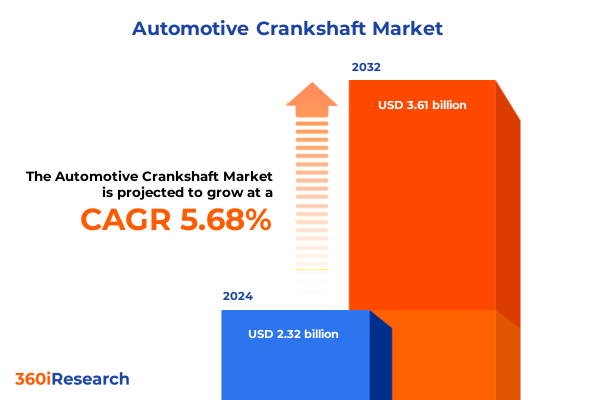

The Automotive Crankshaft Market size was estimated at USD 2.44 billion in 2025 and expected to reach USD 2.57 billion in 2026, at a CAGR of 5.75% to reach USD 3.61 billion by 2032.

Unveiling the Dynamics of the Automotive Crankshaft Market and Its Strategic Importance to Modern Powertrain Engineering and Vehicle Performance

The automotive crankshaft serves as the pivotal component converting linear piston motion into rotational torque that powers vehicles across all segments. As an integral part of the internal combustion engine assembly, crankshafts endure significant mechanical stress, requiring precise engineering to balance strength with manufacturability. Over the past decade, heightened emphasis on fuel efficiency, emissions reduction, and vehicle performance has elevated the engineering requirements for modern crankshafts. Advanced modeling techniques, metallurgical innovations, and process optimizations have collectively enhanced crankshaft durability, weight reduction, and vibration control, reinforcing their strategic importance in powertrain architecture.

Transitioning to electrified and hybrid powertrains has also influenced the traditional crankshaft landscape. Although electric motors do not require crankshafts, hybrid systems maintain internal combustion engines for extended range or performance advantages. Consequently, crankshaft design must adapt to frequent start–stop cycles, alternative fuel combustion characteristics, and tighter NVH (noise, vibration, and harshness) parameters. This evolving context sets the stage for a market that is at once mature and transformative, underpinned by continuous R&D investments and strong aftermarket dynamics. In this report, we explore these foundational drivers and frame the subsequent analysis around the latest technological, regulatory, and competitive forces reshaping the crankshaft market.

Emerging Powertrain Innovations and Evolving Regulatory Dynamics Reshaping Crankshaft Demand Design Complexity and Material Preferences

The past five years have witnessed a rapid acceleration of transformative shifts in powertrain technologies and materials science, directly impacting crankshaft specifications. High-strength alloys, such as forged and billet steels, have gained traction to meet the dual demand for weight reduction and fatigue resistance. At the same time, emerging surface treatments, micro-alloying techniques, and additive manufacturing trials have begun to challenge conventional cast iron and traditional machining paradigms. These material innovations not only enhance mechanical performance but also enable simplified geometries and optimized balancing to reduce NVH levels in premium and commercial applications.

Simultaneously, tightening global emissions regulations have compelled OEMs to pursue combustion engine efficiency improvements through higher-precision components. Direct injection gasoline and CRDI diesel platforms now operate at elevated pressures and temperatures, requiring crankshafts capable of sustaining more aggressive load cycles. In parallel, the gradual penetration of CNG and LPG variants, driven by alternative fuel incentives, has expanded the engine-type segmentation. Furthermore, smart manufacturing initiatives powered by Industry 4.0-such as real-time process monitoring, predictive maintenance, and digital twin simulations-are redefining production process efficiency. These converging trends are redefining the competitive landscape, prompting both incumbents and new entrants to pursue agile innovation strategies.

Evaluation of Recent US Tariff Measures and Their Consolidated Effects on Domestic Crankshaft Production Supply Chain Resilience and Cost Structures

In 2025, the implementation of revised United States tariff measures on steel and aluminum imports has exerted a multifaceted influence on domestic crankshaft manufacturing and global supply chains. Tariff escalations increased raw material costs, particularly for billet steel and specialized alloy inputs sourced through international channels. This cost pressure accelerated vertical integration efforts among key OEMs and tier-1 suppliers, encouraging localized steel procurement and increased in-house forging capacities to mitigate external dependencies. As a result, several manufacturers announced expansion of domestic forging facilities and investments in closed-die forging equipment to secure raw material control and stabilize pricing.

