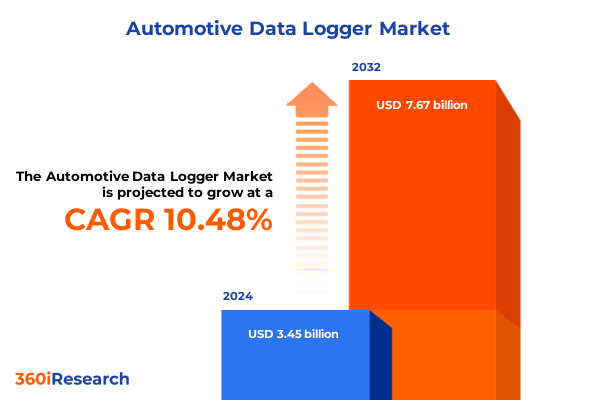

The Automotive Data Logger Market size was estimated at USD 3.73 billion in 2025 and expected to reach USD 4.04 billion in 2026, at a CAGR of 10.82% to reach USD 7.67 billion by 2032.

Unveiling the Strategic Importance of Automotive Data Loggers in Enhancing Vehicle Diagnostics Fleet Efficiency and Telematics Integration

The automotive industry is undergoing a profound transformation driven by the convergence of connected vehicle technologies, advanced analytics, and evolving regulatory mandates. In this context, data loggers have emerged as indispensable components that not only record critical vehicle parameters but also enable real-time diagnostics, preventive maintenance, and intelligent fleet management. By capturing high-resolution data streams from engine performance, drivetrain dynamics, and telematics modules, modern automotive data loggers serve as the foundational instrumentation for both OEMs and aftermarket service providers seeking to enhance reliability, safety, and cost efficiency.

As vehicles evolve toward higher degrees of autonomy and electrification, the role of data loggers has expanded beyond simple recording devices to become integrated solutions that support edge computing, over-the-air updates, and sophisticated data fusion. Consequently, stakeholders across the value chain-including hardware manufacturers, software vendors, service integrators, and end customers-are recalibrating their strategies to leverage these devices for strategic insights, regulatory compliance, and competitive differentiation. Against this backdrop, the executive summary that follows delivers a clear, concise overview of the key market forces, segmentation dynamics, regional variations, leading players, and strategic imperatives that are shaping the future trajectory of the automotive data logger landscape.

Analyzing the Transformative Technological Advances Regulatory Dynamics and Market Drivers Reshaping the Automotive Data Logger Ecosystem

Over the last decade, technological breakthroughs in edge analytics, sensor miniaturization, and wireless connectivity have fundamentally altered the competitive landscape for automotive data loggers. Sensor integration has driven device miniaturization, enabling manufacturers to embed high-precision logging modules directly within vehicle subsystems. Simultaneously, the proliferation of high-bandwidth cellular networks and the advent of dedicated short-range communications have facilitated seamless data transmission, ushering in new possibilities for remote diagnostics and predictive maintenance. Moreover, cloud-based platforms now offer near-instantaneous processing of petabyte-scale data sets, empowering AI-driven anomaly detection and real-time performance optimization.

In addition to technological catalysts, regulatory mandates around emissions, safety monitoring, and cybersecurity have reinforced the imperative for robust logging capabilities. Governments and standards bodies are increasingly specifying data retention requirements for event data recorders and telematics devices, thus driving demand for solutions that combine tamper-proof hardware with encrypted software ecosystems. As a result, the market has witnessed a shift from standalone hardware modules toward integrated solutions that bundle consulting, installation, and ongoing maintenance services. Together, these transformative shifts illustrate a broader evolution in which automotive data loggers are no longer auxiliary devices but core pillars of a data-driven mobility paradigm.

Assessing the Far Reaching Consequences of 2025 United States Tariffs on Automotive Data Logger Production Costs Supply Chains and Pricing Models

In 2025, the United States implemented new tariff structures targeting imported electronic components and subassemblies that are critical to the automotive data logger supply chain. This policy change has introduced a cascading effect on production costs, compelling hardware integrators to reassess sourcing strategies and cost-optimization initiatives. As import duties on memory modules, microcontrollers, and wireless transceivers increased, manufacturers faced pressure to renegotiate supplier agreements, shift to regional content, or absorb margin contractions to remain competitively priced.

Consequently, many solution providers have accelerated their efforts to localize manufacturing footprints, forging partnerships with domestic electronics assemblers and vertically integrating key value chain activities. These strategic pivots have also sparked a gradual realignment of global supply networks, with North American hubs emerging as pivotal nodes for production and distribution. While some stakeholders have passed incremental cost increases onto end users, the imperative to maintain fleet uptime and regulatory compliance has ensured continued adoption, underscoring the resilience of demand even amid tariff-driven headwinds.

