International Inc.

- Mechatronics Group Pty. Ltd.

- Melexis NV

- NTN Corporation

- NXP Semiconductors N.V.

- OPTIMAL Automotive GmbH

- PEC Australia

- PROTERIAL, Ltd.

- Ridex GmbH

- Robert Bosch GmbH

- Sensata Technologies, Inc.

- TE Connectivity Ltd.

- Valeo S.A.

- ZF Friedrichshafen AG

Actionable strategies for industry front-runners to capitalize on emerging trends, streamline operations, and foster sustainable sensor advancements

To navigate evolving tariff structures and supply chain complexities, stakeholders should pursue multi-sourcing strategies that blend domestic and regional suppliers, thereby mitigating exposure to trade fluctuations while preserving cost competitiveness.

Manufacturers must embrace modular sensor platforms compatible with both ICE and hybrid powertrains, reducing platform variation costs and accelerating integration of new vehicle models. This approach supports scalability across multiple OEM collaborations and segmentation tiers.

Prioritizing digital transformation within production facilities by adopting predictive maintenance and digital twins will improve throughput and yield, ensuring that sensor quality remains consistent even as volumes ramp up in electrified vehicle lines.

Regional diversification should align with growth hotspots, scaling capacity in North America for OEM partnerships, while reinforcing EMEA-based R&D hubs to address stringent regulatory demands. In parallel, partnerships with local APAC players can capitalize on rapid EV adoption and supportive policies.

Robust research framework detailing the methodological rigor, data validation techniques, and expert-driven processes underpinning this market analysis

This analysis combines primary insights from interviews with senior engineers and supply chain managers at leading OEMs and Tier 1 suppliers, ensuring a nuanced understanding of sensor performance criteria and integration challenges. Complementary secondary research included peer-reviewed journals, conference proceedings, and patent filings to capture the latest material and MEMS processing breakthroughs.

Data triangulation was performed by reconciling quantitative inputs-such as production volumes and tariff schedules-with qualitative expert perspectives on emerging powertrain architectures. Regional trade database reviews informed the assessment of tariff impacts and supply realignment strategies.

Rigorous validation steps included cross-referencing interview findings against public financial disclosures and industrial white papers, ensuring consistency in reported R&D investments and technological milestones. This robust methodological framework underpins the credibility and relevance of the strategic recommendations presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Crank Angle Sensor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Crank Angle Sensor Market, by Vehicle Type

- Automotive Crank Angle Sensor Market, by Vehicle Fuel Type

- Automotive Crank Angle Sensor Market, by Sensor Type

- Automotive Crank Angle Sensor Market, by Sales Channel

- Automotive Crank Angle Sensor Market, by Application

- Automotive Crank Angle Sensor Market, by Region

- Automotive Crank Angle Sensor Market, by Group

- Automotive Crank Angle Sensor Market, by Country

- United States Automotive Crank Angle Sensor Market

- China Automotive Crank Angle Sensor Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesis of critical insights emphasizing the strategic imperatives and future outlook for stakeholders navigating the crank angle sensor domain

The automotive crank angle sensor market is experiencing a convergence of technological innovation, regulatory mandates, and shifting trade environments that collectively shape future growth trajectories. Electrification and ADAS integration have expanded sensor role definitions beyond traditional engine control, embedding these components within holistic vehicle intelligence ecosystems.

Trade policy shifts, notably the 2025 U.S. tariffs, have illuminated the importance of supply chain agility and regional manufacturing diversification. Industry leaders that proactively adapt procurement strategies and localize value chains can convert these challenges into competitive advantages.

Segmentation insights reinforce the need for versatile sensor designs capable of serving a broad spectrum of vehicle types and applications. Concurrently, regional analyses highlight differentiated growth levers, from EV incentives in the Americas to stringent safety regulations in EMEA and volume scale in Asia-Pacific.

Collectively, these insights underscore an imperative for decision-makers to balance innovation investments with tactical supply chain reconfigurations, ensuring that sensor solutions remain both high-performance and cost-effective in rapidly evolving markets.

Engage directly with our Associate Director to unlock complete market research and drive data-backed decisions in the crank angle sensor sector

Do not let strategic insights remain untapped. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to obtain the full automotive crank angle sensor market research report. Equip your organization with actionable data, expert analysis, and in-depth regional and segmentation breakdowns that will guide your next moves and accelerate growth in the evolving sensor landscape.

- How big is the Automotive Crank Angle Sensor Market?

- What is the Automotive Crank Angle Sensor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?