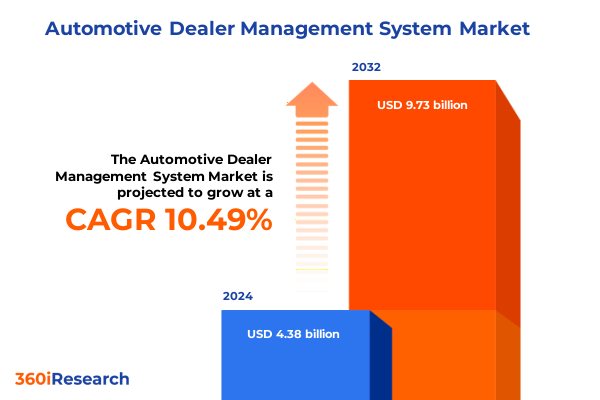

The Automotive Dealer Management System Market size was estimated at USD 4.85 billion in 2025 and expected to reach USD 5.29 billion in 2026, at a CAGR of 10.45% to reach USD 9.73 billion by 2032.

Unveiling the Cornerstones of the Automotive Dealer Management System Landscape as Digital Transformation and Operational Excellence Take Center Stage

The automotive dealer management system arena has emerged as a critical backbone for modern dealerships striving to align their operations with digital customer expectations and data-driven decision-making. As traditional dealership workflows encounter growing complexity, the need for integrated platforms that streamline sales, service, inventory, and finance processes has never been more pronounced. Consequently, stakeholders across the value chain are prioritizing solutions that not only automate routine tasks but also deliver real-time visibility across multiple touchpoints.

Furthermore, the rapid proliferation of connected vehicles and evolving mobility models has ushered in an era where information symmetry between manufacturers, dealers, and customers is paramount. In response, leading system providers have accelerated investments in cloud-native architectures, open application programming interfaces, and modular deployment options. These advancements are not limited to system performance; they extend into predictive analytics, customer engagement tools, and omnichannel retailing capabilities that collectively redefine the dealership-customer relationship.

Moreover, heightened regulatory scrutiny and the drive toward sustainability are catalyzing further innovation, as dealers require robust platforms to manage compliance, tax incentives, and end-of-life vehicle processes. Against this backdrop, dealer principals, corporate leadership teams, and IT decision-makers are seeking executive-level insights that illuminate how next-generation management systems can serve as a nexus between operational efficiency, enhanced customer experience, and future resilience.

Analyzing the Transformative Shifts Redefining Automotive Dealer Management as Customer Expectations and Technological Adoption Surge

Across the past few years, transformative shifts have redefined the automotive retail ecosystem, with digital retailing emerging as a primary catalyst for change. Customers now expect the convenience of initiating vehicle purchases online, completing credit applications in minutes, and scheduling at-home delivery or curbside pickup. This shift has prompted vendors to embed virtual showroom functionalities directly into their core management systems, fundamentally altering the customer journey and dealer engagement models.

In parallel, the migration to cloud-hosted environments has accelerated, driven by the need for scalable infrastructure and agile integrations with third-party fintech, insurance, and sales enablement platforms. As a result, dealers benefit from continuous feature updates, enhanced cybersecurity protocols, and reduced on-premise IT overhead. This development not only supports lean operational structures but also ensures seamless interoperability across environments.

Additionally, the integration of artificial intelligence and machine learning capabilities has opened new frontiers in demand forecasting, service appointment optimization, and targeted marketing outreach. These advanced analytics components enable dealers to anticipate maintenance needs, personalize promotions based on historical behavior, and optimize inventory allocation with unprecedented precision. Collectively, these transformative shifts are remapping competitive boundaries and setting new benchmarks for performance within the automotive retail sector.

