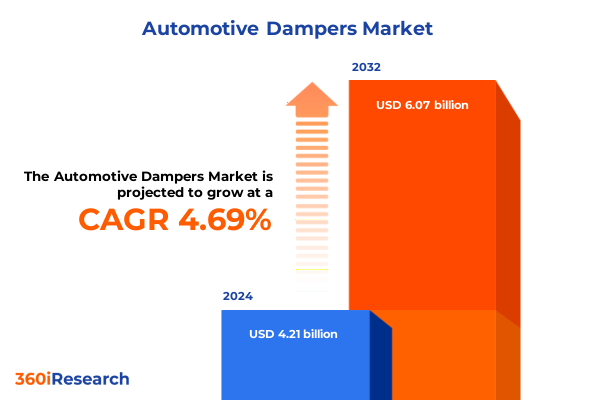

The Automotive Dampers Market size was estimated at USD 4.41 billion in 2025 and expected to reach USD 4.57 billion in 2026, at a CAGR of 4.67% to reach USD 6.07 billion by 2032.

Exploring the Critical Role of Dampers in Advanced Vehicle Dynamics and Emerging Suspension Innovations

The automotive damper sector stands at the heart of vehicle dynamics, driving ride comfort, handling stability, and safety across a broad spectrum of automotive applications. From commercial transport fleets negotiating long-haul routes to performance-oriented passenger cars absorbing road irregularities, dampers play an essential role in modern vehicle architecture. As the industry converges on electrification, autonomy, and sustainability imperatives, the expectations placed on damper performance have evolved accordingly. Innovations in materials, control algorithms, and manufacturing processes are redefining the capabilities of suspension systems, propelling damper technologies beyond traditional hydraulic solutions and into advanced electromechanical and adaptive domains.

Given the pivotal function of dampers in meeting stringent ride quality and emissions regulations, stakeholders from OEMs to aftermarket specialists are intensifying their focus on damper optimization. This report unpacks the technological trajectories, regulatory drivers, and market dynamics shaping the future of dampers. By offering a synthesized view of current trends, emerging breakthroughs, and competitive positioning, the analysis equips automotive professionals, component suppliers, and investors with the insights needed to make informed strategic decisions.

How Electrification, Autonomy, and Digitalization Are Driving a Paradigm Shift in Damper Technology

Recent years have witnessed transformative shifts in the damper landscape, driven by a convergence of electrification, vehicle autonomy, and digitalization trends. Electrified powertrains have imposed new demands on suspension systems due to altered weight distributions, requiring dampers capable of handling increased unsprung mass and delivering consistent performance under regenerative braking dynamics. Meanwhile, the march toward higher levels of driving automation has highlighted the need for active and semi-active dampers that can dynamically adjust to real-time inputs, ensuring occupant comfort and safety during hands-off scenarios.

Simultaneously, digital technologies are enabling predictive suspension control through advanced sensors, connectivity, and machine learning. By anticipating road conditions and driver behavior, next-generation dampers can proactively adapt damping characteristics, mitigating impacts from surface irregularities before they affect ride comfort. These technological inflections are prompting tier-one suppliers and OEMs to pursue collaborations and strategic alliances in sensor integration, software development, and materials science to deliver holistic suspension solutions.

Assessing the Broad Ripples of 2025 U.S. Tariffs on Damper Supply Chains, Cost Structures, and Sourcing Strategies

The imposition of heightened U.S. tariffs on imported automotive components in 2025 has had a reverberating effect on damper supply chains, cost structures, and sourcing strategies. With levy increases targeting critical raw materials and finished components, manufacturers have encountered elevated input costs, prompting many to reevaluate their procurement footprints. As a result, some leading suppliers have accelerated investments in localized production capacity within North America to mitigate tariff exposure and maintain margin stability.

Conversely, downstream OEMs and aftermarket distributors faced with passing through higher component prices to end users have sought opportunities to optimize system architectures, explore alternative materials, and negotiate long-term supply contracts. This recalibration has bolstered the appeal of domestically manufactured dampers and reinforced partnerships with local fabricators, even as global sourcing remains essential for specialized or high-performance applications. In the longer term, the tariffs are catalyzing considerations around vertically integrated manufacturing models and strategic stockpiling of key damper subcomponents to buffer against future trade policy uncertainties.