These tariff-induced dynamics have also affected aftermarket distribution. Higher component costs prompted fleet operators and service networks to optimize maintenance intervals and seek remanufactured or refurbished crankshaft alternatives, driving growth in authorized service channels and independent dealers. At the same time, machine shops have scaled CNC machining capabilities to deliver custom high-precision crankshafts for specialized commercial vehicles, offsetting import constraints. Despite these adjustments, short-term supply constraints persisted in the first half of 2025, underscoring the importance of strategic sourcing partnerships and flexible production networks to navigate ongoing tariff volatility.

Comprehensive Review of Vehicle Type Material Engine Production Process and Distribution Channel Segmentation Insights Driving Industry Differentiation

The crankshaft market’s complexity is evident when viewed through multiple complementary segmentation lenses. Vehicle types-ranging from heavy commercial trucks demanding robust, high-capacity crankshafts to passenger cars prioritizing lightweight design-dictate distinct mechanical and manufacturing considerations. Within material categories, billet steel provides high tensile strength and fatigue life for performance engines, while cast iron remains a cost-effective choice for high-volume commercial applications. Forged steel bridges these requirements, offering a balance of strength and production efficiency.

Engine type further refines demand: CRDI diesel powertrains require crankshafts engineered for high injection pressures and variable loading, whereas port-injection gasoline engines can leverage cast or forged designs optimized for moderate performance. Alternative fuel engines, including CNG and LPG variants, introduce unique combustion profiles that influence journal surface treatments and counterweight configurations. Production processes-casting techniques such as die, investment, and sand casting; forging methods like closed-die and open-die; and machining approaches spanning CNC and traditional operations-factor into cost, precision, and lead time trade-offs. Distribution channels extend from OEM in-house and tier-1 manufacturing arrangements to aftermarket service networks comprised of authorized centers, independent dealers, and online retailers. The interaction of these segmentation dimensions reveals targeted opportunities for product differentiation and value creation across market niches.

This comprehensive research report categorizes the Automotive Crankshaft market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Engine Type

- Production Process

- Vehicle Type

- Distribution Channel

Regional Demand Patterns Across Americas EMEA and Asia-Pacific Highlight Strategic Growth Corridors and Local Supply Chain Opportunities

Regional dynamics exert a profound influence on crankshaft demand, driven by local automotive production ecosystems, regulatory regimes, and infrastructure development priorities. In the Americas, a mature light vehicle market and robust commercial transport sector underpin steady crankshaft consumption. Domestic manufacturing hubs benefit from near-shoring trends and tariff-driven localization, while aftermarket networks capitalize on a broad installed base of legacy internal combustion engines. Canada’s heavy commercial segment and Mexico’s light commercial growth further diversify the regional profile, encouraging suppliers to balance export strategies with local assembly initiatives.

Across Europe, Middle East, and Africa, diverging regulations and market maturity present both challenges and opportunities. Western Europe’s stringent emissions targets accelerate the shift toward advanced, lightweight crankshafts, whereas Eastern European markets maintain volume demand for cost-competitive cast iron alternatives. The Middle East’s expanding infrastructure and logistics corridors drive heavy commercial vehicle fleet growth, while North African markets remain price-sensitive, favoring established forging and machining players. In the Asia-Pacific region, high production volumes in China, India, and ASEAN countries are matched by rapid technology adoption in premium passenger vehicles. The proliferation of small-displacement direct-injection engines and growth in CNG-powered fleets highlight evolving consumer preferences and government incentives that shape crankshaft specifications.

This comprehensive research report examines key regions that drive the evolution of the Automotive Crankshaft market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Intelligence on Leading Crankshaft Manufacturers Reveals Innovation Strategies and Collaborations Shaping Market Leadership

Leading companies in the crankshaft domain are distinguished by their investment in advanced materials research, precision manufacturing capabilities, and integrated supply chain models. Global steel producers have established captive forging operations to deliver bespoke alloy solutions, while specialized component manufacturers have forged partnerships with OEMs to co-develop high-performance shafts for emerging gasoline and diesel platforms. Several tier-1 suppliers have integrated additive manufacturing techniques for rapid prototyping and pilot production of complex geometries, reducing time-to-market for next-generation powertrains.

In parallel, aftermarket specialists have scaled refurbishment networks, leveraging state-of-the-art CNC machining and surface finishing centers to restore crankshafts to near-new tolerances. Collaboration between independent dealers and online service platforms has streamlined ordering and logistics, enhancing turnaround times. Meanwhile, select OEM in-house divisions have expanded in-house machining and heat treatment lines to retain control over critical tolerances and material certifications. Competitive positioning is further defined by M&A activity, with established forging houses acquiring regional machining workshops to reinforce end-to-end capabilities and capitalize on cross-selling opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Crankshaft market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd.

- Amtek Auto Ltd.

- Arrow Precision Ltd.

- Bharat Forge Limited

- Braynt Racing Inc.

- Hyundai Dymos Co., Ltd.

- Mahle GmbH

- Mitsubishi Heavy Industries, Ltd.