Examining the Ripple Effects of 2025 United States Tariffs on Automotive Dealer Ecosystems and Their Operational Dynamics

In 2025, a series of tariff adjustments imposed by the United States government introduced elevated duties on imported automotive components and finished vehicles. These changes have exerted upward pressure on procurement costs, forcing both OEMs and dealer network operators to reassess supply chain strategies and renegotiate vendor contracts. Consequently, dealer management systems have taken on an expanded role, functioning as critical platforms for real-time cost tracking and vendor performance analytics.

Concurrently, heightened cost sensitivities have prompted dealers to seek alternative sourcing partnerships, including reshoring initiatives and regional supplier alliances. This shift has reinforced the importance of platform flexibility, as management systems must now accommodate shifting bill-of-materials and dynamic vendor master data. Moreover, the cumulative cost impact has incentivized deeper adoption of digital proof-of-delivery and mobile invoicing tools, which reduce manual errors and accelerate billing cycles.

As a result, system providers are focusing on delivering configurable tariff engines and integrated compliance modules that automatically apply duty differentials and generate audit-ready documentation. These advancements not only mitigate financial risk but also streamline the reconciliation process across sales, service, and parts divisions. Ultimately, the 2025 tariff landscape has underscored the strategic value of dealer management platforms in preserving margin integrity and sustaining operational continuity under volatile trade conditions.

Dissecting the Market Through Key Segmentation Lenses to Reveal Tailored Insights for Offerings Vehicle Types Applications and End-Users

A nuanced understanding of product and service offerings reveals that the market is bifurcated between core dealer management solutions and an array of specialized services. While the foundational software drives day-to-day sales, finance, and inventory workflows, managed services extend system oversight through remote monitoring and maintenance, and professional services deliver tailored implementation, training, and process optimization. This layered structure enables dealerships to balance capital expenditure against the need for expert support and continuous innovation.

Moving to vehicle type segmentation, the demand landscape varies markedly between commercial and passenger inventory. Heavy commercial vehicles, tasked with demanding duty cycles and fleet management complexities, necessitate features such as advanced maintenance scheduling and telematics integration, whereas light commercial vehicles and passenger cars prioritize customer-facing CRM modules and digital retailing trajectories. Consequently, providers must adapt their roadmaps to address the divergent requirements of high-utilization assets and consumer-oriented sales funnels.

Examining application-based segmentation, modules for customer relationship management, dealer tracking, finance, inventory, and sales each represent distinct operational pillars. The CRM components drive post-sale engagement and loyalty programs, dealer tracking enhances lead management and showroom analytics, finance modules streamline credit approvals and compliance reporting, inventory systems optimize stock levels and order workflows, and sales modules unify contract management with digital retailing pathways. Integration between these applications underpins the holistic value proposition of modern platforms.

Finally, in terms of end-users, the ecosystem encompasses new vehicle dealerships, used vehicle dealers, and automotive rental services. New automotive dealers focus on manufacturer incentives, warranty management, and franchise compliance, while used vehicle operators emphasize price optimization, vehicle history reporting, and remarketing tools. Rental service providers, by contrast, demand seamless rental contract processing, usage-based billing, and return inspection workflows. These distinct requirements necessitate configurable solutions capable of serving multiple vertical subsegments within the dealer network.

This comprehensive research report categorizes the Automotive Dealer Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Vehicle Type

- Application

- End-User

Mapping Regional Dynamics Across Americas Europe Middle East Africa and Asia-Pacific to Uncover Growth Drivers and Market Nuances

Regional dynamics play a pivotal role in shaping adoption trajectories and innovation priorities. In the Americas, emphasis on digital retail capabilities and compliance with evolving emissions standards has driven widespread deployment of cloud-native systems, enabling dealers to integrate with OEM data networks and support electric vehicle ecosystems. This maturation is reinforced by a competitive landscape where network consolidation and technology partnerships accelerate going-to-market strategies.

Within Europe, the Middle East, and Africa, dealerships face diverse regulatory environments and variable infrastructure maturity. In Western Europe, advanced data protection requirements and sophisticated vehicle financing structures demand robust security controls and seamless integration with financial institutions. Meanwhile, emerging Middle Eastern and African markets prioritize modular deployments and managed services to mitigate local IT resource constraints and to adapt solutions for variable market conditions.