Exploring Multifaceted Segmentation Insights across Offering Connectivity Vehicle Type Application and End User Dimensions for Strategic Roadmapping

A nuanced understanding of market segmentation is vital for stakeholders seeking to tailor their offerings and capture distinct value pools. Based on offering, hardware remains the cornerstone, with integrated solutions embedding data loggers within vehicle architectures and standalone devices catering to retrofit applications; meanwhile, services encompass consulting to define logging specifications, installation to integrate modules into diverse vehicle platforms, and maintenance to ensure continuous operation under rigorous environmental conditions; concurrently, software offerings bifurcate into cloud-based analytics suites that aggregate fleet-wide data for cross-fleet benchmarking and on-premise platforms that prioritize data sovereignty and offline analytics.

Connectivity segmentation reveals a bifurcation between wired interfaces, which deliver high-throughput, low-latency data transfer for diagnostic applications, and wireless modalities that enhance mobility and remote monitoring; within wireless, Bluetooth excels for localized short-range communications, cellular networks facilitate wide-area telemetry, and Wi-Fi supports bulk data offload during scheduled maintenance windows. Vehicle type further diversifies demand, as heavy commercial vehicles such as buses and trucks prioritize durability and regulatory logging, light commercial vehicles including pickups and vans emphasize fleet optimization and fuel monitoring, and passenger cars-spanning hatchbacks, sedans, and SUVs-incorporate data logging primarily for performance tuning and usage-based insurance programs.

Turning to application, diagnostics modules focus on engine health and performance monitoring, fleet management solutions address inventory tracking and performance analytics, telematics offerings deliver location-based services and real-time tracking, and usage-based insurance platforms support pay-per-mile pricing and risk assessment. Finally, end-user segmentation distinguishes aftermarket channels, where dealers and independent workshops retrofit and service vehicles, from OEM channels that integrate data loggers into factory builds and manage lifecycle support. By weaving these segmentation lenses together, stakeholders can identify high-impact intersections-such as cloud-based telematics for heavy commercial fleets or on-premise diagnostic suites for OEM assembly lines-to inform product roadmaps and go-to-market strategies.

This comprehensive research report categorizes the Automotive Data Logger market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Connectivity

- Vehicle Type

- Application

- End User

Investigating Regional Market Dynamics and Growth Drivers across the Americas Europe Middle East Africa and Asia Pacific Automotive Data Logger Sectors

Regional dynamics exert a profound influence on adoption rates, technology preferences, and regulatory compliance frameworks across the automotive data logger market. In the Americas, mature regulatory environments in North America drive stringent data recording specifications, fueling uptake of advanced telematics platforms and cloud-centric analytics services; meanwhile, Latin American markets are witnessing nascent interest in retrofit solutions that address growing logistics and transportation needs, spurring aftermarket growth despite infrastructural constraints.

Moving to Europe, Middle East, and Africa, the European Union’s Ahead of regulatory mandates for emissions monitoring and cross-border fleet movement have accelerated investments in integrated hardware-software bundles that ensure uninterrupted data retention. In the Middle East, burgeoning infrastructure projects and defense applications are creating demand for high-reliability logging devices, while in Africa, pilot deployments for public transit and mining fleets are catalyzing interest in low-power, robust standalone units. In the Asia Pacific region, rapid industrialization in Southeast Asia, electrification initiatives in China, and advanced manufacturing in Japan and South Korea are driving a surge in both wired diagnostic tools and wireless telematics modules. These interregional contrasts reflect a mosaic of opportunities, underscoring the need for customized value propositions that align with each region’s regulatory, operational, and economic idiosyncrasies.

This comprehensive research report examines key regions that drive the evolution of the Automotive Data Logger market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Automotive Data Logger Innovators and Strategic Partnerships Shaping Competition Value Propositions and Technological Differentiation

A diverse set of industry leaders is shaping the competitive landscape through relentless innovation, strategic alliances, and vertical integration. Established automotive OEM tier-one suppliers have leveraged their scale and engineering prowess to offer integrated hardware and software bundles, often enhancing proprietary platforms with third-party analytics engines. Meanwhile, specialist data logger manufacturers are forging partnerships with telecommunications providers to embed advanced connectivity features into compact modules, enabling seamless over-the-air updates and hybrid cloud analytics.

Emerging players are disrupting traditional value chains by introducing subscription-based service models that package consulting, installation, and maintenance under single agreements, thus simplifying procurement and lifecycle management for fleet operators. Additionally, cross-industry collaborations-spanning cybersecurity firms, sensor producers, and software integrators-are giving rise to certified logging ecosystems that adhere to stringent data integrity and encryption standards. Collectively, these competitive moves are fostering differentiation through end-to-end solution portfolios, accelerated time-to-market, and enhanced customer support frameworks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Data Logger market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aptiv Corporation

- Continental AG

- Danlaw, Inc.

- Dewesoft d.o.o.

- dSPACE GmbH

- Harman International Industries, Inc.

- HORIBA Ltd.

- Influx Technology Ltd.

