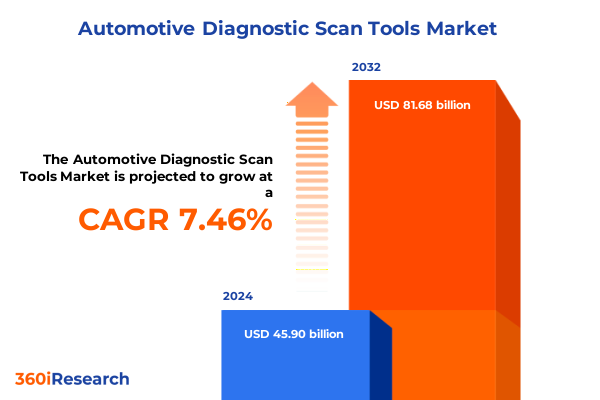

The Automotive Diagnostic Scan Tools Market size was estimated at USD 49.41 billion in 2025 and expected to reach USD 52.76 billion in 2026, at a CAGR of 7.44% to reach USD 81.68 billion by 2032.

Revolutionary Automotive Diagnostic Tools Deliver Real-Time Data and Predictive Maintenance for Enhanced Vehicle Performance and Service Efficiency

The automotive diagnostic scan tools sector has entered a new era marked by rapid technological innovation and heightened demand for data-driven maintenance solutions. As internal combustion engines evolve with increasingly complex control systems, the need for advanced diagnostics has become indispensable. Workshop operators, OEM service departments, and independent vehicle owners alike now rely on comprehensive scan tools to quickly identify, interpret, and resolve fault codes, ensuring minimal downtime and optimal vehicle performance.

This landscape has shifted dramatically over the past decade, transitioning from basic code readers that merely displayed error codes to sophisticated platforms integrating real-time data streaming, cloud connectivity, and artificial intelligence. Mobile applications now offer on-the-go diagnostic capabilities, while PC-based software suites deliver in-depth analysis and historical data comparison. At the same time, handheld devices remain essential for quick checks and field service.

Regulatory pressures related to emissions, safety standards, and cybersecurity have further propelled market growth, compelling suppliers to enhance tool capabilities and comply with stringent requirements. Meanwhile, consumer expectations around faster service turnaround and predictive maintenance have raised the bar for diagnostic accuracy and usability.

This executive summary presents a concise yet comprehensive overview of the market’s key drivers, transformative shifts, regulatory impacts, segmentation insights, and regional dynamics to equip stakeholders with the knowledge needed to navigate this evolving domain effectively.

Emerging Artificial Intelligence Innovations and Connected IoT Frameworks Are Setting New Standards for Predictive Accuracy and Remote Vehicle Diagnostics

Technological advancements have fundamentally reshaped the automotive diagnostic arena, with the integration of artificial intelligence and machine learning elevating the precision and predictive power of scan solutions. Manufacturers are leveraging vast repositories of vehicle data to develop algorithms that not only pinpoint existing faults but also forecast potential failures based on usage patterns and component wear. This shift toward predictive diagnostics enables fleet operators and service centers to schedule maintenance proactively, reducing unplanned downtime and extending vehicle lifecycles.

Simultaneously, the proliferation of Internet of Things (IoT) frameworks has introduced new paradigms in remote vehicle monitoring. Diagnostic platforms now connect seamlessly with cloud infrastructures, allowing technicians to access real-time parameters and historical logs from any location. Such connectivity has given rise to remote troubleshooting services, in which OEM engineers can guide local technicians through complex repair procedures using live data feeds and augmented reality overlays.

Furthermore, partnerships between software developers, chipset providers, and automotive OEMs have fostered unified diagnostic standards, promoting interoperability across diverse vehicle makes and models. This collaborative ecosystem not only streamlines tool compatibility but also accelerates the rollout of over-the-air updates, ensuring the latest diagnostic routines and regulatory calibrations are readily available.

As the industry embraces these transformative shifts, the emphasis is increasingly on delivering end-to-end digital experiences that blend predictive analytics, cloud architecture, and mobile accessibility, setting new benchmarks for speed, accuracy, and user engagement in automotive diagnostics.