In the Asia-Pacific region, rapid urbanization and the proliferation of mobility-as-a-service models have heightened interest in omnichannel retailing and digital payment platforms. Dealers in mature Asia-Pacific economies are pioneering integrated telematics and in-car connectivity solutions, whereas developing markets leverage affordable professional services to customize entry-level management systems. Collectively, these regional nuances underscore the importance of localized strategies and ecosystem partnerships to address geographic-specific requirements.

This comprehensive research report examines key regions that drive the evolution of the Automotive Dealer Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Organizations Shaping the Automotive Dealer Management System Market through Innovation Partnerships and Strategic Investments

Key players in the market are leveraging strategic investments and technological differentiation to solidify their positions. Established vendors are expanding cloud-based portfolios, integrating predictive analytics, and forging partnerships with fintech and telematics providers to deliver comprehensive solutions. These alliances facilitate end-to-end workflows, from digital credit applications to post-sale service engagement, thereby enhancing dealer retention and customer lifetime value.

In parallel, innovative challengers are entering the arena with niche offerings focused on microservices architectures, low-code customization, and embedded mobile capabilities. By prioritizing rapid deployment and user-centric design, these entrants are securing footholds among independent and mid-size dealers seeking flexibility without the overhead of legacy deployments. As a result, incumbent suppliers are accelerating platform modernization to preserve competitive advantage.

Furthermore, ongoing consolidation through mergers and acquisitions is repositioning several organizations to offer vertically integrated suites that encompass parts procurement, insurance, and telematics services. This trend toward platform convergence is redefining the competitive landscape, prompting participants to differentiate through domain expertise, service excellence, and open ecosystem models. Ultimately, these strategic developments underscore the criticality of innovation agility and collaborative networks in a dynamic market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Dealer Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Autofusion, Inc.

- Autosoft Inc.

- BiT Dealership Software, Inc.

- Blue Sky Business Solutions, LLC

- CDK Global LLC

- COGXIM Softwares Pvt. Ltd.

- Cox Automotive Inc.

- Dominion Enterprises

- e-Emphasys Technologies Inc.

- ELVA BALTIC SIA

- Epicor Software Corporation

- GaragePlug Inc.

- Gateway DMS Pty. Ltd.

- incadea GmbH

- International Business Machines Corporation

- Lithia Motors

- MH Sub I, LLC dba Internet Brands

- PBS Systems

- Quorum Information Technologies Inc.

- Ramco Systems Limited

- SAP SE

- Solera Inc.

- The Reynolds and Reynolds Company

- Wipro Limited

Providing Actionable Recommendations to Industry Leaders for Navigating Emerging Trends and Capturing Value in a Rapidly Evolving Market

To thrive in this rapidly changing environment, industry leaders should prioritize the adoption of modular platform architectures that enable incremental feature rollouts and seamless integration with third-party applications. By leveraging containerized deployments and open APIs, dealerships can reduce cycle times for new feature activation and future-proof their systems against evolving technology paradigms.

Moreover, investments in artificial intelligence–driven analytics and machine learning models can generate actionable insights around customer preferences, service patterns, and inventory optimization. This focus on data democratization empowers stakeholders at all levels to make informed decisions, anticipate market shifts, and personalize customer interactions.

Additionally, strengthening cybersecurity frameworks remains paramount, as increased connectivity and digital retailing expose dealers to potential threats. Consequently, adopting multi-layered security controls, continuous monitoring, and compliance automation will safeguard sensitive customer and operational data.

Finally, fostering cross-industry collaborations-such as alliances with telematics providers, fintech companies, and aftersales service networks-can unlock new revenue streams and enhance value propositions. By orchestrating an ecosystem of complementary services, dealers can deliver seamless end-to-end experiences, reinforce brand loyalty, and differentiate themselves in a competitive marketplace.