- Mubea International GmbH

- Sango Co., Ltd.

- SIFCO Industries, Inc.

- Tenneco Inc.

- Thyssenkrupp AG

Strategic Initiatives and Operational Best Practices to Capitalize on Technological Trends and Regulatory Shifts in the Crankshaft Sector

To thrive amid evolving technical and regulatory landscapes, industry leaders should prioritize a multifaceted strategy encompassing material innovation, manufacturing agility, and strategic partnerships. Investing in alloy development and surface engineering can yield lighter, more durable crankshafts that meet stringent efficiency and emissions requirements. Simultaneously, integrating digital process controls and predictive maintenance systems across forging, casting, and machining operations will enhance production reliability and yield real-time insights into equipment health.

Establishing collaborative alliances with OEMs, steel suppliers, and aftermarket distributors will de-risk raw material volatility and expand market access. Companies can leverage joint development agreements to co-create crankshaft variants for alternative fuel vehicles or specialty commercial applications. Additionally, expanding refurbishment and remanufacturing capabilities through dedicated service centers will tap into growing sustainability mandates and cost-conscious end users. Finally, monitoring tariff and trade policy developments and adjusting sourcing networks accordingly will safeguard margins and ensure supply chain resilience in the face of geopolitical shifts.

Rigorous Qualitative and Quantitative Research Framework Underpinning Market Analysis Ensuring Data Integrity and Analytical Robustness

This report is grounded in a rigorous research methodology combining primary interviews with senior executives, engineers, and procurement specialists across OEMs, tier-1 suppliers, and aftermarket service providers. Secondary data sources include industry whitepapers, trade association publications, regulatory filings, and technical journals focused on metallurgy and powertrain engineering. Quantitative analysis leverages proprietary datasets on production volumes, material consumption patterns, and equipment investment cycles, cross-referenced with trade statistics and tariff schedules.

The research process employed a triangulation approach to validate findings, integrating manufacturer data, supply chain cost models, and aftermarket service metrics. Qualitative insights were systematically coded to identify emerging themes in material innovation, production automation, and distribution strategies. Regional market validation was conducted through localized expert panels and site visits to key manufacturing hubs in North America, Western Europe, and Asia-Pacific. This comprehensive framework ensures that the report delivers actionable intelligence with high confidence in its accuracy and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Crankshaft market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Crankshaft Market, by Material Type

- Automotive Crankshaft Market, by Engine Type

- Automotive Crankshaft Market, by Production Process

- Automotive Crankshaft Market, by Vehicle Type

- Automotive Crankshaft Market, by Distribution Channel

- Automotive Crankshaft Market, by Region

- Automotive Crankshaft Market, by Group

- Automotive Crankshaft Market, by Country

- United States Automotive Crankshaft Market

- China Automotive Crankshaft Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesis of Market Drivers Challenges and Strategic Imperatives Guiding Future Crankshaft Industry Trajectories in the Evolving Automotive Landscape

The synthesis of market drivers, challenges, and strategic imperatives underscores the continued relevance of the crankshaft in both legacy and emerging powertrain architectures. While electrification trends will gradually alter long-term demand profiles, the persistence of hybrid systems and internal combustion engines in commercial and performance sectors ensures sustained market vitality. Key challenges-such as raw material cost fluctuations, evolving emissions standards, and supply chain complexity-can be effectively addressed through targeted material research, digital manufacturing adoption, and robust trade policy monitoring.

Looking forward, companies that seamlessly integrate advanced alloys, predictive process controls, and aftermarket refurbishment services will be best positioned to capture diverse growth opportunities. Regional nuances in regulatory frameworks and vehicle fleet compositions highlight the importance of tailored product and distribution strategies. Ultimately, the most successful players will be those that marry engineering excellence with strategic agility, transforming insights into competitive advantage as the crankshaft market navigates the transition to cleaner, smarter mobility solutions.

Engage Directly with Associate Director Ketan Rohom for Bespoke Crankshaft Market Intelligence and Strategic Research Solutions

Ready to elevate your strategic planning and gain a competitive advantage in the automotive crankshaft market? Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore customized licensing options, exclusive data access, and collaborative research solutions tailored to your business objectives. Unlock in-depth analysis, proprietary datasets, and scenario modeling that will empower your organization to make informed investment decisions and drive innovation.

Engaging with our specialist will ensure you receive personalized guidance on report customization, priority support, and early access to upcoming updates. Don’t miss the opportunity to secure the comprehensive market intelligence you need to stay ahead of evolving regulations, material innovations, and supply chain disruptions. Contact Ketan today to take the first step toward transforming insights into actionable strategies.

- How big is the Automotive Crankshaft Market?

- What is the Automotive Crankshaft Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?