Unveiling the Nuanced Interplay of Suspension Types, Vehicle Categories, Distribution Channels, and Damper Designs

In examining suspension type, the damper market can be viewed through the lens of passive solutions-characterized by fixed damping rates-alongside the growing segments of active systems, which leverage electrohydraulic controls, and semi-active systems, which employ electrorheological or hydraulic modulation to dynamically vary damping. Advancements in electromagnetic actuation and adaptive fluid technologies are further enhancing the responsiveness and energy efficiency of these active and semi-active configurations, aligning performance with an expanding array of vehicle use cases.

Vehicle segmentation underscores distinct demands across commercial fleets, off-highway machinery, and passenger cars. Heavy-duty transport applications necessitate robust dampers optimized for load-bearing durability, while off-highway equipment in agricultural, construction, and mining settings requires tailored damping profiles to withstand extreme terrain. Passenger cars-from hatchbacks and MPVs to sedans and SUVs-are driving growth in lightweight, compact damper designs that deliver comfort without sacrificing handling precision or increasing unsprung mass.

From a distribution perspective, OEM channels continue to set the bar in terms of specification rigor and integration within complete suspension assemblies, whereas the aftermarket segment is fostering opportunities for retrofit and performance-tuning dampers. By design, mono-tube structures-whether floating piston or solid piston-offer rapid heat dissipation and consistent damping under severe-duty conditions, while twin-tube configurations balance cost efficiency and ride comfort in pressurized or standard variants. Front and rear positioning further dictates specific valving strategies, with rear double-tube or single-tube geometries tailored to differing dynamic load profiles across axle applications.

This comprehensive research report categorizes the Automotive Dampers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Suspension Type

- Design

- Position

- Vehicle Type

- Distribution Channel

Mapping Regional Trends: Americas’ Electrification Push, EMEA’s Autonomous Initiatives, and Asia-Pacific’s Production Scale-Up

Across the Americas, robust demand for commercial vehicle electrification and stringent safety regulations are driving damper innovations that balance energy efficiency with ride quality. North American OEMs are collaborating with tier-one suppliers to co-develop adaptive damping modules optimized for electric truck platforms, while aftermarket players are introducing retrofit kits tailored to aging fleet applications.

The Europe, Middle East & Africa region is marked by a proliferation of autonomous vehicle pilot programs, stringent emissions targets, and continued investment in high-performance passenger cars. In response, suppliers are advancing electromechanical and electrohydraulic dampers with integrated sensing and connectivity features to meet the dual imperatives of comfort and regulatory compliance.

Asia-Pacific remains the largest growth frontier, spurred by rapid urbanization, infrastructure expansion, and a burgeoning passenger car market. Chinese and Indian manufacturers are scaling up mono-tube and twin-tube damper production both for domestic consumption and export. Meanwhile, OEMs in Japan and South Korea are pioneering lightweight magnesium alloy components and next-generation semi-active systems for premium EV applications.

This comprehensive research report examines key regions that drive the evolution of the Automotive Dampers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How Leadership in Technology Partnerships, Regional Ventures, and Aftermarket Offerings Is Redefining Competitive Advantage

Leading players in the damper market are differentiating through strategic alliances, technology licensing, and targeted R&D investments. Global automotive suppliers have established centers of excellence for adaptive damping algorithms in Europe, while forging joint ventures with regional fabricators to expand capacity in high-growth Asia-Pacific markets. Innovative startups specializing in magnetic fluid technologies and smart materials have attracted venture funding, signaling growing investor confidence in next-gen damper modalities.

Concurrently, aftermarket specialists have enhanced their portfolios with performance-oriented products, leveraging digital marketing channels and diagnostic platforms to capture end-user demand for customizable ride experiences. Partnerships between software firms and suspension OEMs are yielding predictive maintenance solutions that integrate damper condition monitoring within vehicle health management systems. Such collaborations underscore the evolving competitive landscape, where technological prowess and ecosystem connectivity are paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Dampers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arnott Industries

- BC Racing

- D2 Racing Sports

- Eibach Springs Inc.

- Fox Factory Holding Corp.

- Gabriel India Limited

- H&R Spezialfedern GmbH

- Hitachi Astemo Ltd.