New U.S. Tariff Regulations in 2025 Are Driving Supply Chain Realignment and Cost Optimization Strategies in Diagnostic Equipment Manufacturing

The introduction of targeted tariff measures by the United States in early 2025 has had a profound impact on the supply chains underpinning automotive diagnostic equipment. By imposing higher duties on imported electronic components, including key semiconductor modules often sourced from Asia, domestic manufacturers faced increased production costs. These changes prompted leading tool providers to reassess their procurement strategies, accelerating moves toward regional sourcing and local assembly to mitigate tariff exposure.

In response, several diagnostic tool vendors have established assembly operations within North America, leveraging domestic suppliers for printed circuit boards and electronic subcomponents. This shift not only reduces the overall landed cost of devices but also strengthens supply chain resilience against future policy fluctuations. Concurrently, aftermarket players have absorbed a portion of these cost increases through lean manufacturing practices and technology-driven operational efficiencies, thereby limiting downstream price hikes for end users.

Moreover, the tariff landscape has spurred innovation in product design, with suppliers optimizing electronic architectures to minimize reliance on high-cost imported chips. Some companies have adopted modular designs that allow for rapid substitution of component sources without extensive redesign, ensuring continuity of production in the face of evolving trade restrictions.

Overall, the cumulative effects of the 2025 tariff regime have catalyzed a realignment of manufacturing footprints, fostered supply chain diversification, and driven cost-optimization strategies that will continue to influence competitive dynamics and product roadmaps across the automotive diagnostic scan tools market.

Comprehensive Market Segmentation Analysis Reveals Unique Tool Types, Connectivity Modes, Vehicle Applications, and End User Preferences Driving Adoption

When examining tool categories, handheld devices continue to dominate point-of-service scenarios due to their portability and ease of use, whereas PC-based platforms offer comprehensive functionality ideal for in-depth analysis within shop environments. Mobile applications are gaining momentum as technicians value the ability to initiate diagnostics via smartphone interfaces and instantly share reports with stakeholders. These varied tool types cater to distinct user behaviors and operational settings, ensuring comprehensive market coverage.

Connectivity options further differentiate offerings, with wired interfaces providing reliable data transfer in controlled environments. In contrast, wireless solutions leverage Bluetooth for short-range communication on the workshop floor and Wi-Fi for broader coverage, enabling seamless cloud integration and remote access. These connectivity modes accommodate diverse infrastructure capabilities and usage scenarios, underscoring the importance of choosing the right interface for specific diagnostic requirements.

Different vehicle categories also shape tool specifications and functionalities. Heavy commercial vehicles demand ruggedized solutions with specialized protocols for on-highway diagnostic buses, while light commercial vehicles and passenger cars often rely on standardized OBD-II interfaces. Two-wheeler diagnostics, a rapidly growing segment in urban markets, require compact, battery-powered devices optimized for narrow architectures. Each vehicle type imposes unique technical considerations that influence product development and feature sets.

Diagnostic applications span from ABS and airbag fault analysis to emission testing, engine troubleshooting, and transmission diagnostics. Independent vehicle owners typically seek basic fault code readers for quick checks, whereas workshops and OEM service centers invest in full-suite diagnostic solutions that integrate multiple test modules. Sales channels encompass offline partnerships with distributors and brick-and-mortar retailers, alongside growing online platforms, including dedicated e-commerce portals and OEM websites. These segmentation insights highlight the multifaceted nature of the market and the tailored approaches needed to address specific end-user needs.

This comprehensive research report categorizes the Automotive Diagnostic Scan Tools market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Tool Type

- Connectivity

- Vehicle Type

- Application

- End User

- Sales Channel

Distinct Regional Dynamics Highlight Tailored Growth Drivers and Adoption Patterns in Americas, EMEA, and Asia-Pacific Automotive Diagnostic Markets

In the Americas, mature automotive markets demonstrate high levels of tool penetration, underpinned by rigorous emission standards and extensive service networks. Technicians leverage advanced diagnostics to comply with environmental regulations and optimize the performance of increasingly complex powertrains. The presence of large commercial fleets further bolsters demand for predictive maintenance solutions that minimize downtime and reduce operational expenditures.

Across Europe, Middle East, and Africa, stringent safety and emission regulations in the European Union have catalyzed the adoption of sophisticated scan tools. Well-established workshop chains and OEM service centers drive demand for integrated diagnostic suites that support both conventional and alternative powertrains. In Middle Eastern markets, rising fleet modernization programs are accelerating uptake, while in Africa, growing urbanization and an expanding passenger vehicle base are creating new opportunities for entry-level diagnostics.