Outlining a Rigorous Research Methodology Combining Primary Engagement and Secondary Intelligence for Robust Market Analysis

This study integrates a hybrid research methodology that blends primary interviews with senior executives across dealership networks, vendor leadership, and industry analysts, alongside structured surveys targeting end users. These first-hand insights were complemented by secondary data collected from governmental publications, regulatory filings, and peer-reviewed journals. To ensure objectivity, data triangulation techniques were applied, reconciling quantitative findings with qualitative perspectives.

Furthermore, an expert advisory panel consisting of technology consultants and former dealership operators reviewed preliminary conclusions, providing validation and refining key thematic areas. The research process also incorporated ongoing market monitoring to account for regulatory changes, tariff announcements, and M&A developments that impact strategic imperatives.

Additionally, rigorous quality assurance checks, including database audits and consistency reviews, were conducted to uphold data integrity. This comprehensive approach ensures that the analysis reflects current market dynamics, addresses stakeholder concerns, and supports reliable decision-making across strategic, financial, and operational domains.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Dealer Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Dealer Management System Market, by Offering

- Automotive Dealer Management System Market, by Vehicle Type

- Automotive Dealer Management System Market, by Application

- Automotive Dealer Management System Market, by End-User

- Automotive Dealer Management System Market, by Region

- Automotive Dealer Management System Market, by Group

- Automotive Dealer Management System Market, by Country

- United States Automotive Dealer Management System Market

- China Automotive Dealer Management System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Drawing Comprehensive Conclusions to Illuminate Core Findings and Strategic Imperatives for Stakeholders in the Automotive Dealer Domain

In conclusion, the automotive dealer management system domain stands at the intersection of digital transformation and operational complexity. The convergence of cloud architectures, AI-driven analytics, and omnichannel retail strategies is reshaping dealer workflows and customer experiences alike. Concurrently, trade policy dynamics, such as the 2025 tariff shifts, have underscored the need for adaptable platforms capable of preserving margin integrity.

Segmentation insights reveal differentiated requirements across offerings, vehicle types, applications, and end-user categories, highlighting the importance of configurable solutions that address both high-volume fleet operations and consumer-facing retail demands. Regional variations further underscore the necessity for localized deployment models, as emerging markets seek managed services while mature regions demand stringent compliance and advanced feature sets.

Moreover, a competitive landscape characterized by strategic partnerships, platform modernization, and mergers and acquisitions is elevating the stakes for all participants. In this context, the recommended strategies around modular architectures, AI-driven insights, cybersecurity enhancements, and cross-industry collaboration serve as critical levers for sustained growth.

Ultimately, stakeholders equipped with these findings and strategic imperatives are poised to capitalize on the fundamental shifts transforming dealership operations and customer engagement in the years ahead.

Driving Immediate Engagement with Ketan Rohom to Secure Insightful Market Intelligence and Empower Strategic Decision-Making

To capitalize on these insights and drive impactful outcomes, prospects are encouraged to engage directly with Ketan Rohom, a seasoned authority in Sales & Marketing with deep expertise in automotive dealer management systems. By collaborating with Ketan, organizations gain prioritized access to in-depth analyses, tailored guidance, and customized solutions designed to navigate the evolving market landscape. Conversations with Ketan can illuminate unpublished findings, clarify strategic nuances, and align decision-making with the latest industry intelligence. Prospective clients seeking to strengthen competitive positioning, accelerate digital transformation efforts, or refine operational models are invited to reach out for a dedicated consultation. Partnering with Ketan enables decision-makers to harness actionable intelligence rapidly, translate data-driven insights into concrete initiatives, and unlock growth opportunities with confidence. This engagement represents a direct pathway to acquiring the comprehensive market research report, empowering stakeholders to make informed investments, optimize technology roadmaps, and drive sustained value across dealership operations.

- How big is the Automotive Dealer Management System Market?

- What is the Automotive Dealer Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?