- Koni BV

- KW Suspensions GmbH

- KYB Corporation

- Magneti Marelli S.p.A.

- Ohlins Racing AB

- QA1 Precision Products

- Rancho Suspension

- ST Suspensions

- Tein Inc.

- Tenneco Inc.

- ThyssenKrupp AG

- ZF Friedrichshafen AG

Strategies for Industry Leaders to Embrace Manufacturing Flexibility, Cross-Industry Collaboration, and Regional Resilience

Industry leaders should prioritize the development of flexible manufacturing cells that can pivot between passive, semi-active, and fully active damper production. By integrating modular production lines with rapid tooling capabilities, suppliers can reduce time-to-market for customized solutions and buffer against tariff-driven supply disruptions.

In parallel, forging cross-industry partnerships with sensor, software, and materials specialists will be critical to deliver holistic suspension ecosystems. A proactive approach to co-development agreements for embedded electronics and advanced control software will enable OEMs and tier-one suppliers to differentiate their offerings in an increasingly software-defined vehicle landscape.

Leaders must also evaluate direct investments in regional production hubs to curtail exposure to trade policy fluctuations. Establishing joint ventures or greenfield facilities in key markets will safeguard supply continuity while unlocking local incentives and mitigating logistics costs. Finally, adopting predictive analytics for demand forecasting and real-time workforce optimization can improve capacity utilization and drive sustainable operational excellence.

Integrating Primary Interviews, Patent Landscaping, and Case Study Analyses for Robust Damper Market Intelligence

This report synthesizes insights from a triangulated research methodology combining primary interviews with OEM engineers, suspension system integrators, and aftermarket specialists; secondary data analysis encompassing trade policy documents, patent filings, and industry whitepapers; and an examination of real-world case studies illustrating damper performance in diverse vehicle applications. The primary research phase involved structured discussions with decision-makers at leading automotive OEMs across North America, Europe, and Asia-Pacific, ensuring a comprehensive understanding of regional variances in damper requirements.

Secondary sources were meticulously vetted to exclude paywalled forecasts, relying instead on regulatory archives, technical journals, and open-access patent databases. Patent landscaping techniques were applied to map emerging damping technologies, while trade policy reviews provided context on tariff developments and their market ramifications. Case study evaluations of commercial fleets, EV platforms, and off-highway machinery furnished quantitative performance metrics and qualitative feedback from end users, underpinning the actionable insights and strategic recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Dampers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Dampers Market, by Suspension Type

- Automotive Dampers Market, by Design

- Automotive Dampers Market, by Position

- Automotive Dampers Market, by Vehicle Type

- Automotive Dampers Market, by Distribution Channel

- Automotive Dampers Market, by Region

- Automotive Dampers Market, by Group

- Automotive Dampers Market, by Country

- United States Automotive Dampers Market

- China Automotive Dampers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Positioning for Sustainable Market Leadership through Innovation, Supply Chain Agility, and Data-Driven Insights

As the automotive industry accelerates toward electrification, connectivity, and autonomy, the demand for sophisticated damper solutions will only intensify. Stakeholders who invest in adaptive and semi-active technologies, localize critical production processes, and harness data-driven maintenance models will secure a decisive edge. The evolving tariff landscape underscores the importance of supply chain agility, while regional divergences highlight the need for tailored market approaches.

By understanding the intricate interplay of suspension types, vehicle applications, regulatory forces, and competitive strategies, decision-makers can navigate uncertainties and capitalize on emerging trends. This executive summary equips you with the foundational insights to chart a resilient, innovation-led path forward in the dynamic automotive damper ecosystem, empowering your organization to deliver superior ride experiences and drive market leadership.

Unlock Exclusive Automotive Damper Market Insights by Connecting Directly with Our Associate Director of Sales & Marketing

For a deeper dive into the comprehensive automotive damper market research report that uncovers actionable intelligence and strategic insights, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engage directly to secure your copy, customize scope according to your objectives, and gain the competitive intelligence necessary to navigate disruptions and capitalize on emerging opportunities.

Don’t miss this opportunity to leverage in-depth analysis and data-driven recommendations tailored to your organization’s needs. Connect with Ketan today to elevate your market strategy and position your business for sustained growth in the evolving automotive dampers landscape.

- How big is the Automotive Dampers Market?

- What is the Automotive Dampers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?