Asia-Pacific showcases dynamic growth fueled by emerging economies with rapidly expanding vehicle populations. In China and India, the two-wheeler segment significantly contributes to overall tool demand, necessitating compact, cost-effective devices. The region also witnesses a surge in online sales channels as digital penetration rises, enabling OEMs to reach end users via branded portals. As local suppliers innovate to meet domestic requirements, the Asia-Pacific market becomes increasingly competitive, driving continuous product enhancements and localized support services.

These regional insights underscore the importance of tailoring product portfolios, service models, and go-to-market strategies to the distinct drivers and regulatory environments across Americas, EMEA, and Asia-Pacific territories.

This comprehensive research report examines key regions that drive the evolution of the Automotive Diagnostic Scan Tools market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Industry Leaders Boost Cloud Platforms, R&D Investments, and Strategic Alliances to Enhance Diagnostic Tool Capabilities and Support

Leading manufacturers are differentiating themselves through investments in cloud-based diagnostic platforms that unite remote monitoring, data analytics, and mobile interfaces. By forging partnerships with chipset suppliers and software houses, these companies integrate machine learning capabilities into their offerings, enhancing fault detection accuracy and streamlining repair workflows. Such strategic alliances not only enrich product portfolios but also strengthen intellectual property positions.

Some global players focus on expanding their footprints in emerging markets by establishing local assembly facilities and service centers. This approach reduces lead times, optimizes costs, and improves after-sales support, fostering customer loyalty. Concurrently, these firms continue to invest heavily in research and development, exploring next-generation technologies such as over-the-air recalibrations, bidirectional control testing, and augmented reality–assisted diagnostics.

Smaller specialized vendors differentiate by offering niche solutions tailored to specific vehicle segments or applications, such as heavy-duty commercial bus diagnostics or two-wheeler emission testing. Their agility allows rapid adaptation to changing regulatory requirements and customer feedback, reinforcing their position in targeted market pockets.

Overall, the competitive landscape is characterized by robust R&D pipelines, strategic collaborations with OEMs and technology partners, and a keen focus on value-added service models. These concerted efforts continue to shape the evolution of diagnostic scan tool offerings, driving feature innovation and elevating user experiences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Diagnostic Scan Tools market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Actia Group SA

- Ancel Technology Co. Ltd.

- Autel Intelligent Technology Corp. Ltd.

- Bacharach Inc.

- Continental AG

- Cornwell Quality Tools

- Delphi Technologies PLC

- Draper Tools Limited

- Gray Manufacturing Company Inc.

- Hickok Incorporated

- Innova Electronics Corporation

- Launch Tech Co. Ltd.

- Mac Tools

- Matco Tools

- OTC Tools

- Power Probe Inc.

- Robert Bosch GmbH

- Sealey Group

- Snap-on Incorporated

- Softing AG

- SPX Corporation

- TEXA S.p.A.

- Thinkcar Technology Co. Ltd.

Strategic Roadmap for Integrating AI-Driven Analytics, Supply Chain Resilience, and Digital Channels to Maximize Diagnostic Tool Market Impact

To capitalize on emerging opportunities, industry leaders should prioritize the integration of artificial intelligence and predictive analytics into their diagnostic ecosystems. By leveraging machine learning algorithms trained on extensive vehicle data sets, companies can offer advanced fault prediction services that improve maintenance scheduling and resource allocation. This proactive stance will not only elevate operational efficiency but also differentiate tool portfolios in a crowded market.

Moreover, strengthening supply chain resilience is essential in the face of evolving trade policies. Establishing regional manufacturing hubs and forging relationships with alternative component suppliers will mitigate tariff impacts and reduce lead times. Investing in modular hardware architectures can further enable rapid substitution of parts without extensive redesign, preserving production agility.

In parallel, companies must refine their go-to-market strategies by enhancing e-commerce capabilities and OEM portal integrations. Seamless digital purchasing experiences, coupled with value-added services such as remote software updates and subscription-based diagnostic packages, can bolster customer engagement and recurring revenue streams. Tailored training programs and dedicated technical support will reinforce user confidence and maximize tool utilization.