- Intrepid Control Systems, Inc.

- IPETRONIK GmbH & Co. KG

- Keysight Technologies, Inc.

- National Instruments Corporation

- Racelogic Ltd.

- Robert Bosch GmbH

- TTTech Auto GmbH

- Vector Informatik GmbH

Formulating Actionable Strategic Recommendations to Empower Industry Leaders in Capturing Value and Mitigating Risks in the Data Logger Market

Industry leaders must prioritize several strategic imperatives to capitalize on emergent opportunities and mitigate evolving risks. First, investment in modular hardware architectures that support rapid sensor integration and customization will enable swift adaptation to new regulatory mandates and technology trends. Coupled with this, developing interoperable software frameworks that facilitate seamless data exchange across cloud and on-premise environments will address enterprise security concerns and data sovereignty requirements.

Furthermore, establishing collaborative partnerships with connectivity providers and sensor manufacturers can accelerate the co-development of next-generation logging modules featuring edge-analytics capabilities. At the service level, offering bundled consulting, installation, and maintenance packages with clearly defined service-level agreements will drive customer stickiness and recurring revenue. Additionally, embedding advanced AI-driven analytics within telematics platforms will unlock predictive insights that boost operational efficiency, reduce downtime, and support usage-based insurance models. By executing these strategic actions, market participants can differentiate their offerings, capture adjacent growth opportunities, and fortify their market positioning.

Outlining a Robust Multi Stage Research Methodology Leveraging Primary Expert Interviews Secondary Intelligence and Data Triangulation Techniques

This study leverages a multi-stage methodology to ensure the rigor and relevance of its insights. Initially, comprehensive secondary research was conducted, sourcing data from regulatory filings, industry white papers, technical standards documentation, and company disclosures. This phase provided a foundational understanding of market drivers, legislative frameworks, and technology evolutions. Subsequently, primary research was undertaken through in-depth interviews with subject matter experts, including R&D heads at OEMs, senior engineers at tier one suppliers, fleet managers, and data analytics specialists.

Data triangulation was then employed to reconcile quantitative findings from secondary sources with qualitative insights from primary interviews. Analytical frameworks such as Porter’s Five Forces, PESTEL analysis, and value chain mapping were applied to assess competitive intensity, macroeconomic influences, and supplier-buyer dynamics. Finally, all insights were validated through peer review by external industry experts and cross-referenced against publicly available case studies. This rigorous approach ensures that the conclusions and recommendations presented herein are grounded in empirical evidence and reflect the current state of the automotive data logger market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Data Logger market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Data Logger Market, by Offering

- Automotive Data Logger Market, by Connectivity

- Automotive Data Logger Market, by Vehicle Type

- Automotive Data Logger Market, by Application

- Automotive Data Logger Market, by End User

- Automotive Data Logger Market, by Region

- Automotive Data Logger Market, by Group

- Automotive Data Logger Market, by Country

- United States Automotive Data Logger Market

- China Automotive Data Logger Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Drawing Strategic Conclusions on Market Trends Technological Evolutions and Competitive Imperatives to Illuminate Future Opportunities in the Sector

Across the spectrum of technological innovation, regulatory evolution, and market segmentation, automotive data loggers have transitioned from auxiliary recording devices to strategic enablers of data-driven mobility ecosystems. The convergence of advanced connectivity, cloud computing, and AI analytics has elevated the value proposition of data loggers, forging new pathways for operational efficiency, safety enhancement, and business model innovation. Moreover, the 2025 tariff adjustments in the United States have underscored the importance of resilient supply chains and localized manufacturing strategies.

Segmentation analysis reveals that tailored offerings-whether cloud-based telematics for heavy commercial fleets, on-premise diagnostic suites for OEM installations, or subscription-based service packages for aftermarket operators-will define market winners. Regionally, the Americas, EMEA, and Asia Pacific each present unique regulatory and operational contexts that demand customized go-to-market approaches. Ultimately, the interplay of leading players forging strategic alliances, technological trailblazers embedding AI-driven insights, and service innovators bundling end-to-end solutions will chart the future trajectory of this dynamic market sector.

Engage with Ketan Rohom Associate Director Sales Marketing to Acquire the Comprehensive Automotive Data Logger Market Research Report Now

To obtain an in-depth exploration of market dynamics strategic developments and future growth catalysts within the automotive data logger sphere, reach out directly to Ketan Rohom Associate Director Sales Marketing to discuss tailored research insights that align with your organizational priorities and competitive intelligence needs. Engage in a consultative dialogue to leverage advanced analytical frameworks, scenario planning modules, and exclusive industry benchmarks that will empower your decision-making processes and roadmap development. Initiate this conversation today to secure your access to the comprehensive report that synthesizes primary interviews, rigorous secondary intelligence, and actionable recommendations designed to elevate your market positioning and drive sustained innovation.

- How big is the Automotive Data Logger Market?

- What is the Automotive Data Logger Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?