Finally, cultivating collaborative partnerships with automotive OEMs, fleet operators, and service networks can unlock new avenues for co-development and joint go-to-market initiatives. By aligning product roadmaps with emerging powertrain technologies and regulatory trends, businesses can ensure their diagnostic solutions remain at the forefront of industry evolution.

Rigorous Multi-Source Research Framework Incorporates Expert Interviews, Secondary Data Analysis, and Survey Validation for Reliable Market Insights

This research employs a rigorous multi-method approach that combines primary and secondary data sources to deliver comprehensive market insights. Primary research involved in-depth interviews with senior executives from diagnostic tool manufacturers, automotive OEM service divisions, independent workshops, and key distributors. These conversations provided qualitative perspectives on technology adoption, regulatory compliance, and end-user requirements.

Secondary research included the systematic review of industry publications, technical white papers, regulatory filings, and patent databases to track recent innovations and emerging standards. Publicly available trade data and customs records were analyzed to understand the effects of tariff policies and component sourcing patterns.

Quantitative validation was achieved through structured surveys administered to a representative sample of technicians, fleet managers, and aftermarket retailers across key regions. Data triangulation techniques ensured alignment between qualitative insights and market reality, strengthening the report’s credibility. An expert advisory panel comprising independent industry consultants and academic researchers further reviewed findings, providing an objective lens and identifying potential blind spots.

This comprehensive methodology guarantees that the resulting market intelligence is both robust and actionable, offering decision-makers a precise understanding of current trends and future possibilities within the automotive diagnostic scan tools domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Diagnostic Scan Tools market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Diagnostic Scan Tools Market, by Tool Type

- Automotive Diagnostic Scan Tools Market, by Connectivity

- Automotive Diagnostic Scan Tools Market, by Vehicle Type

- Automotive Diagnostic Scan Tools Market, by Application

- Automotive Diagnostic Scan Tools Market, by End User

- Automotive Diagnostic Scan Tools Market, by Sales Channel

- Automotive Diagnostic Scan Tools Market, by Region

- Automotive Diagnostic Scan Tools Market, by Group

- Automotive Diagnostic Scan Tools Market, by Country

- United States Automotive Diagnostic Scan Tools Market

- China Automotive Diagnostic Scan Tools Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Integrated Market Synthesis Highlights the Imperative of Agility, Predictive Analytics, and Strategic Differentiation in Diagnostic Solutions

The automotive diagnostic scan tools market is poised at the intersection of digital transformation, regulatory evolution, and shifting end-user expectations. Advanced connectivity, driven by IoT frameworks and cloud architectures, is redefining traditional service models and empowering remote diagnostics and predictive maintenance. Simultaneously, trade policy shifts and regional regulatory agendas are influencing supply chain configurations and product strategies.

Market segmentation reveals a diverse landscape where handheld, PC-based, and mobile application platforms cater to distinct use cases, while wireline and wireless connectivity options support varied infrastructure scenarios. Vehicle categories ranging from two-wheelers to heavy commercial trucks necessitate specialized diagnostic protocols, and end users span independent owners, workshops, and OEM service departments, each with unique requirements. Online and offline sales channels continue to evolve in response to digital commerce expansion.

Leading companies reinforce their competitive positions through targeted R&D investments, strategic partnerships, and service enhancements, setting the stage for continued innovation. As the industry advances, successful players will be those that adapt their supply chains, integrate AI-driven analytics, and cultivate seamless digital experiences for end users.

Ultimately, this synthesis of market intelligence underscores the imperative for agility and foresight. Organizations that align their strategies with emerging technological trends and regional dynamics will be best positioned to thrive in this rapidly evolving domain.

Engage with Our Associate Director of Sales and Marketing for Exclusive Access to In-Depth Market Intelligence and Strategic Insights

For tailored insights and a deeper understanding of the evolving dynamics within the automotive diagnostic scan tools market, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings extensive experience in guiding decision-makers through complex technology landscapes and can provide personalized consultations to align strategic priorities with emerging trends. Engaging with him will give you privileged access to detailed analyses, competitive intelligence, and bespoke recommendations that drive meaningful business outcomes. Take the next step toward empowering your organization with the intelligence needed to stay ahead in this rapidly transforming sector by securing the full market research report today

- How big is the Automotive Diagnostic Scan Tools Market?

- What is the Automotive Diagnostic Scan Tools Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?